Research papers, #bankunderground posts, publications and news from

Bank of England researchers. Staff opinion and analysis, not necessarily official BoE views

How to get URL link on X (Twitter) App

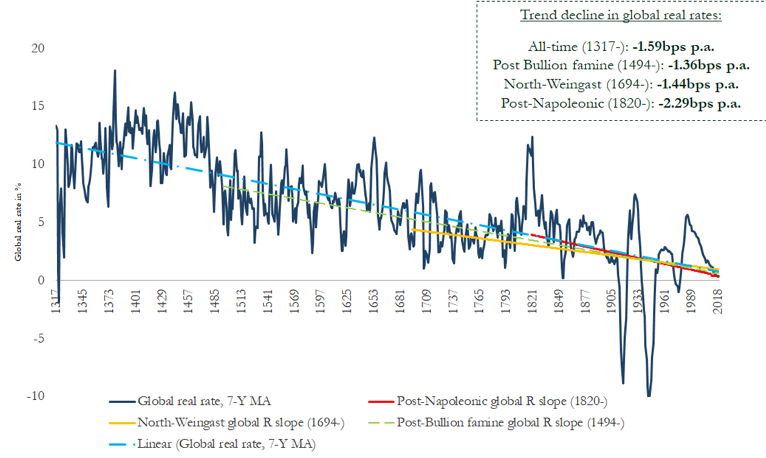

2/ The new series aims to revisit long-run nominal and real capital return trends which are at the core of multiple current debates. Existing classics - such as Homer and Sylla's History of Interest Rates - ignored archival and even many secondary sources.

2/ The new series aims to revisit long-run nominal and real capital return trends which are at the core of multiple current debates. Existing classics - such as Homer and Sylla's History of Interest Rates - ignored archival and even many secondary sources.

2/ Paper uses a “User Cost of Housing” Model, where the price of a house is equal to present discounted value of the housing services a house produces. Monthly cost of buying should equal the rental price after allowing for maintenance costs, taxes etc.

2/ Paper uses a “User Cost of Housing” Model, where the price of a house is equal to present discounted value of the housing services a house produces. Monthly cost of buying should equal the rental price after allowing for maintenance costs, taxes etc.