Sold 7 companies & pioneered the ecommerce aggregator model. Now building @NaturalDogCo to $100M.

I tweet about scaling brands & co-host the @acquanon podcast.

3 subscribers

How to get URL link on X (Twitter) App

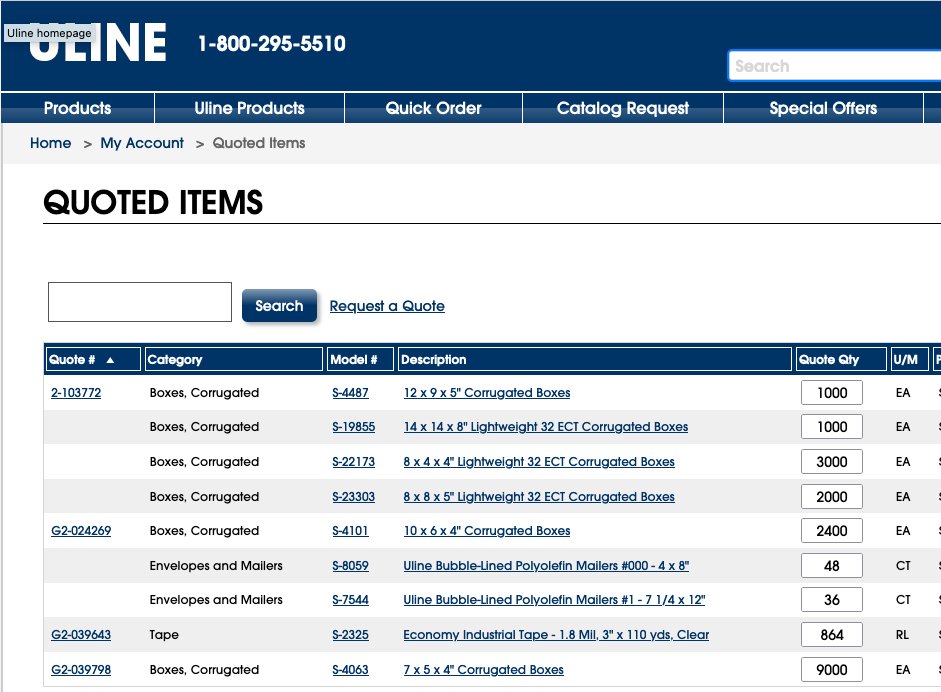

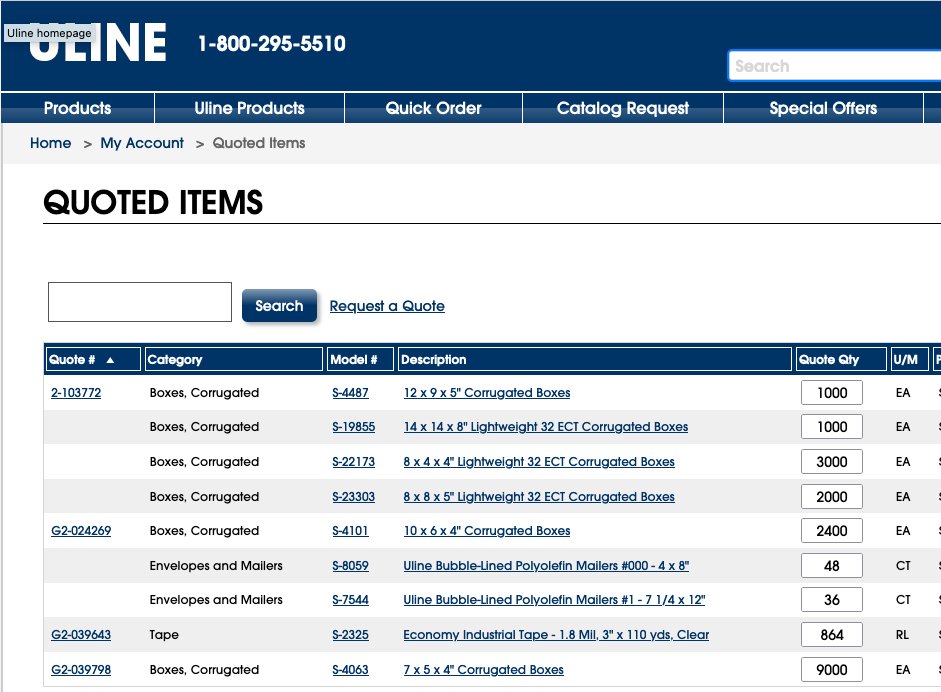

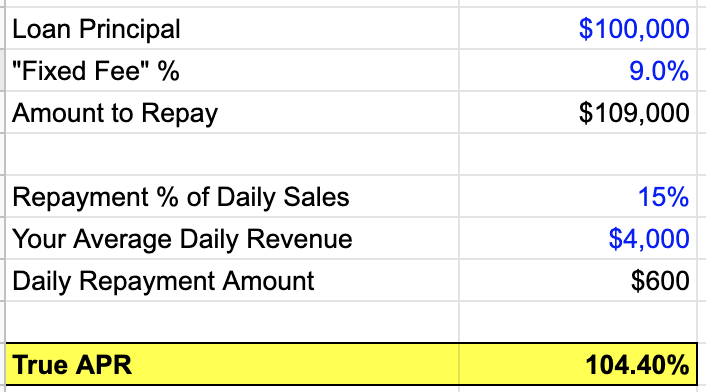

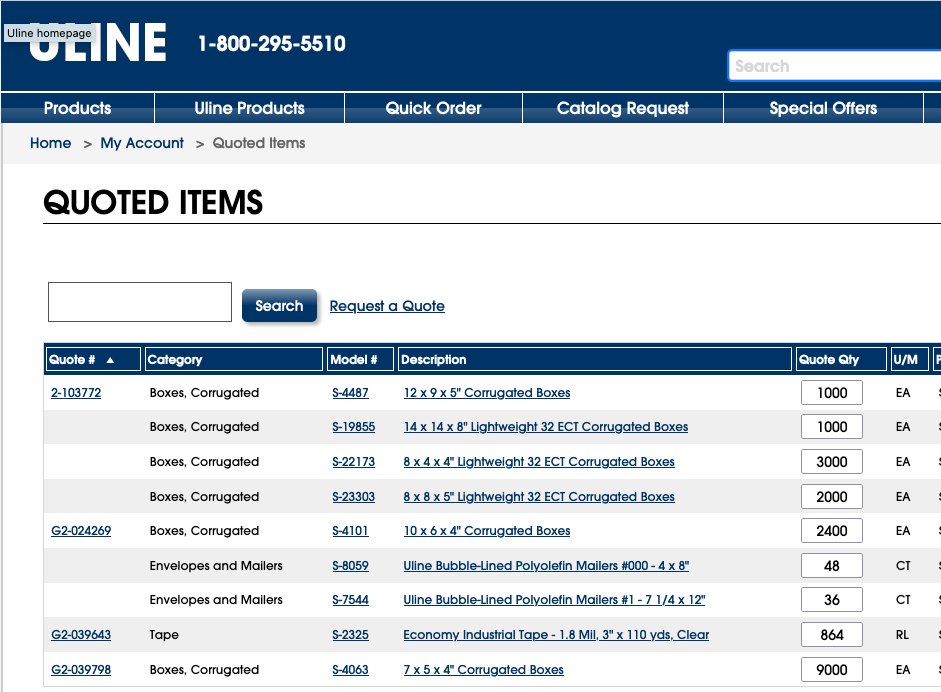

Go to your "Order History", and write down the item numbers (S-XXXXX) of anything you order in large quantities, and the largest quantity you'd be willing to order that item in, so you can get the best price.

Go to your "Order History", and write down the item numbers (S-XXXXX) of anything you order in large quantities, and the largest quantity you'd be willing to order that item in, so you can get the best price.

@ElementsBrands It is downright small business hostile. The resources required for compliance are too much for small businesses to bear. The only option is non-compliance and pray not to get caught.

@ElementsBrands It is downright small business hostile. The resources required for compliance are too much for small businesses to bear. The only option is non-compliance and pray not to get caught.

Go to your "Order History", and write down the item numbers (S-XXXXX) of anything you order in large quantities, and the largest quantity you'd be willing to order that item in, so you can get the best price.

Go to your "Order History", and write down the item numbers (S-XXXXX) of anything you order in large quantities, and the largest quantity you'd be willing to order that item in, so you can get the best price.

Let's warm up with a few more:

Let's warm up with a few more:

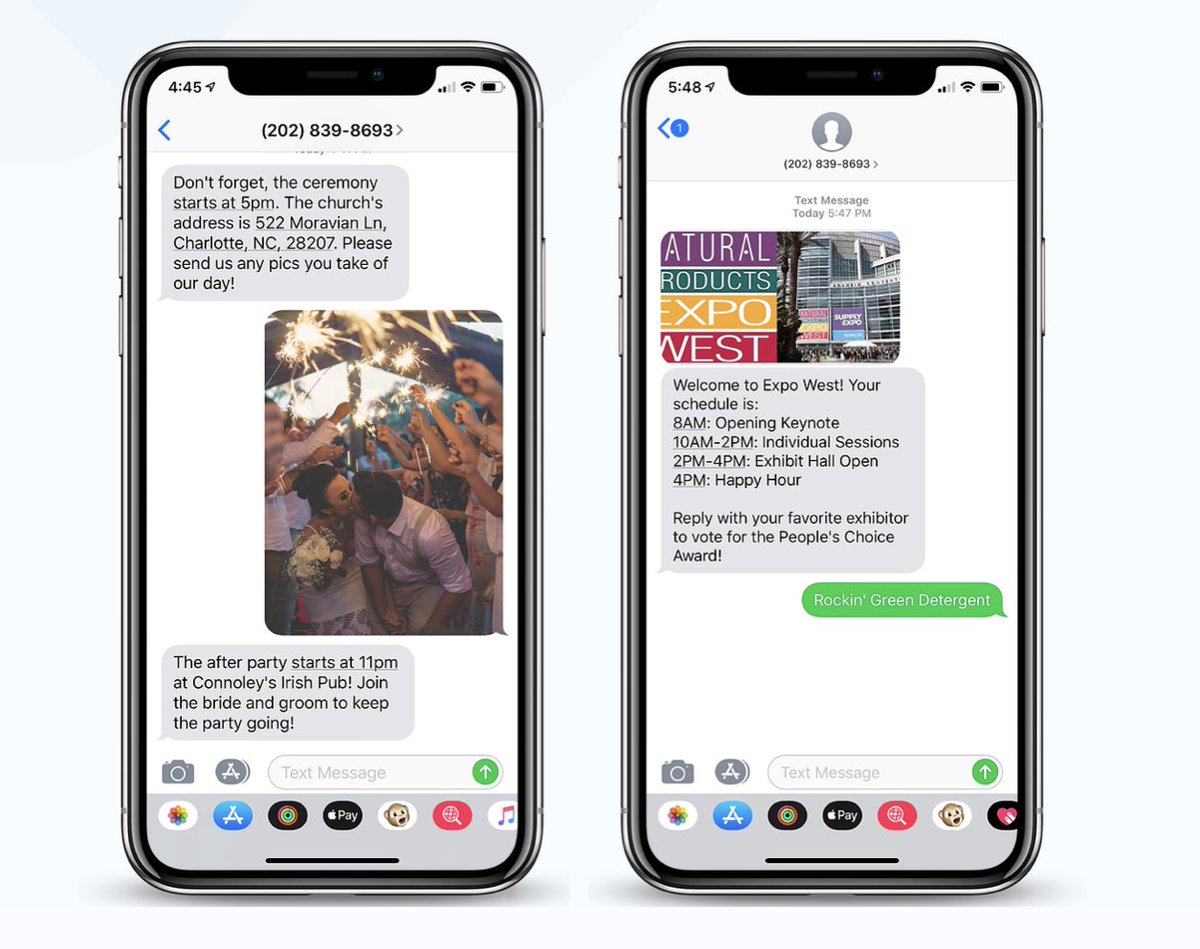

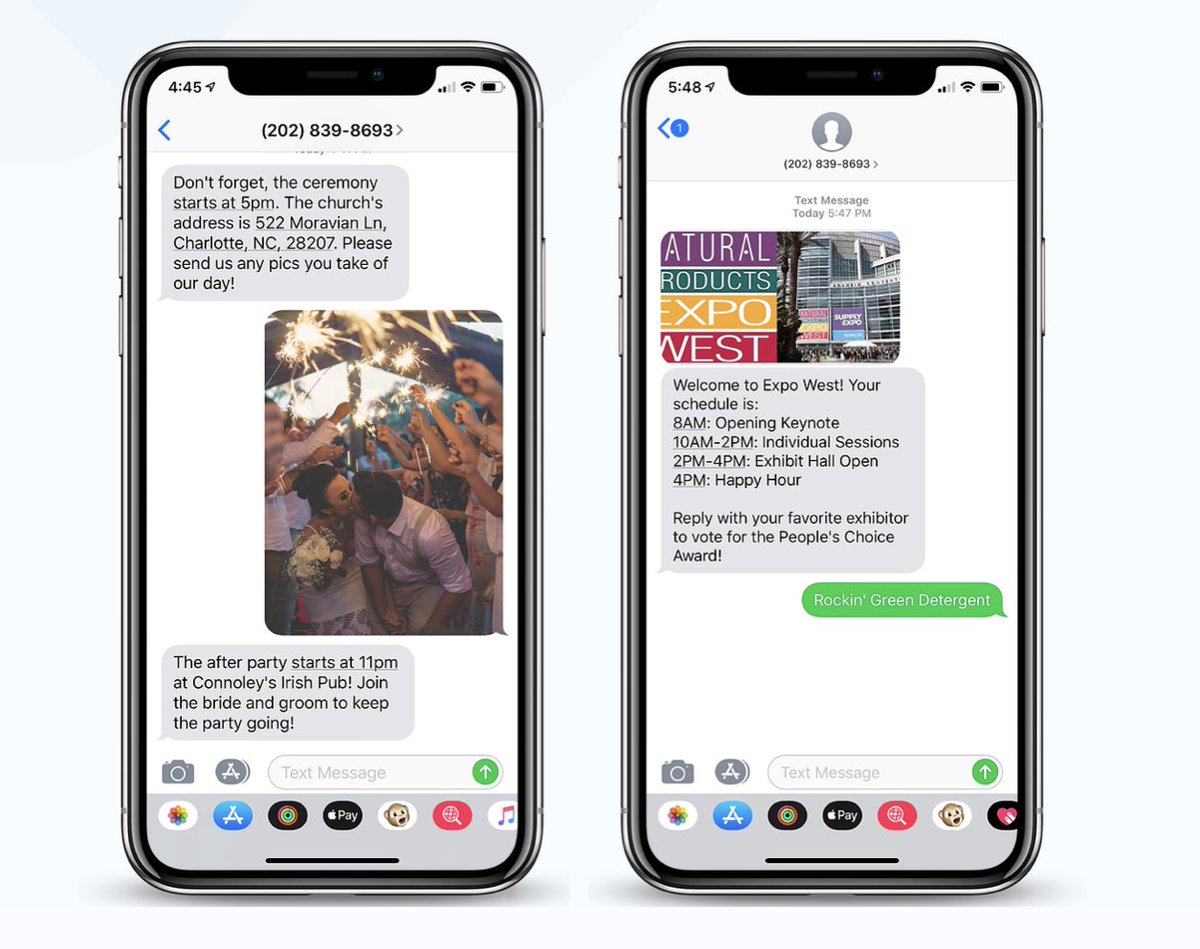

A week before the wedding, my wife asked if there was a way to pre-schedule text messages to our guests.

A week before the wedding, my wife asked if there was a way to pre-schedule text messages to our guests.

Figs took something lame and generic (scrubs) and made them functional, comfortable, and cool.

Figs took something lame and generic (scrubs) and made them functional, comfortable, and cool.