Student of business models. Player of infinite games. Lets build something together.

7 subscribers

How to get URL link on X (Twitter) App

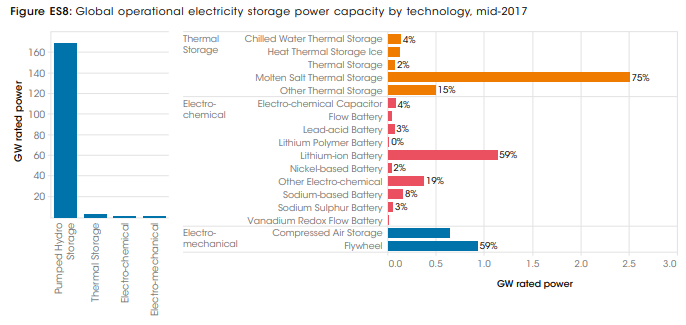

"Hydro storage currently dominates total

"Hydro storage currently dominates total

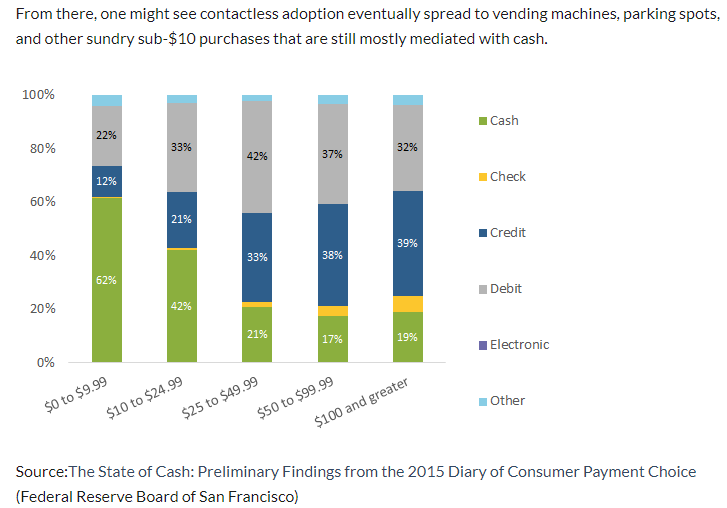

@scuttleblurb does this sound like a digital wallet for businesses? scuttleblurb.com/vma3/

@scuttleblurb does this sound like a digital wallet for businesses? scuttleblurb.com/vma3/

ECL announces new customer vertical:

ECL announces new customer vertical:

"returns in complex systems are distributed in a fashion much closer to power laws than normal," and occur via "punctuated equilibrium"

"returns in complex systems are distributed in a fashion much closer to power laws than normal," and occur via "punctuated equilibrium"

Uses example of pictures being taken and saved and shown for free on our phones vs paying to have pictures developed 10 years ago.

Uses example of pictures being taken and saved and shown for free on our phones vs paying to have pictures developed 10 years ago.

To date, fixed income trading has primarily been monetized by the existing exchanges via their data / analytics business. The most valuable piece of data to control = an index & the corresponding data that is owned by the index operator.

To date, fixed income trading has primarily been monetized by the existing exchanges via their data / analytics business. The most valuable piece of data to control = an index & the corresponding data that is owned by the index operator.

https://twitter.com/ivan_brussels/status/1113100797326262275

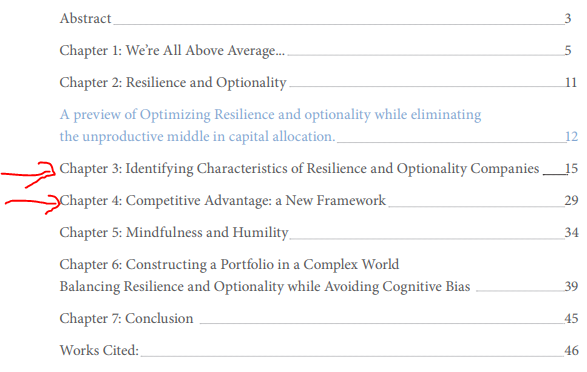

Movie theaters vs sports & theme parks; just as the barbells are working in retail (dollar stores & luxury taking share from the middle), also true in entertainment; movie theaters = the dollar stores of out of home entertainment

Movie theaters vs sports & theme parks; just as the barbells are working in retail (dollar stores & luxury taking share from the middle), also true in entertainment; movie theaters = the dollar stores of out of home entertainment

the ongoing "Electronification of Trading"

the ongoing "Electronification of Trading"

https://twitter.com/BluegrassCap/status/1099726843425497090As a business model analogy, Zillow is trying to do to the existing RE market (anchored around local MLS) what Netflix did to the cable bundle.