Daily Biotech Updates: Public & Private Market Updates, Company Building, Financing, Exit Strategies, & Emerging Science Trends | Current: Janitor at Biotech VC

How to get URL link on X (Twitter) App

2/ In mice, both combos beat their GLP-1 backbone:

2/ In mice, both combos beat their GLP-1 backbone:

2/ 🔍 1The Backstory

2/ 🔍 1The Backstory

2/ 🎯 Autologous CAR-T has a speed problem

2/ 🎯 Autologous CAR-T has a speed problem

2/ 📈 The Market Mood Has Flipped

2/ 📈 The Market Mood Has Flipped

2/ How ADCs Actually Work

2/ How ADCs Actually Work

How ADCs Actually Work

How ADCs Actually Work

🎯 The Bullish Binary Setup

🎯 The Bullish Binary Setup

What is lepodisiran?

What is lepodisiran?

2/ Financial Position 💰

2/ Financial Position 💰

2/ Tracking LNPs in real time 📡

2/ Tracking LNPs in real time 📡

2/ This use case caught our eye- using AI to develop clinical biomarkers for development.

2/ This use case caught our eye- using AI to develop clinical biomarkers for development.

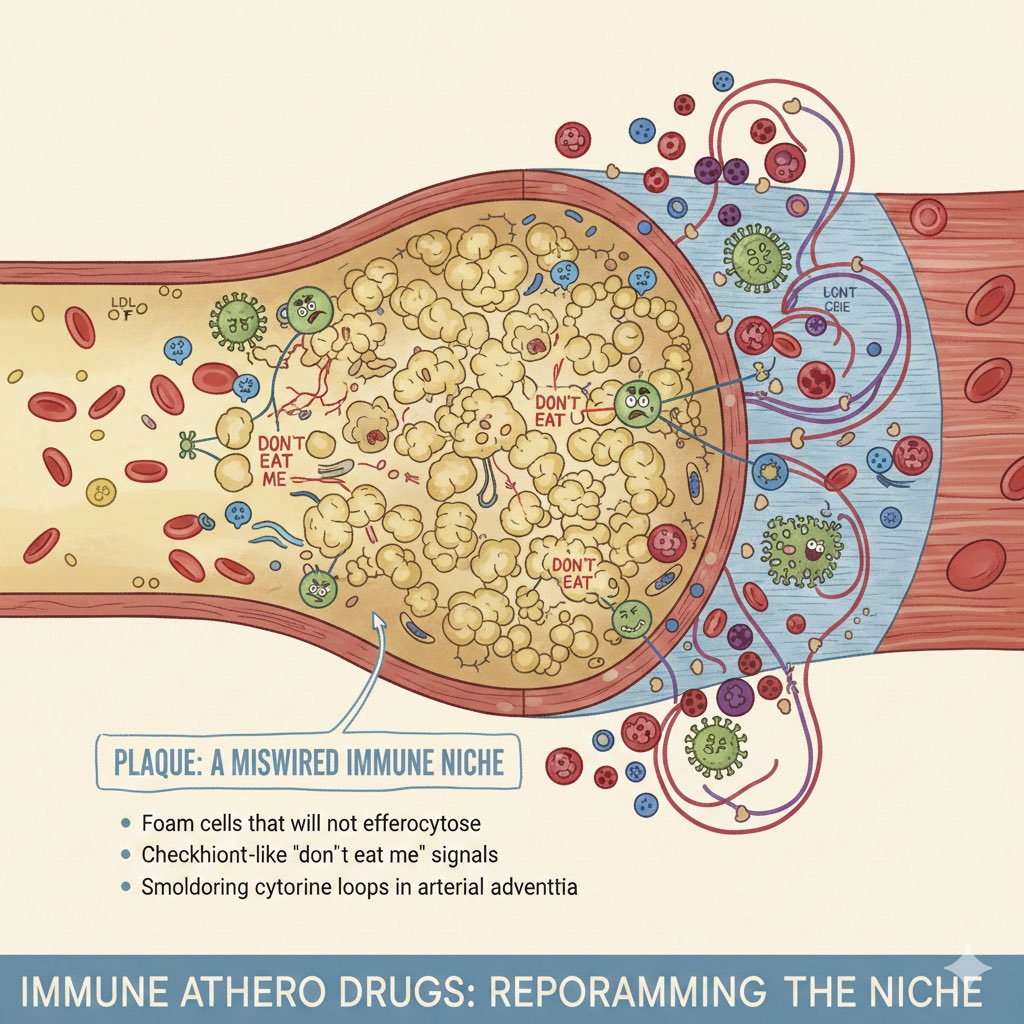

2/ Another exciting development is the use of IMMUNE CHECKPOINTS, which can help boost the immune response against cancer by blocking proteins that prevent the immune system from attacking cancer cells.

2/ Another exciting development is the use of IMMUNE CHECKPOINTS, which can help boost the immune response against cancer by blocking proteins that prevent the immune system from attacking cancer cells.