How to get URL link on X (Twitter) App

Looking at just startups, it’s a talent arms race between the two biggest AI startups w/ @AnthropicAI taking the #1 spot with a median offer of $347k and @OpenAI 2nd with a median offer of $307k in their engineering jobs. Grammarly, Reddit + Mavenclinic round out the top 5 (2/5)

Looking at just startups, it’s a talent arms race between the two biggest AI startups w/ @AnthropicAI taking the #1 spot with a median offer of $347k and @OpenAI 2nd with a median offer of $307k in their engineering jobs. Grammarly, Reddit + Mavenclinic round out the top 5 (2/5)

Which companies are leading the surge in hiring for GenAI talent? Big tech leads the pack with $AMZN $NVDA $MSFT and $GOOG among the top 10 along with tech dinosaurs $ORCL and $IBM. Outside of tech, big banks like Citigroup and CapitalOne also are hiring big in this area

Which companies are leading the surge in hiring for GenAI talent? Big tech leads the pack with $AMZN $NVDA $MSFT and $GOOG among the top 10 along with tech dinosaurs $ORCL and $IBM. Outside of tech, big banks like Citigroup and CapitalOne also are hiring big in this area

The biggest late stage security startups are showing signs of a extreme slowdown in hiring. Total job postings for Cybereason, Snyk, Lacework, Tanium (all IPO candidates) are down 77% on avg since the start of 2022. (2/3)

The biggest late stage security startups are showing signs of a extreme slowdown in hiring. Total job postings for Cybereason, Snyk, Lacework, Tanium (all IPO candidates) are down 77% on avg since the start of 2022. (2/3)

Not all SaaS products saw a slowdown. Grafana Cloud, an observability product hasn’t seen much of a decrease. Mentions of “observability” in job postings continue to rise, suggesting this might be an area of relative strength. (2/5)

Not all SaaS products saw a slowdown. Grafana Cloud, an observability product hasn’t seen much of a decrease. Mentions of “observability” in job postings continue to rise, suggesting this might be an area of relative strength. (2/5)

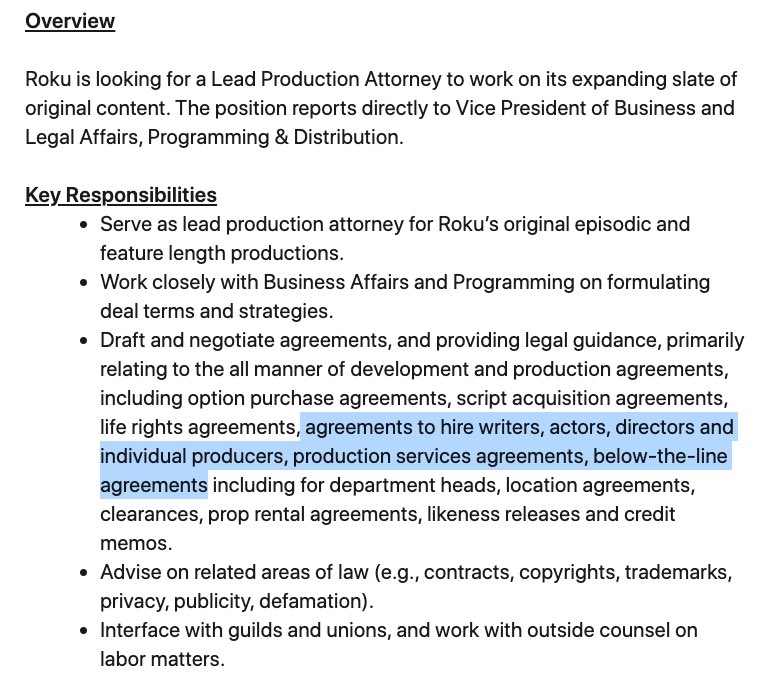

For women, Athleta as the #1 competitor isn’t a huge surprise. Most comments were around its low prices like “it’s less expensive than LULU” and “better value”. Alo/GymShark/Fabletics also had its fans. There was little overlap in brands both sexes loved other than $NKE

For women, Athleta as the #1 competitor isn’t a huge surprise. Most comments were around its low prices like “it’s less expensive than LULU” and “better value”. Alo/GymShark/Fabletics also had its fans. There was little overlap in brands both sexes loved other than $NKE

Project management is a huge space with lots of spending on digital advertising. Let’s take 1 channel: YouTube. Among all public enterprise software corps, $ASAN and $MNDY ranked #1 and #3 in YT ad spend in the past year (ClickUp, if public would’ve been #1)

Project management is a huge space with lots of spending on digital advertising. Let’s take 1 channel: YouTube. Among all public enterprise software corps, $ASAN and $MNDY ranked #1 and #3 in YT ad spend in the past year (ClickUp, if public would’ve been #1)

TikTok isn’t just stealing time away from other social apps. It’s a huge influencer of purchasing decisions, rivaling Instagram. In fact, there were 2x as many people that tweeted about buying something they saw on TikTok vs Instagram last year.

TikTok isn’t just stealing time away from other social apps. It’s a huge influencer of purchasing decisions, rivaling Instagram. In fact, there were 2x as many people that tweeted about buying something they saw on TikTok vs Instagram last year.

How does $PTON engagement vary by weekday? It turns out most people workout on Monday. But as the week goes on, there is a gradual decline in usage. My guess is that ppl start the week highly motivated but become lazier towards the weekend. (2/7)

How does $PTON engagement vary by weekday? It turns out most people workout on Monday. But as the week goes on, there is a gradual decline in usage. My guess is that ppl start the week highly motivated but become lazier towards the weekend. (2/7)

Since Elastic’s license change, there was some outrage among devs. But data suggests Amazon’s fork OpenSearch isn’t gaining much market share. According to NPM download data, OpenSearch is getting ~1% of the downloads that $ESTC is getting daily.

Since Elastic’s license change, there was some outrage among devs. But data suggests Amazon’s fork OpenSearch isn’t gaining much market share. According to NPM download data, OpenSearch is getting ~1% of the downloads that $ESTC is getting daily.

What is the bear thesis for $OKTA? Microsoft. An analysis of a sample of churned customers in 2021 shows that ~55% of them switched to Microsoft (Azure Active Directory). 30% of them switched to Google. (2/4)

What is the bear thesis for $OKTA? Microsoft. An analysis of a sample of churned customers in 2021 shows that ~55% of them switched to Microsoft (Azure Active Directory). 30% of them switched to Google. (2/4)

Mentions of “Monday.com” in job openings have also seen a steady increase. While the majority of their customers are SMBs, they are seeing more traction among enterprises. New and expanding companies this Q include…

Mentions of “Monday.com” in job openings have also seen a steady increase. While the majority of their customers are SMBs, they are seeing more traction among enterprises. New and expanding companies this Q include…

2nd, they are hiring a Director to build out Upwork Academy, which seems to be a new elearning platform with courses and certifications. $FVRR launched their elearning platform in 2018, though this $UPWK offering might seem closer to a Coursera.

2nd, they are hiring a Director to build out Upwork Academy, which seems to be a new elearning platform with courses and certifications. $FVRR launched their elearning platform in 2018, though this $UPWK offering might seem closer to a Coursera.

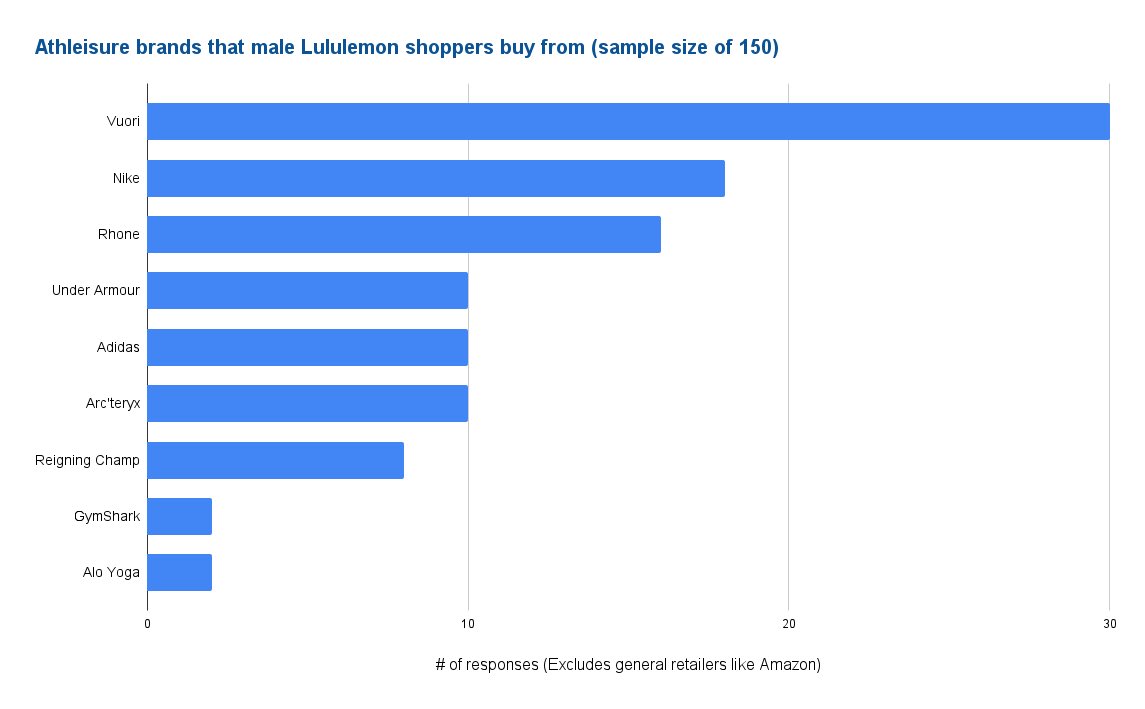

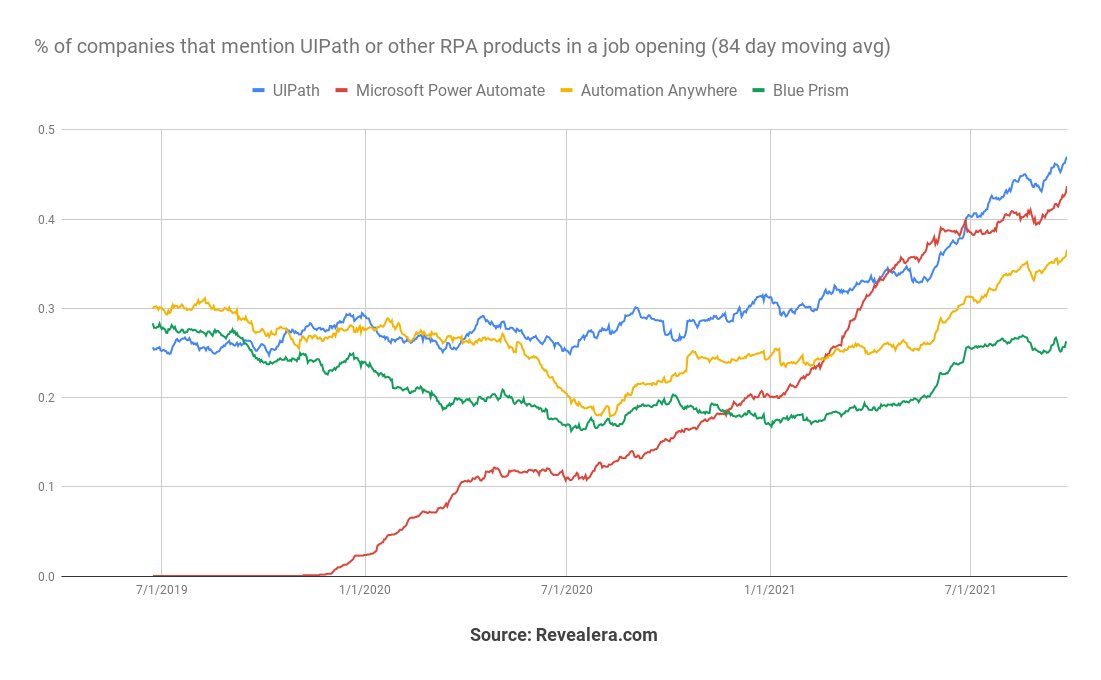

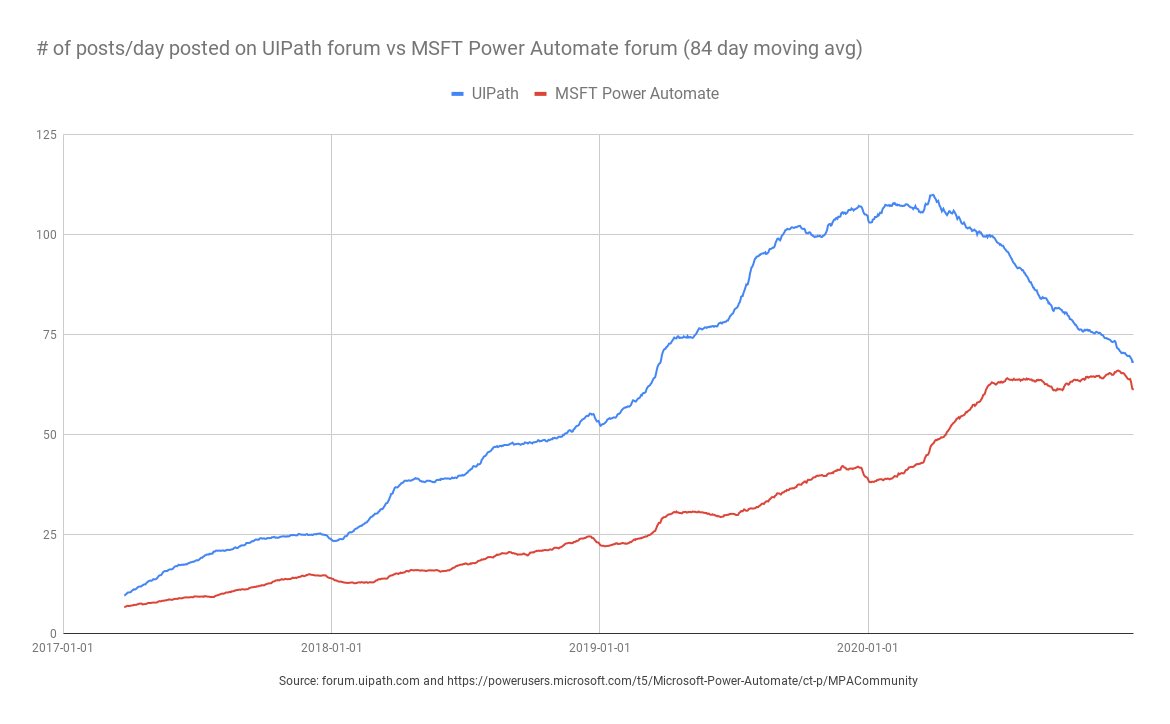

2nd, the # of posts on $MSFT Power Automate forums has been on a consistent uptrend. While the # of posts on $PATH forums has been declining. There could be good reasons for the latter (less support needed) but this further shows that $MSFT Power Automate is gaining traction.

2nd, the # of posts on $MSFT Power Automate forums has been on a consistent uptrend. While the # of posts on $PATH forums has been declining. There could be good reasons for the latter (less support needed) but this further shows that $MSFT Power Automate is gaining traction.

In a nutshell, $ZI is a sales intelligence tool that sells data about business contacts + companies to sales teams who use it to find + cultivate new leads. It strives to have the most accurate contact data. There are 3 big reasons their data is the best.

In a nutshell, $ZI is a sales intelligence tool that sells data about business contacts + companies to sales teams who use it to find + cultivate new leads. It strives to have the most accurate contact data. There are 3 big reasons their data is the best.

2/ The 1st catalyst is the licensing change invoked in January. As Elastic adds new features, the $AMZN fork will soon be inferior to the $ESTC version. More customers will choose $ESTC because it will be more innovative and have the focus/vision of the original team.

2/ The 1st catalyst is the licensing change invoked in January. As Elastic adds new features, the $AMZN fork will soon be inferior to the $ESTC version. More customers will choose $ESTC because it will be more innovative and have the focus/vision of the original team.

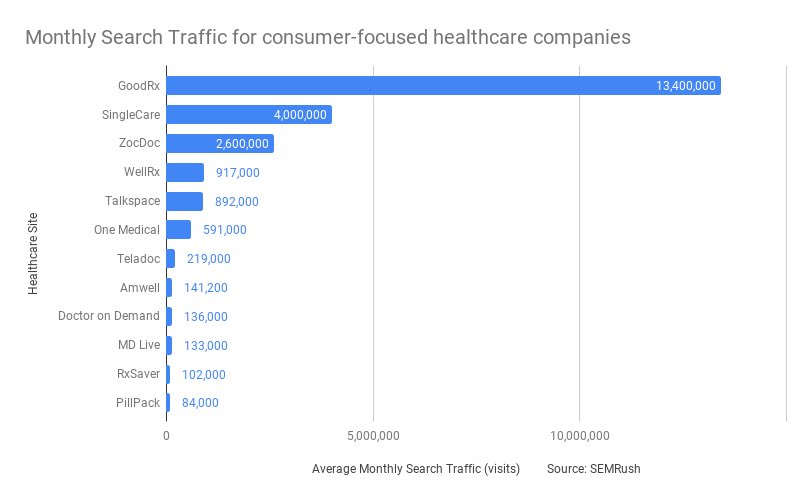

This looks to be a new product separate from their Telehealth/HeyDoctor offering. Based on the description, it could be similar to ZocDoc, as it will allow consumers to “find/compare/book healthcare services by speciality, condition and treatment.” (2/6)

This looks to be a new product separate from their Telehealth/HeyDoctor offering. Based on the description, it could be similar to ZocDoc, as it will allow consumers to “find/compare/book healthcare services by speciality, condition and treatment.” (2/6)

The % of companies looking for AWS, Azure or Google Cloud expertise continues to rise. It has increased from 13.7% a year ago to 16.8% now, which is impressive when you consider the size of all of them. (2/6)

The % of companies looking for AWS, Azure or Google Cloud expertise continues to rise. It has increased from 13.7% a year ago to 16.8% now, which is impressive when you consider the size of all of them. (2/6)

While sales-related jobs are up 33%, the vast majority of $ZM new jobs are engineering-related, which are up 433% YoY. They are investing a lot into improving products such as Zoom Phone, Zoom Apps, as well as the video quality of the current platform. (2/5)

While sales-related jobs are up 33%, the vast majority of $ZM new jobs are engineering-related, which are up 433% YoY. They are investing a lot into improving products such as Zoom Phone, Zoom Apps, as well as the video quality of the current platform. (2/5)