Filtering out the hype with evidence-based reports on the cryptocurrency space, with a focus on #Bitcoin - https://t.co/pgRGU9CuKE

3 subscribers

How to get URL link on X (Twitter) App

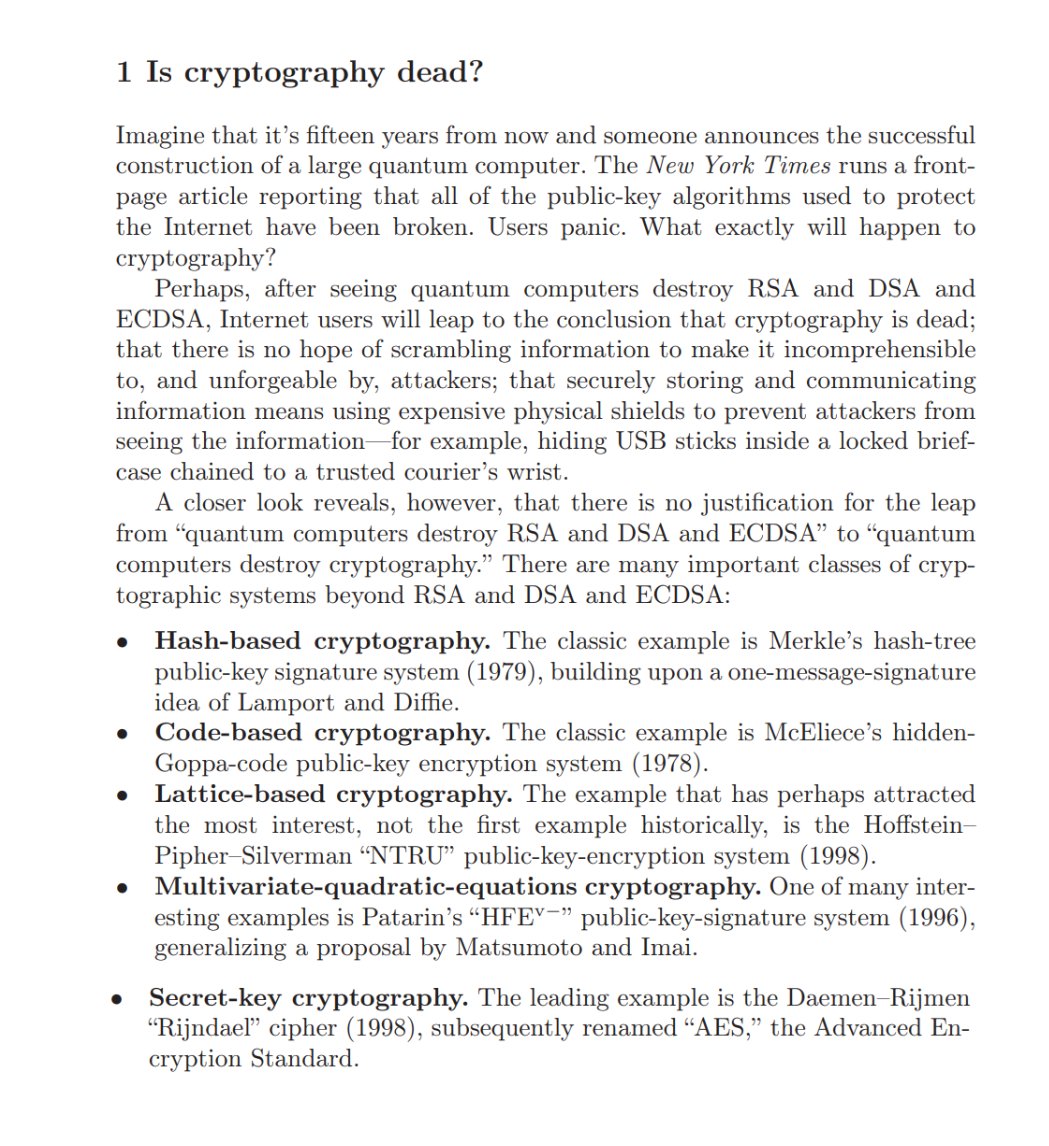

The book starts by imagining that in 15 years time (2023) quantum computers will be successfully constructed and asks if this will kill cryptography?

The book starts by imagining that in 15 years time (2023) quantum computers will be successfully constructed and asks if this will kill cryptography?

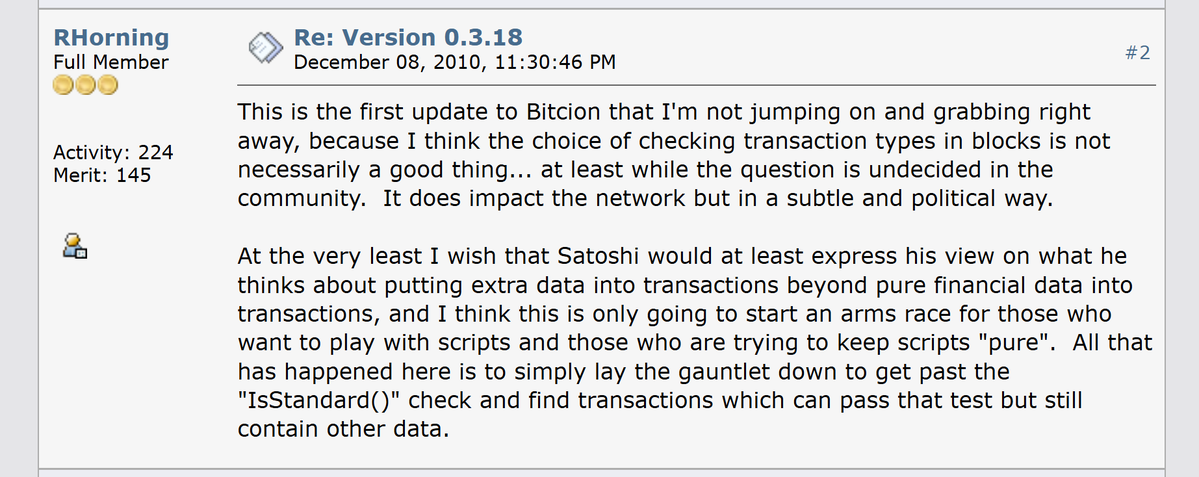

Some were concerned that this would prevent people using the blockchain to store arbitrary data

Some were concerned that this would prevent people using the blockchain to store arbitrary data

Jonathan Hough KC has arrived. Looks like the court staff have set up a video link for CSW

Jonathan Hough KC has arrived. Looks like the court staff have set up a video link for CSW

Justice Mellow has arrived and the session has started. CSW has dialled in via video

Justice Mellow has arrived and the session has started. CSW has dialled in via video

The judge has arrived, the court is now in session

The judge has arrived, the court is now in session

CSW arrives in court

CSW arrives in court

The opening skeleton argument by COPA:

The opening skeleton argument by COPA: