Assistant professor of economics @UVA;

Past lives: PhD @MITEcon, @Uber, @AQRCapital, @UChicago

How to get URL link on X (Twitter) App

https://twitter.com/dwarkesh_sp/status/20057099230620920381. In a baseline AK economy, consumption taxation still dominates capital taxation!(!!!)

https://twitter.com/arpitrage/status/1985849318423646540Step 1: "A bureaucrat or a computer needs to make a decision between two or more candidates. It needs a legible signal."

https://x.com/cherylwoooo/status/1929348520370417704

The motivation here is like:

The motivation here is like:

https://twitter.com/MTabarrok/status/1917927703098904675

The main argument is that the main hindrance to scientific progress historically was elite suppression, and the printing press changed the balance of power

The main argument is that the main hindrance to scientific progress historically was elite suppression, and the printing press changed the balance of power

https://twitter.com/ben_j_todd/status/1912123220569870375

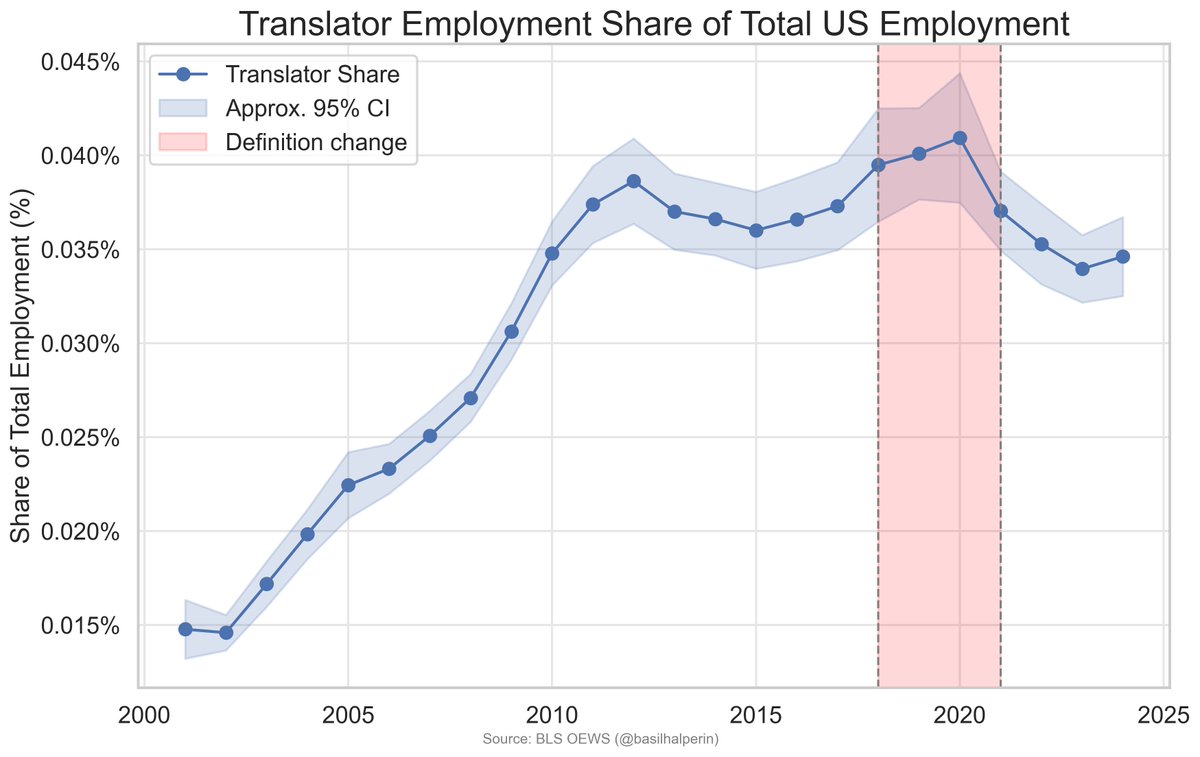

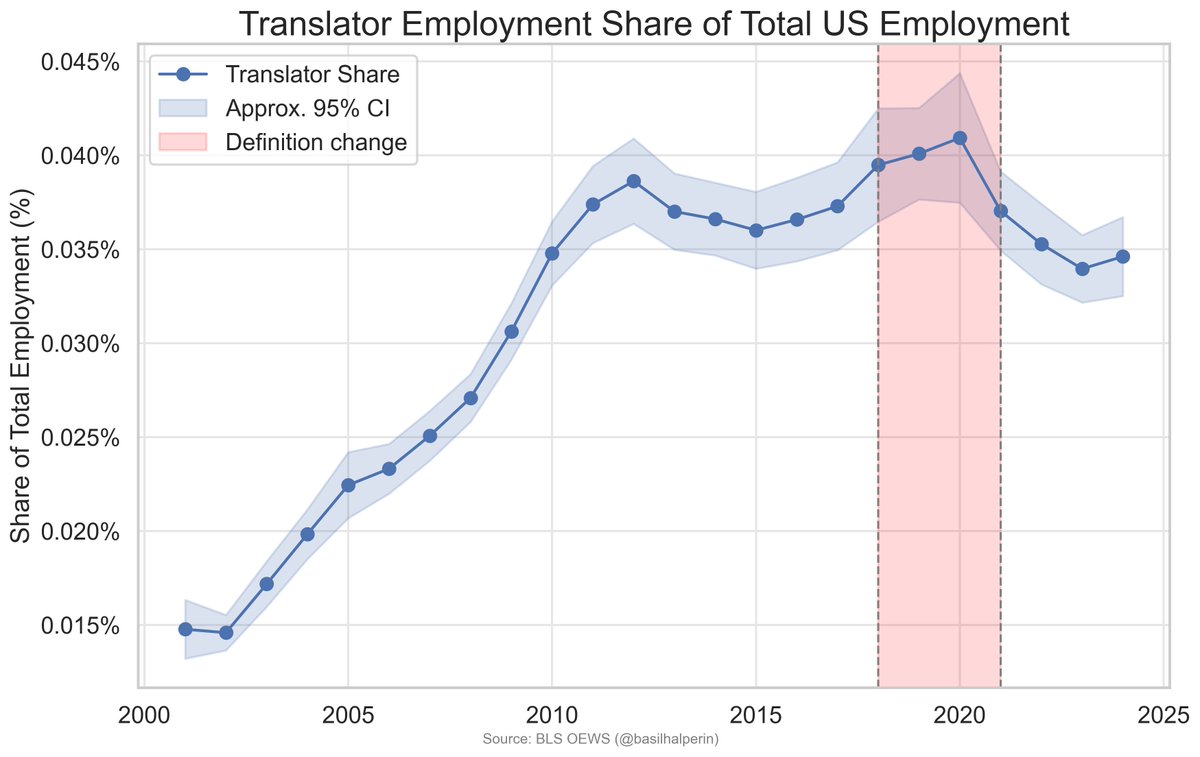

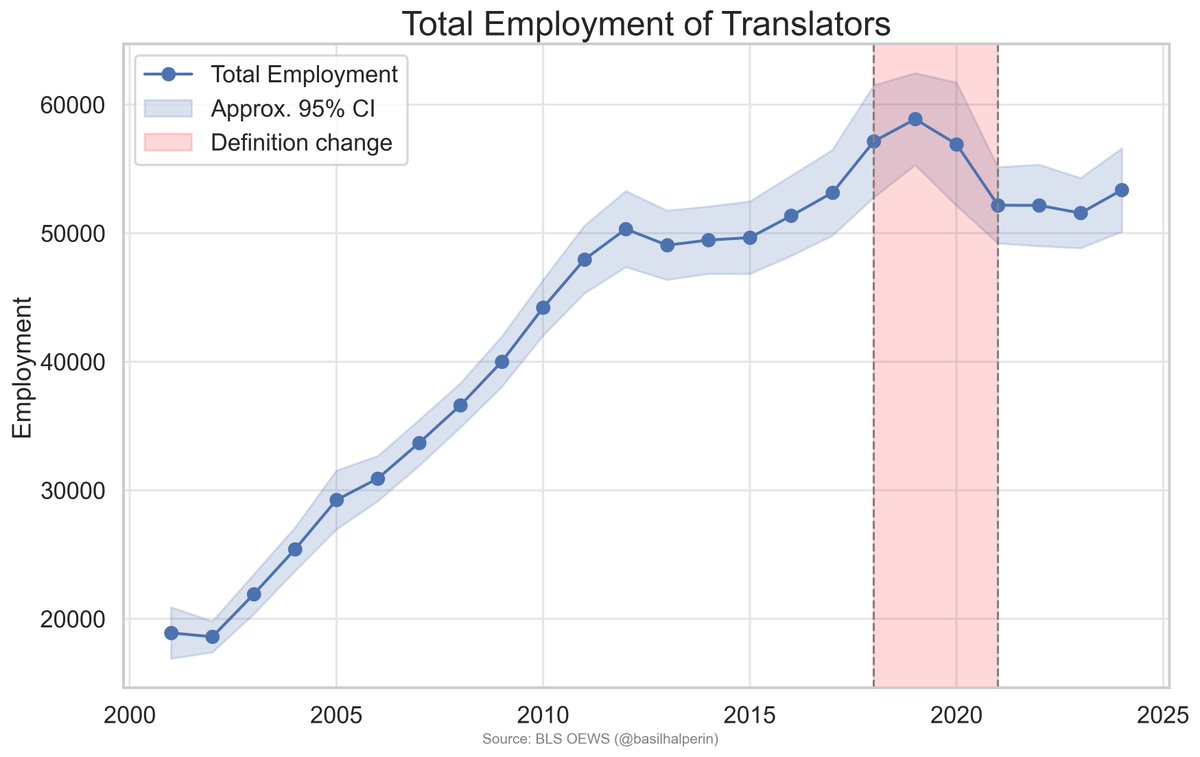

Or total employment in levels...

Or total employment in levels...

https://twitter.com/alz_zyd_/status/18640828449533135343. Kalshi/Polymarket have markets on tax policy changes => clean tax shock measure?

https://twitter.com/BasilHalperin/status/1856396146530484447

2. Relatedly (and again tentatively): an update against *downward* nominal wage rigidity -- the idea that nominal wages are asymmetrically rigid downward, but not upward

2. Relatedly (and again tentatively): an update against *downward* nominal wage rigidity -- the idea that nominal wages are asymmetrically rigid downward, but not upward

https://twitter.com/ZMazlish/status/1856384397160661024

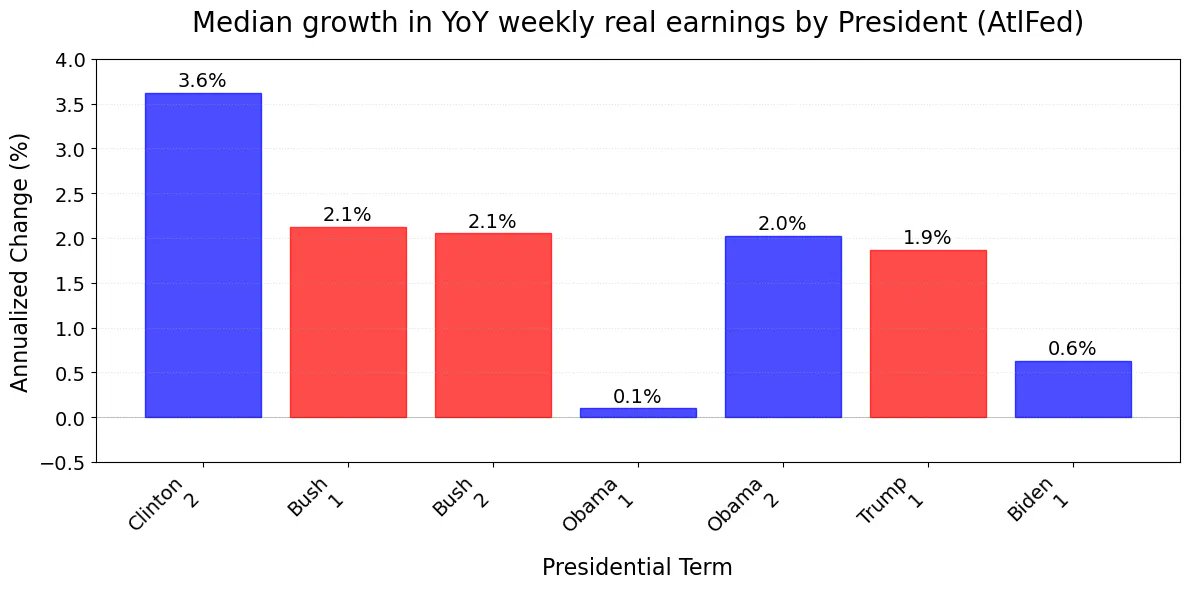

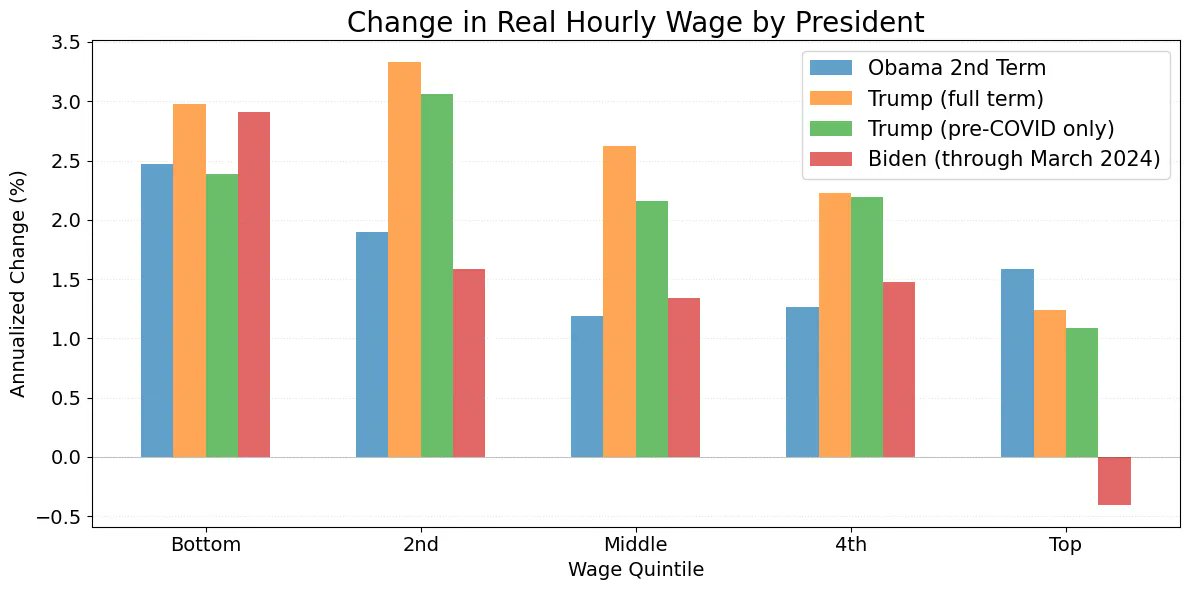

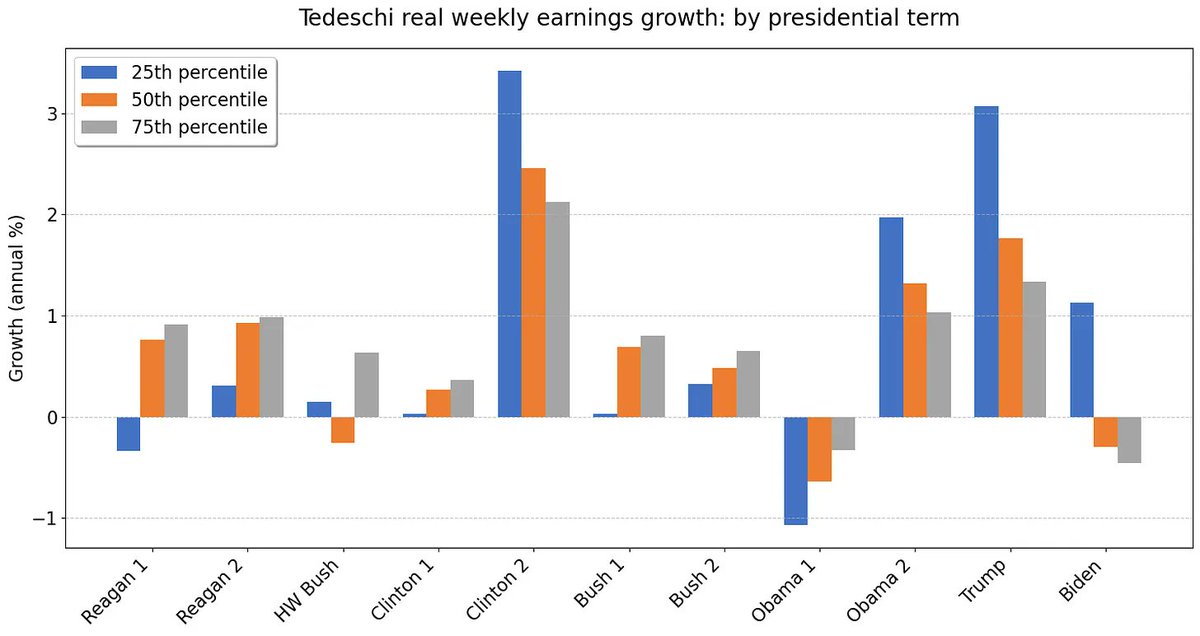

Point 1: In no part of the income distribution did wages grow faster while Biden was president than they did 2012-2020 (!), in the raw data and especially with a composition adjustment

Point 1: In no part of the income distribution did wages grow faster while Biden was president than they did 2012-2020 (!), in the raw data and especially with a composition adjustment

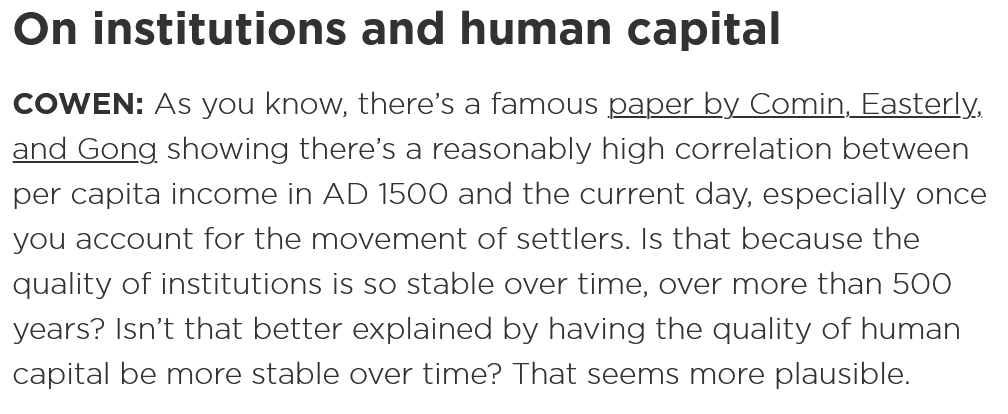

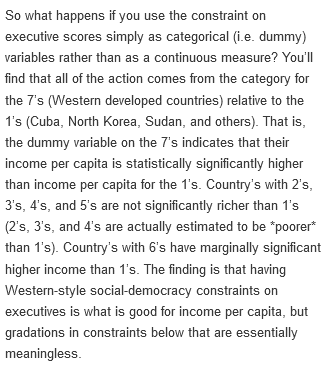

Part 2 of the series discusses AJR 2001. He discusses four critiques:

Part 2 of the series discusses AJR 2001. He discusses four critiques:

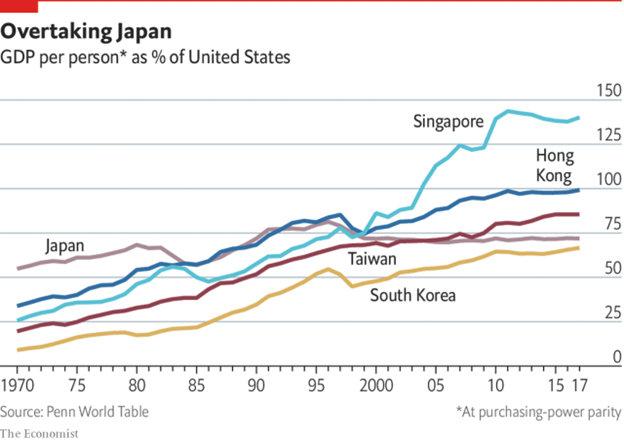

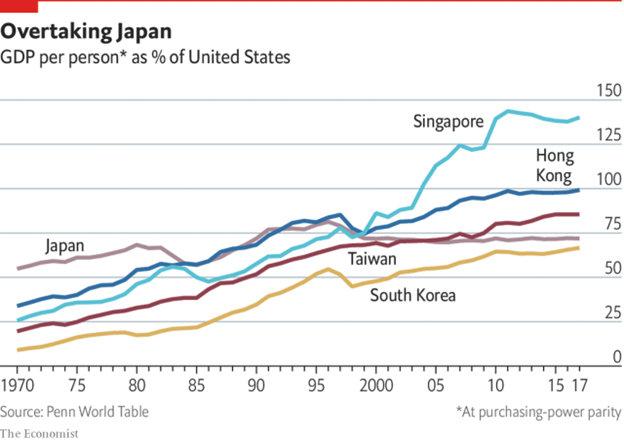

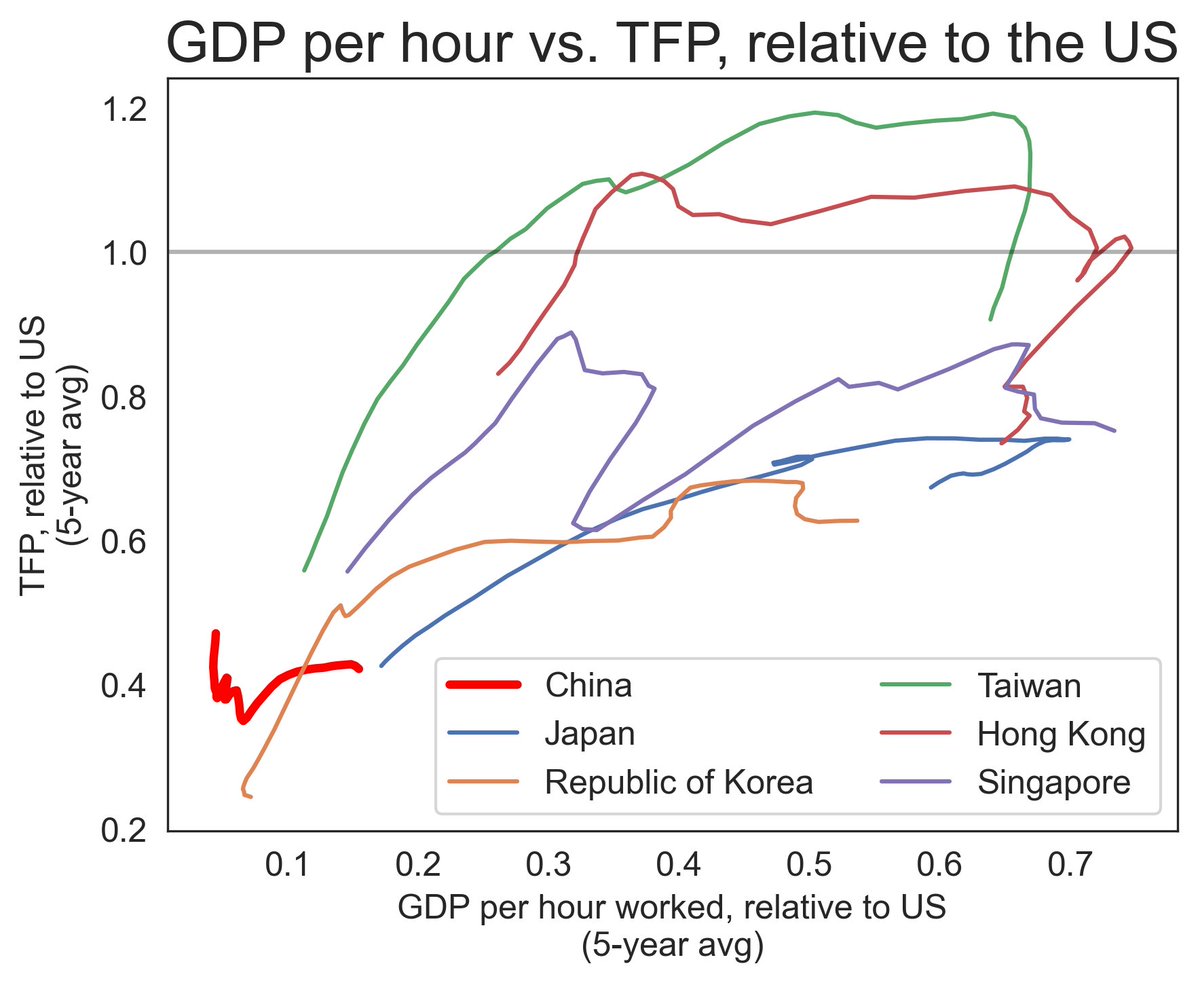

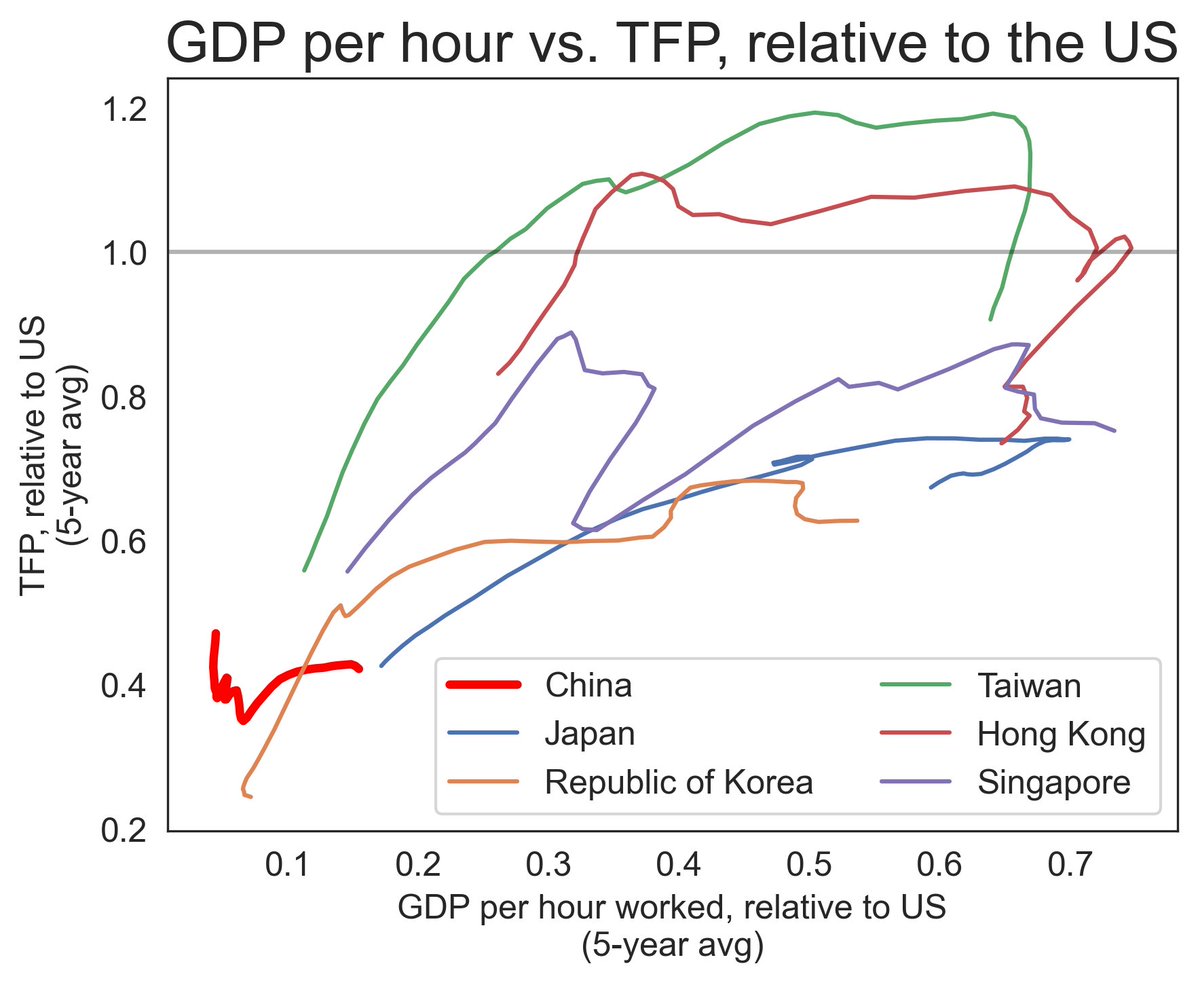

The natural background to the China question is the lit on the rapid growth of Japan + the East Asian Tigers (Hong Kong, Singapore, South Korea, Taiwan), on which I recently gave an opinionated summary

The natural background to the China question is the lit on the rapid growth of Japan + the East Asian Tigers (Hong Kong, Singapore, South Korea, Taiwan), on which I recently gave an opinionated summaryhttps://twitter.com/BasilHalperin/status/1811058315008295134