Former Deputy Director of the White House National Economic Council. Now posting here: https://t.co/6sCXYkt8MA

9 subscribers

How to get URL link on X (Twitter) App

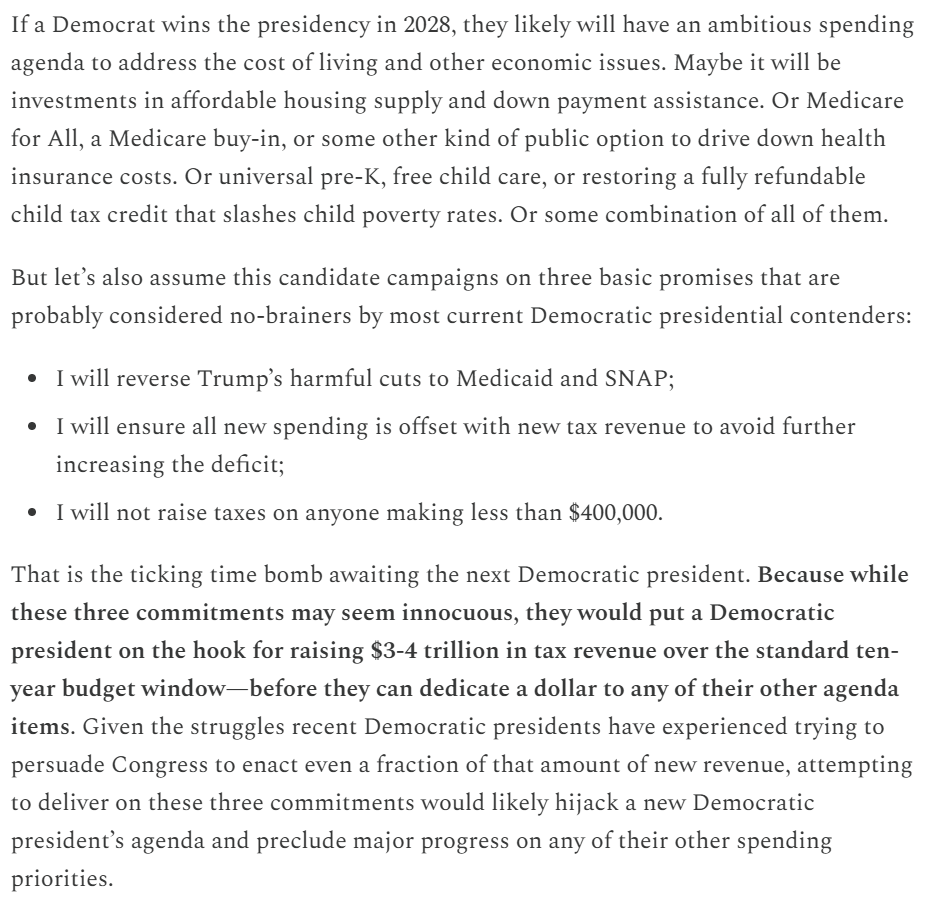

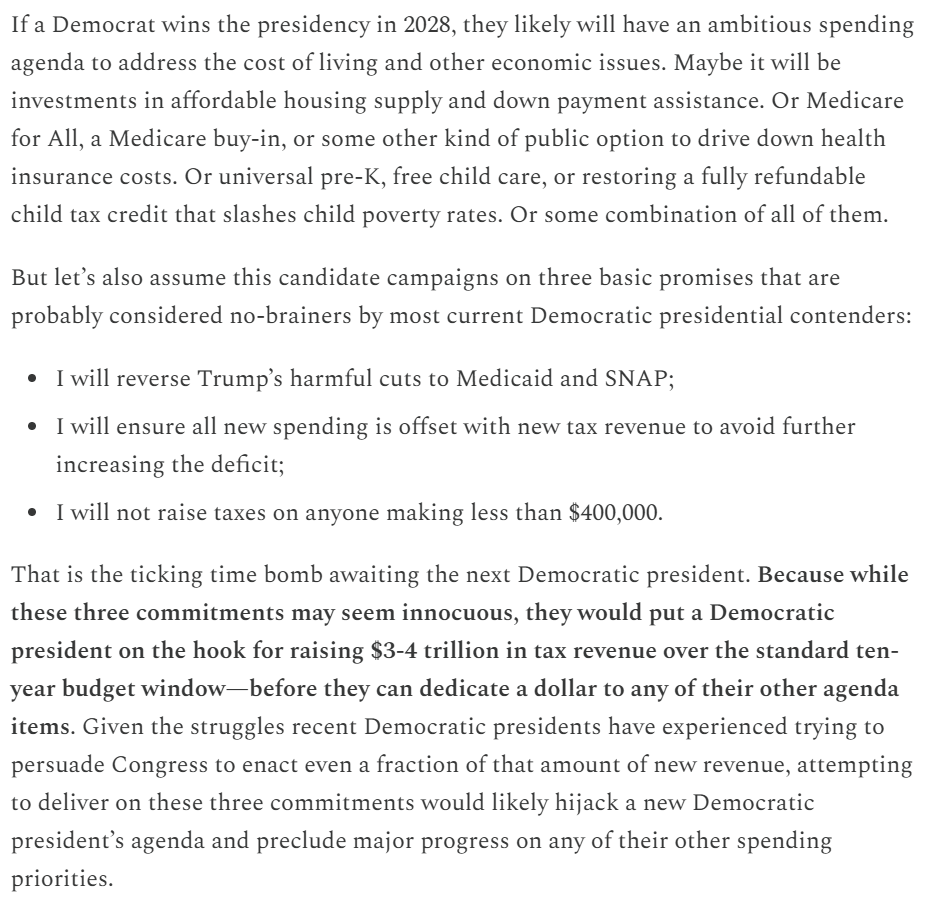

Trump and the GOP have left two massive issues for a potential Democratic president to deal with in 2029:

Trump and the GOP have left two massive issues for a potential Democratic president to deal with in 2029:

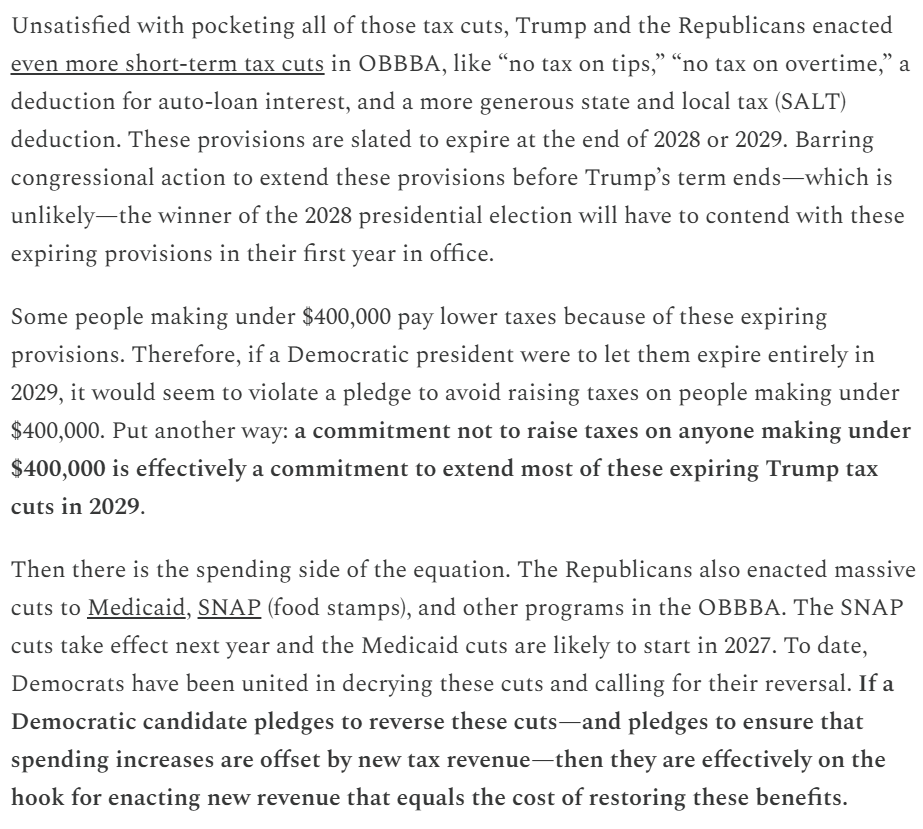

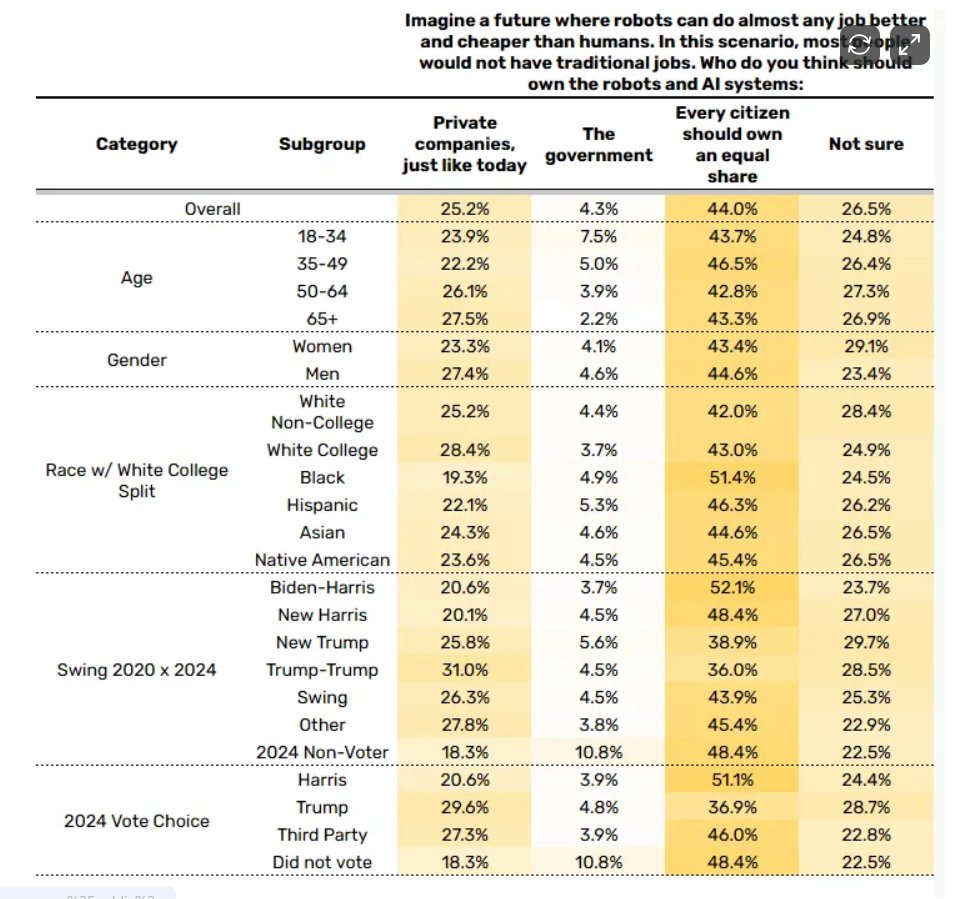

Do Americans welcome a world in which AI replaces most paid work and they are free to pursue whatever they want? No -- a strong majority believe jobs are important for purpose and dignity. 2/

Do Americans welcome a world in which AI replaces most paid work and they are free to pursue whatever they want? No -- a strong majority believe jobs are important for purpose and dignity. 2/

https://twitter.com/JakeSherman/status/1940840849170174357Q: So what does this bill do?

That said, I wish we had enacted the housing, care, and child tax credit elements in Build Back Better so we would have had concrete cost-of-living benefits to run on. People should reflect on which part of the Democratic Party denied us those agenda items.

That said, I wish we had enacted the housing, care, and child tax credit elements in Build Back Better so we would have had concrete cost-of-living benefits to run on. People should reflect on which part of the Democratic Party denied us those agenda items.

https://twitter.com/sullycnbc/status/1760546907074556237For a long time, that law wasn’t administered properly. People did their ten years, submitted the paperwork, and didn’t get relief. The Biden Administration went back and fixed it, giving public servants the debt relief they’re entitled to under the law. 2/

https://x.com/BharatRamamurti/status/1757077252804645087?s=20Federal Pell Grants help address the cost of attending college. The typical student receiving a Pell Grant comes from a family making under $30,000 a year.

https://twitter.com/steverattner/status/1714685187273949370As a result, people should consider alternative explanations. The large disparity between people’s satisfaction with their own financial condition (fairly high) and the broader state of the economy (fairly low) suggests that media narrative plays at least some role. 2/

https://twitter.com/crampell/status/1564017070802706432Here is data from the Education Department on borrowers who graduated in 2014/15 and 2015/16.

https://twitter.com/FinancialCmte/status/1535343704936005632The second big reason gas prices are up is Putin's actions in Ukraine and the global response raising oil prices. Pump prices are up more than $1.60 since then. Our response had the backing of Republicans, as Jesse details here:

https://twitter.com/JesseLee46/status/1535275861791985666?s=20&t=nFF1ltlQAg37pKwLl34DIw

https://twitter.com/Markzandi/status/1533451827009691648The key difference is that the American Rescue Plan has generated a world-beating economic recovery for the US, allowing us to face this global challenge from a unique position of strength.

A straightforward way to assess the distributive effect of cancellation might be to ask, "how much of the cancelled debt is held by people in the bottom half of the income spectrum vs. the top half?"

A straightforward way to assess the distributive effect of cancellation might be to ask, "how much of the cancelled debt is held by people in the bottom half of the income spectrum vs. the top half?"