Accelerating corporate #Bitcoin adoption w/ exclusive access to leaders, resources & strategies driving success | @Strategy x @BTCInc

How to get URL link on X (Twitter) App

2/ Under the proposal, companies could be removed from major MSCI indexes solely because #Bitcoin becomes a majority asset on their balance sheet — even if nothing about their core business changes.

2/ Under the proposal, companies could be removed from major MSCI indexes solely because #Bitcoin becomes a majority asset on their balance sheet — even if nothing about their core business changes.

2/ At the core is a multi-layered structure designed to match investor risk appetite with capital needs:

2/ At the core is a multi-layered structure designed to match investor risk appetite with capital needs:

2/ The S&P 500 is the most tracked index in the world, with over $5 TRILLION in passive capital tied to it.

2/ The S&P 500 is the most tracked index in the world, with over $5 TRILLION in passive capital tied to it.

2/ This marks the largest capital raise ever to launch a #Bitcoin treasury strategy—and the largest PIPE in a public Bitcoin-related transaction to date.

2/ This marks the largest capital raise ever to launch a #Bitcoin treasury strategy—and the largest PIPE in a public Bitcoin-related transaction to date.

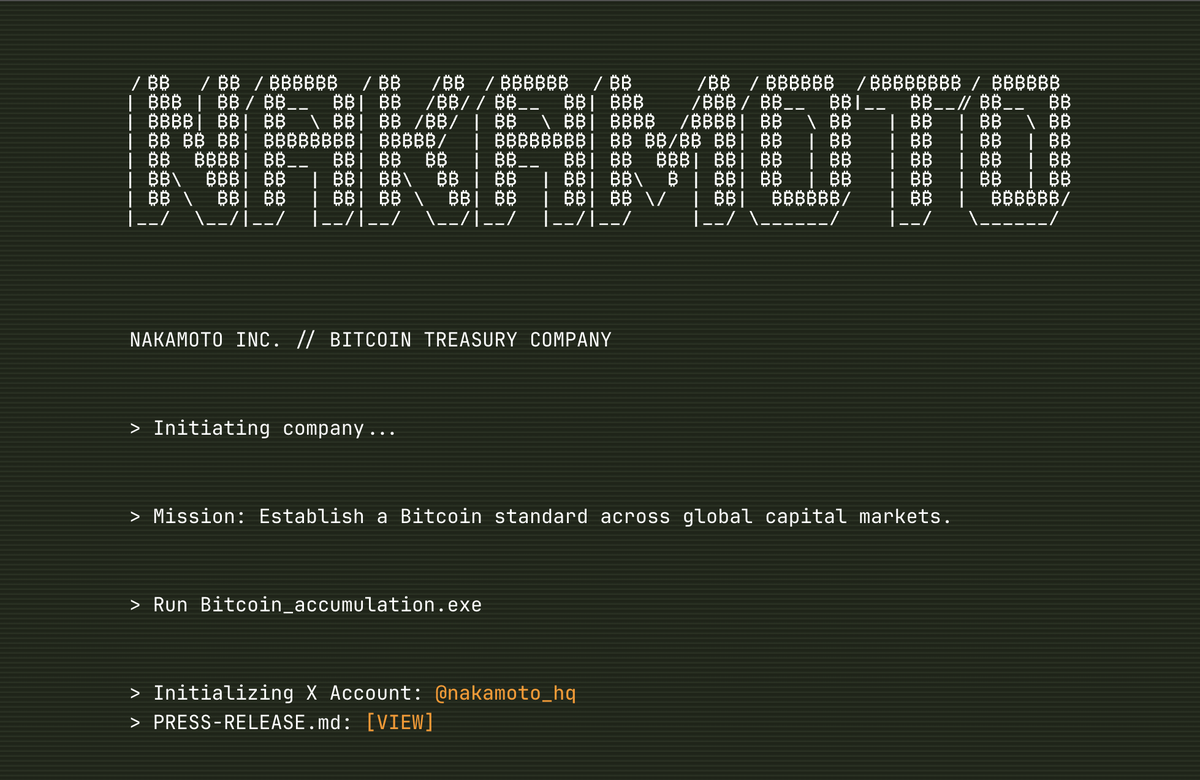

1/ 📦 553,555 BTC holdings

1/ 📦 553,555 BTC holdings

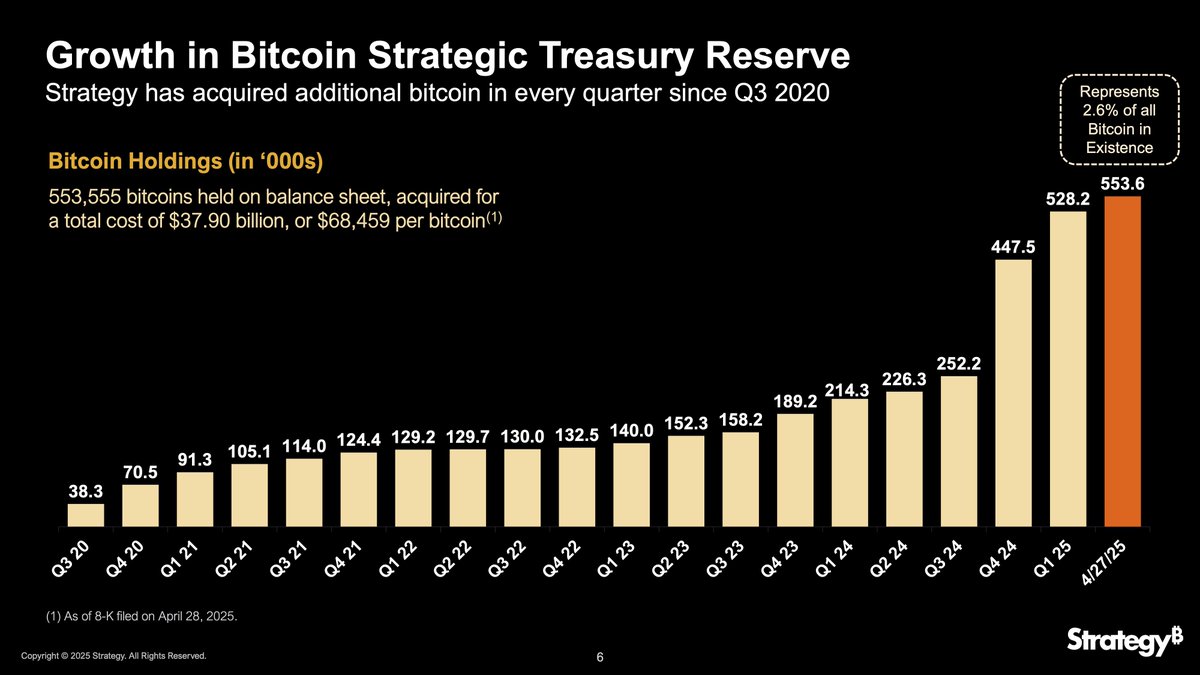

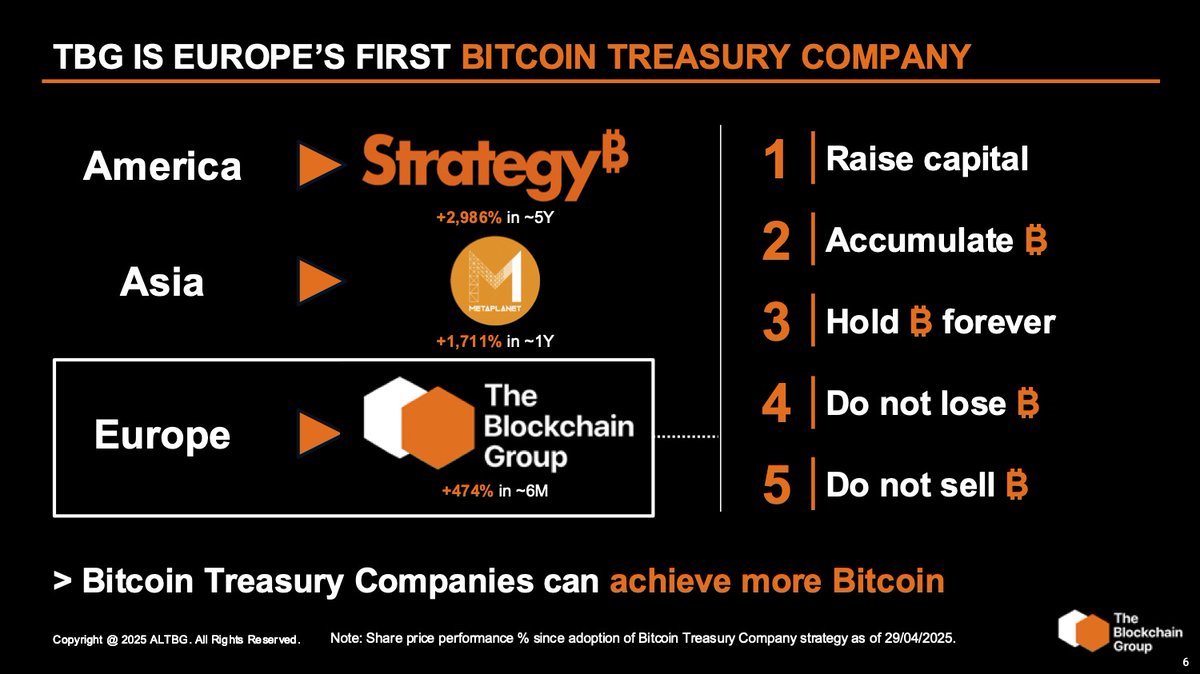

2/ The Blockchain Group ($ALTBG) didn’t pivot to #Bitcoin—It rebuilt itself around it.

2/ The Blockchain Group ($ALTBG) didn’t pivot to #Bitcoin—It rebuilt itself around it.

2/ A #Bitcoin treasury isn’t just an asset—it’s a capital strategy.

2/ A #Bitcoin treasury isn’t just an asset—it’s a capital strategy.

2/ With an initial allocation of 42,000 BTC, Twenty One will debut as the #2 largest public Bitcoin holder—second only to @Strategy.

2/ With an initial allocation of 42,000 BTC, Twenty One will debut as the #2 largest public Bitcoin holder—second only to @Strategy.

@Strategy @MicroStrategy @saylor 2/ $STRF will accumulate cumulative dividends at 10% per annum, payable quarterly starting June 30, 2025.

@Strategy @MicroStrategy @saylor 2/ $STRF will accumulate cumulative dividends at 10% per annum, payable quarterly starting June 30, 2025.

2/ This ETF simplifies exposure to a strategy pioneered by Michael @Saylor, Chairman of @Strategy (formerly @MicroStrategy), which uses corporate debt to acquire #Bitcoin.

2/ This ETF simplifies exposure to a strategy pioneered by Michael @Saylor, Chairman of @Strategy (formerly @MicroStrategy), which uses corporate debt to acquire #Bitcoin.

2/ How do you spot a zombie company?

2/ How do you spot a zombie company?

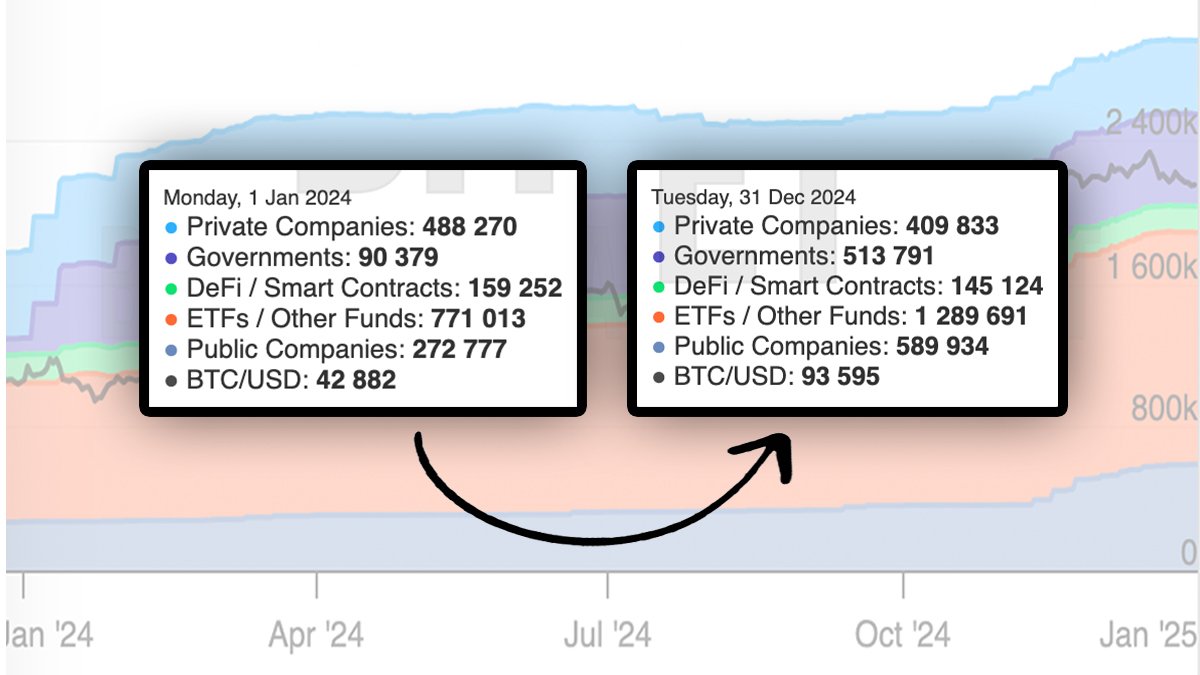

2/ Public companies drove Bitcoin adoption in 2024, increasing their holdings to 589,934 BTC.

2/ Public companies drove Bitcoin adoption in 2024, increasing their holdings to 589,934 BTC.

➡️ Transparent Valuation

➡️ Transparent Valuation