How to get URL link on X (Twitter) App

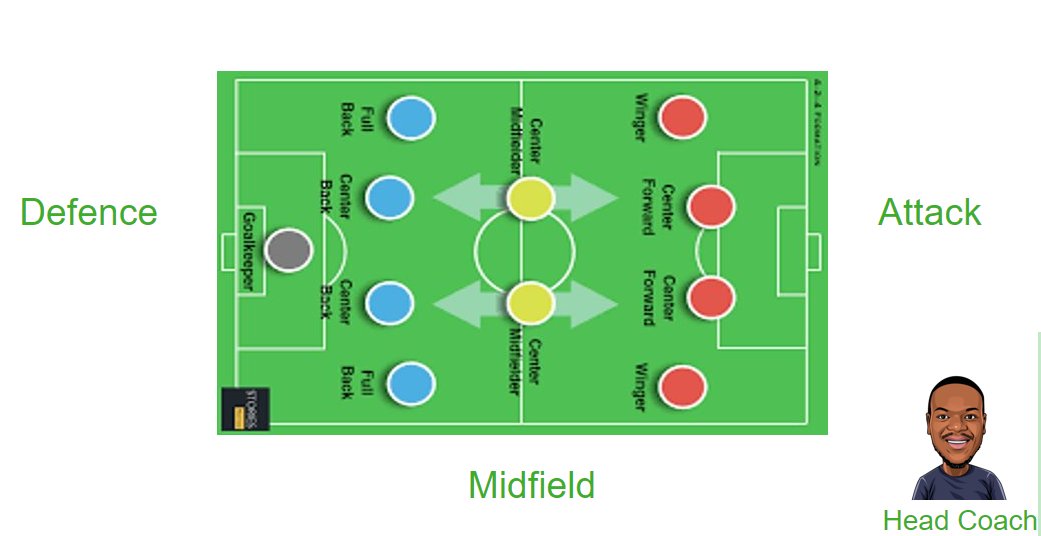

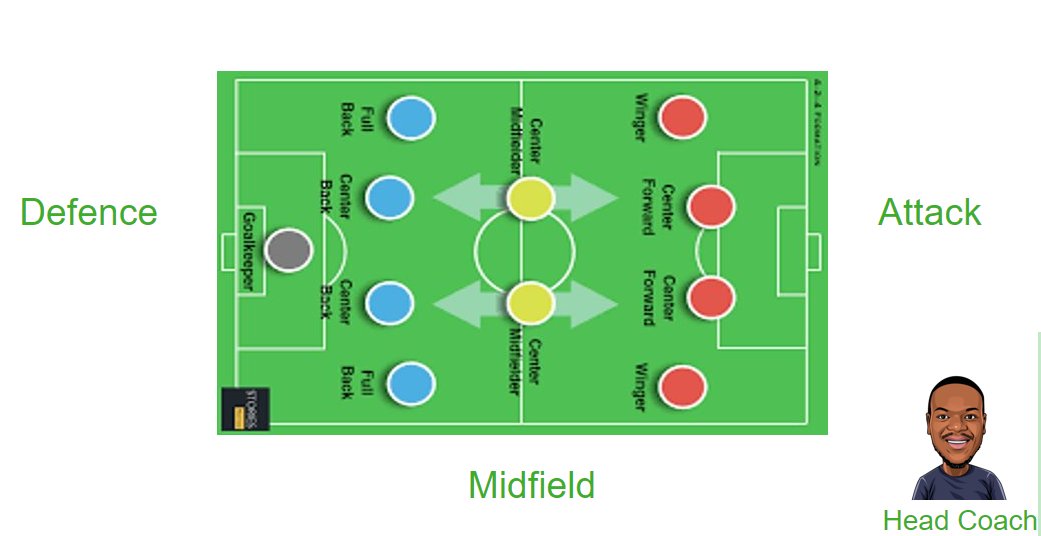

My defense contains 4 defensive masters... The Galacticos of defenders.

My defense contains 4 defensive masters... The Galacticos of defenders.

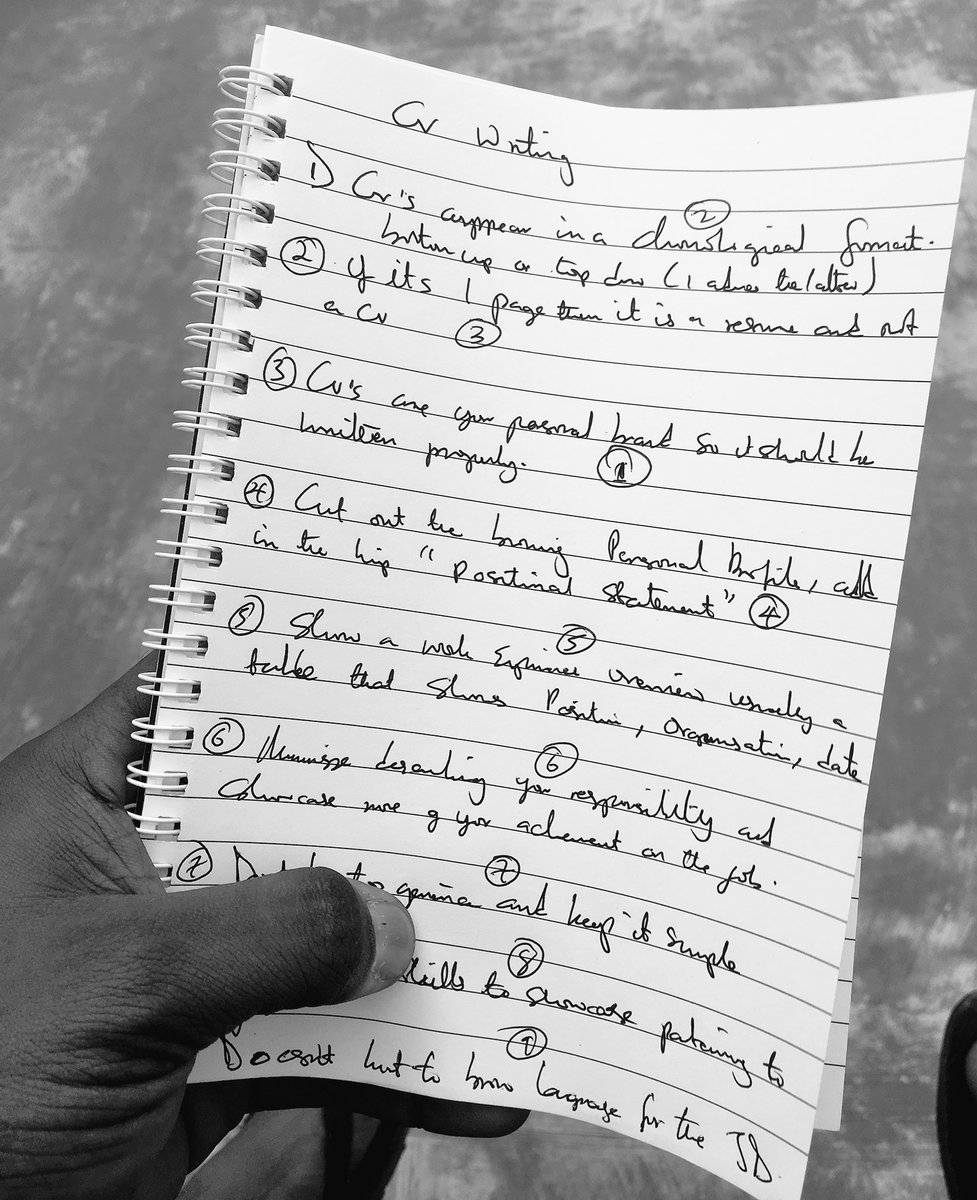

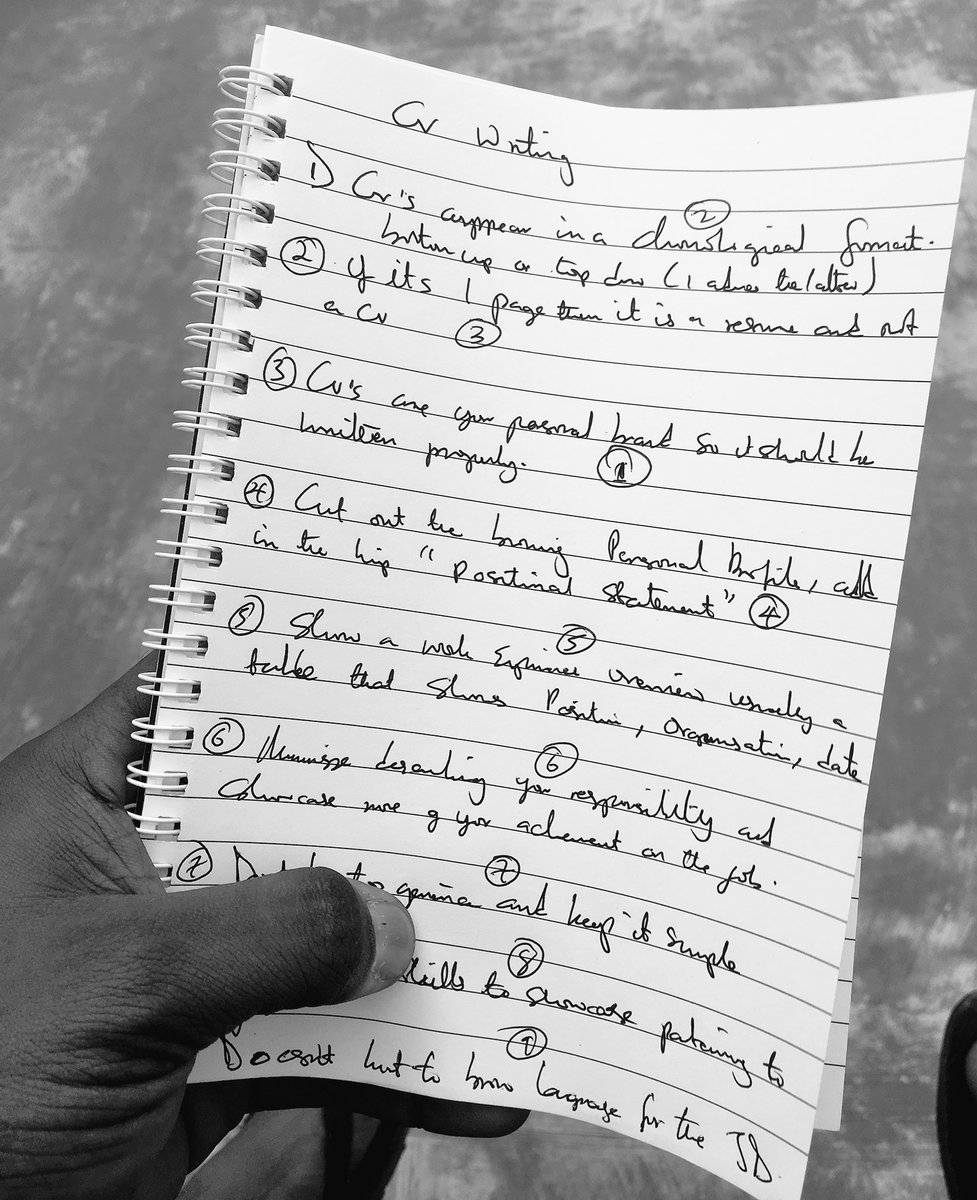

2. So before we go into writing your CV let’s just talk about a few things about your CV. Remember last week we mentioned how your CV is your brand, it’s important to have an outstanding CV as in today’s market personal branding is 🔑 key. #CareerswithJide

2. So before we go into writing your CV let’s just talk about a few things about your CV. Remember last week we mentioned how your CV is your brand, it’s important to have an outstanding CV as in today’s market personal branding is 🔑 key. #CareerswithJide