Head of Macro Research at Global Macro Investor https://t.co/TBWOM0tODa | Head of Asset Allocation at EXPAAM https://t.co/CPCWy0eHx8 | My opinions only DYOR

9 subscribers

How to get URL link on X (Twitter) App

The log regression channel says the same:

The log regression channel says the same:

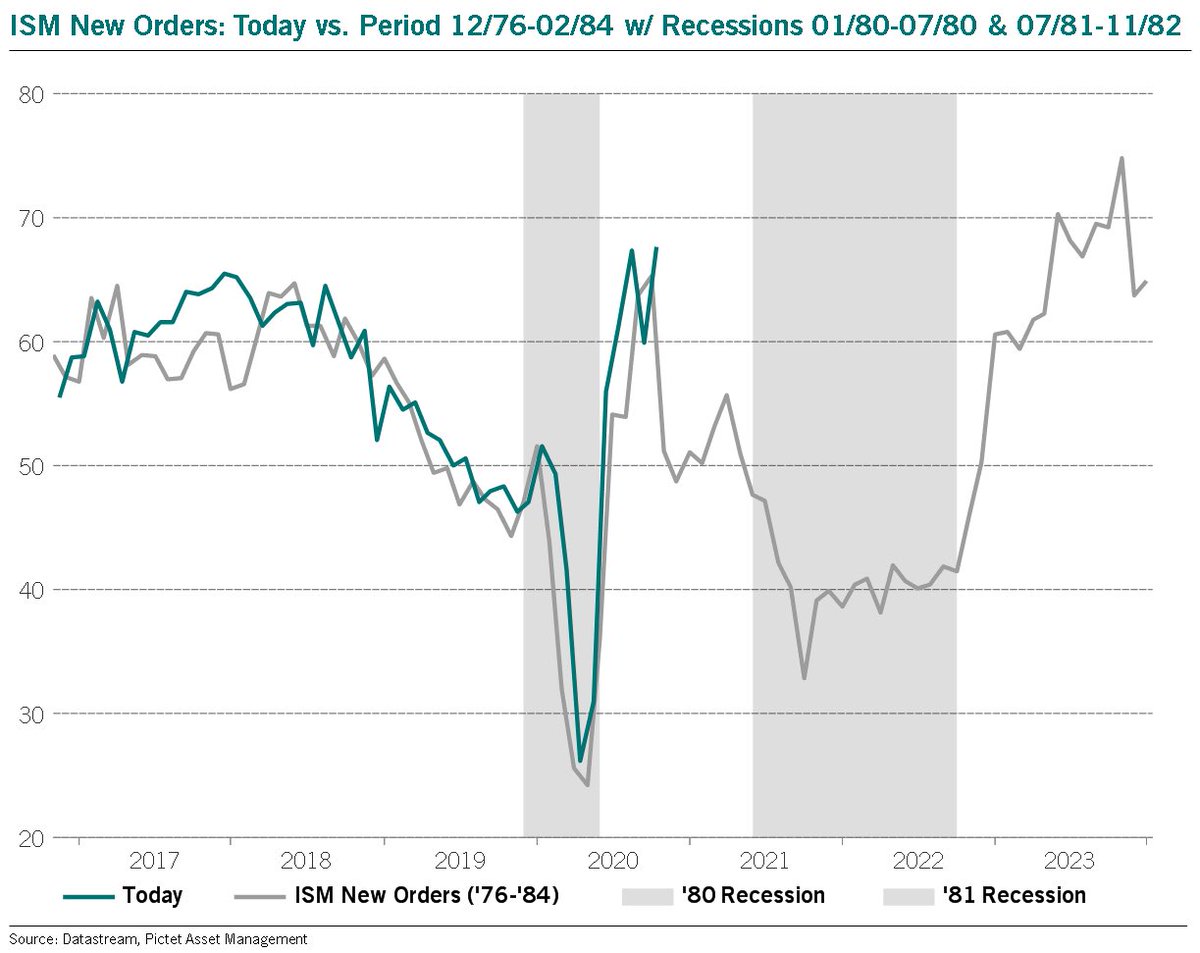

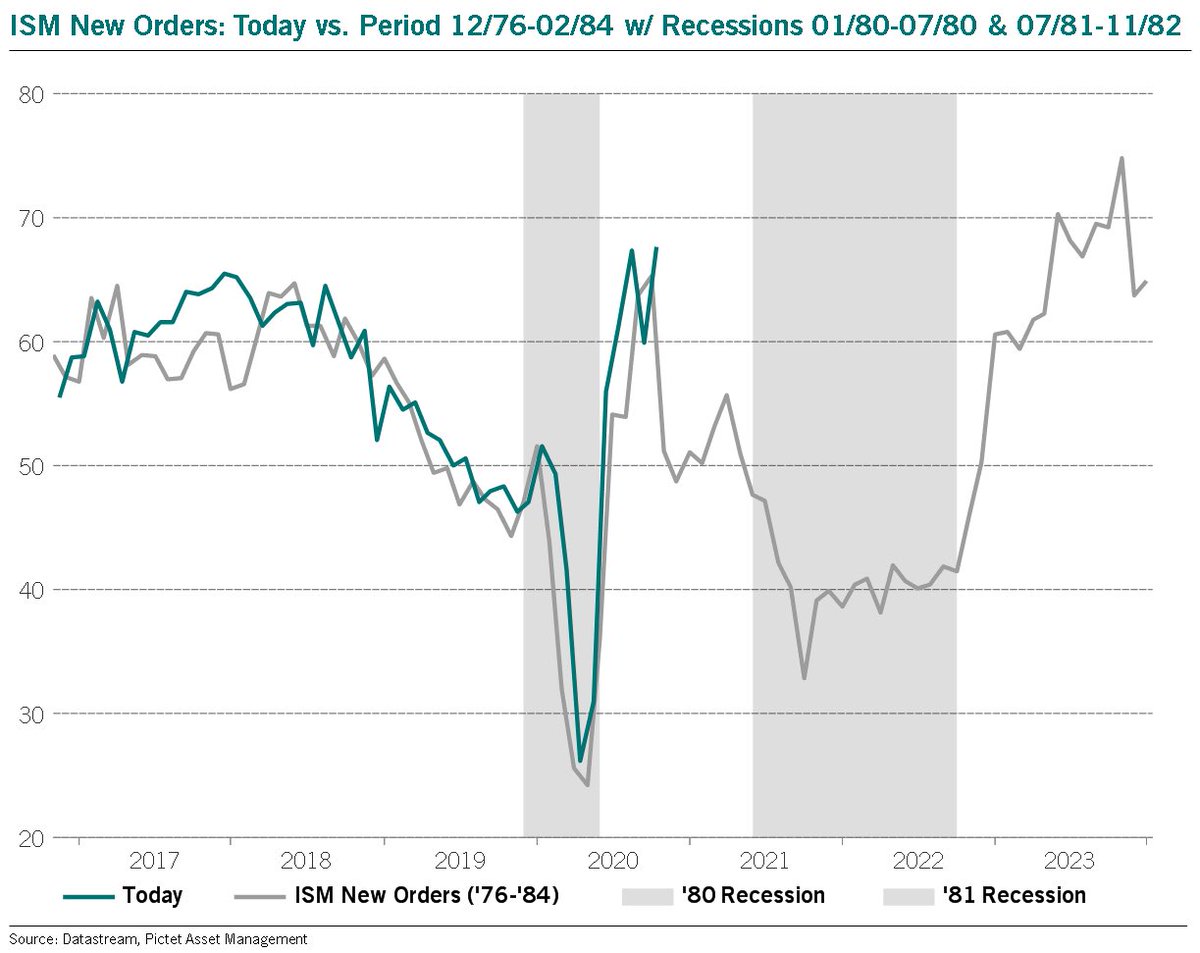

Remember, SLOOS just equals current ISM…

Remember, SLOOS just equals current ISM…

The “credit crunch” that everyone is talking about IS coming…

The “credit crunch” that everyone is talking about IS coming…

Back in 1990, CPI rose to 6.4% year-on-year (near ten year highs at the time), igniting fears that the 1970s were returning with a vengeance…

Back in 1990, CPI rose to 6.4% year-on-year (near ten year highs at the time), igniting fears that the 1970s were returning with a vengeance…

https://twitter.com/BittelJulien/status/1555497329947545602

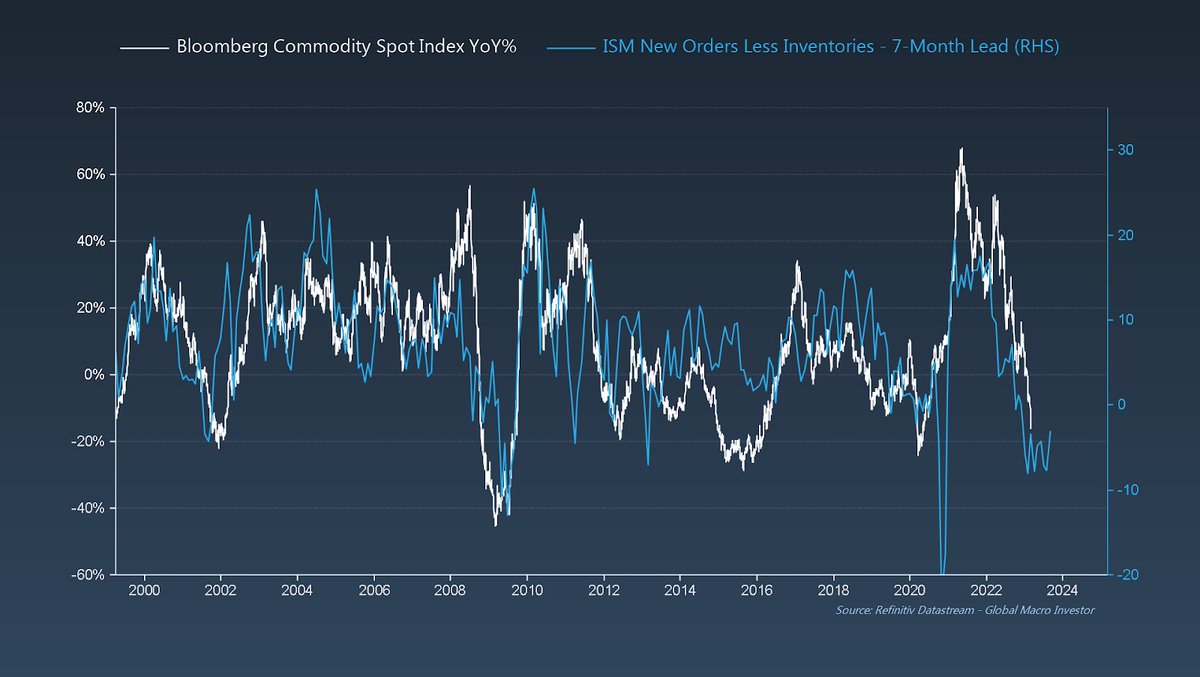

This is also interesting when you take into account that ISM New Orders minus Inventories is likely in the process of bottoming and leads commodity prices by seven months.

This is also interesting when you take into account that ISM New Orders minus Inventories is likely in the process of bottoming and leads commodity prices by seven months.

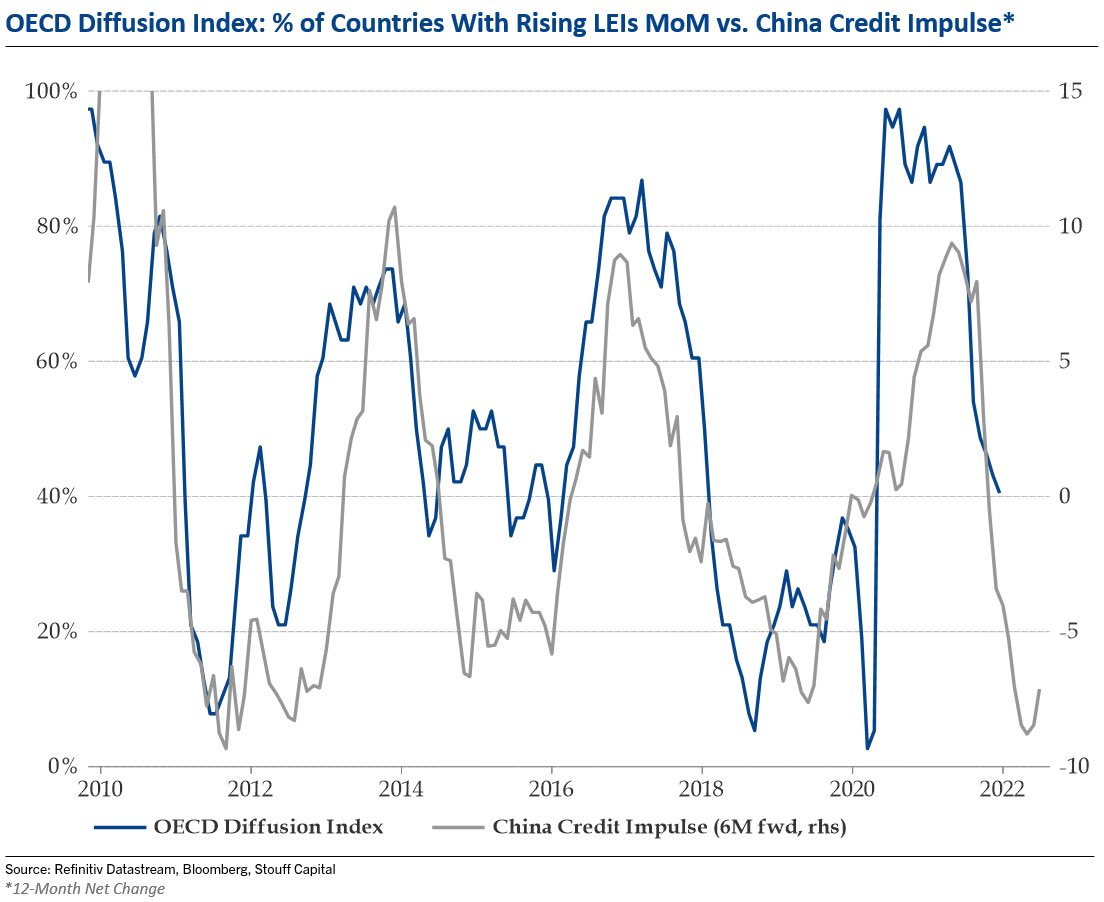

The main driver of this slowdown has been China…

The main driver of this slowdown has been China…

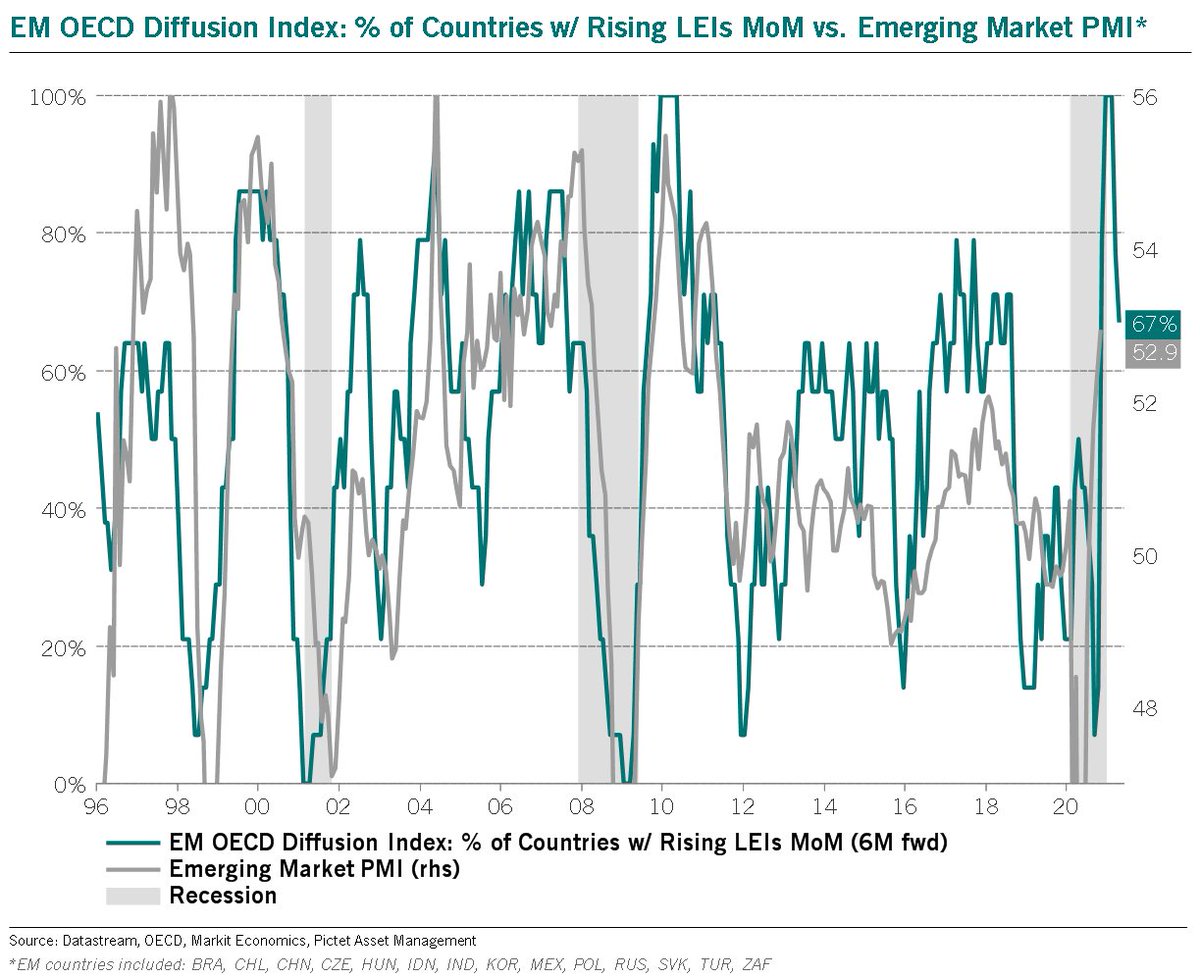

While there’s still room for a further rise in EM PMIs into year-end, the % of EM OECD countries with rising lead indicators MoM is down to 67%, from 100% in July.

While there’s still room for a further rise in EM PMIs into year-end, the % of EM OECD countries with rising lead indicators MoM is down to 67%, from 100% in July.

2) A close below long-term support would be a clear negative, but for the time being we continue to hold.

2) A close below long-term support would be a clear negative, but for the time being we continue to hold.

Even the magnitude of the move is identical: a 40pt rise over 6M.

Even the magnitude of the move is identical: a 40pt rise over 6M.

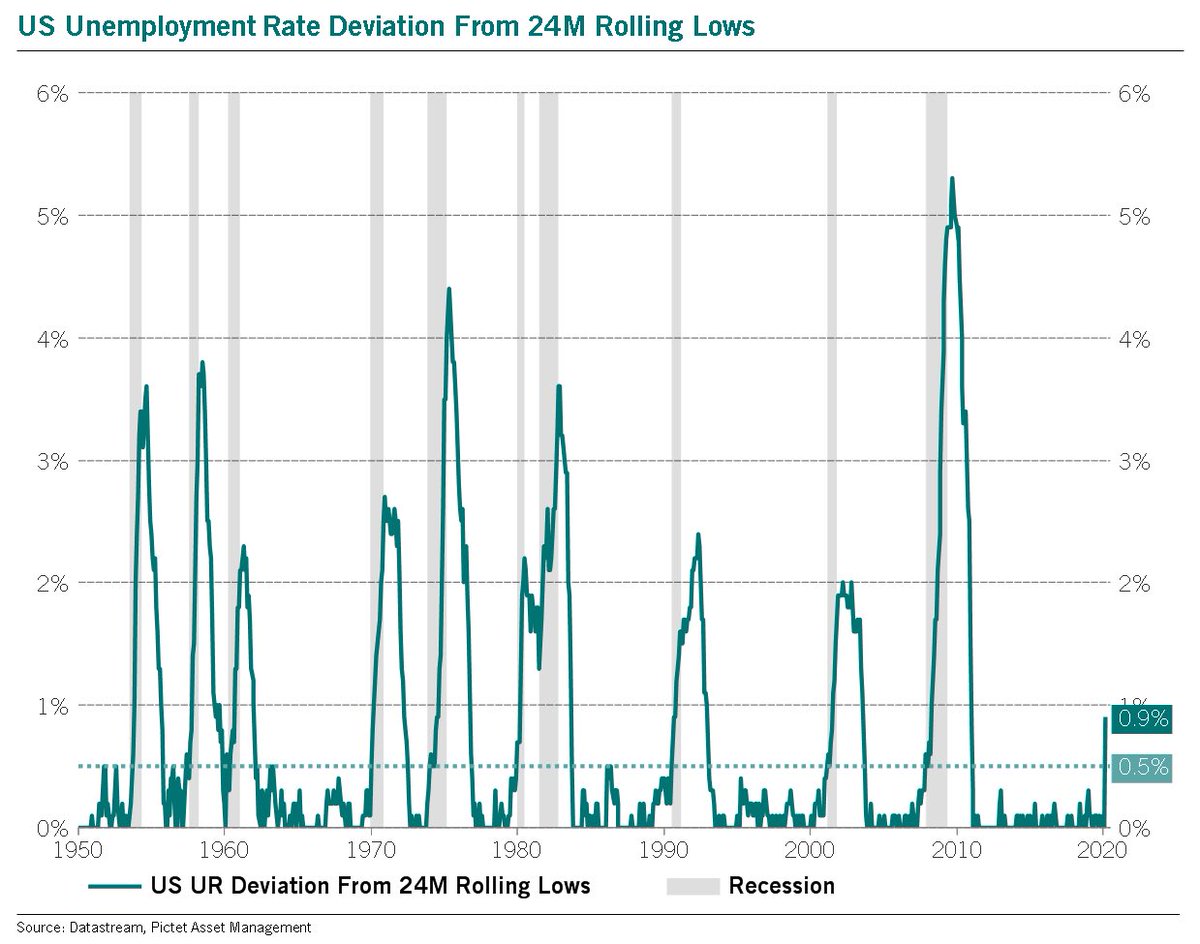

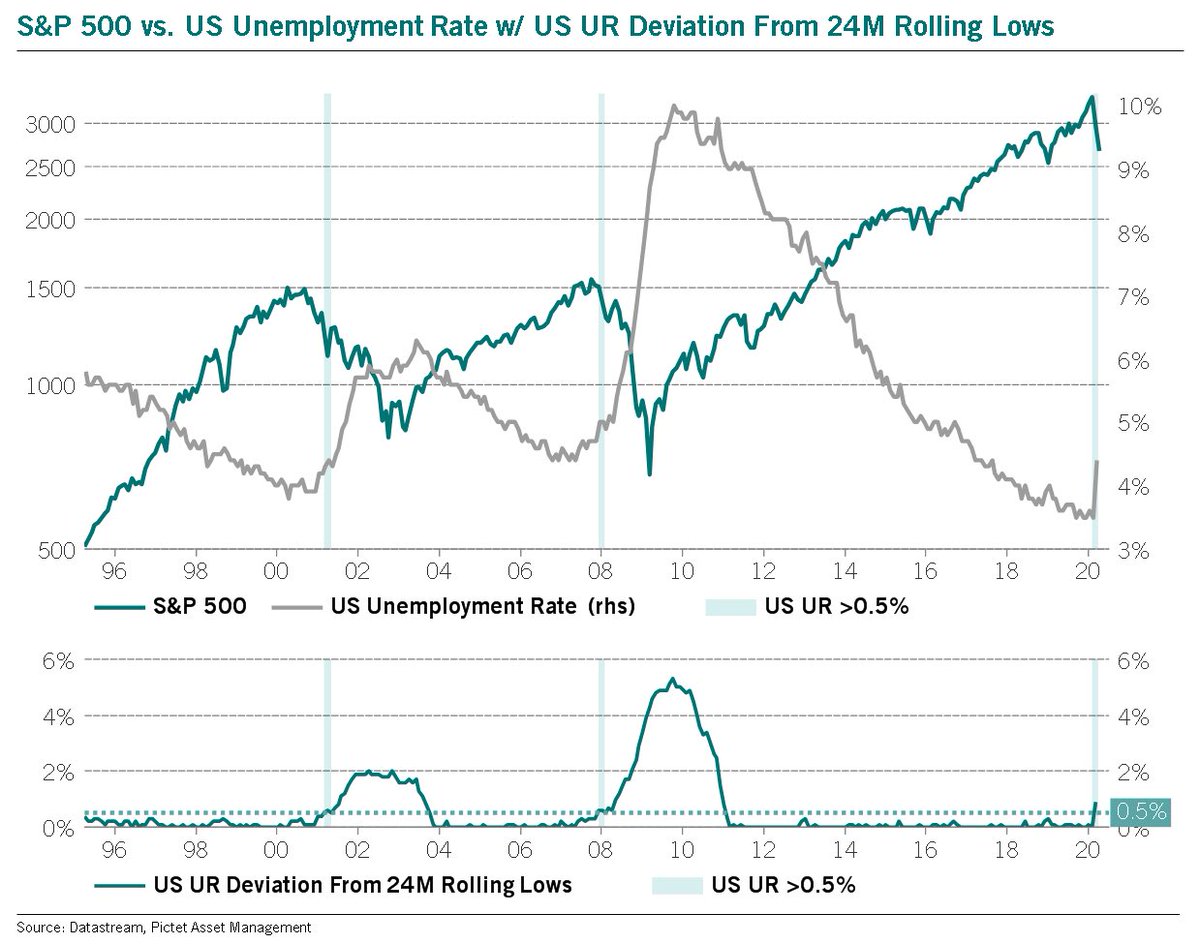

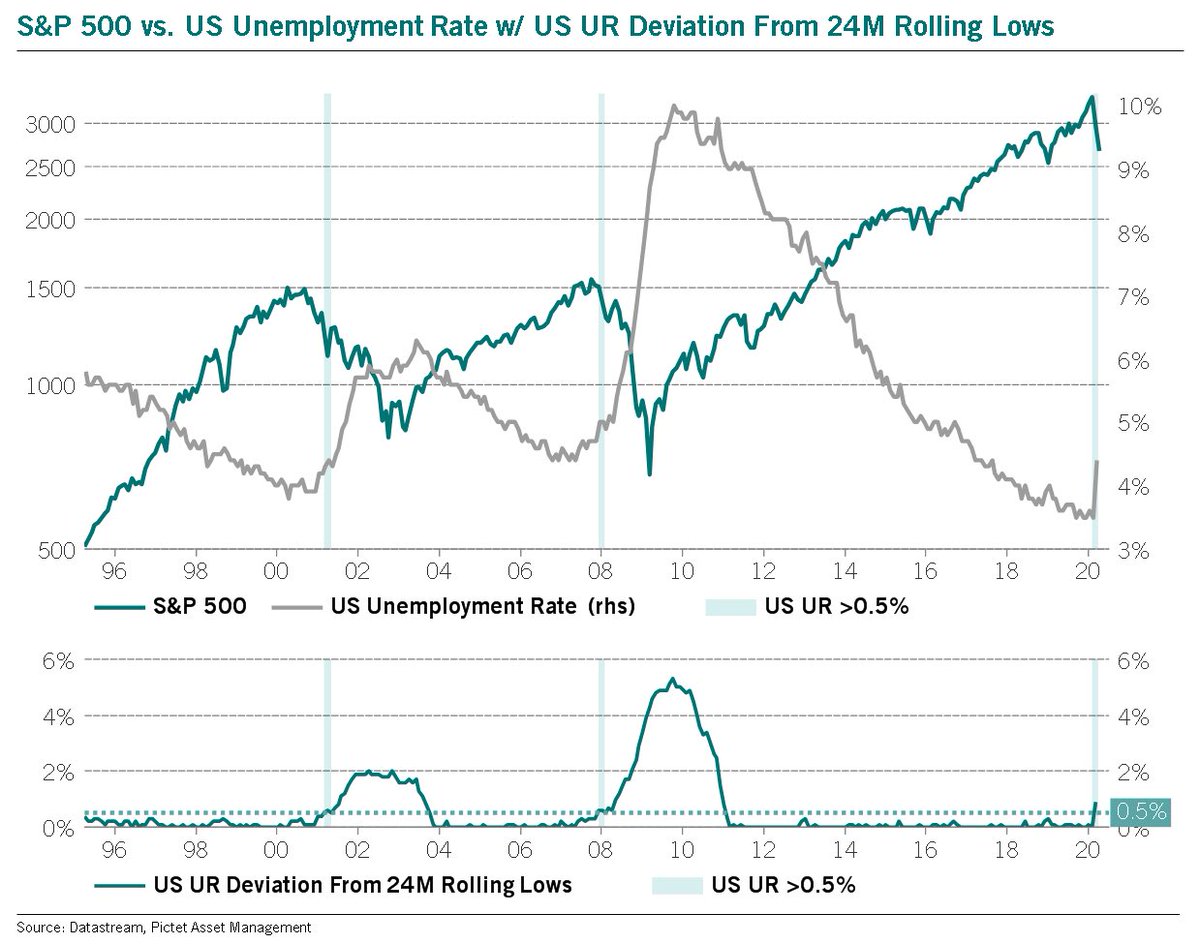

Here is the long-term chart of the US unemployment rate deviation from 24M rolling lows. A monthly close above 0.5% has a 100% track record over 70Y at signalling a recession.

Here is the long-term chart of the US unemployment rate deviation from 24M rolling lows. A monthly close above 0.5% has a 100% track record over 70Y at signalling a recession.