Research fellow at @CER_EU, formerly with @EFTASecretariat and the Norwegian Civil Service

2 subscribers

How to get URL link on X (Twitter) App

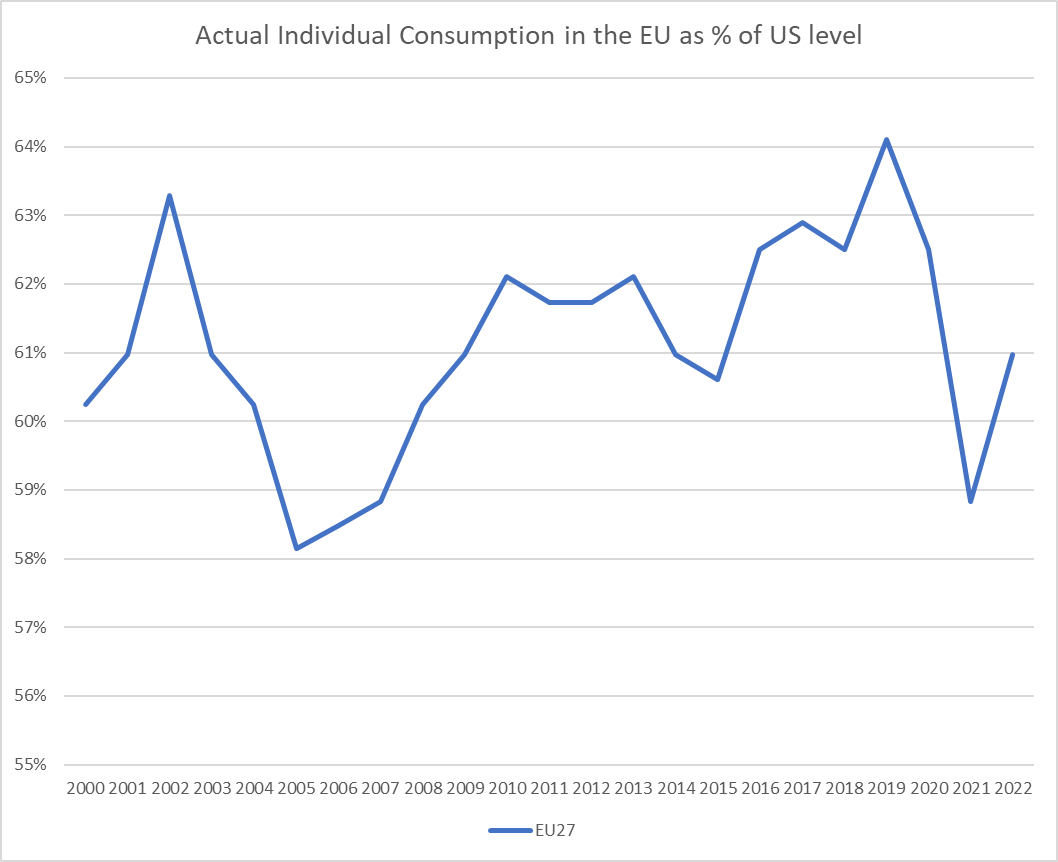

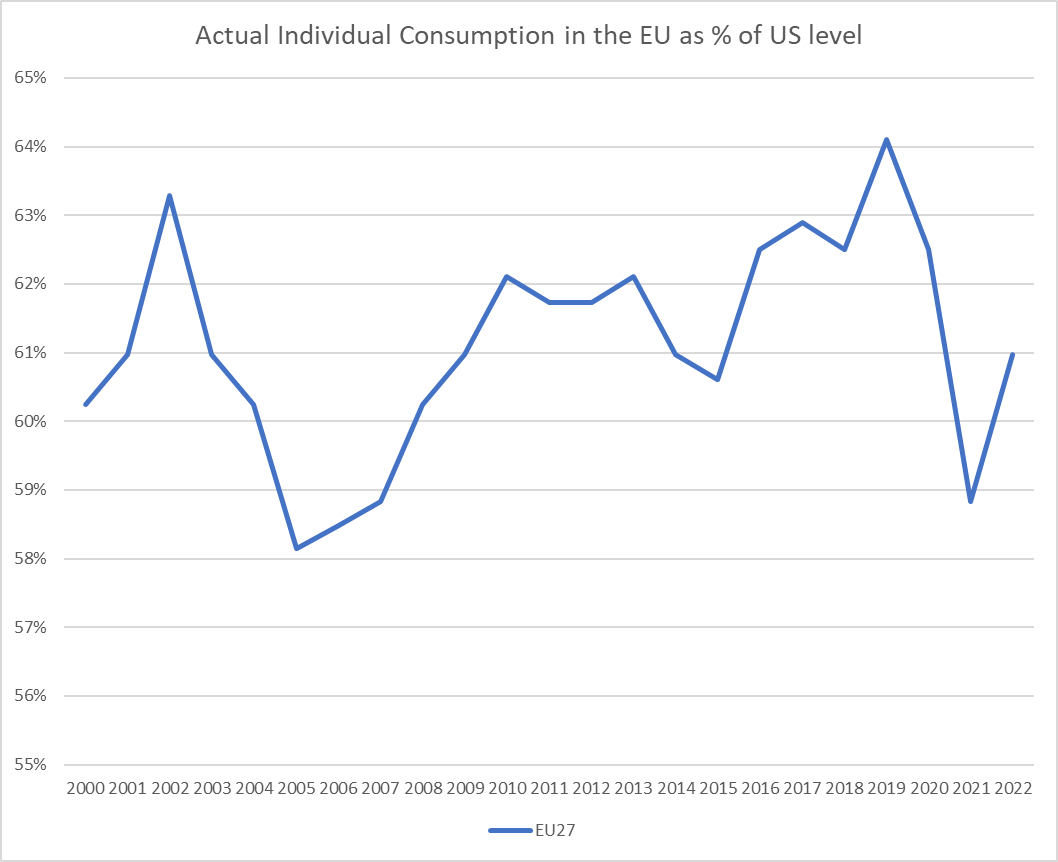

What you might notice is first that consumption in Europe is much lower than in the US, which is indisputably richer. There are several reasons for this: societal choices, history certain US structural advantages. I won't discuss those here. What's interesting is how stable it is

What you might notice is first that consumption in Europe is much lower than in the US, which is indisputably richer. There are several reasons for this: societal choices, history certain US structural advantages. I won't discuss those here. What's interesting is how stable it is

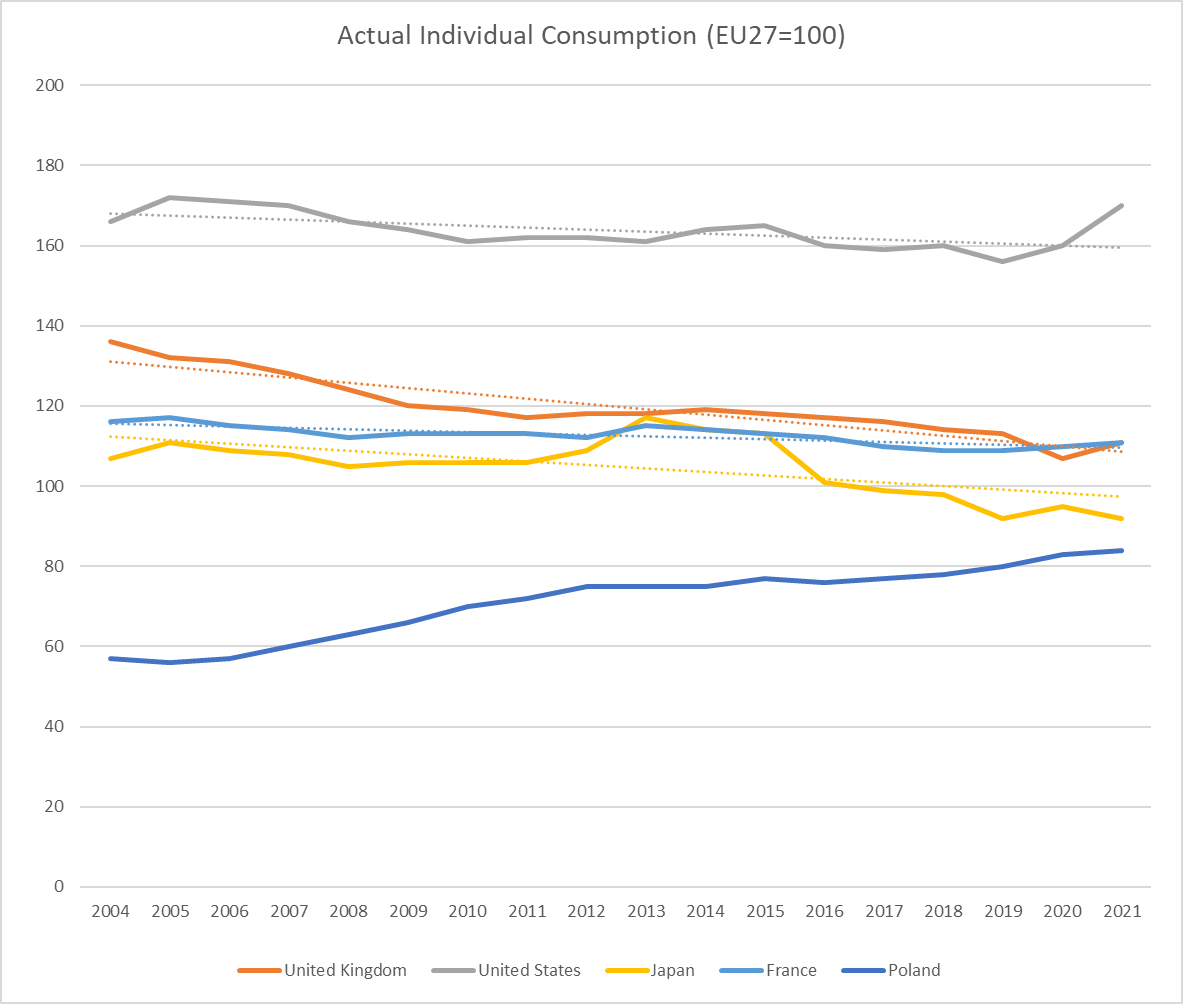

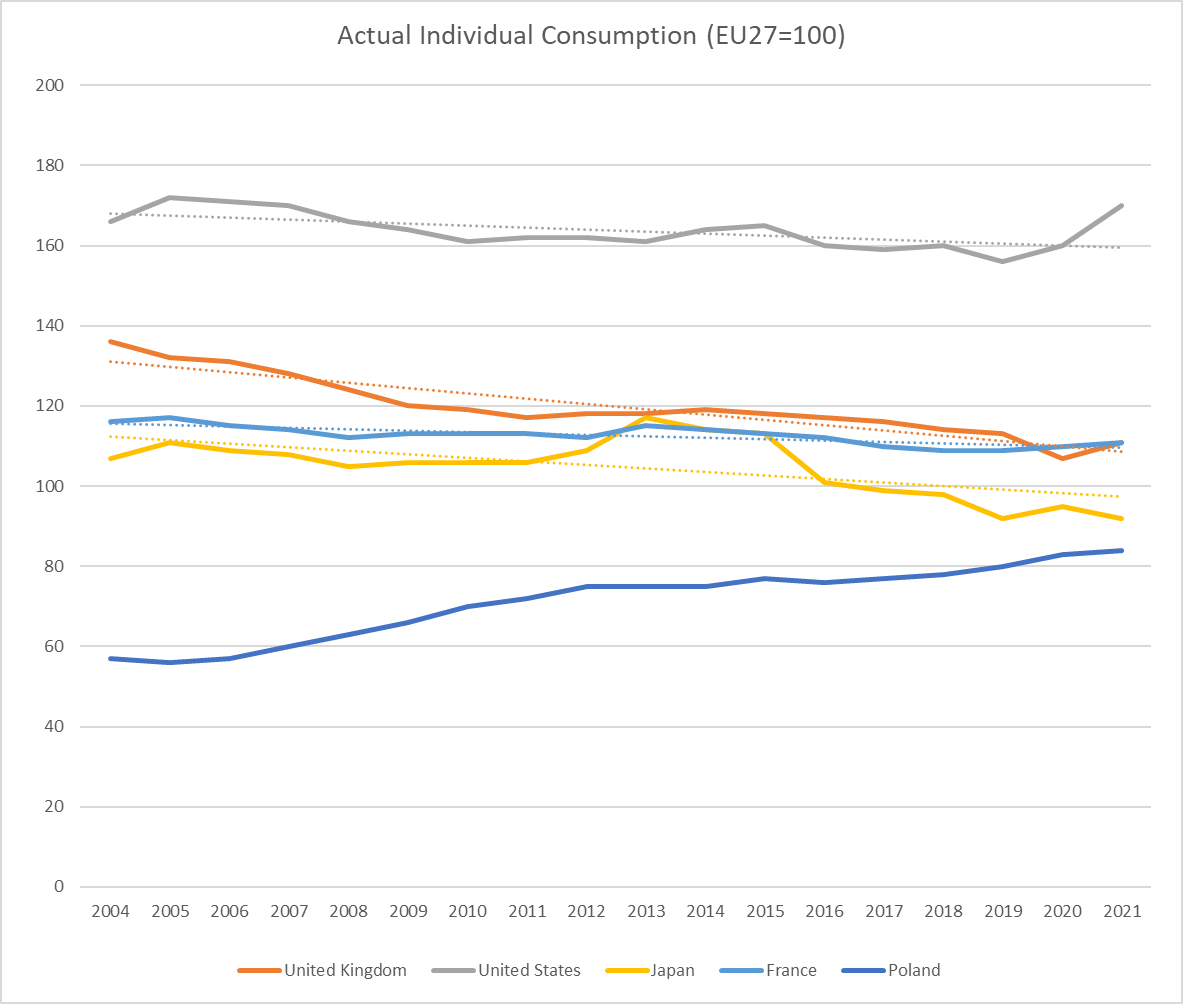

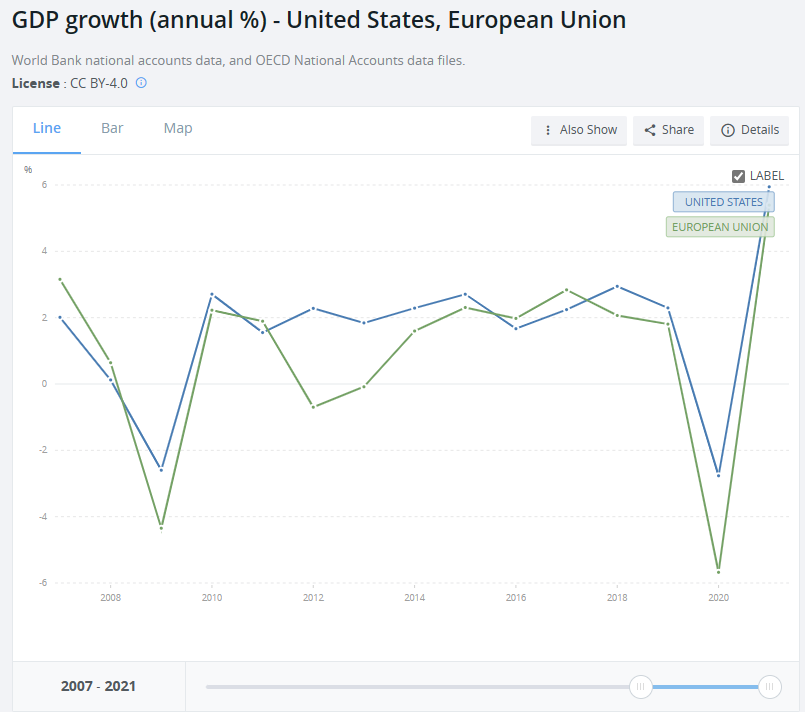

Note you'd expect formerly Communist countries to outperform, so richer countries would be expected to move closer to the EU average. The US having a smaller declining trend line than others is in that sense an achievement.

Note you'd expect formerly Communist countries to outperform, so richer countries would be expected to move closer to the EU average. The US having a smaller declining trend line than others is in that sense an achievement.

https://twitter.com/HenryJFoy/status/1670789883827298306First, it is true that the US has some undeniable advantages: abundant domestic energy, USD reserve status and dominance of the global software sector (I refuse say technology -there is advanced technology outside Silicon Valley). It also has top universities and leading research

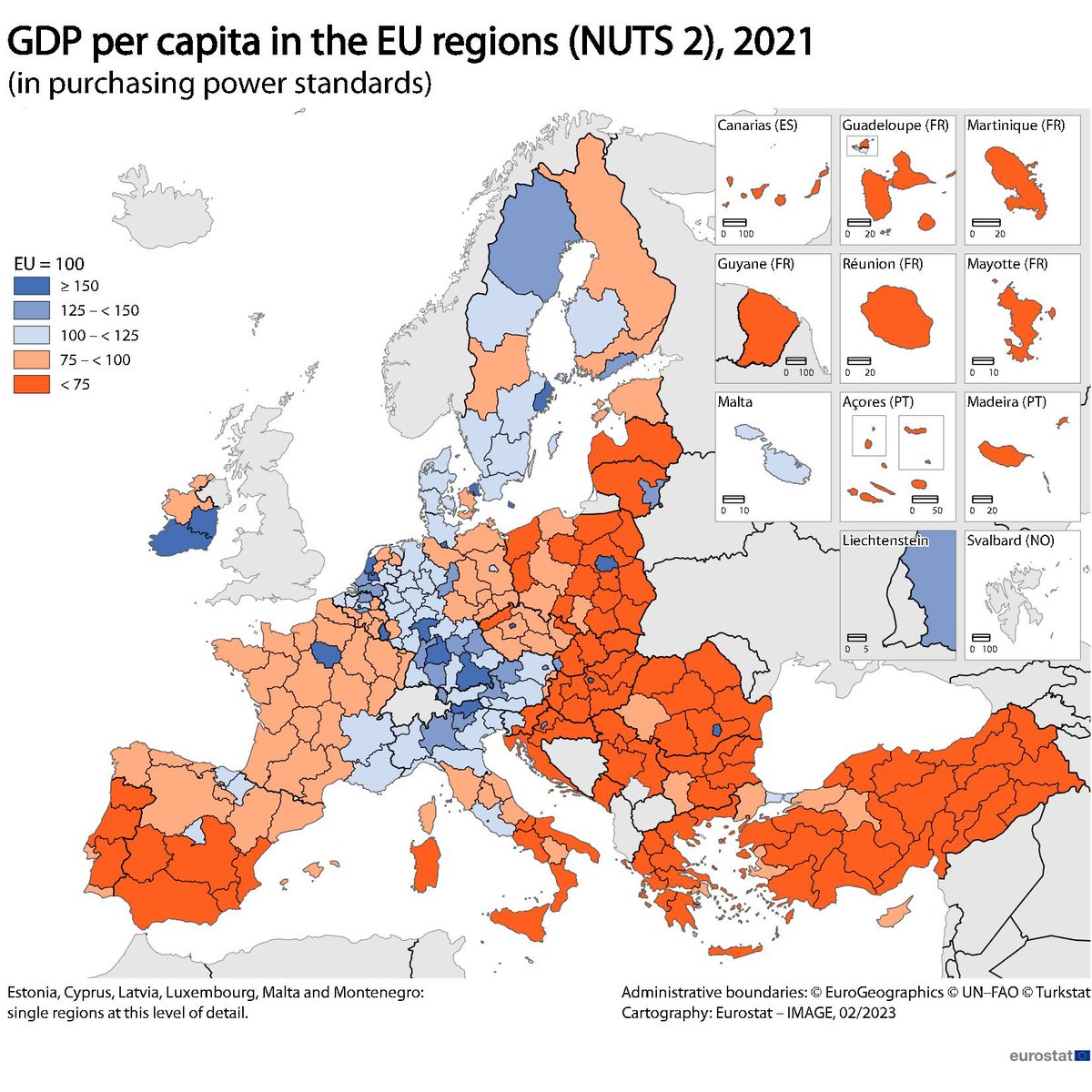

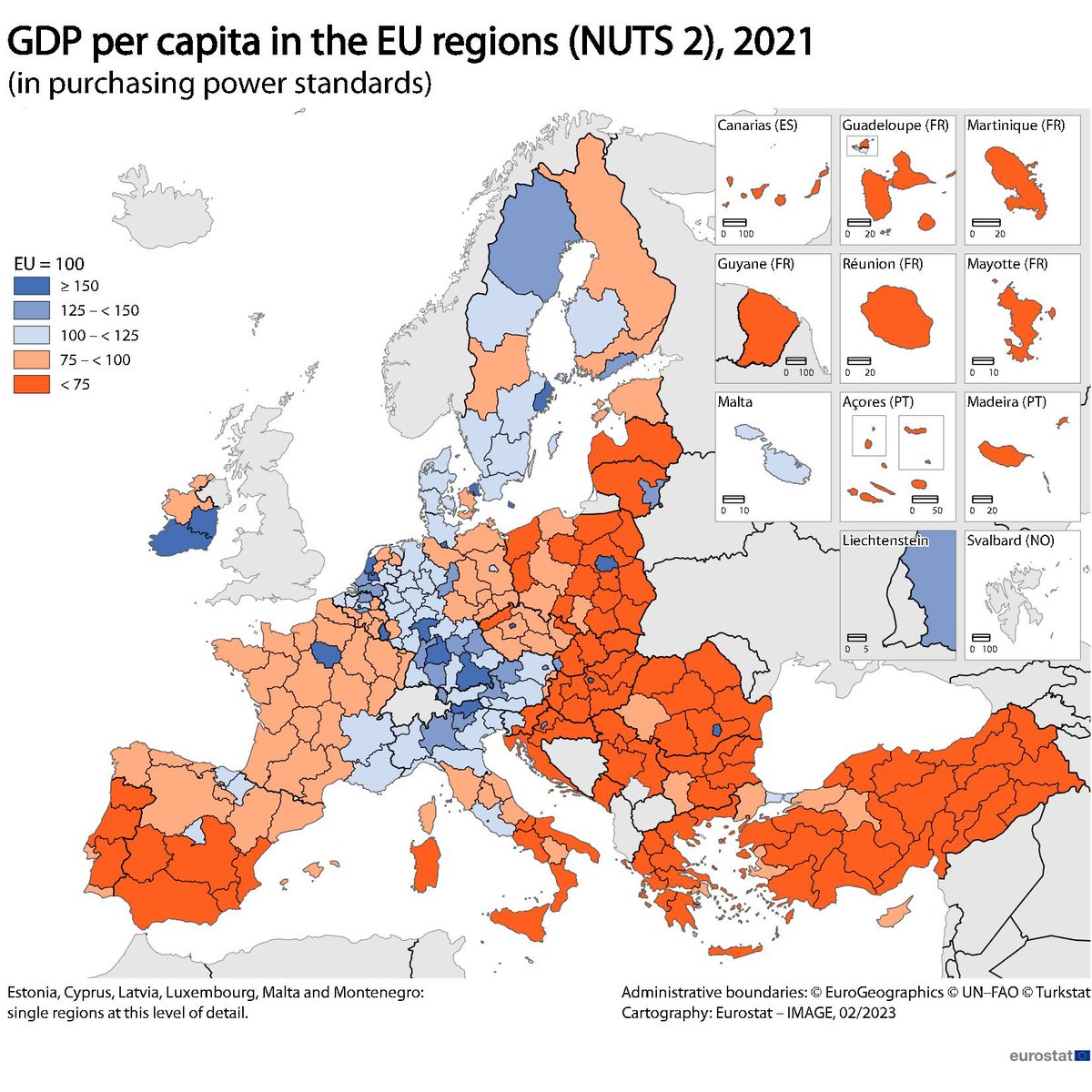

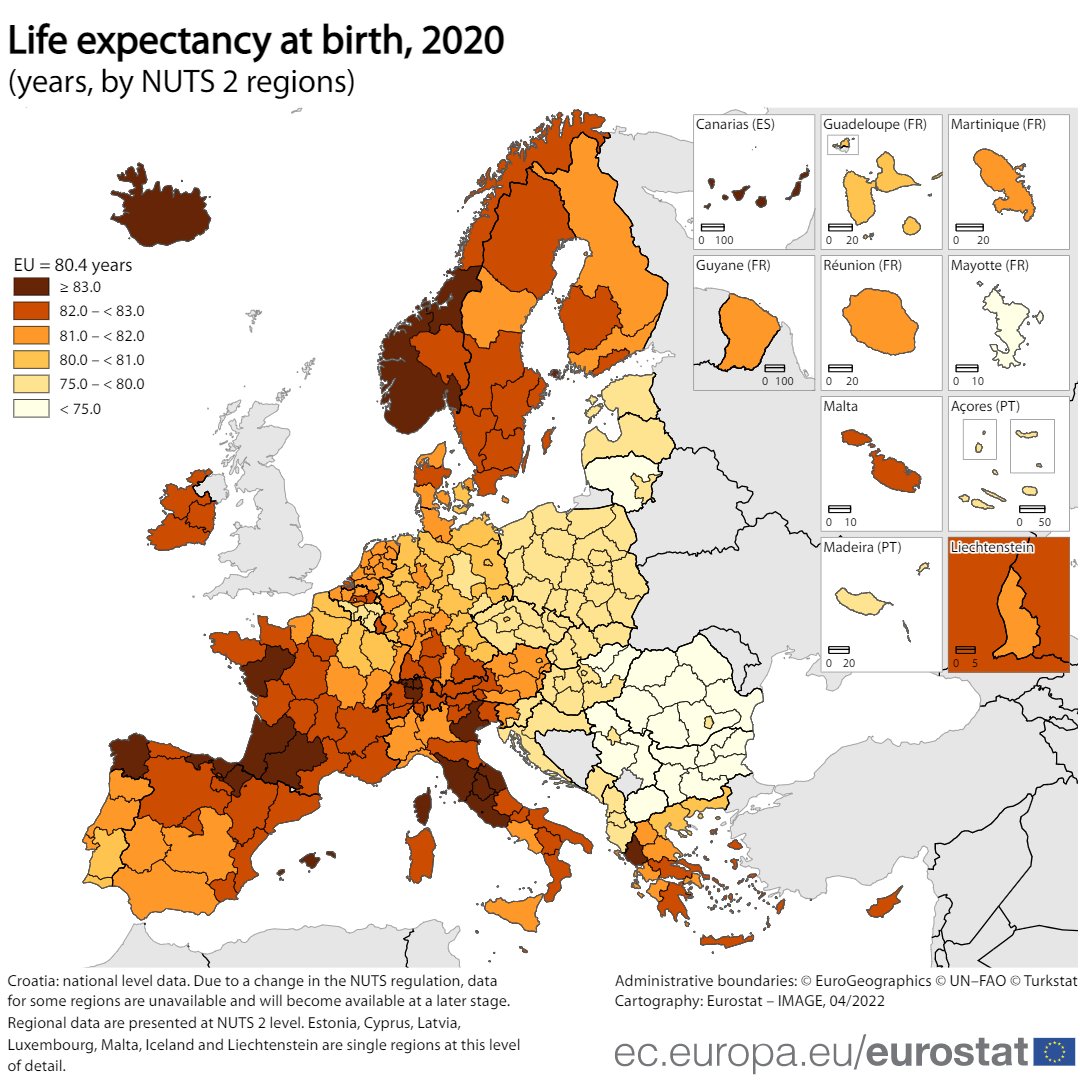

The engine of the European economy is the zone that stretches from Northern Italy through Austria, Switzerland, much of Germany, Benelux, and southern Scandinavia. Paris is a wealthy enclave by itself. Also some might be surprised by Warsaw and Bucharest here.

The engine of the European economy is the zone that stretches from Northern Italy through Austria, Switzerland, much of Germany, Benelux, and southern Scandinavia. Paris is a wealthy enclave by itself. Also some might be surprised by Warsaw and Bucharest here.

https://twitter.com/MikeSington/status/1613635324953133056

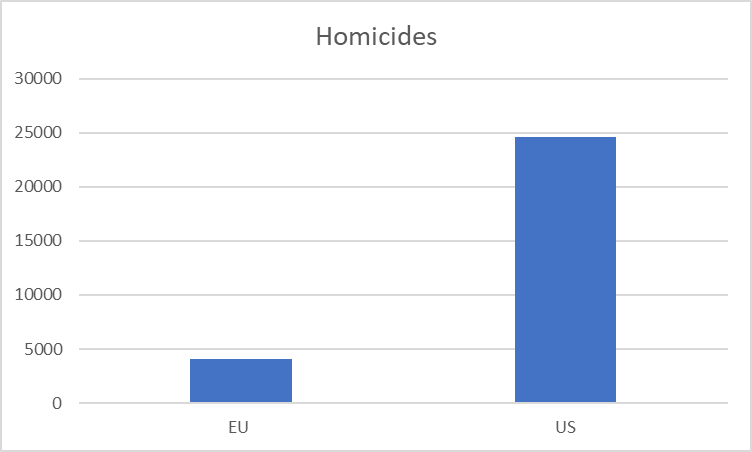

A lot of people think the US is a more violent society. And it is true there are more intentional homicides in the US than the EU (data for 2021)

A lot of people think the US is a more violent society. And it is true there are more intentional homicides in the US than the EU (data for 2021)

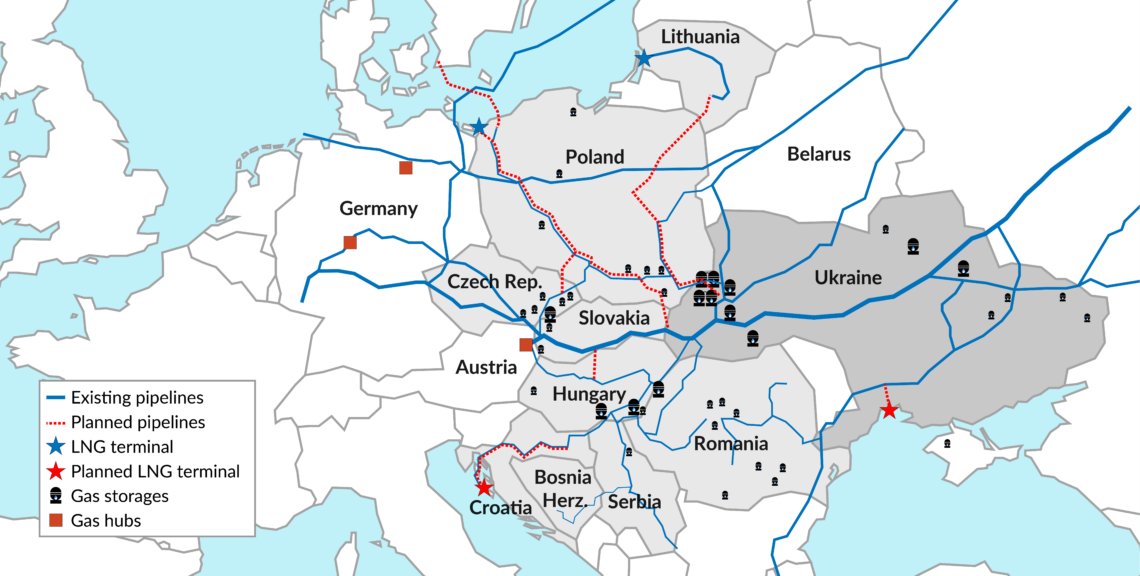

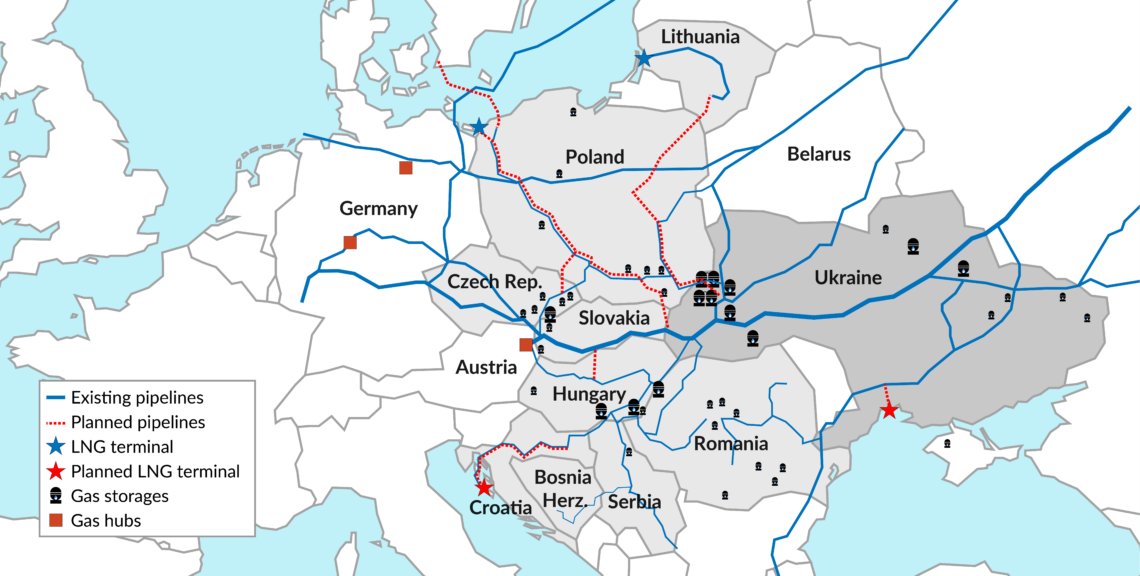

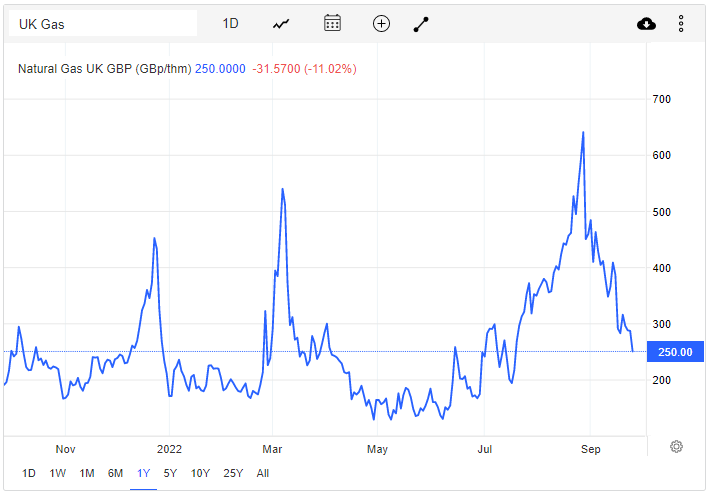

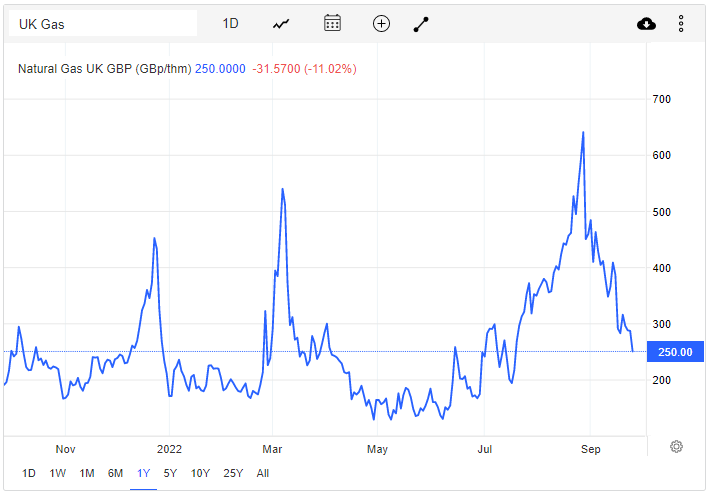

Yesterday the Nordstream pipeline through the Baltic was likely sabotaged, rendering it inoperable. The Nordstream 1 pipeline to Germany had not carried gas since end of August and Nordstream 2 famously never even got started.

Yesterday the Nordstream pipeline through the Baltic was likely sabotaged, rendering it inoperable. The Nordstream 1 pipeline to Germany had not carried gas since end of August and Nordstream 2 famously never even got started.

Of course, if it continues to fall below that level there will eventually be savings for consumers as well.

Of course, if it continues to fall below that level there will eventually be savings for consumers as well.

https://twitter.com/jburnmurdoch/status/1570832839318605824I would also argue it's unfair on the UK. Being sort of middling compared to your neighbours does not make you poor, even if you have real issues with inequality.

https://twitter.com/RobinBrooksIIF/status/1570296888196218880This is particularly true if you look at trade balances as % of GDP

https://twitter.com/adrianmschmidt/status/1570340738080055299

Looking at it in a 5-year perspective, you can clearly see that Phase 1 started last year. From April to October the price of gas quadrupled. Part of this was recovery from the pandemic, but the main thing here is that Gazprom started limiting exports and, crucially storage.

Looking at it in a 5-year perspective, you can clearly see that Phase 1 started last year. From April to October the price of gas quadrupled. Part of this was recovery from the pandemic, but the main thing here is that Gazprom started limiting exports and, crucially storage.

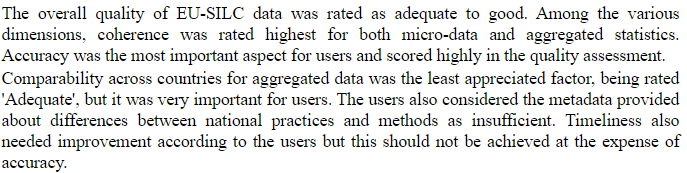

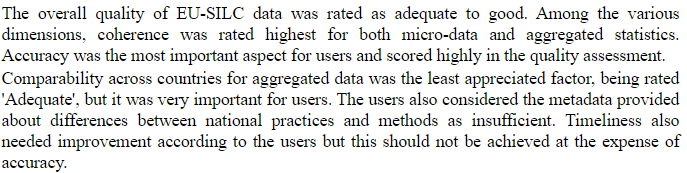

https://twitter.com/resfoundation/status/1547133006997082113A time series break means a revision of methodology, which makes it difficult to compare over time. Differing methodology also makes it hard to compare between countries. Eurostat notes user feedback:

https://twitter.com/RobinBrooksIIF/status/1513516340505628674First, let's be clear about what the current situation does. Russia can support its currency, import necessities. But sanctions have severe effects on domestic production, investment and economic development as I mention here:

https://twitter.com/BergAslak/status/1513400945471852544

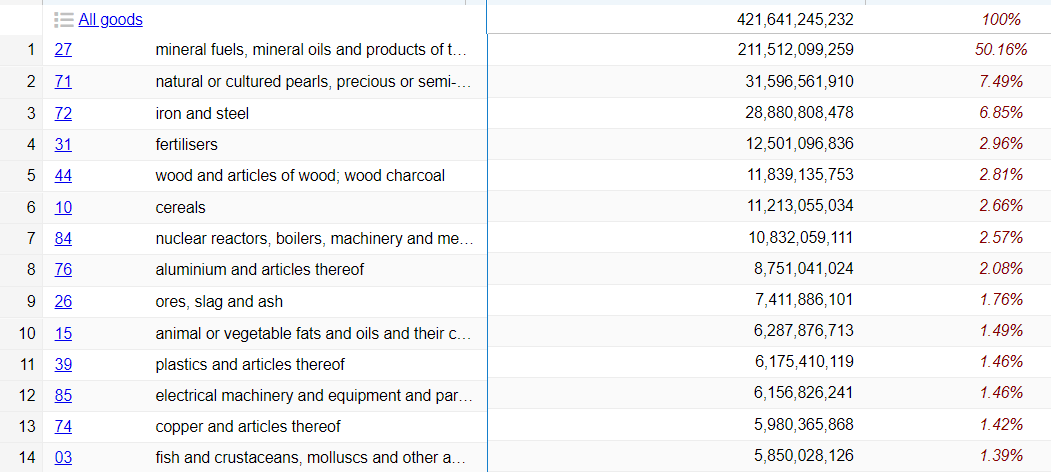

https://twitter.com/BergAslak/status/1512402321745104901As mentioned, Russian exports have not been hit to the same degree as imports. But some Russian export sectors have been hit - notably metallurgy and coal. A significant part of exports 30-40% goes to markets that will no longer be accessible. This will hurt the economy and jobs

Well, Russia runs a substantial current account surplus. So they have a lot of goods to sell, and sanctions have so for not targeted Russian exports to a substantial degree.

Well, Russia runs a substantial current account surplus. So they have a lot of goods to sell, and sanctions have so for not targeted Russian exports to a substantial degree. https://twitter.com/RobinBrooksIIF/status/1512072895073116170