SEBI RA License No - INH000011282

Tweets for Education Purpose only.

8 subscribers

How to get URL link on X (Twitter) App

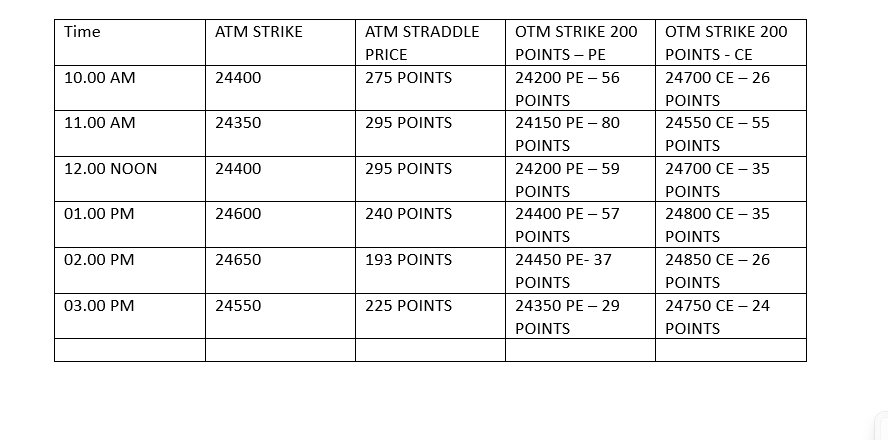

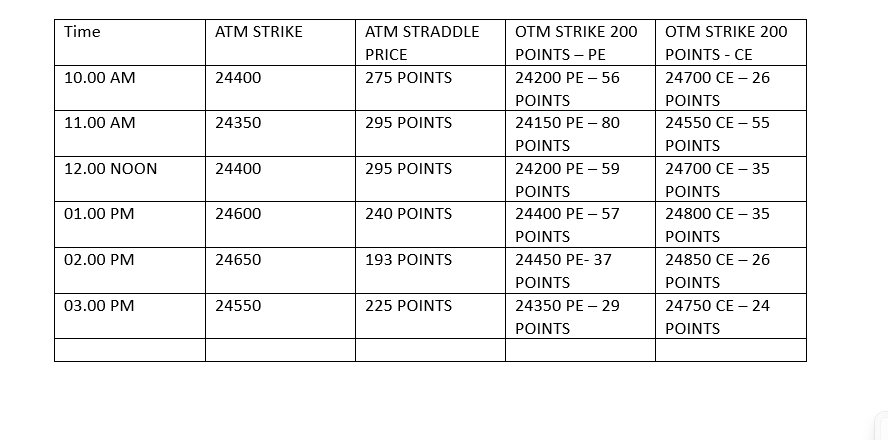

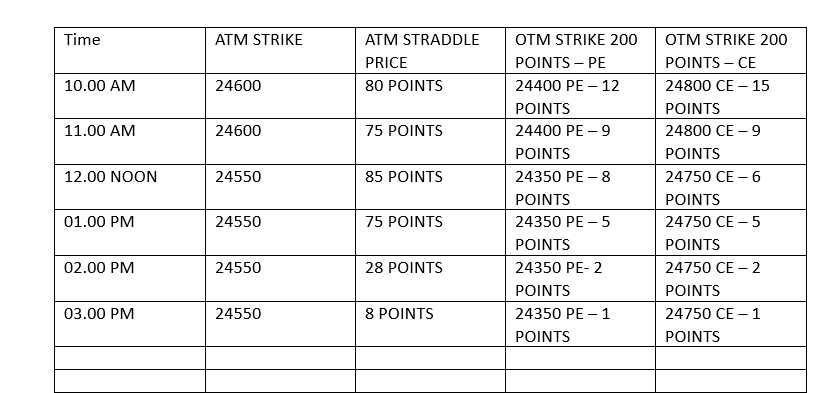

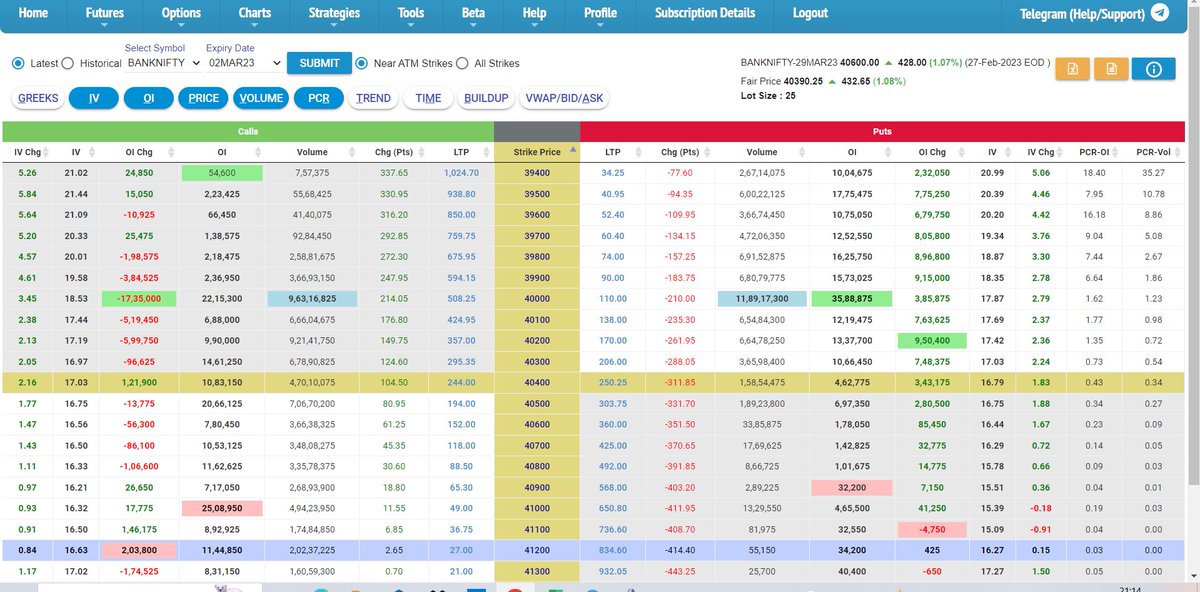

We can easily observe that the Prices of ATM straddle were almost 3x of what they were today . The VIX (the index to measure the volatility) was around 14.50 and today it was around 13.25. So a fall of 10% approx. in the volatility. But this 10% fall cant be ascribed to so low premium today. Our point of discussion is why the Option prices were so high on last Thursday and what made Index to show a volatility of 4% in a day.

We can easily observe that the Prices of ATM straddle were almost 3x of what they were today . The VIX (the index to measure the volatility) was around 14.50 and today it was around 13.25. So a fall of 10% approx. in the volatility. But this 10% fall cant be ascribed to so low premium today. Our point of discussion is why the Option prices were so high on last Thursday and what made Index to show a volatility of 4% in a day.

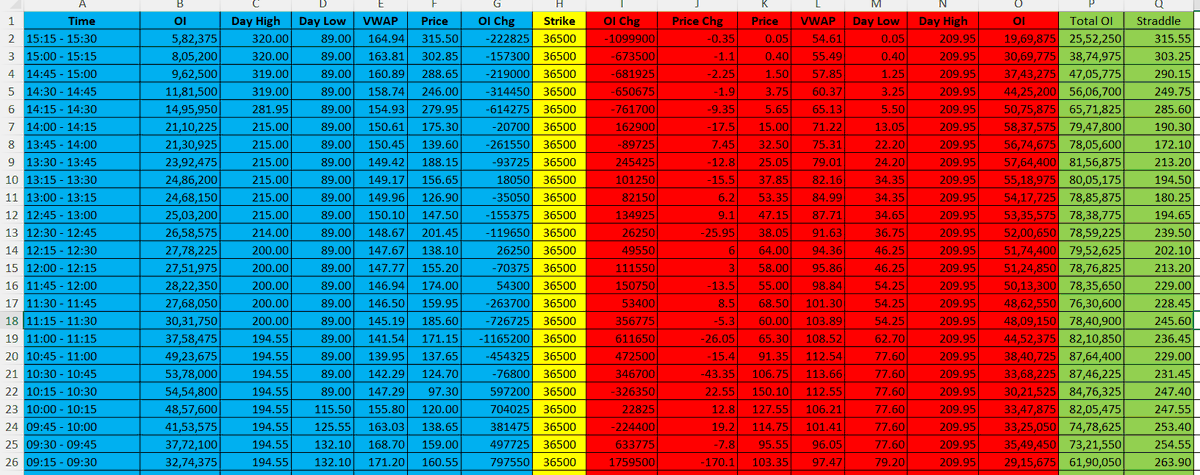

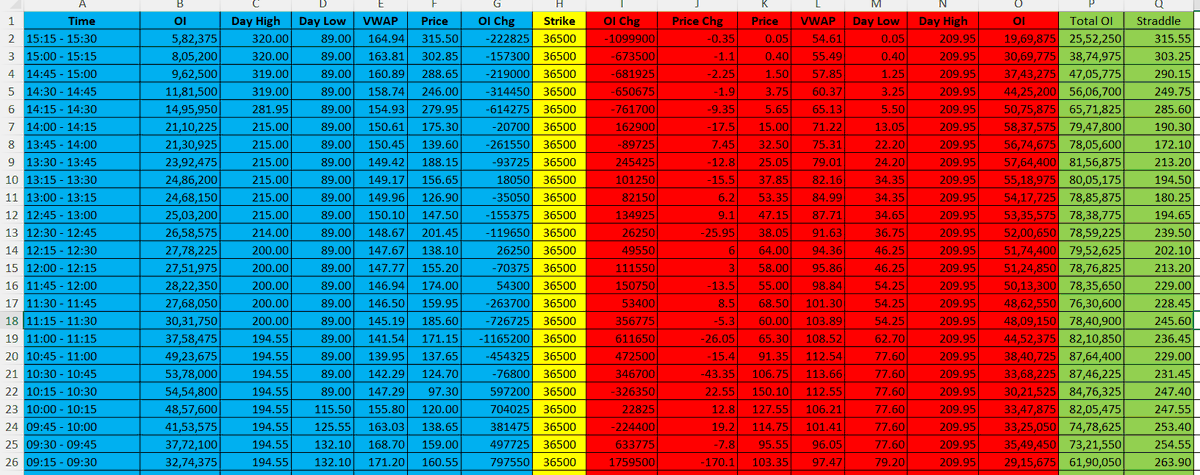

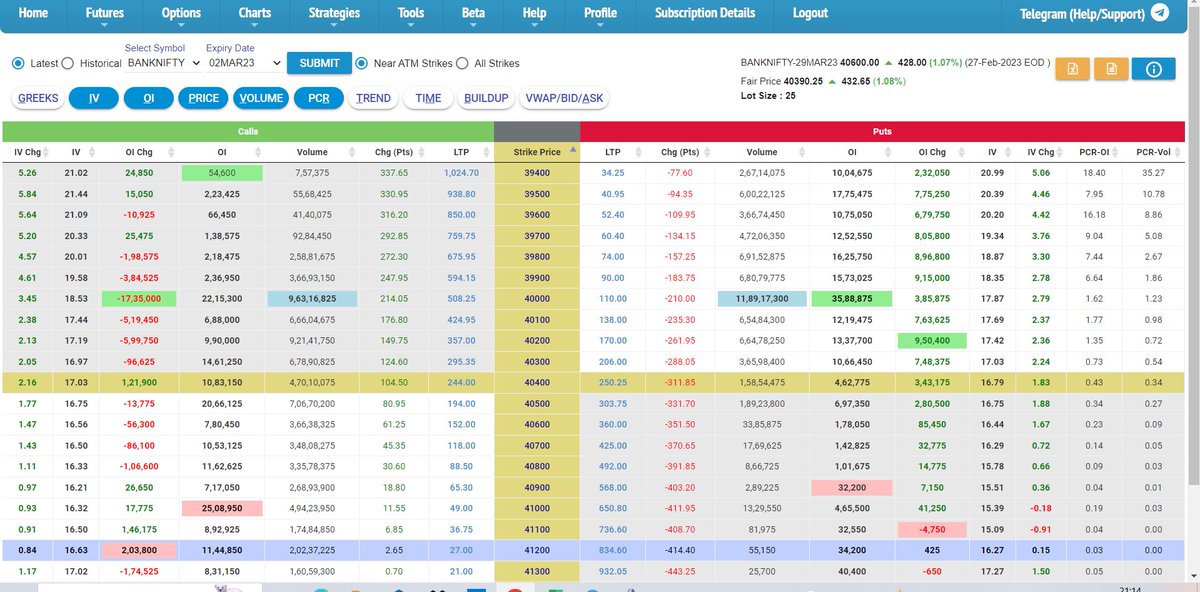

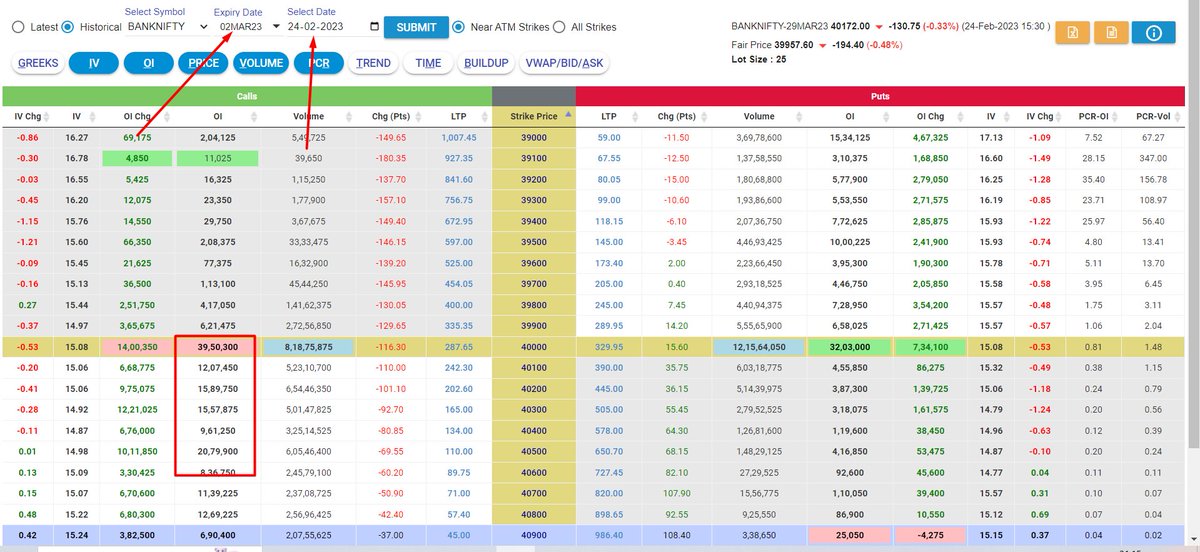

Now see this OC as per Friday close. Here concentrate especially on CE side. If my memory serves me right, then I have never seen 40lk contract O/s on friday close in any particular option. But friday saw 40000CE close at 39lk OI. Quite huge by friday standard.

Now see this OC as per Friday close. Here concentrate especially on CE side. If my memory serves me right, then I have never seen 40lk contract O/s on friday close in any particular option. But friday saw 40000CE close at 39lk OI. Quite huge by friday standard.

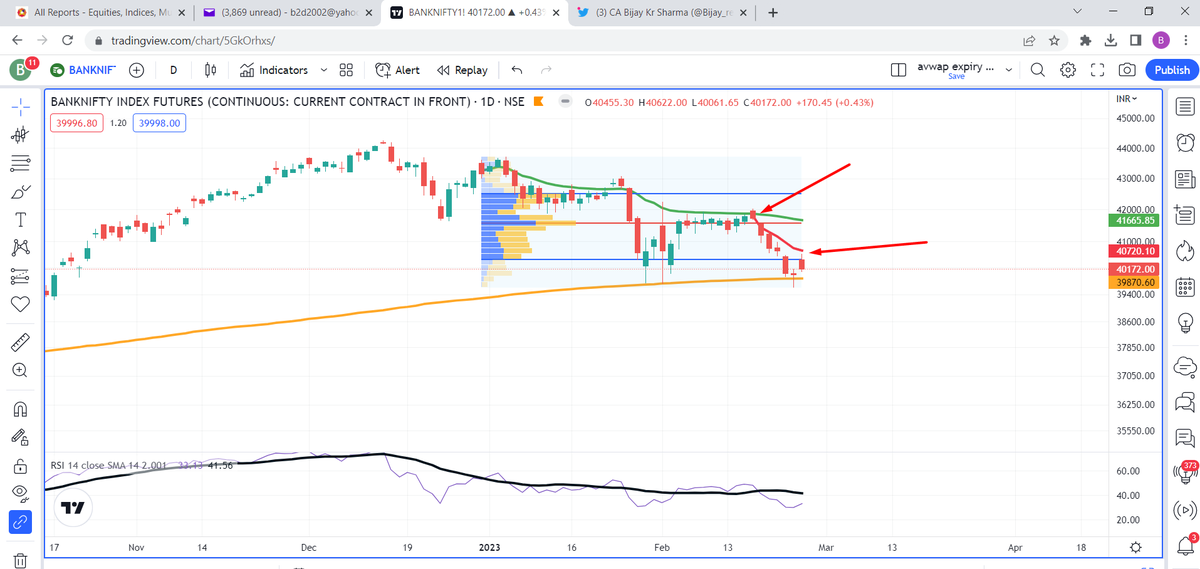

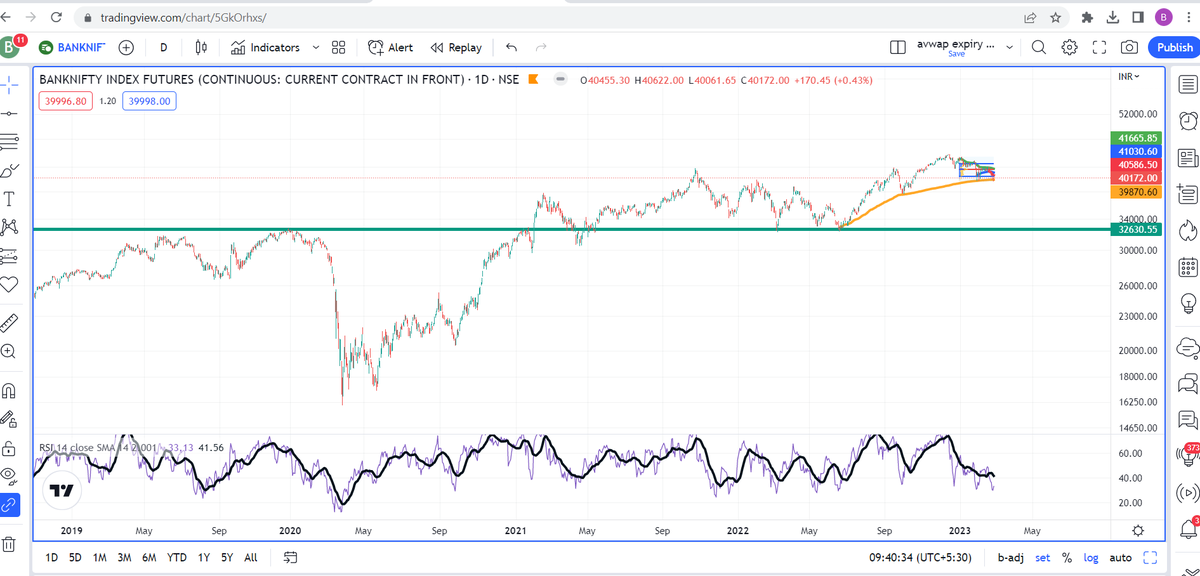

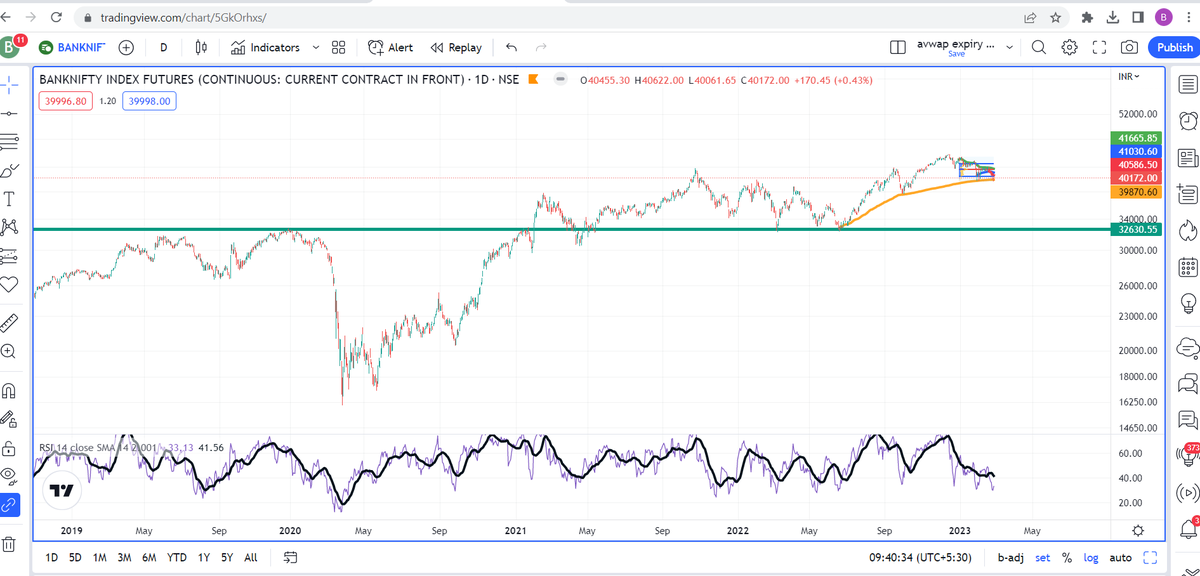

below it on intraday basis and then recover to close above it at day end. This is standing at 39870 now or say 39800. So first and foremost we need to make sure that BNF doesnt close below 39800 for two consecutive days and violation of this will open up 37400 or so.

below it on intraday basis and then recover to close above it at day end. This is standing at 39870 now or say 39800. So first and foremost we need to make sure that BNF doesnt close below 39800 for two consecutive days and violation of this will open up 37400 or so.