Automotive long/short & Tesla skeptic. More in-depth, weekly updates on Tesla & its automotive rivals can be found here: https://t.co/8lbZs0zwTU

4 subscribers

How to get URL link on X (Twitter) App

$TSLA's current premium is "unidentifiable" and "too significant".

$TSLA's current premium is "unidentifiable" and "too significant".

This is how many new EVs will be on sale in the US vs $TSLA & its line-up in 2023.

This is how many new EVs will be on sale in the US vs $TSLA & its line-up in 2023.

$TSLA discloses foreign cash holdings each quarter.

$TSLA discloses foreign cash holdings each quarter.

https://twitter.com/wintonARK/status/1374405386179014661

2/ @wintonARK why use theories like Wright's Law?

2/ @wintonARK why use theories like Wright's Law?

$ARKK top holding: $TSLA at 9.92% of NAV

$ARKK top holding: $TSLA at 9.92% of NAV

2/ UBS sees VW & $TSLA as #1 & #2 by 2025, w/ $TM at #3 from close to 0% now.

2/ UBS sees VW & $TSLA as #1 & #2 by 2025, w/ $TM at #3 from close to 0% now.

2/ This is a list of ARK's 18 most illiquid holdings, in terms of the # of trading days it would take ARK to exit its position based on avg 30-day volume.

2/ This is a list of ARK's 18 most illiquid holdings, in terms of the # of trading days it would take ARK to exit its position based on avg 30-day volume.

2/ This table of @ARKInvest's most toxic positions is sorted by the highest number of days needed to sell ARK's holdings vs the 30-day avg trading volume.

2/ This table of @ARKInvest's most toxic positions is sorted by the highest number of days needed to sell ARK's holdings vs the 30-day avg trading volume.

2/ $TSLA wasn't forthcoming about its chip woes on its Jan-27th conf-call. But we've since learned this:

2/ $TSLA wasn't forthcoming about its chip woes on its Jan-27th conf-call. But we've since learned this:

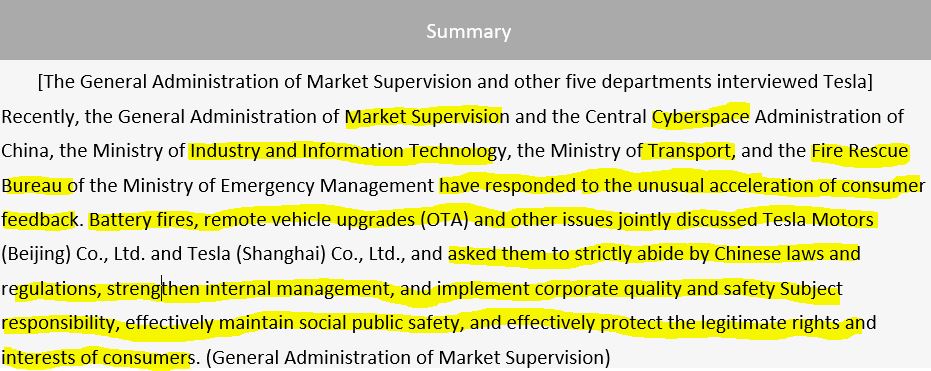

2/ $TSLA being questioned by 5 CCP agencies is the #2 news trending on China's Weibo now & made it to the nightly news.

2/ $TSLA being questioned by 5 CCP agencies is the #2 news trending on China's Weibo now & made it to the nightly news.

2/ $GS logic for $TSLA's $740bn fair value:

2/ $GS logic for $TSLA's $740bn fair value:

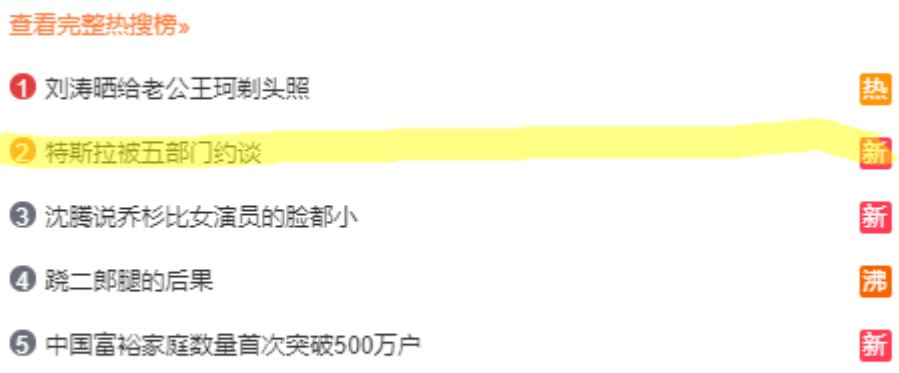

2/n @VWGroup boasted about having "secured" enough cell supply for 4.5m BEVs through 2023.

2/n @VWGroup boasted about having "secured" enough cell supply for 4.5m BEVs through 2023.

2) GF1 cost $4.2bn in initial capex, so 10GWh of extra capacity in 2021 requires $1.2bn (38% on top of consensus) & to reach 100 GWh by 2022, another $6.5bn will be needed (2x 2022 consensus).

2) GF1 cost $4.2bn in initial capex, so 10GWh of extra capacity in 2021 requires $1.2bn (38% on top of consensus) & to reach 100 GWh by 2022, another $6.5bn will be needed (2x 2022 consensus).