Writing code to (someday) perform financial analysis at the speed of thought. Currently playing with a GraphRAG app for financial reports stored as PDFs

How to get URL link on X (Twitter) App

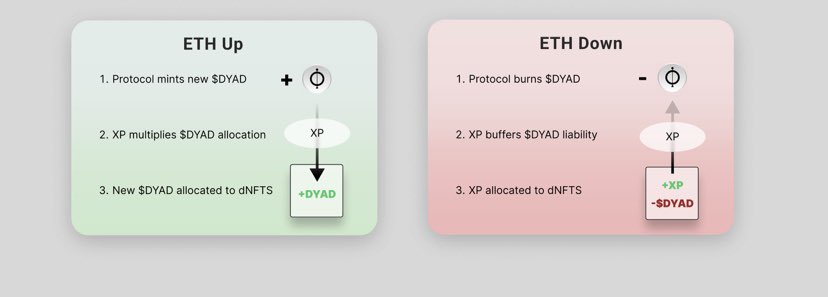

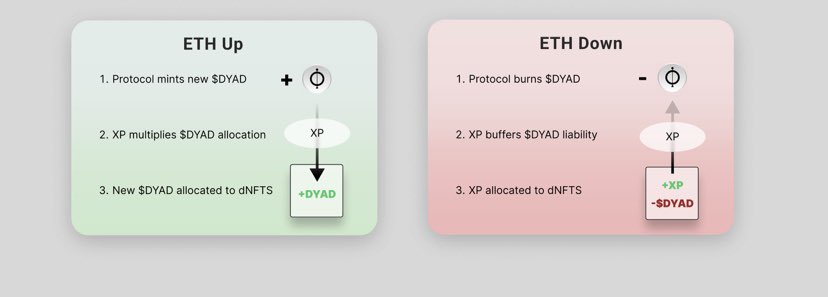

1a. What is $RAI?

1a. What is $RAI?