Fintech law | Regulatory Legal @tapi_latam – Integrating Latam | Ex-@mercadopago / LL.M. @UChicagoLaw.

Opinions are my own.

2 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/eriz35/status/1413215061808648196Circle takes dollars

https://twitter.com/sprwn/status/1406365406881800192First of all, I want to make it clear that I do not feel entitled to demand anything from Flare Networks Ltd ("FNL"); they are free to do whatever they deem appropriate in order to secure the future development of the network.

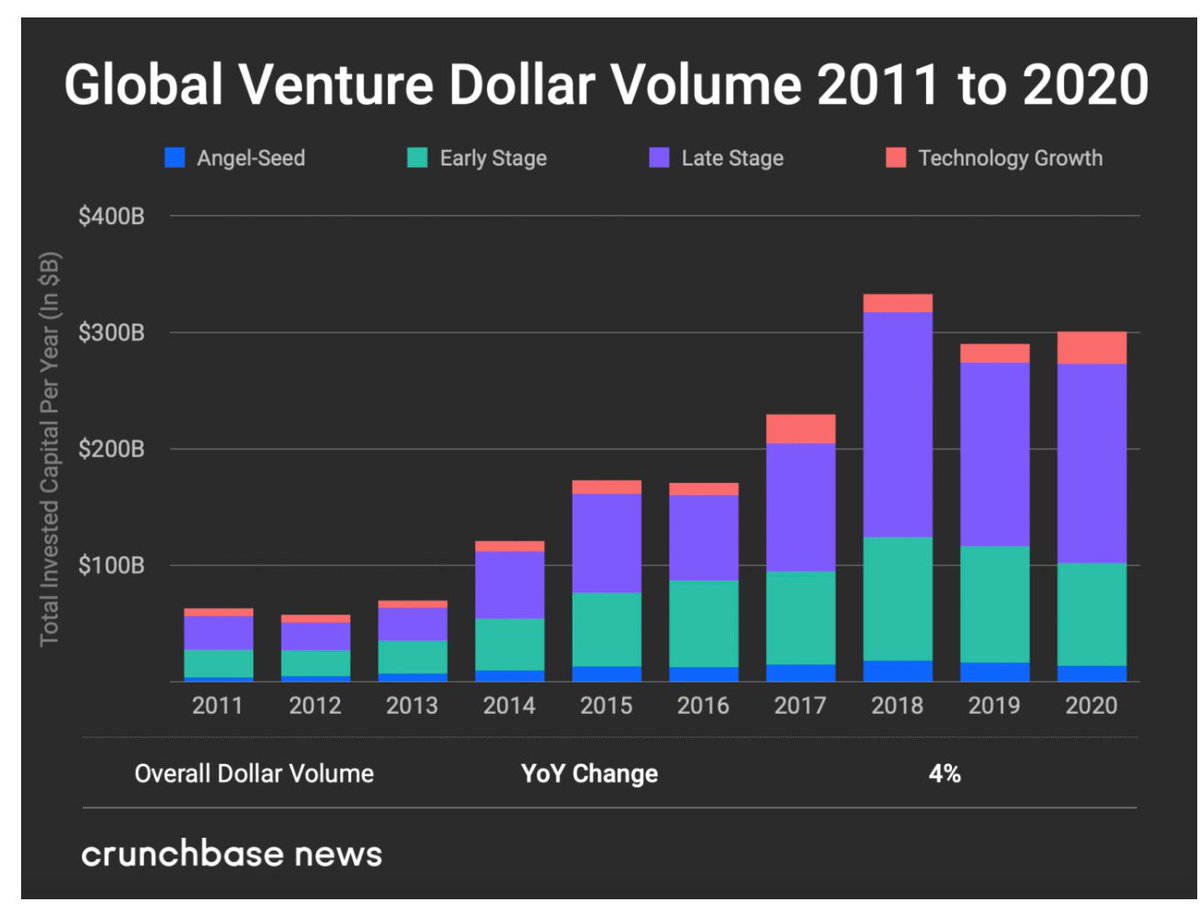

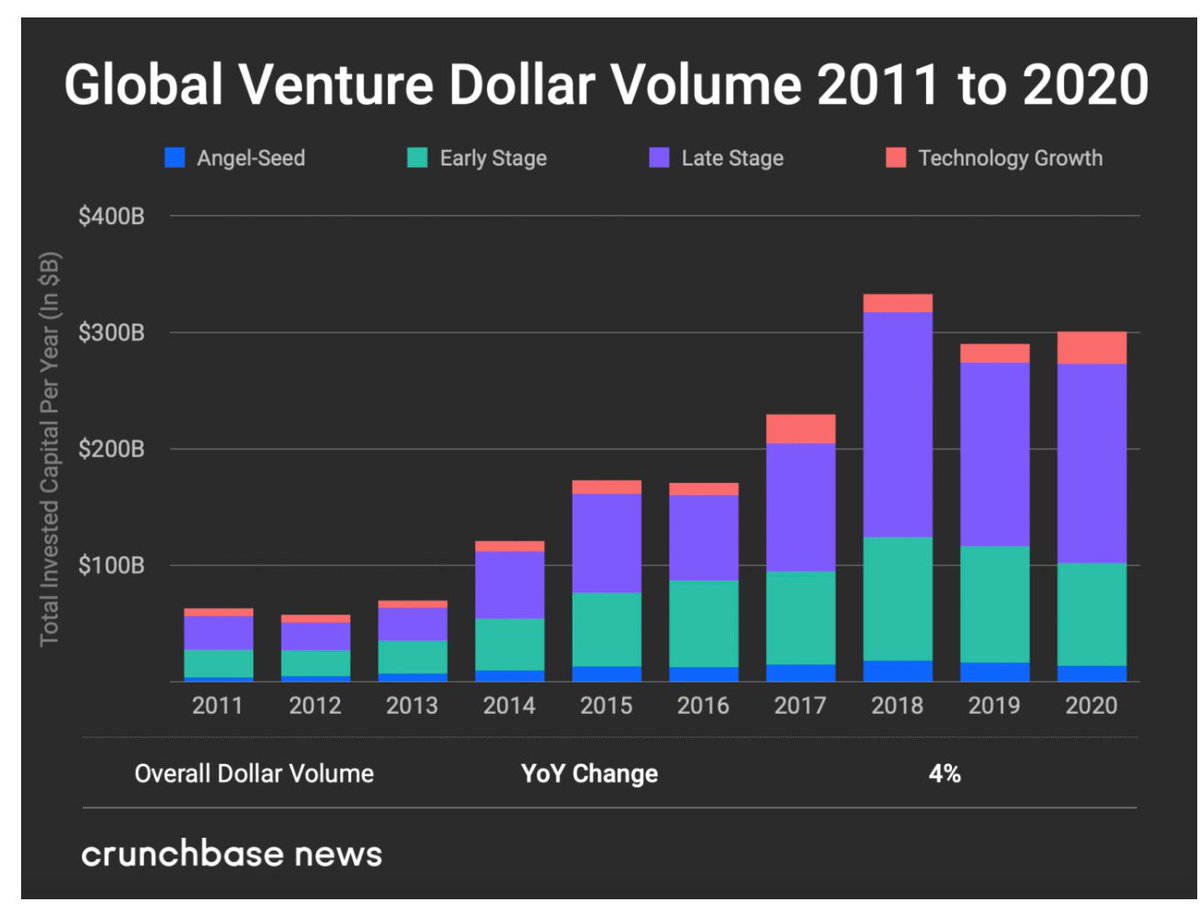

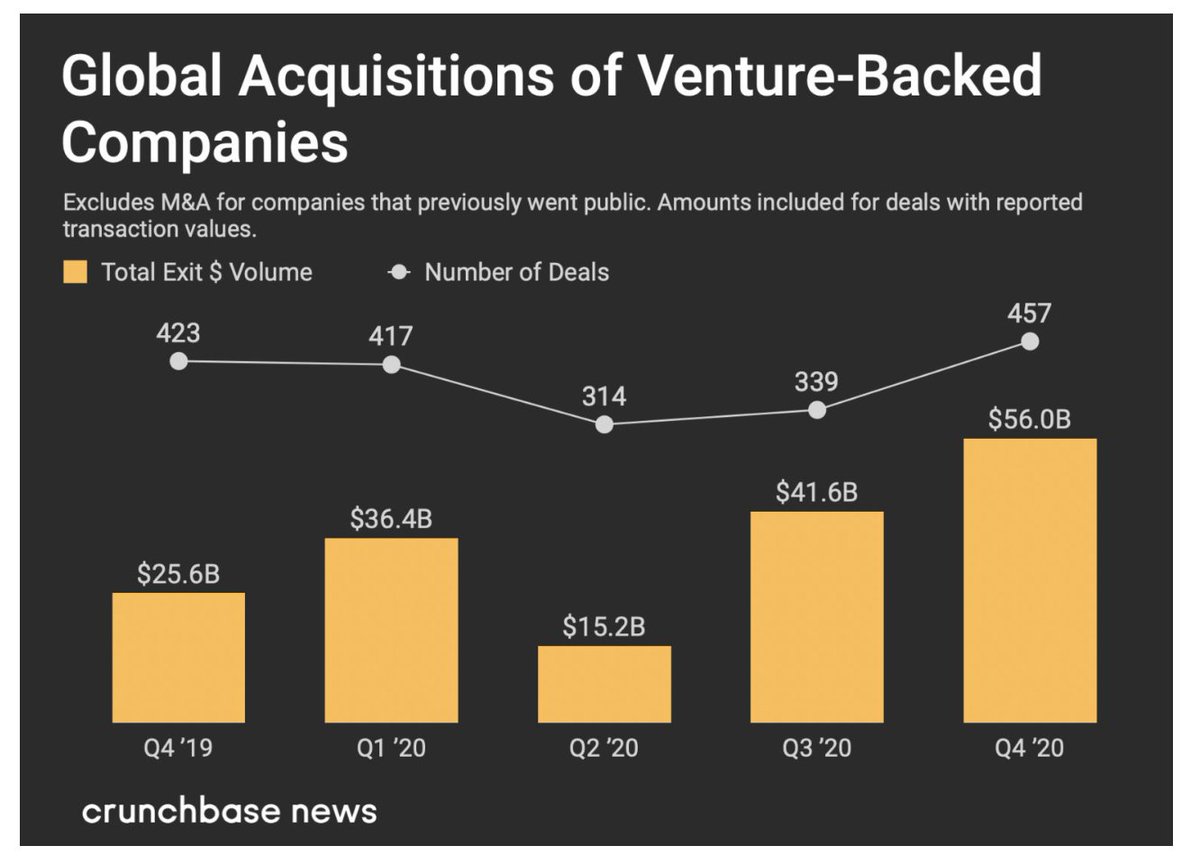

Conclusion: VC firms are raising barriers to entry for new competitors and are also promoting the concentration of markets with their aggresive, profit-seeking exit strategies.

Conclusion: VC firms are raising barriers to entry for new competitors and are also promoting the concentration of markets with their aggresive, profit-seeking exit strategies.

https://twitter.com/jerallaire/status/13764933434761871381. Crypto. com users who hold USDC and have a Visa card attached to their Crypto. com account, make USDC payments to Visa merchants.

Imagine the impact that having an SEC commissioner opining against the SEC's own actions, would provoke on the judge.

Imagine the impact that having an SEC commissioner opining against the SEC's own actions, would provoke on the judge.

I see no single strategic reason, beyond perhaps management bias, for these blockchain/crypto [more like BTC/ETH] advocates, to not fight the SEC's harmful predilection to regulate crypto through reckless enforcement actions that destabilize the industry as a whole.

I see no single strategic reason, beyond perhaps management bias, for these blockchain/crypto [more like BTC/ETH] advocates, to not fight the SEC's harmful predilection to regulate crypto through reckless enforcement actions that destabilize the industry as a whole.

2/

2/