How to get URL link on X (Twitter) App

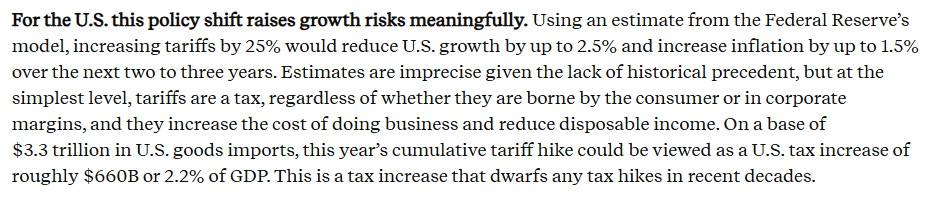

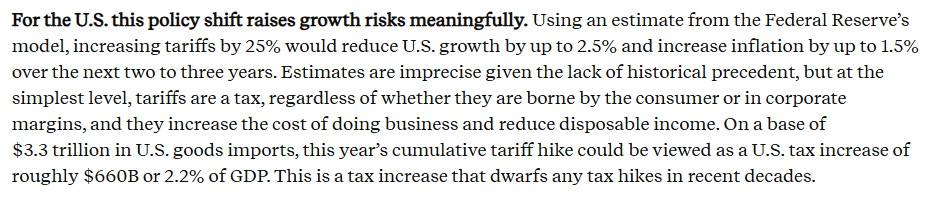

https://twitter.com/BigJohn043/status/1907901081209766379JP Morgan took the amount of tariffs times the new tariff rates and came up with $660B annually in new taxes or 2.2% of GDP.

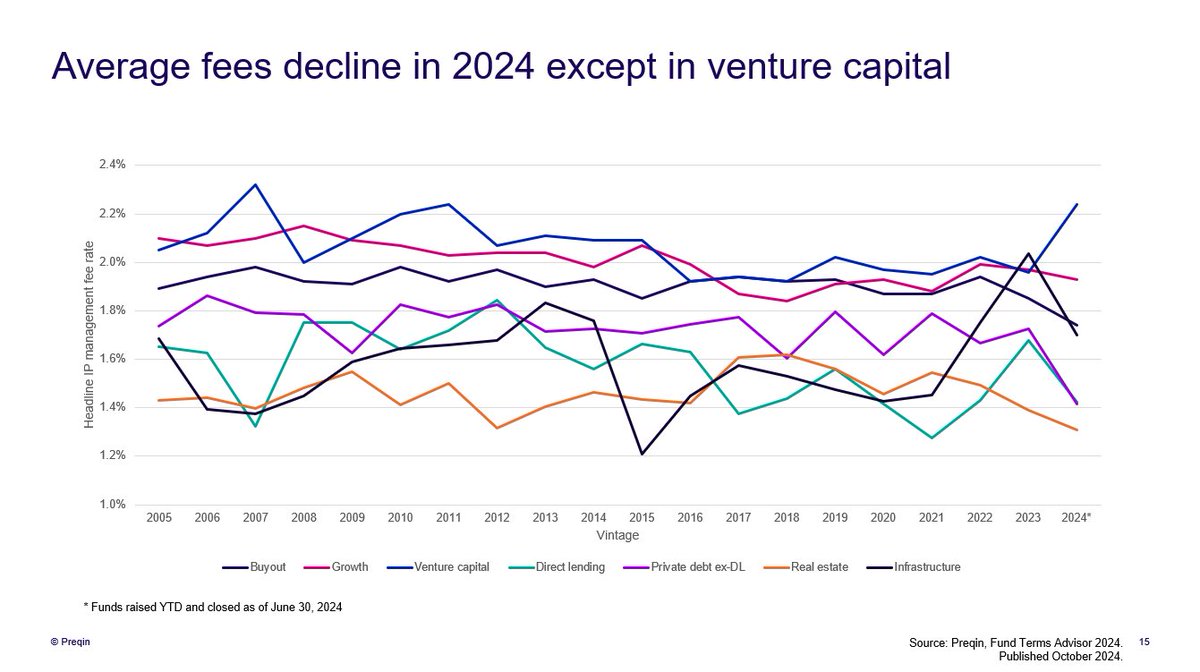

Fees for private asset classes are down across the board. Some of this is driven by a shift towards larger funds that have lower fee rates.

Fees for private asset classes are down across the board. Some of this is driven by a shift towards larger funds that have lower fee rates.

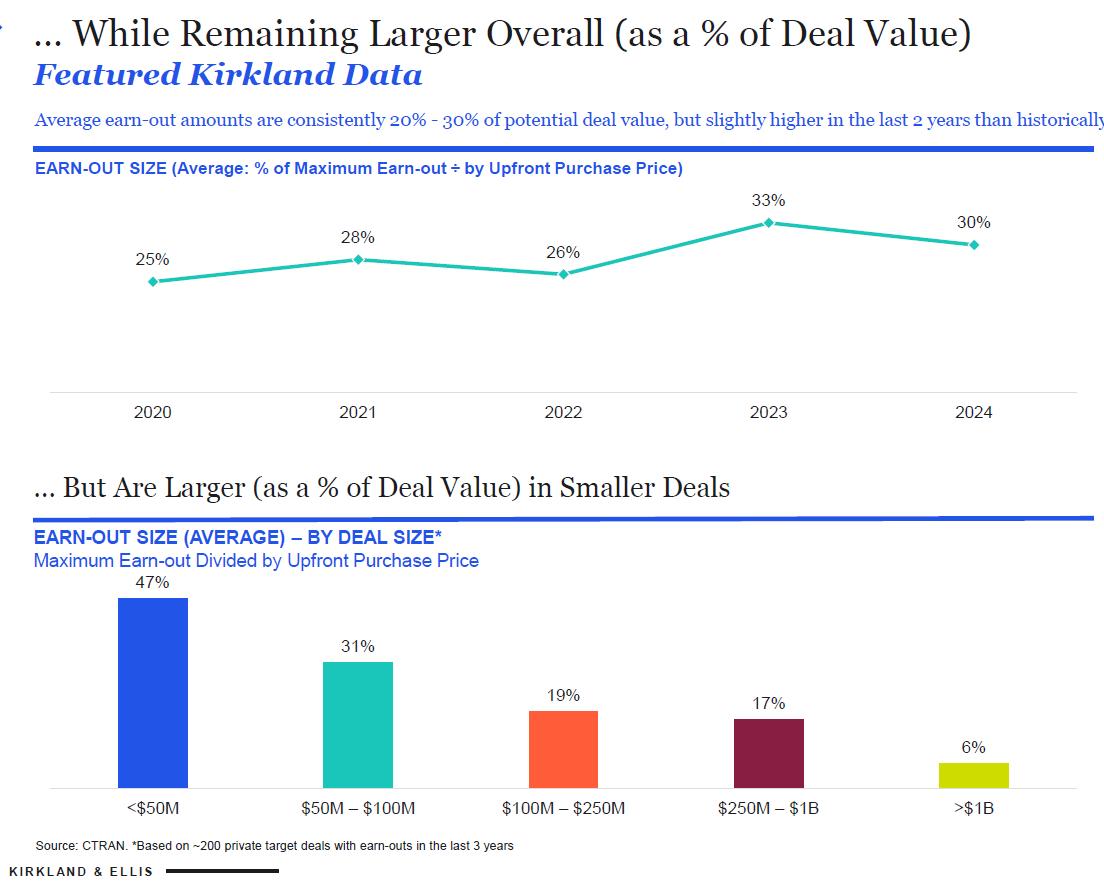

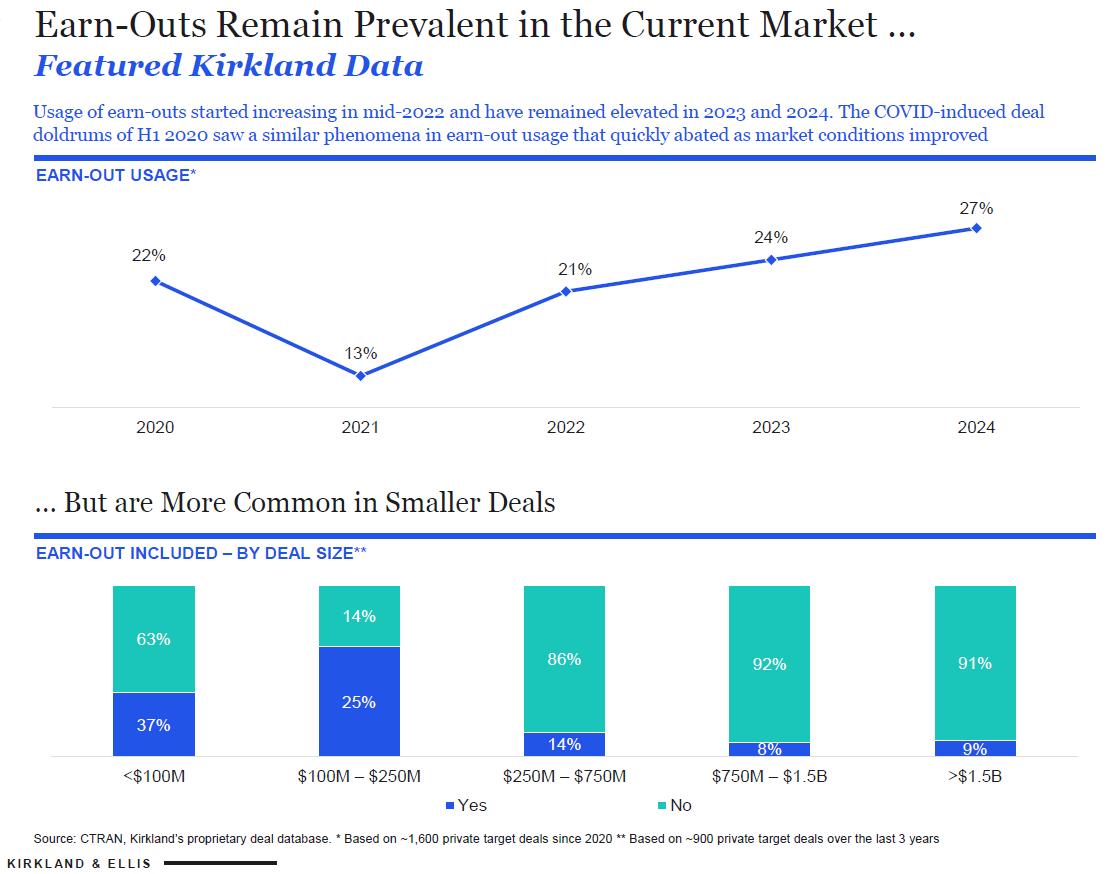

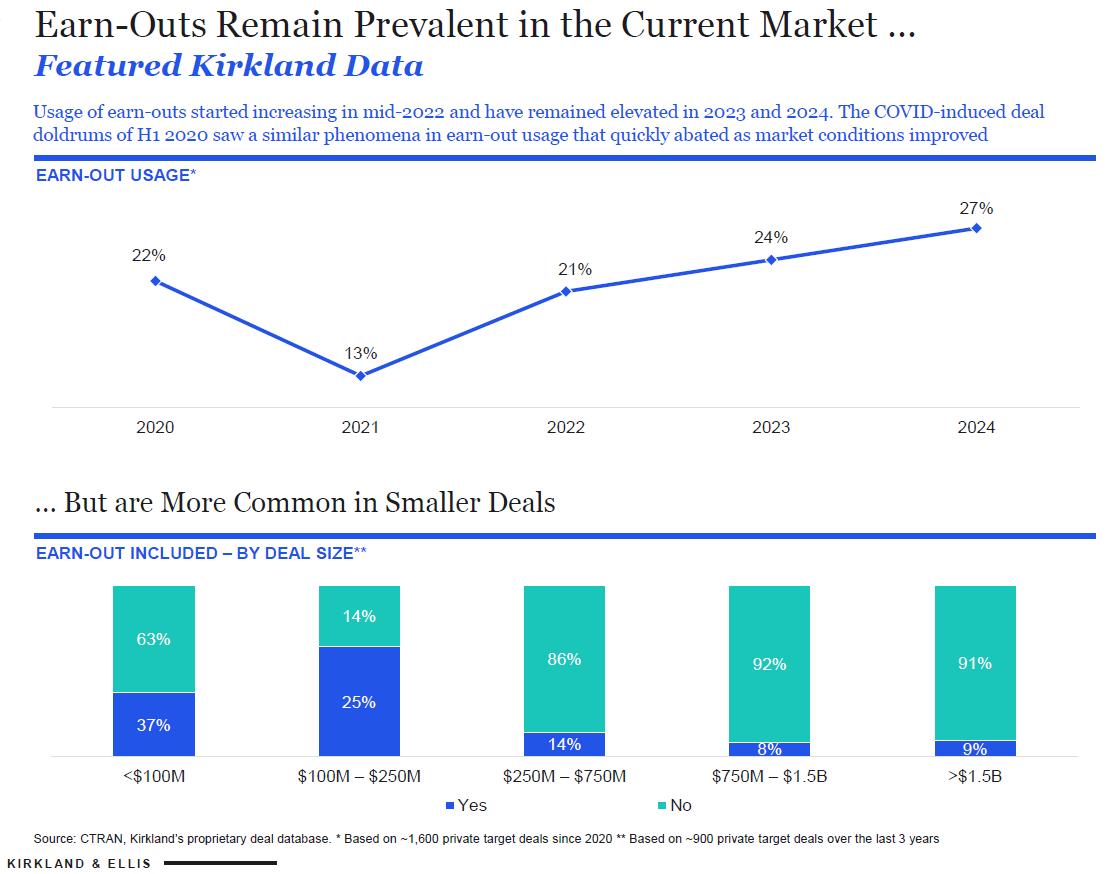

And the average earnout is 30% of deal size. Surprised they are so large. Really shocked by this.

And the average earnout is 30% of deal size. Surprised they are so large. Really shocked by this.