How to get URL link on X (Twitter) App

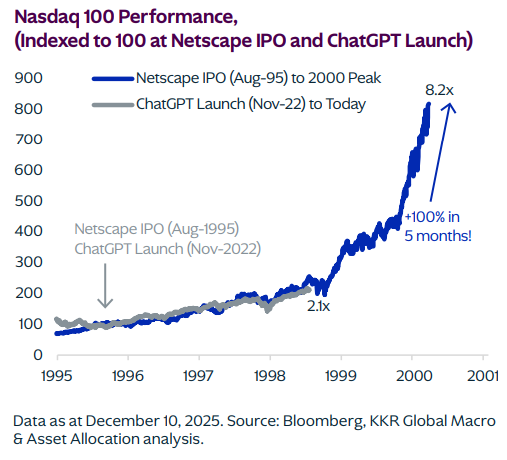

2/ Capex as a percentage of operating cash flows is reaching unprecedented levels for the hyperscalers

2/ Capex as a percentage of operating cash flows is reaching unprecedented levels for the hyperscalers

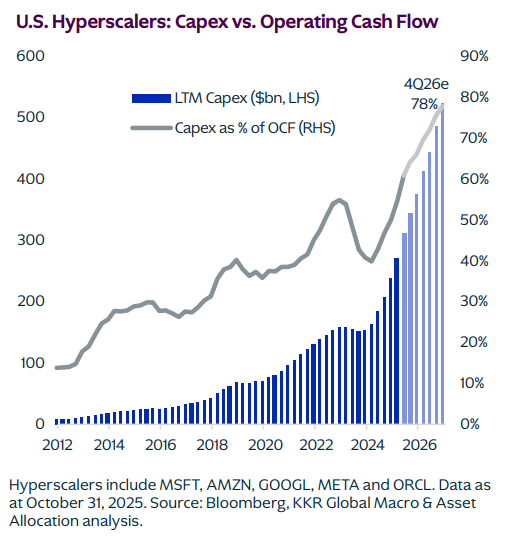

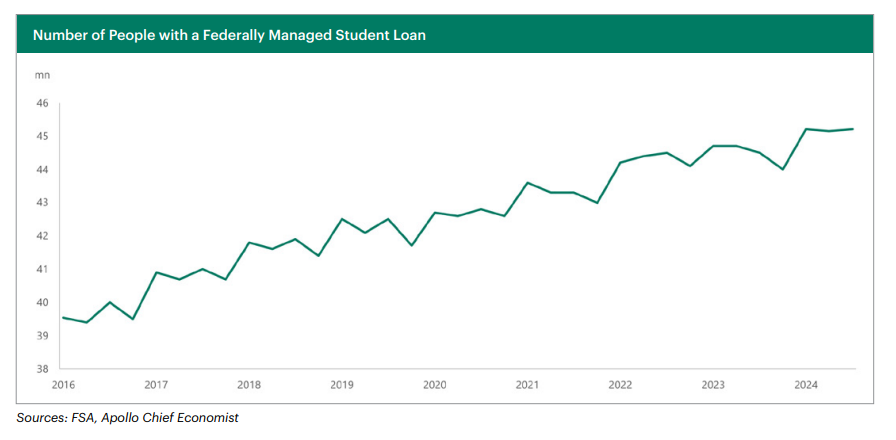

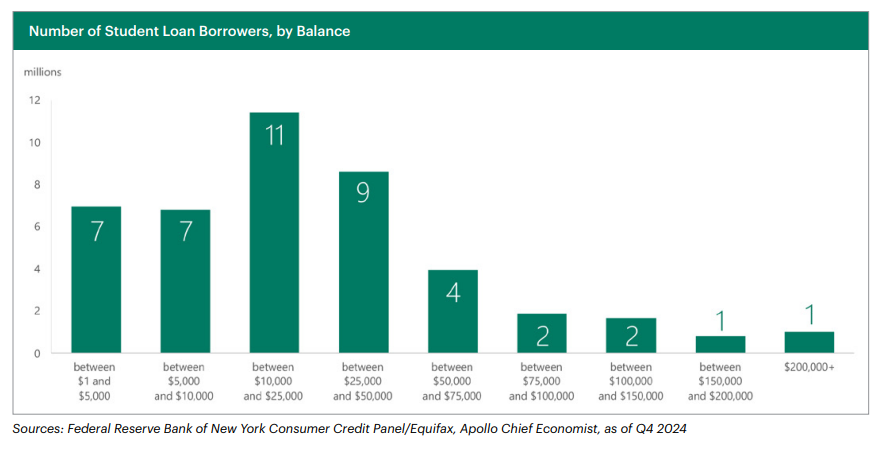

2/ These loan balances are significant and broad-reaching. Restarting payments on loans of this magnitude will have real consequences for household budgets and for the broader economy.

2/ These loan balances are significant and broad-reaching. Restarting payments on loans of this magnitude will have real consequences for household budgets and for the broader economy.

2. Wealth inequality has significantly worsened.

2. Wealth inequality has significantly worsened.

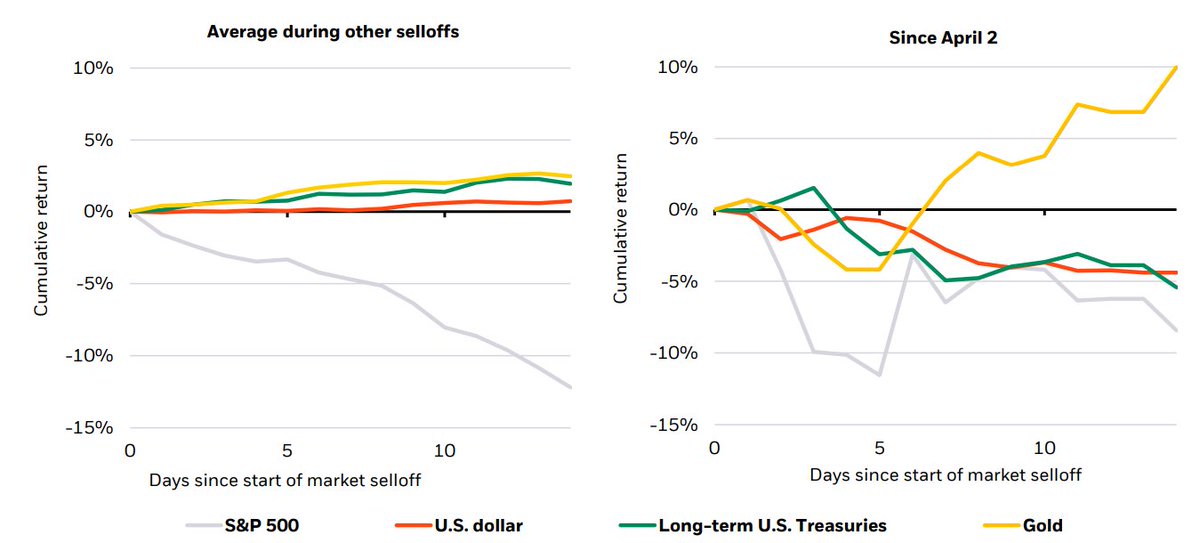

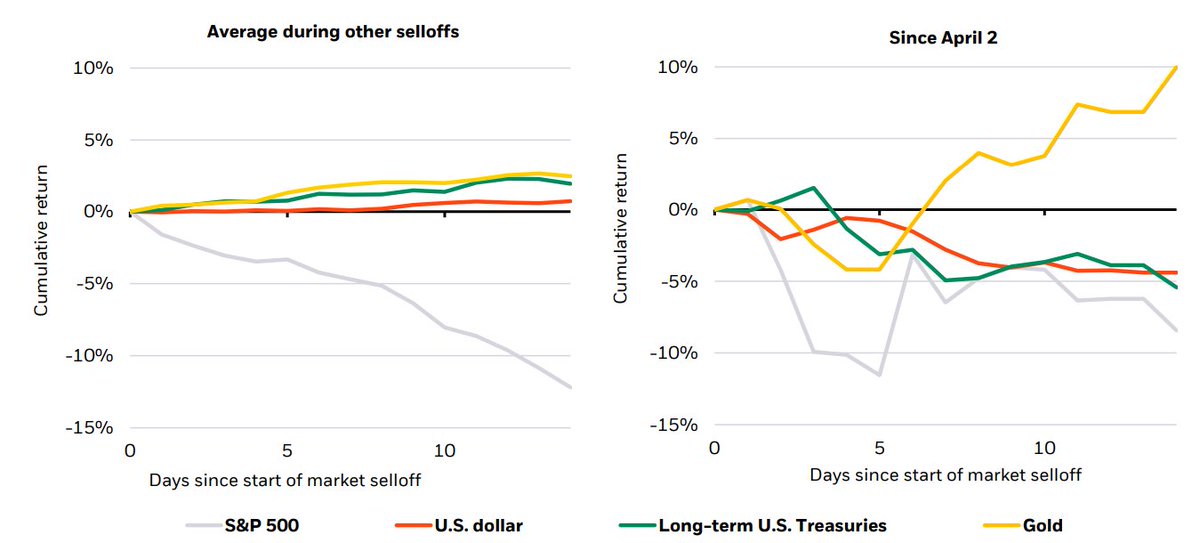

2/ Tariffs currently trending towards de-escalation...

2/ Tariffs currently trending towards de-escalation...

2/ Trade policy and economic policy uncertainty remains near all time highs, as of April data

2/ Trade policy and economic policy uncertainty remains near all time highs, as of April data