Managing Editor @wealth. Billionaires, personal finance, real estate. Still watch the yield curve. CFA Charterholder. #GoCats. Email: bchappatta1@bloomberg.net

How to get URL link on X (Twitter) App

I had written "green light" for March initially, but a certain someone beat me to the punch. 👁️

I had written "green light" for March initially, but a certain someone beat me to the punch. 👁️https://twitter.com/RenMacLLC/status/1479446380099903488

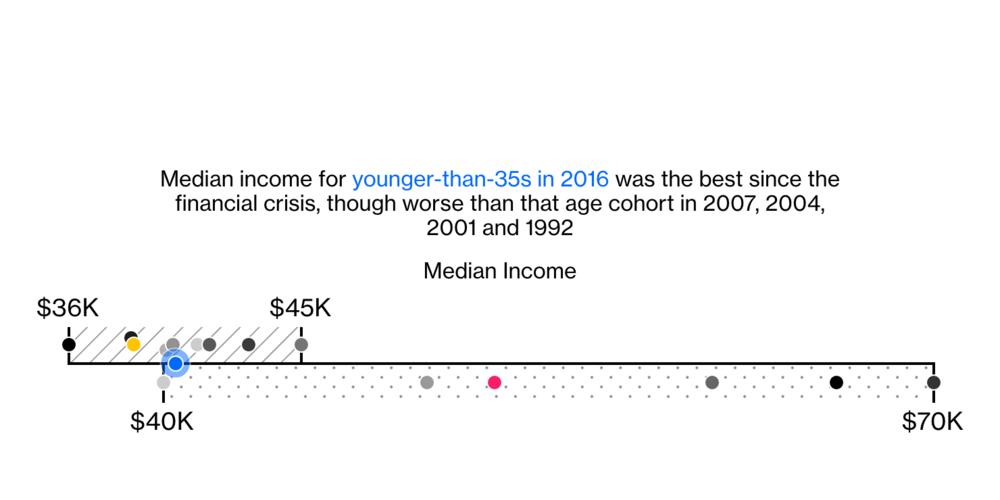

https://twitter.com/conorsen/status/1392457928414744578

https://twitter.com/stevenmnuchin1/status/1329539416306618368