Bitwise is a trusted partner to investors, financial advisors, family offices, and institutions looking to understand and access crypto.

How to get URL link on X (Twitter) App

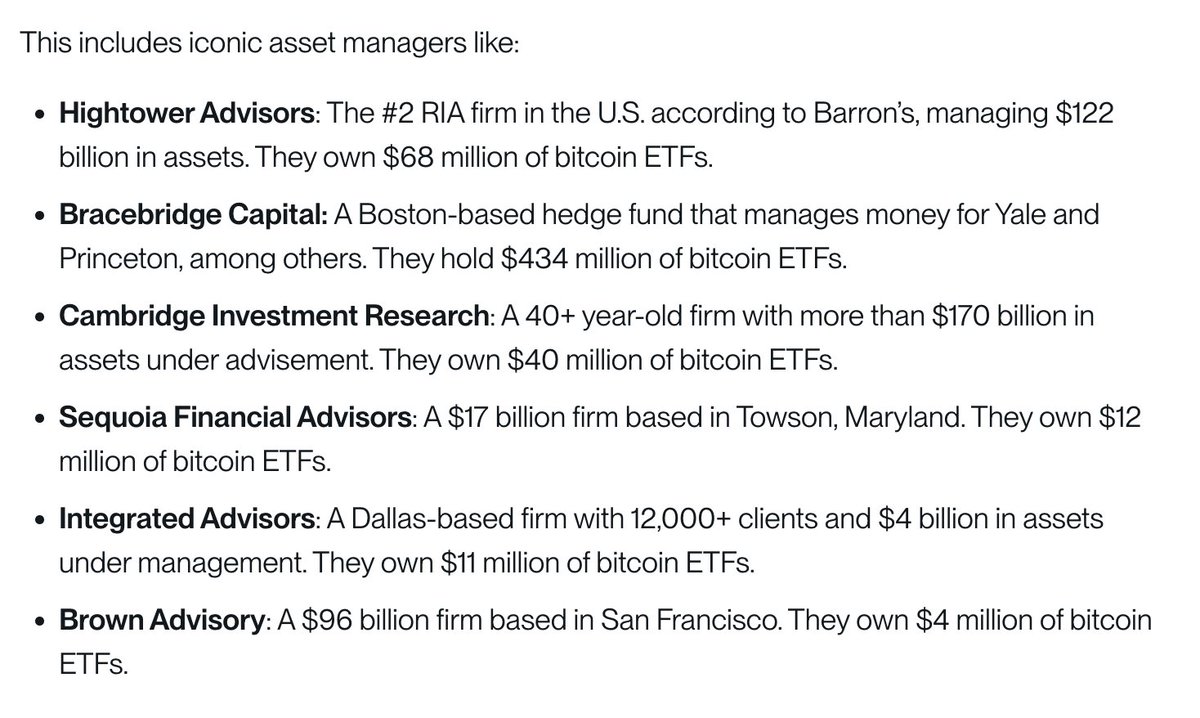

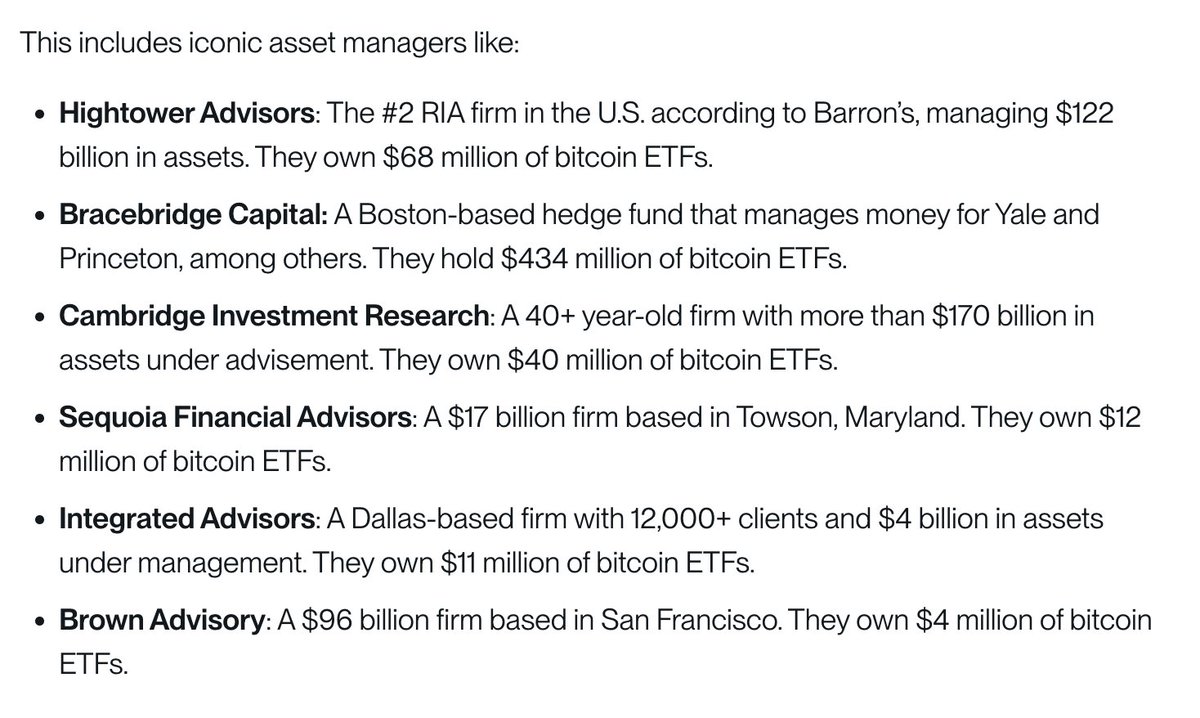

Takeaway 2: A Historic Scale of Professional Investor Ownership

Takeaway 2: A Historic Scale of Professional Investor Ownership

2/ First, the fund's holdings.

2/ First, the fund's holdings.

2/

2/

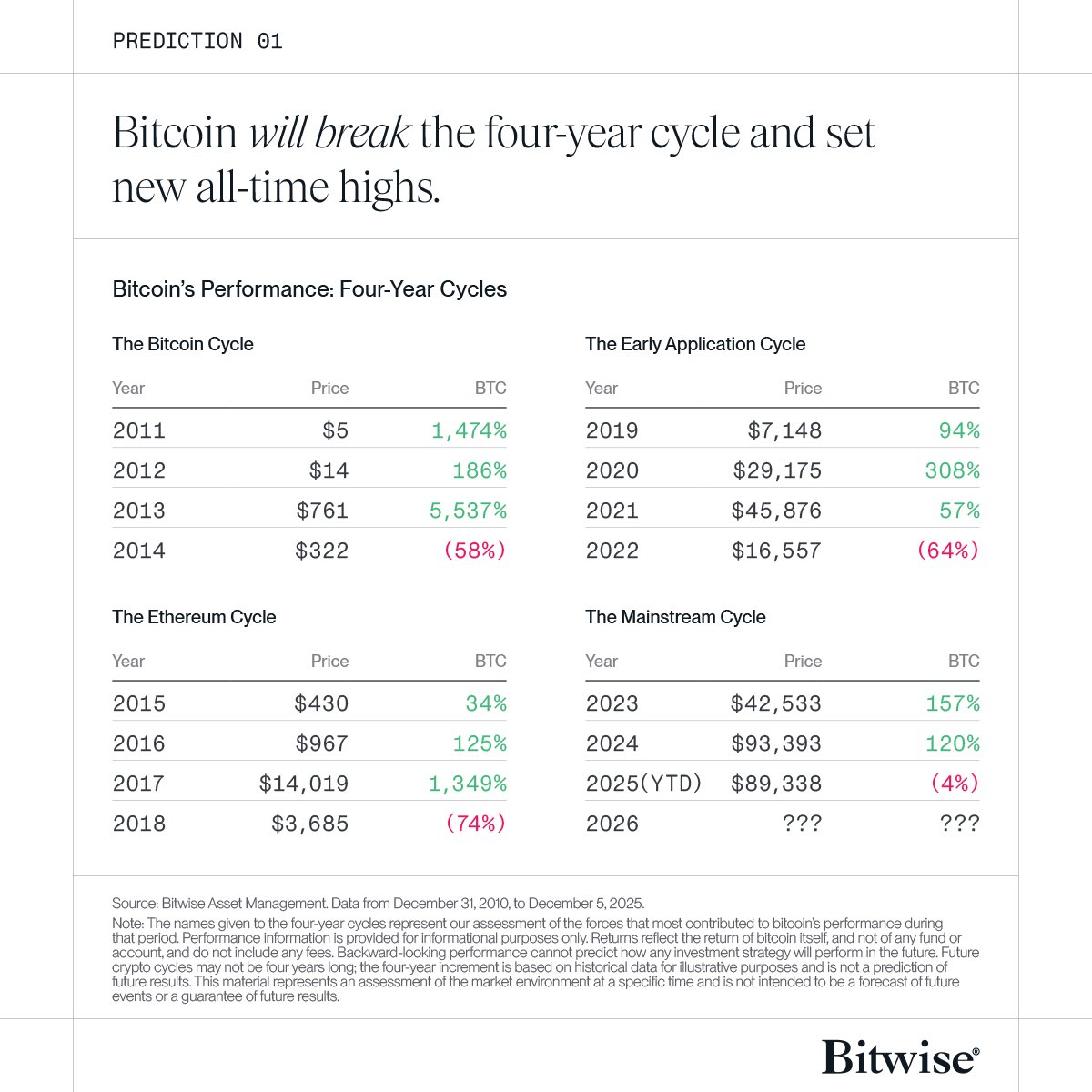

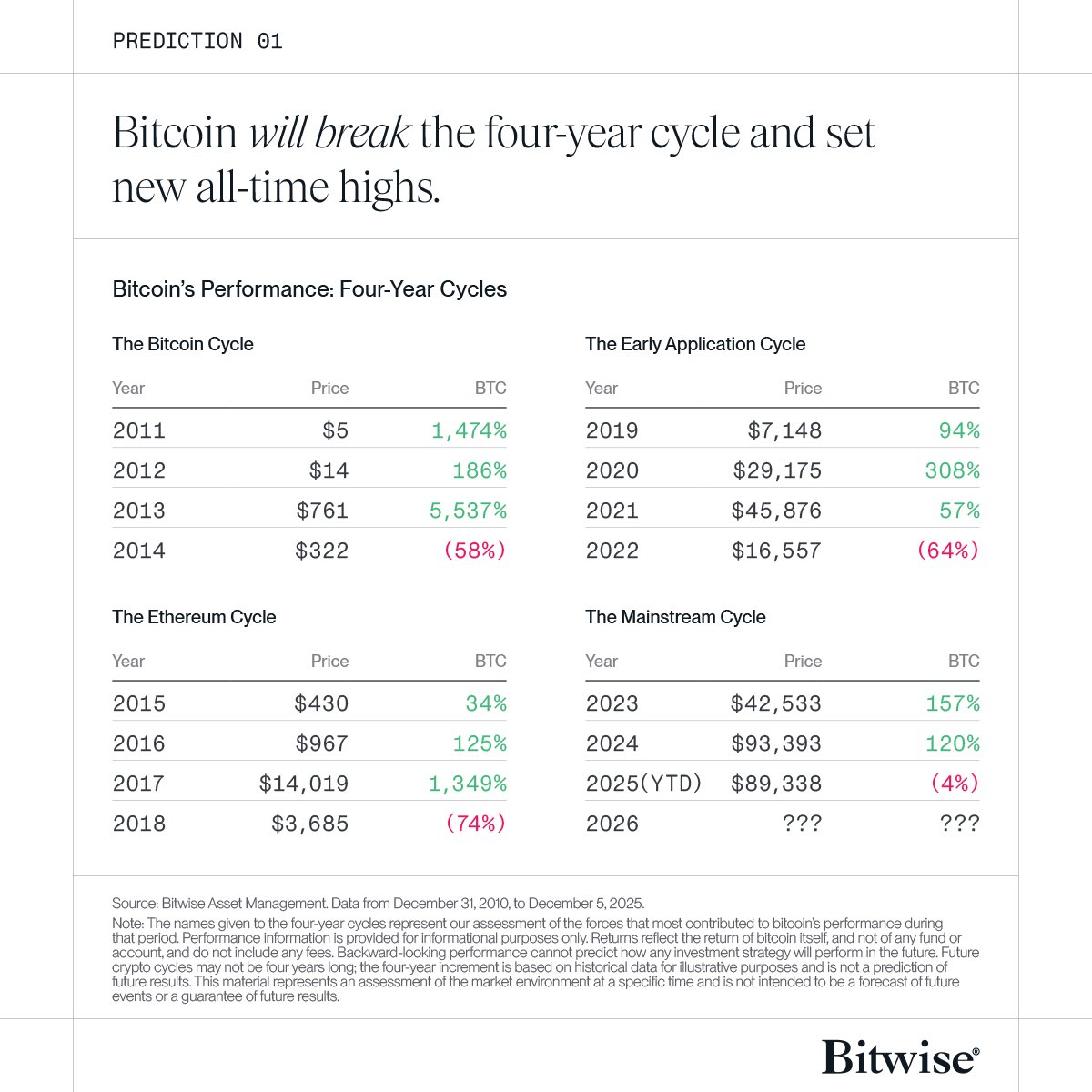

2/ First, key takeaways:

2/ First, key takeaways: