I write about debt and dubious balance sheets for the @FT. Have a tip? Email: robert.smith@ft.com / robert.smith.ft@proton.me | WhatsApp/Signal: +447921685062

2 subscribers

How to get URL link on X (Twitter) App

FLASHBACK: When the FT asked in 2020 whether he had taken out a loan to finance his $100mn investment in Virgin Galactic, Palihapitiya denied it was the case, writing: “That is NOT correct”.

FLASHBACK: When the FT asked in 2020 whether he had taken out a loan to finance his $100mn investment in Virgin Galactic, Palihapitiya denied it was the case, writing: “That is NOT correct”.

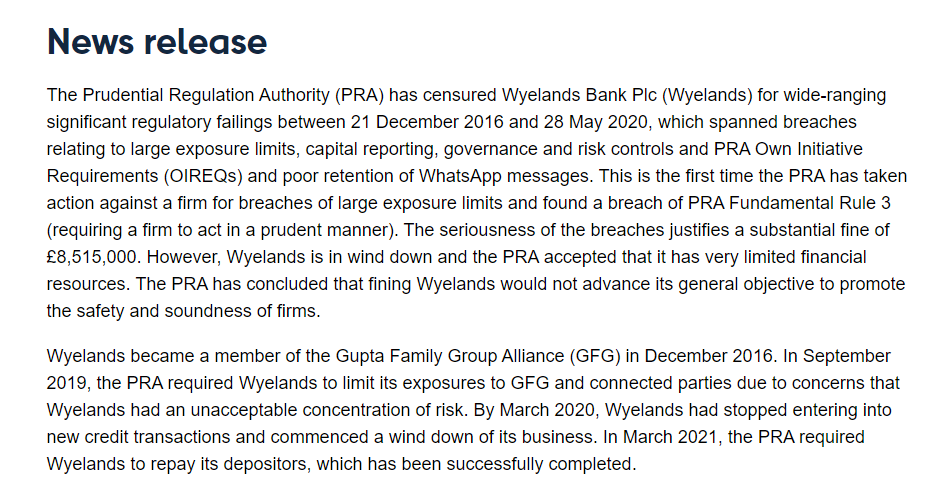

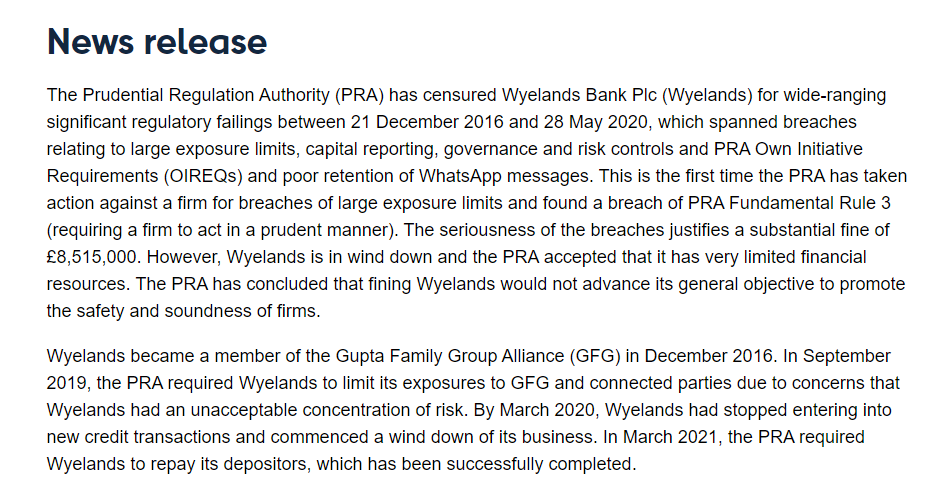

We first exposed that Gupta was using Wyelands to extensively finance his creaking industrial empire way back in the summer of 2019 ft.com/content/54f7c0…

We first exposed that Gupta was using Wyelands to extensively finance his creaking industrial empire way back in the summer of 2019 ft.com/content/54f7c0…

cc @daniburgz

cc @daniburgz https://twitter.com/daniburgz/status/1573273761616658434?t=bsmqpD3tqV-J_bExQX9kPw&s=19

https://twitter.com/brian_armstrong/status/1435439543692365828Just absolutely wild that the SEC might think that little slips of digital paper entitling the holder to "yield" are securities

https://twitter.com/BondHack/status/1296807190729236480If you investigate or criticise one of France's largest grocers you can expect to face intimidation and/or surveillance.