CFR senior fellow. Views are my own. Retweets are not endorsements. Writes on sovereign debt and capital flows.

85 subscribers

How to get URL link on X (Twitter) App

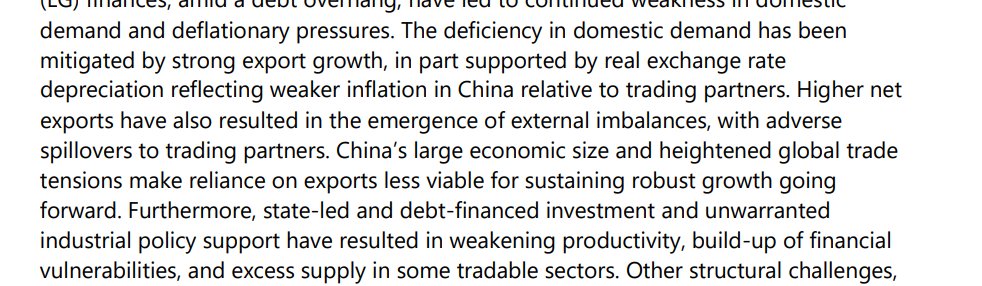

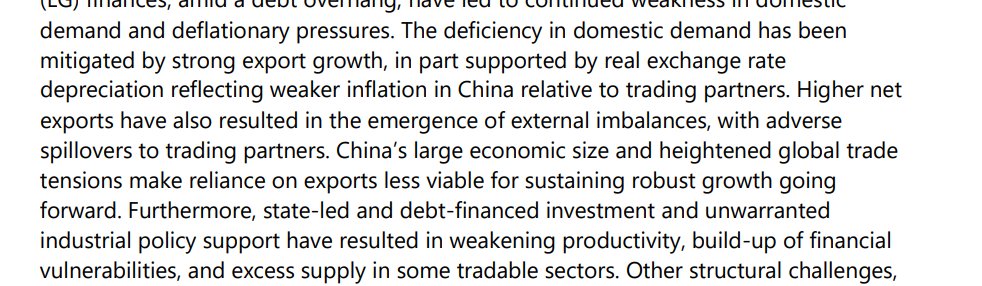

James Mayger and Jorgelina Do Rosario of Bloomberg reminded me that the 2024 staff report didn't mention external imbalances at all -- so there has been an important evolution in the IMF's thinking in the last couple of years

James Mayger and Jorgelina Do Rosario of Bloomberg reminded me that the 2024 staff report didn't mention external imbalances at all -- so there has been an important evolution in the IMF's thinking in the last couple of years

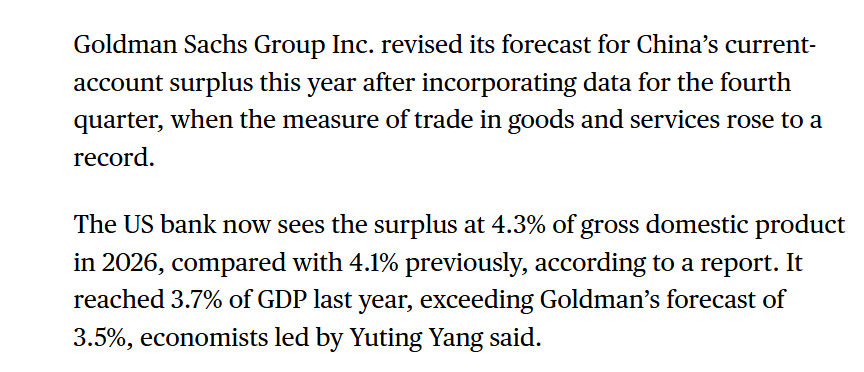

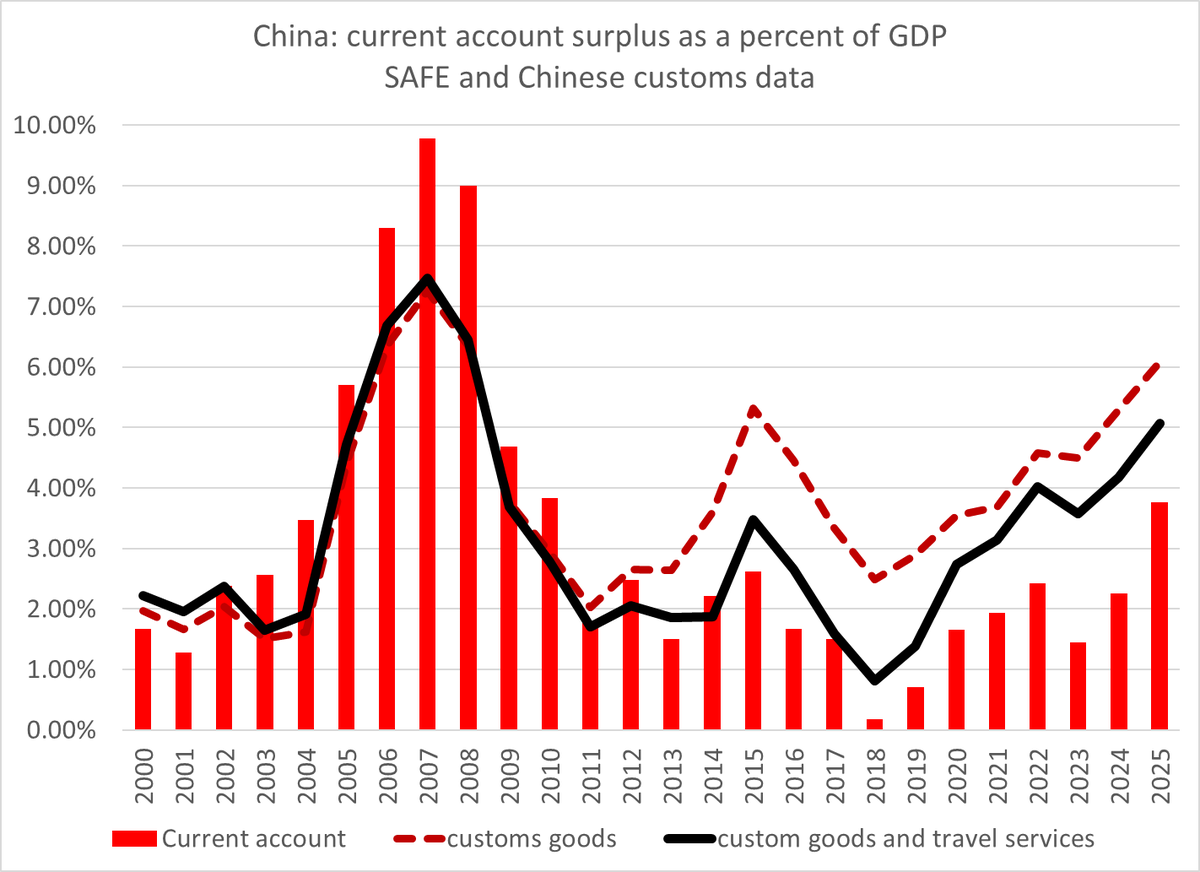

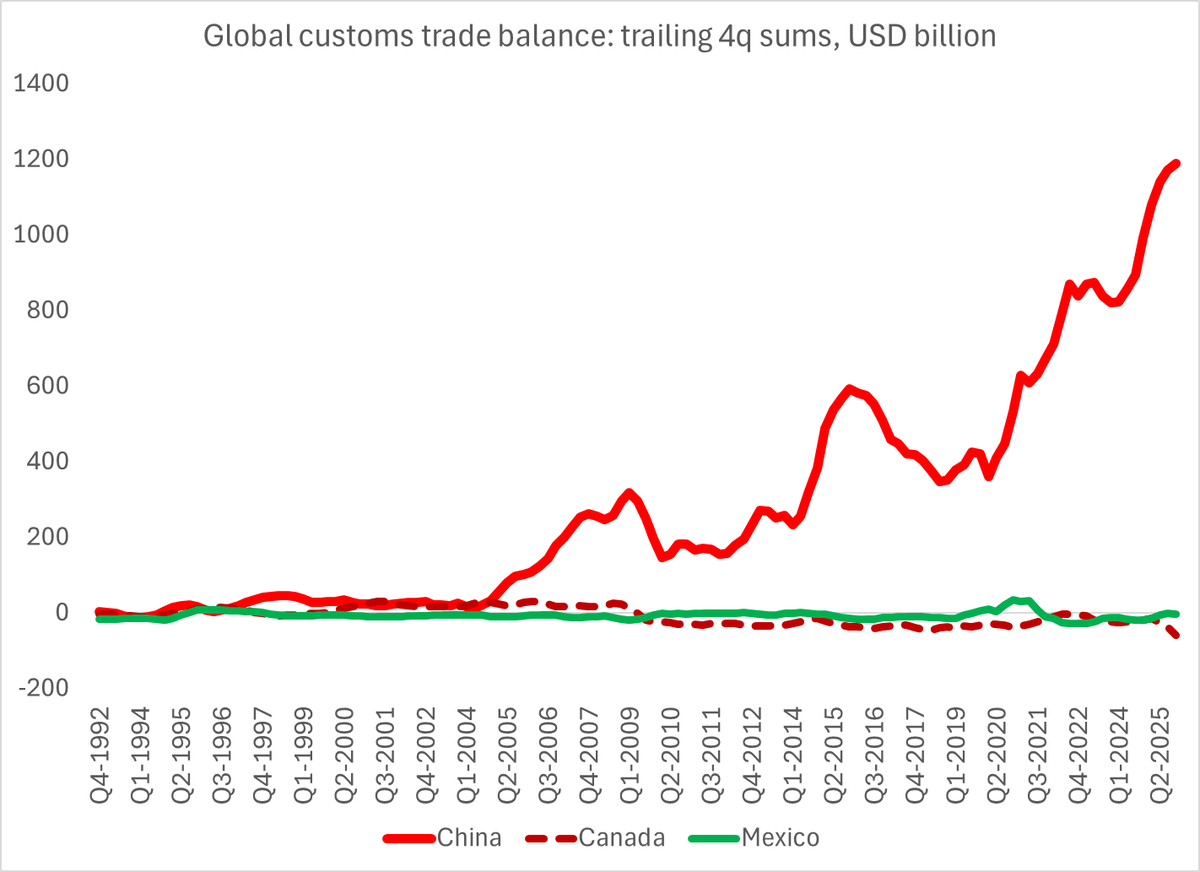

Goldman's forecast -- which is almost certainly better than the IMF's forthcoming forecast -- isn't that bold. The customs surplus net of tourism (travel) is already 5% of GDP, and that should be a reasonable estimate of the surplus of a country with a positive NIIP!

Goldman's forecast -- which is almost certainly better than the IMF's forthcoming forecast -- isn't that bold. The customs surplus net of tourism (travel) is already 5% of GDP, and that should be a reasonable estimate of the surplus of a country with a positive NIIP!

https://twitter.com/elerianm/status/2023109728679719176

The total offshore assets of SAFE, the CIC, the SCBs (over $1.5 trillion now) and the policy banks likely approaches $7 trillion. SAFE's securities holdings top $3 trillion & other investors hold ~ $700b in foreign securities ...

The total offshore assets of SAFE, the CIC, the SCBs (over $1.5 trillion now) and the policy banks likely approaches $7 trillion. SAFE's securities holdings top $3 trillion & other investors hold ~ $700b in foreign securities ...

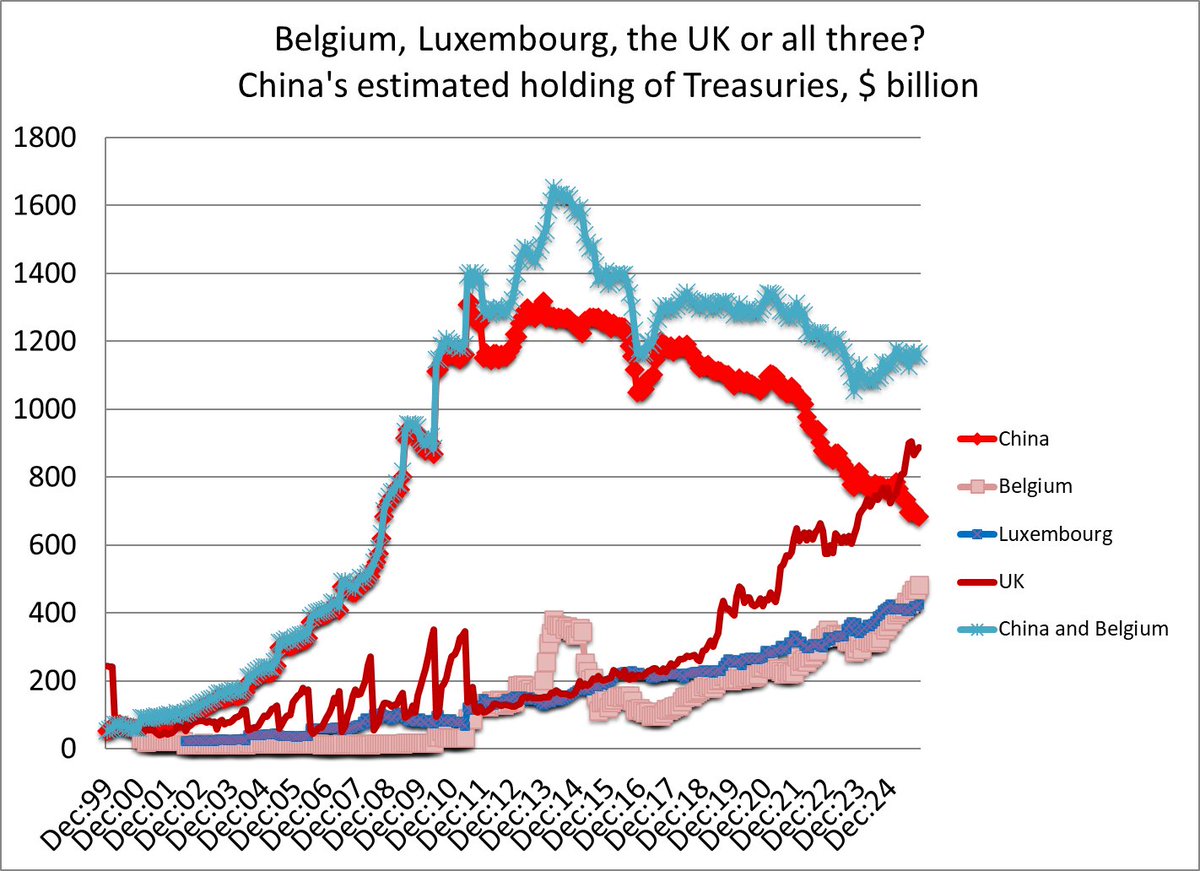

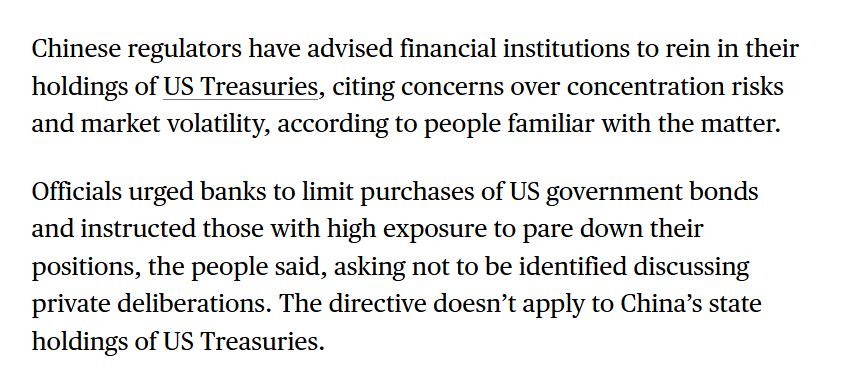

The official US data on foreign holdings doesn't show any basis for Chinese concern -- China's Treasuries in US custodianship (in theory state accounts as well as state bank accounts) are heading down not up

The official US data on foreign holdings doesn't show any basis for Chinese concern -- China's Treasuries in US custodianship (in theory state accounts as well as state bank accounts) are heading down not up

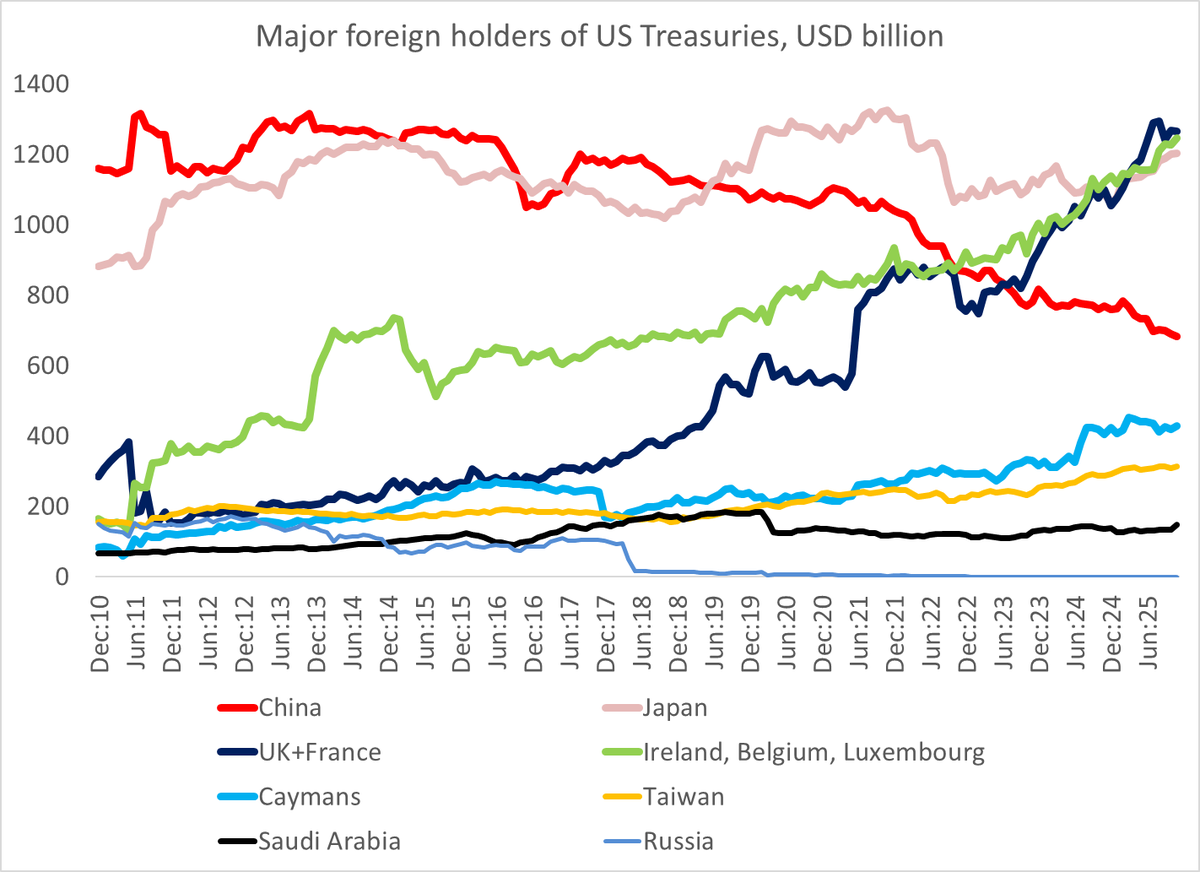

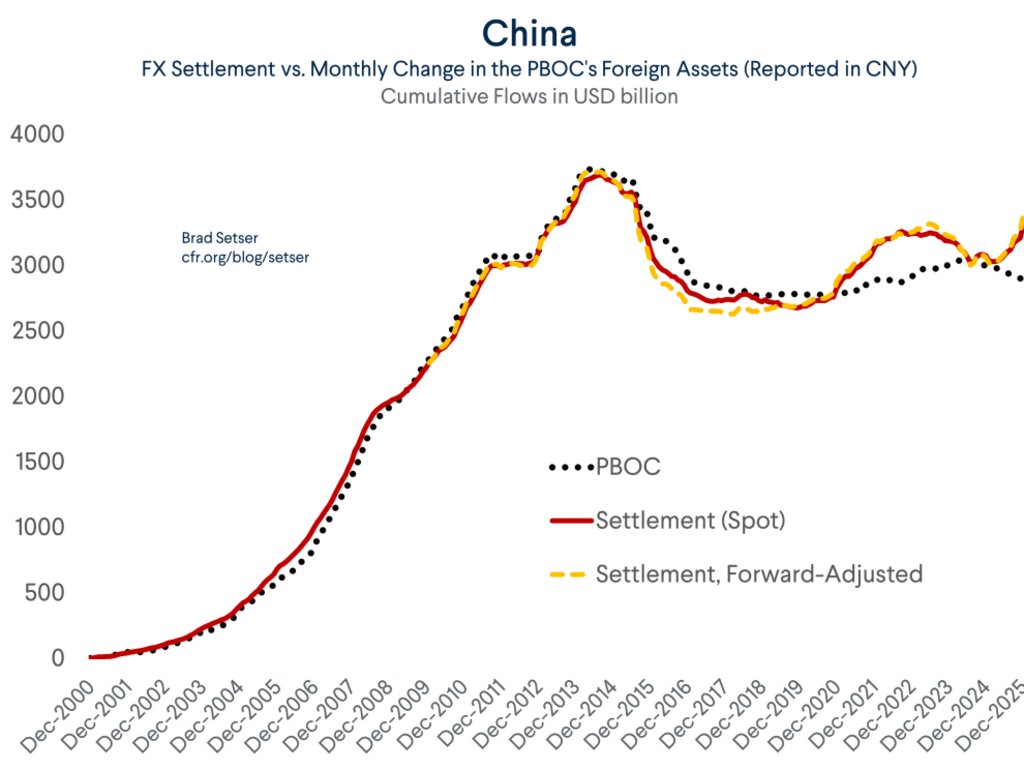

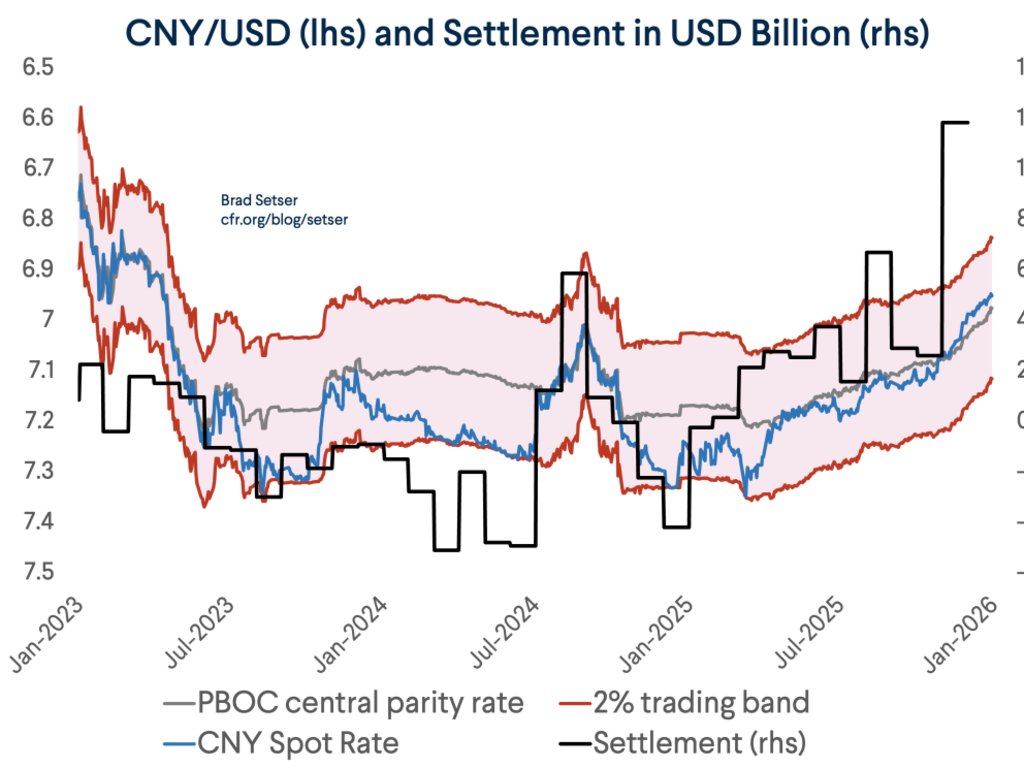

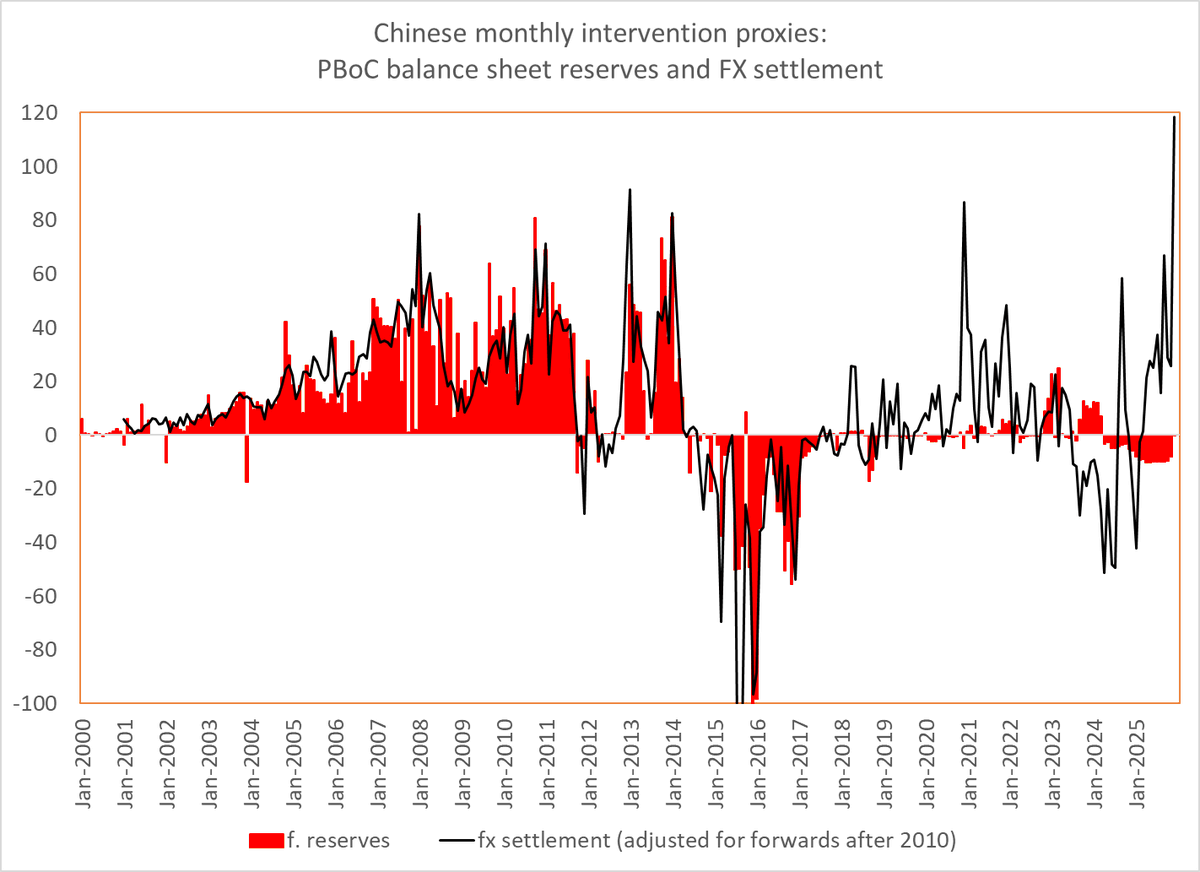

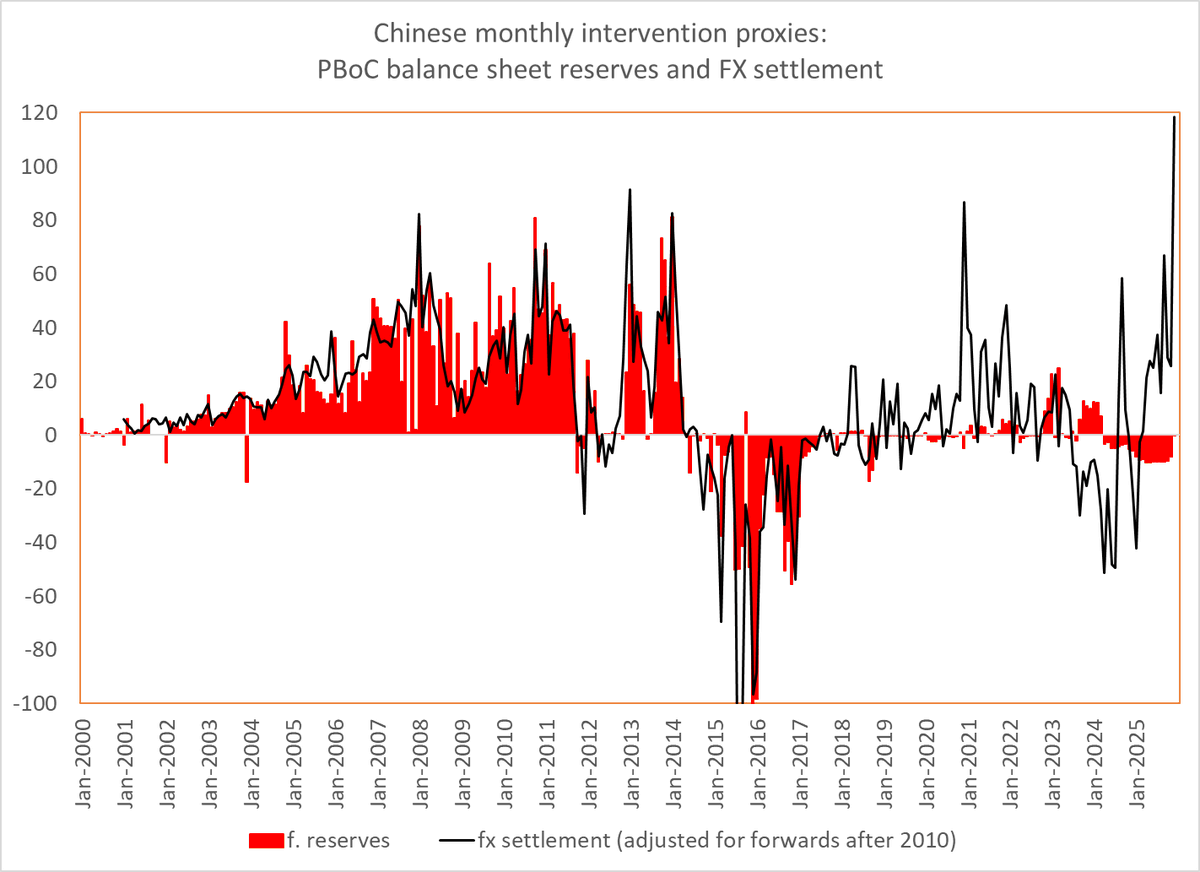

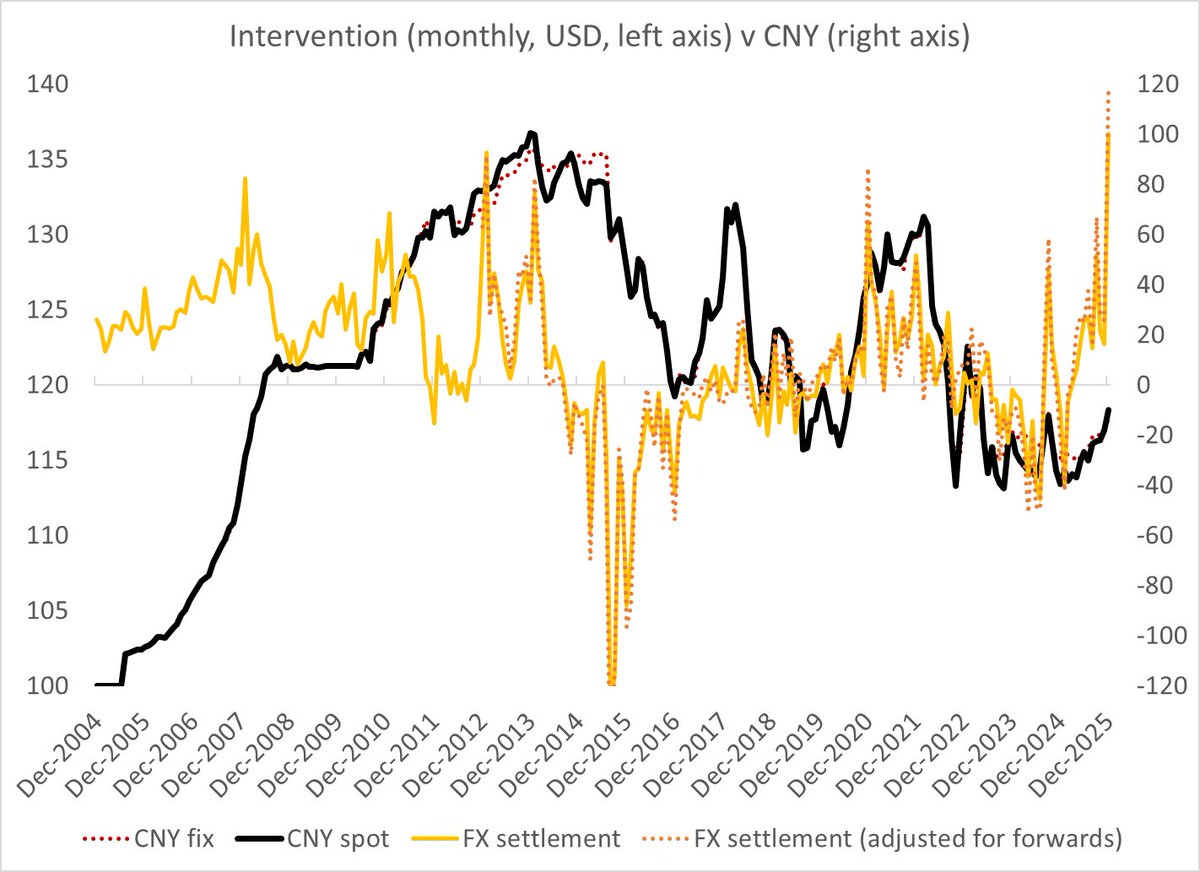

It is quite clear that state bank purchases (and in 23/ early 24 sales) of fx have replaced PBOC purchases and sales and the core technique China uses to manage the band around the daily fx -- i.e. settlement looks like an intervention variable

It is quite clear that state bank purchases (and in 23/ early 24 sales) of fx have replaced PBOC purchases and sales and the core technique China uses to manage the band around the daily fx -- i.e. settlement looks like an intervention variable

This seems clear

This seems clear

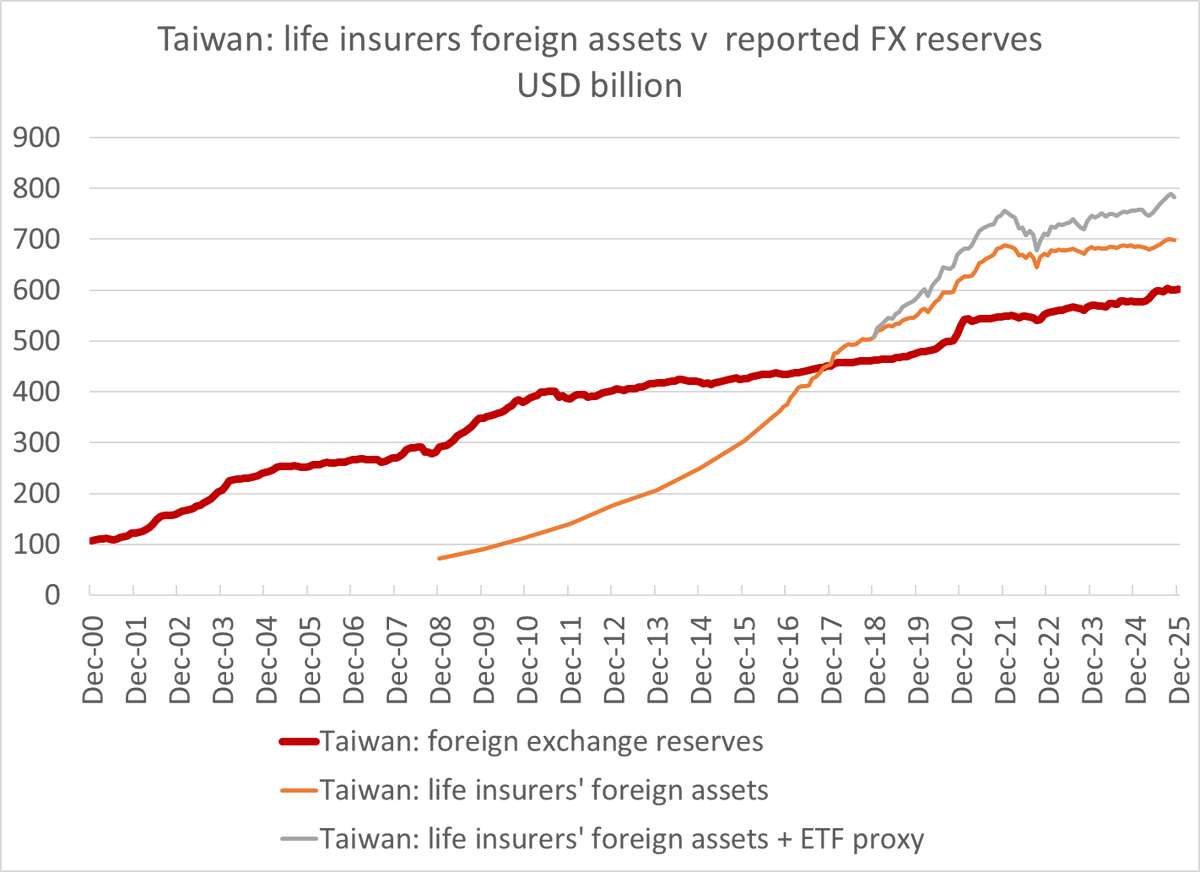

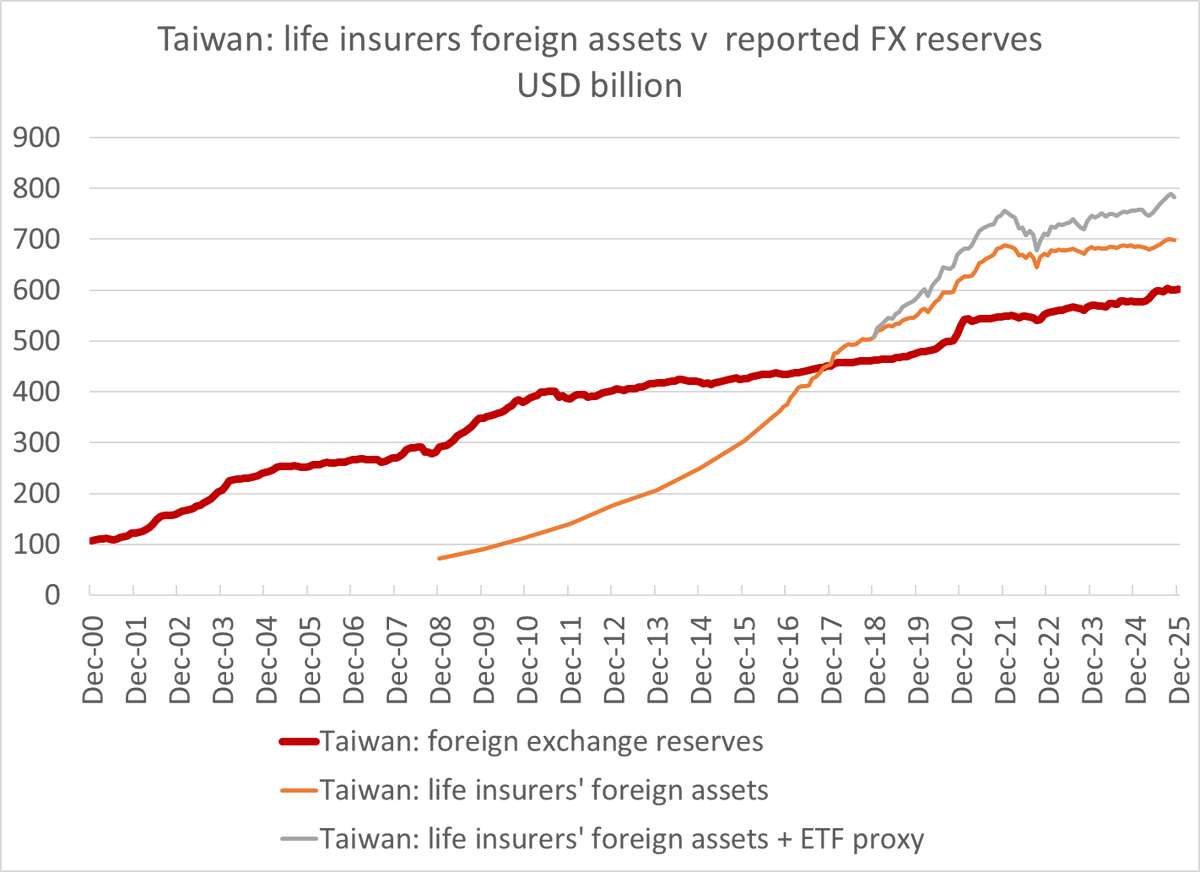

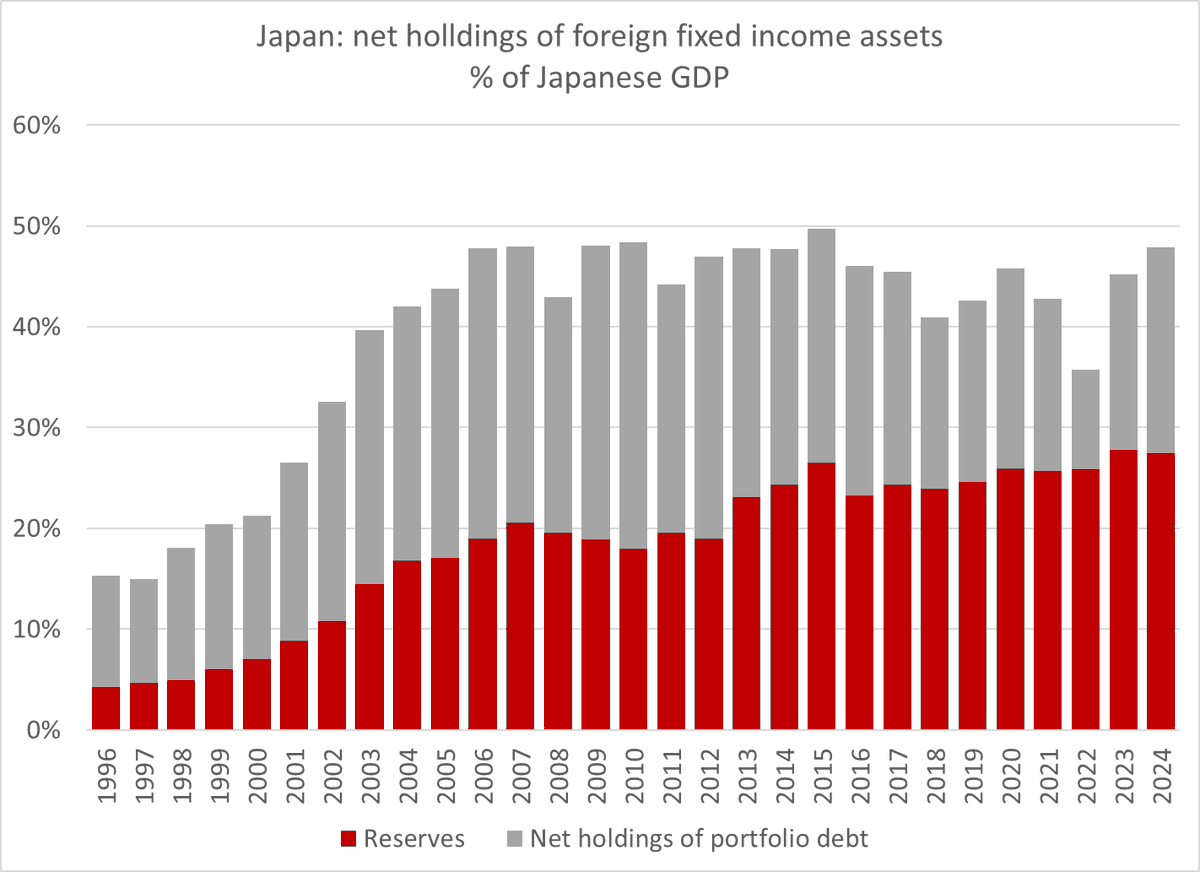

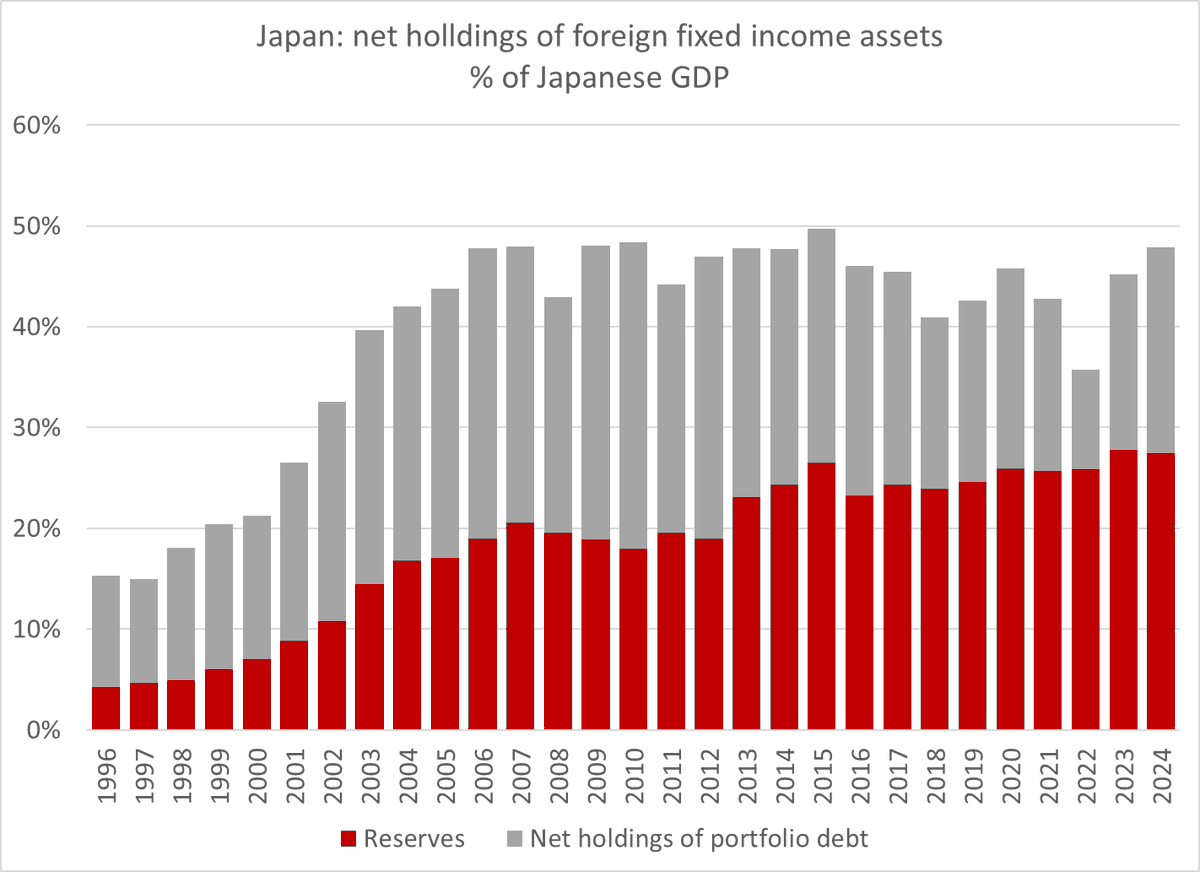

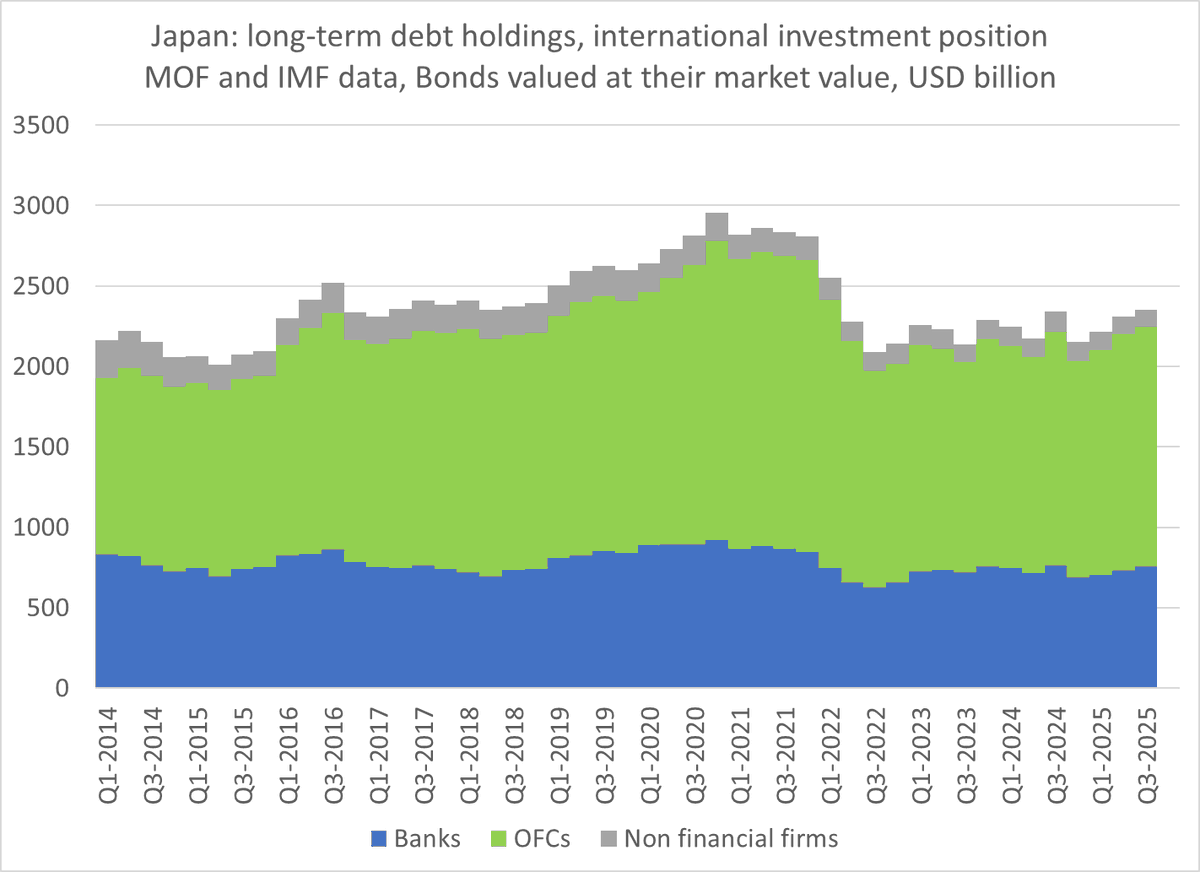

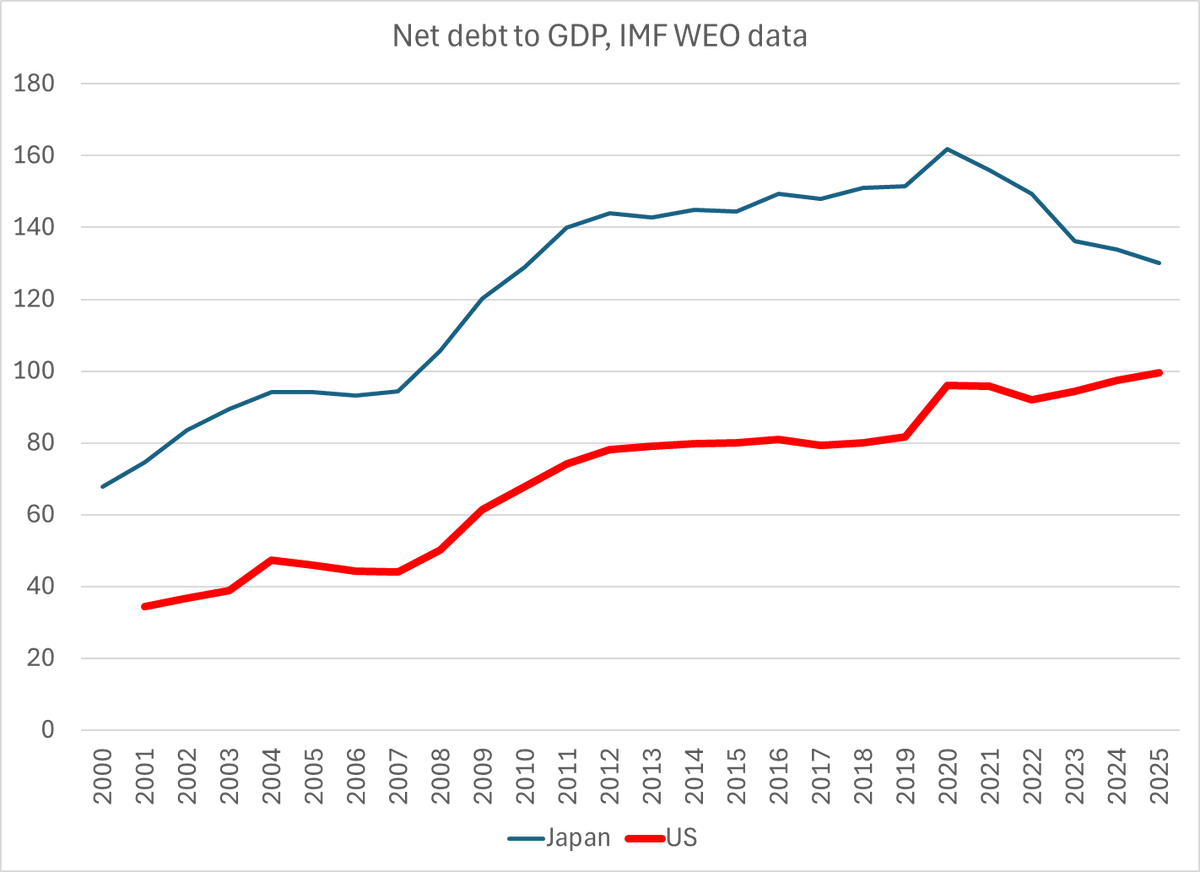

Japan's net holdings of bonds (net of foreign holdings of JGBs) is close to 50% of its GDP (a creditor position as big v GDP as the US net det position). That includes $1 trillion in bonds held in Japan's $1.175 trillion in reserves, + over $2 trillion in other holdings

Japan's net holdings of bonds (net of foreign holdings of JGBs) is close to 50% of its GDP (a creditor position as big v GDP as the US net det position). That includes $1 trillion in bonds held in Japan's $1.175 trillion in reserves, + over $2 trillion in other holdings

https://twitter.com/Richard_Casey/status/2014628745022185826

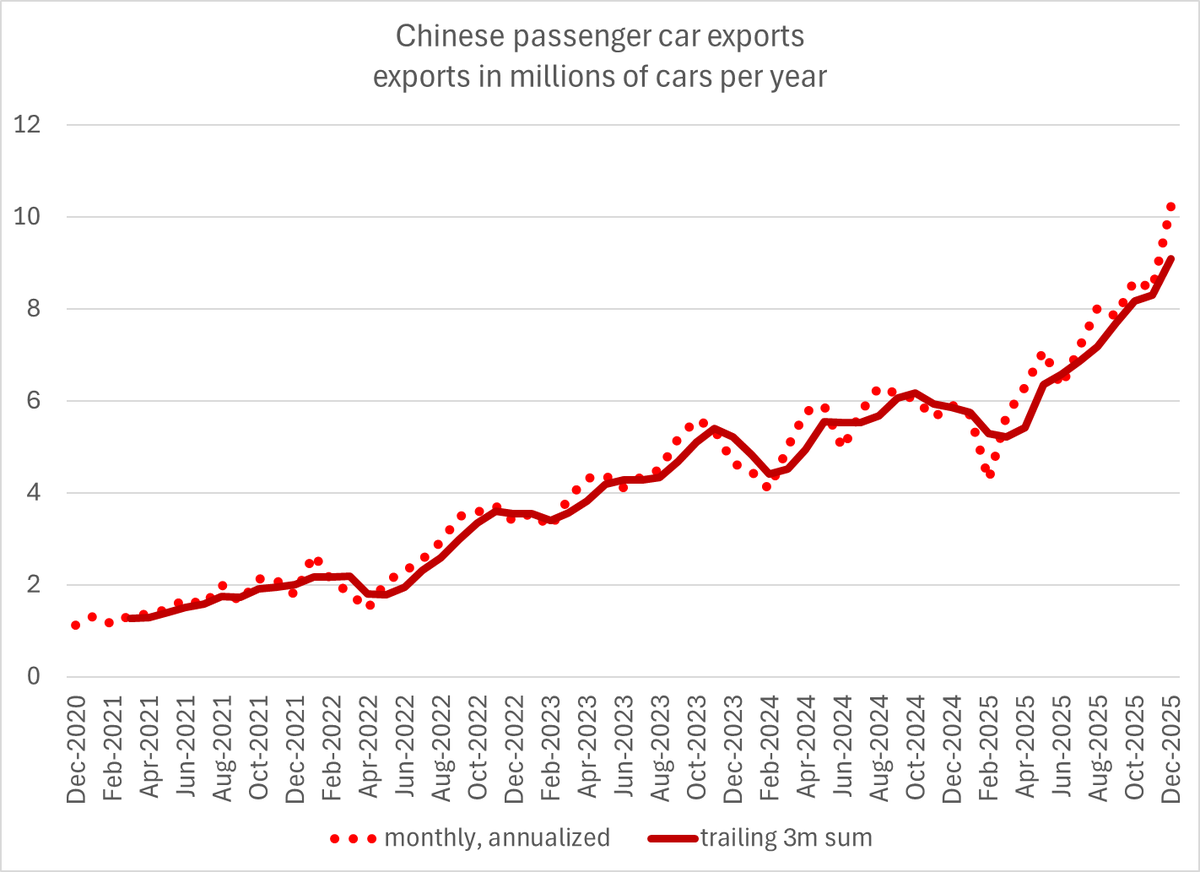

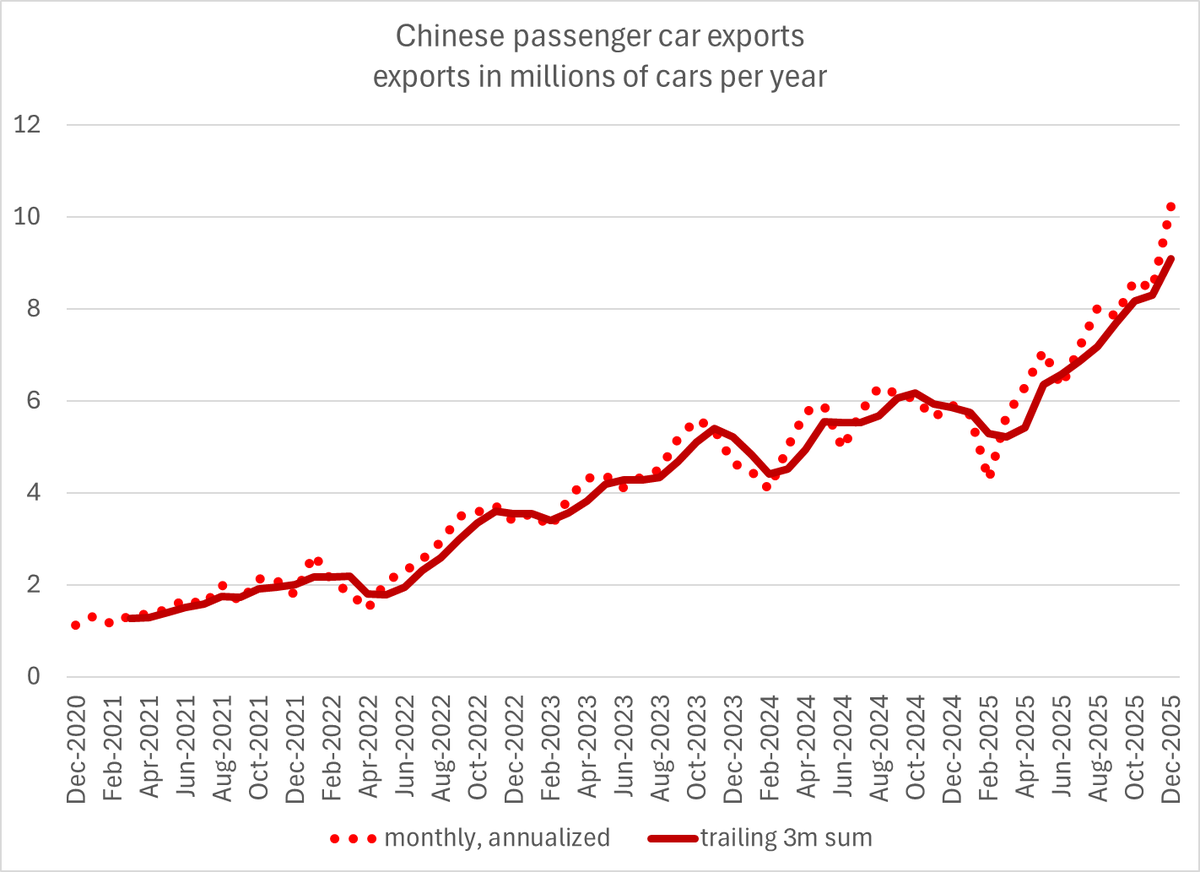

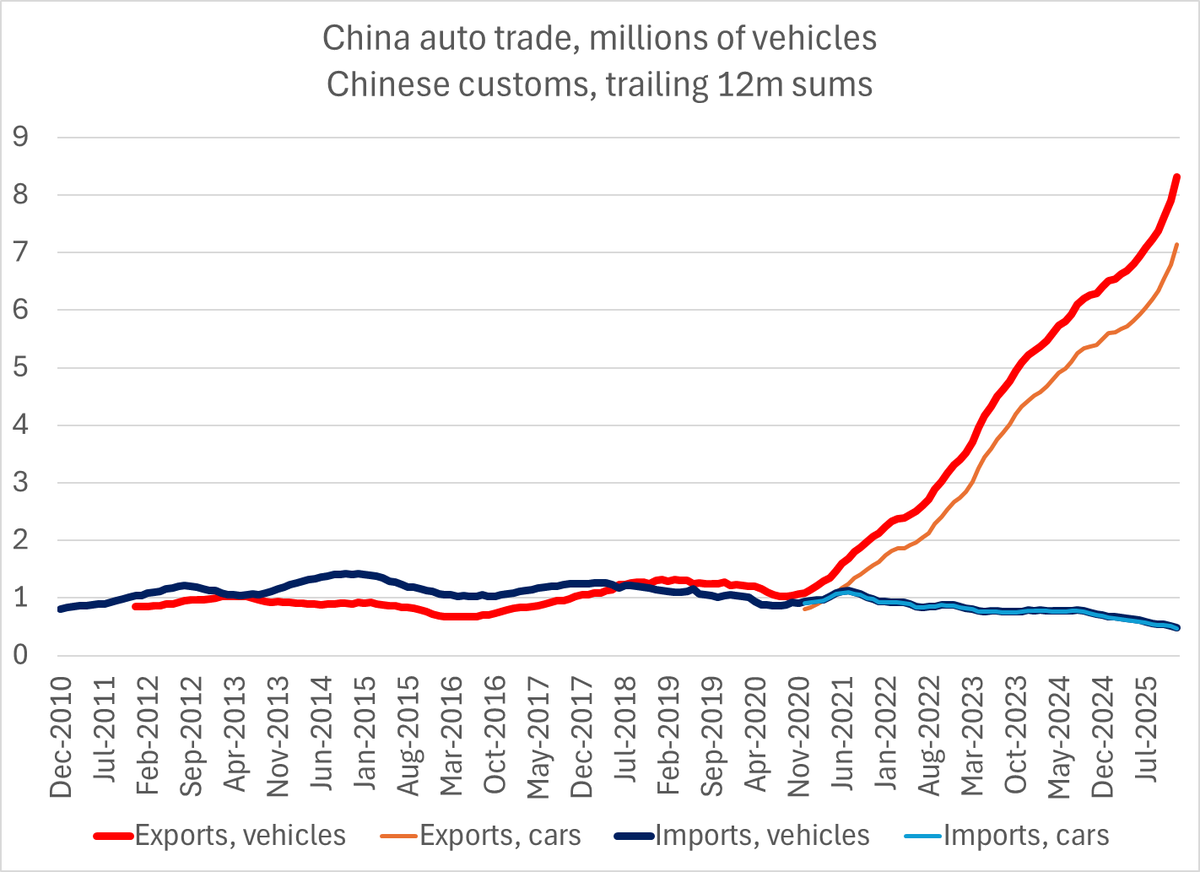

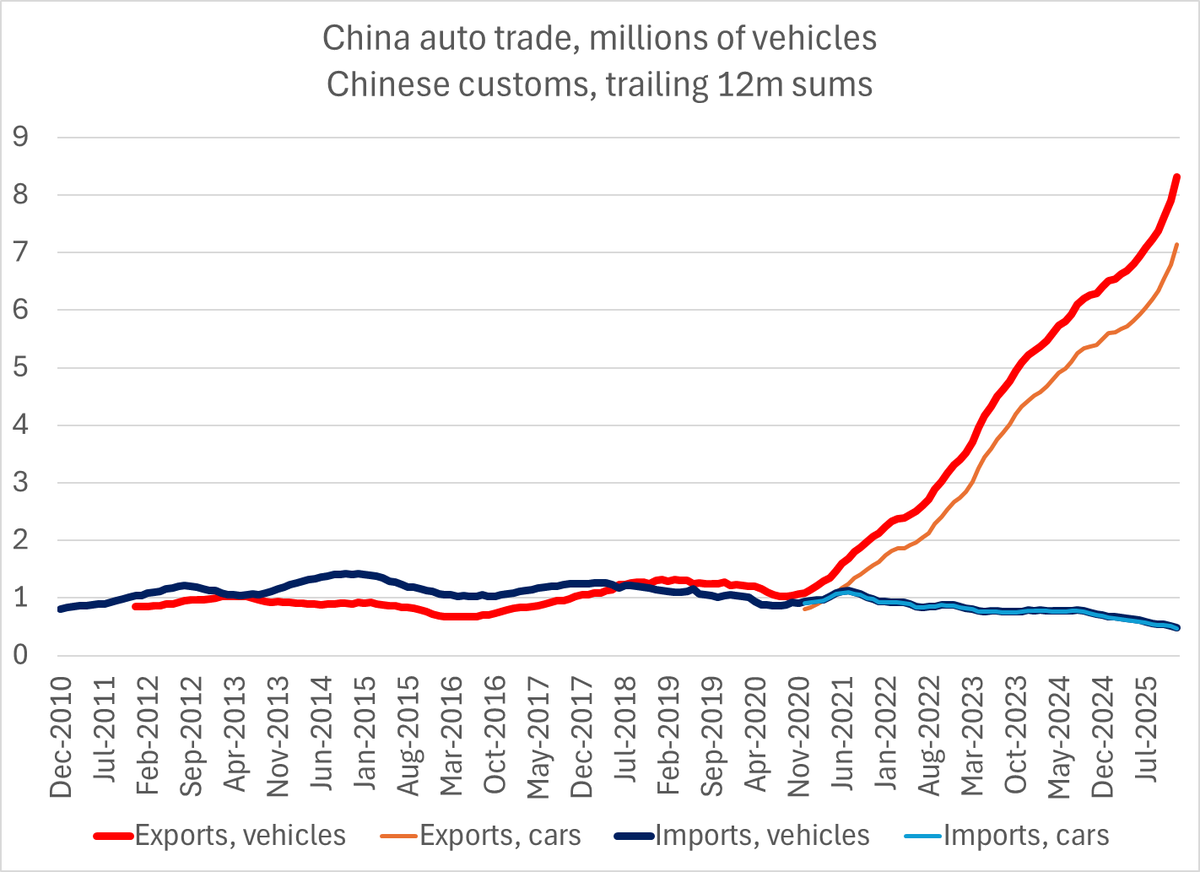

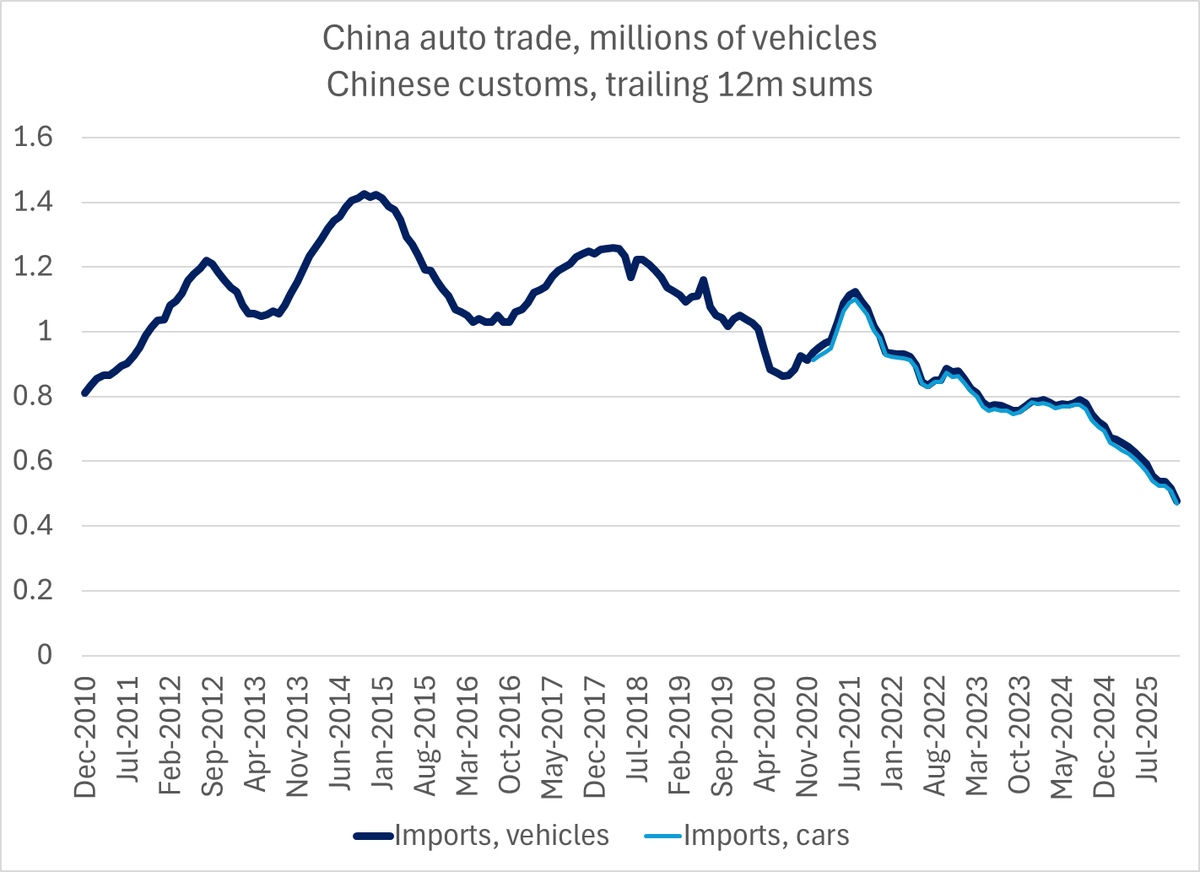

14m cars would be roughly 1/4th of the global market for cars outside China (the Chinese market is ~ 25m cars) ... no way that doesn't have a disruptive impact.

14m cars would be roughly 1/4th of the global market for cars outside China (the Chinese market is ~ 25m cars) ... no way that doesn't have a disruptive impact.

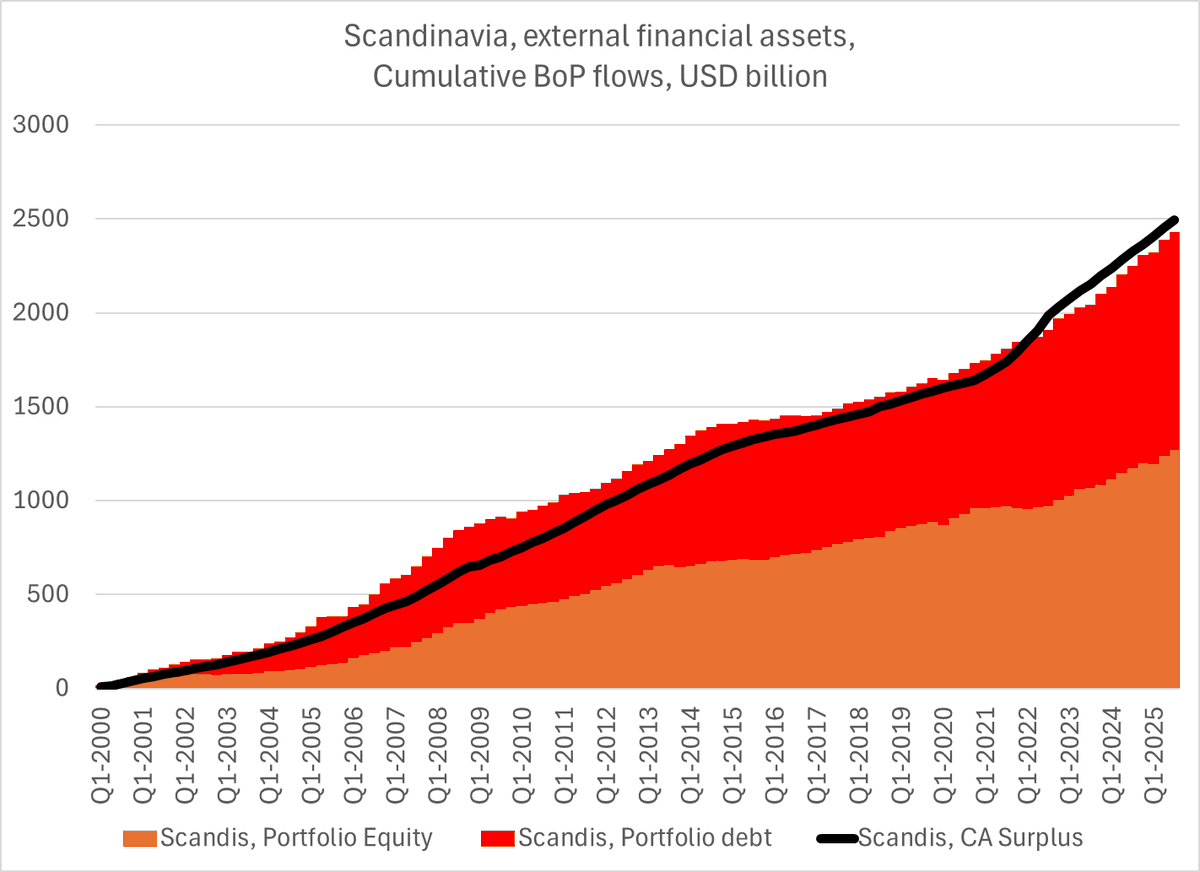

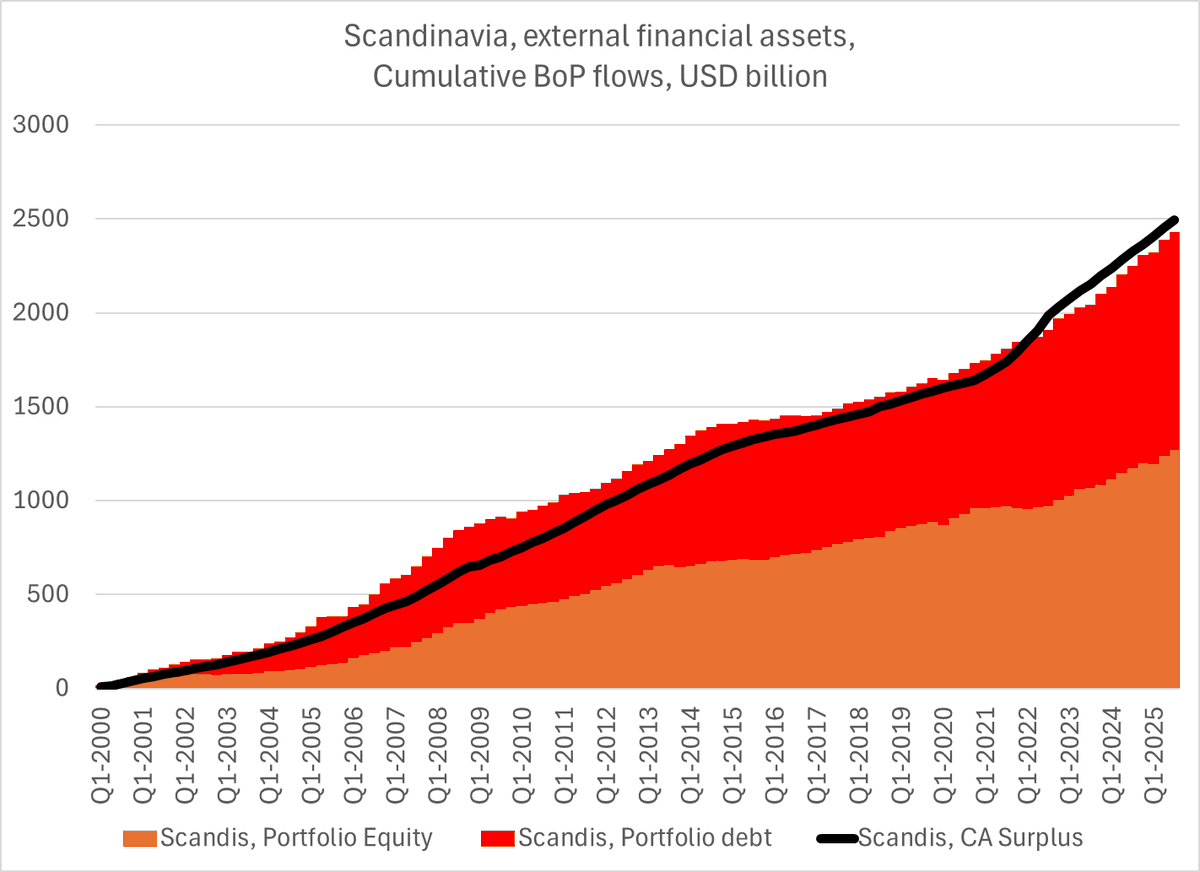

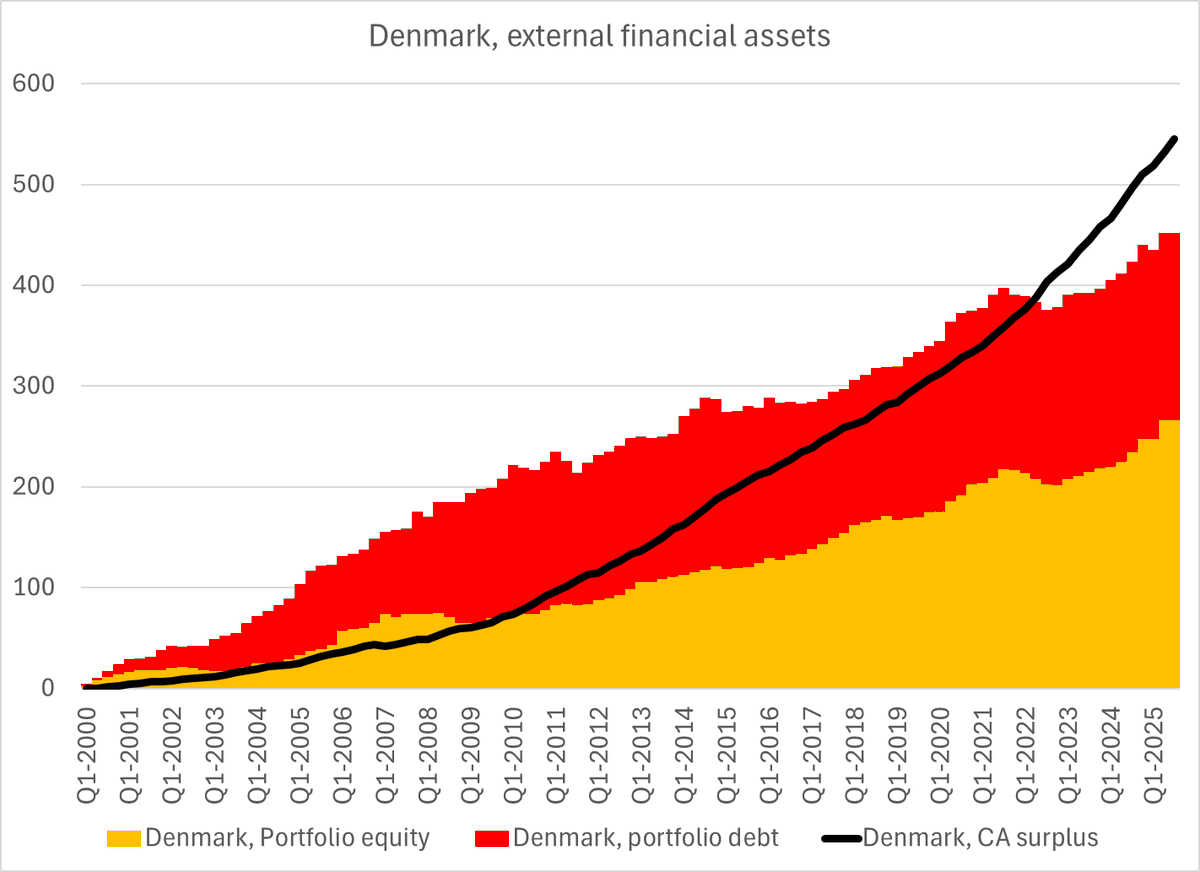

For the big 3 collectively, portfolio flows map well to the current account surplus -- which is a common outcome now that there is less intermediation via the central bank. Denmark's portfolio flows tho are now a bit smaller than its accumulated surplus

For the big 3 collectively, portfolio flows map well to the current account surplus -- which is a common outcome now that there is less intermediation via the central bank. Denmark's portfolio flows tho are now a bit smaller than its accumulated surplus

Passenger car imports are down to half a million, and falling fast ... no market for the world there

Passenger car imports are down to half a million, and falling fast ... no market for the world there

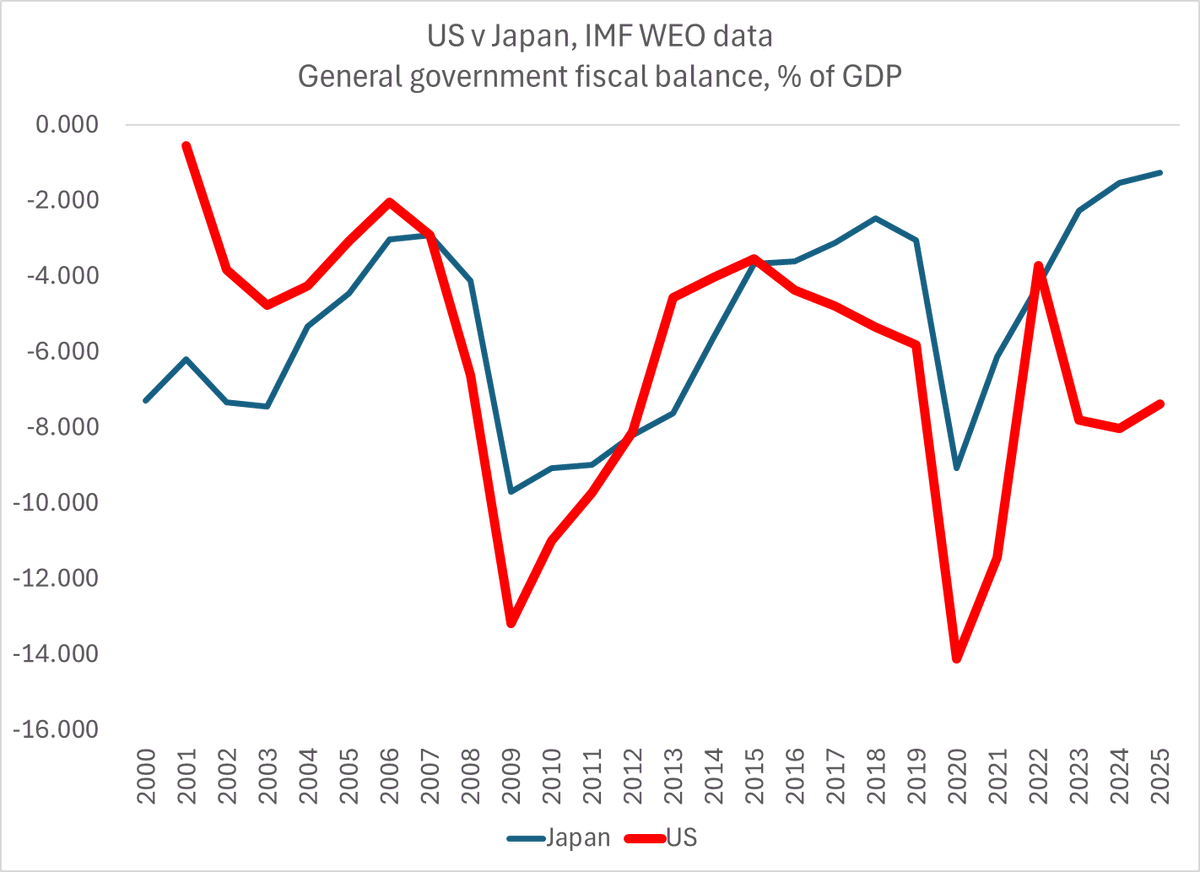

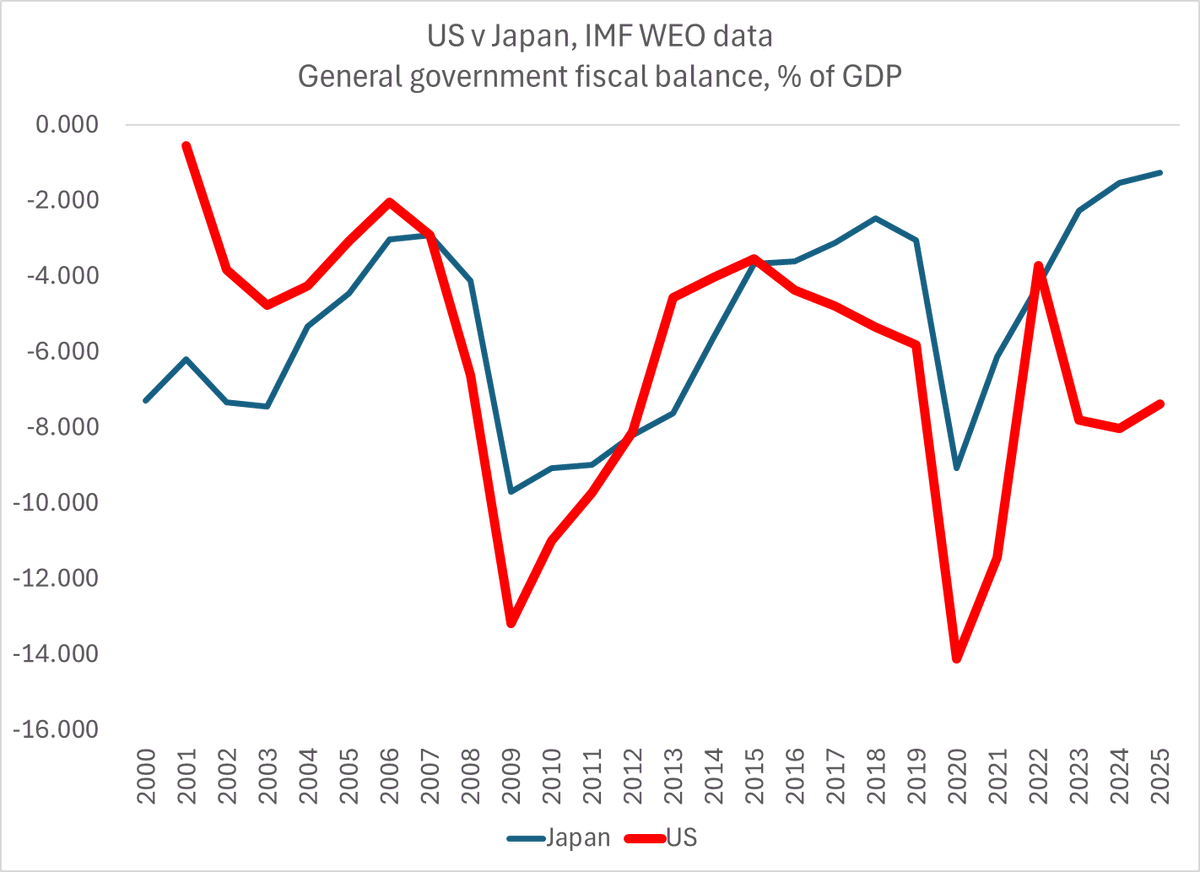

Maybe the IMF's data is off, but it has the general government deficit in 2025 at under 2 pp pf GDP (way better than the US) and it likely would be ~ 2% of GDP even with Takaichi's 0.7 pp of GDP(?) stimulus

Maybe the IMF's data is off, but it has the general government deficit in 2025 at under 2 pp pf GDP (way better than the US) and it likely would be ~ 2% of GDP even with Takaichi's 0.7 pp of GDP(?) stimulus

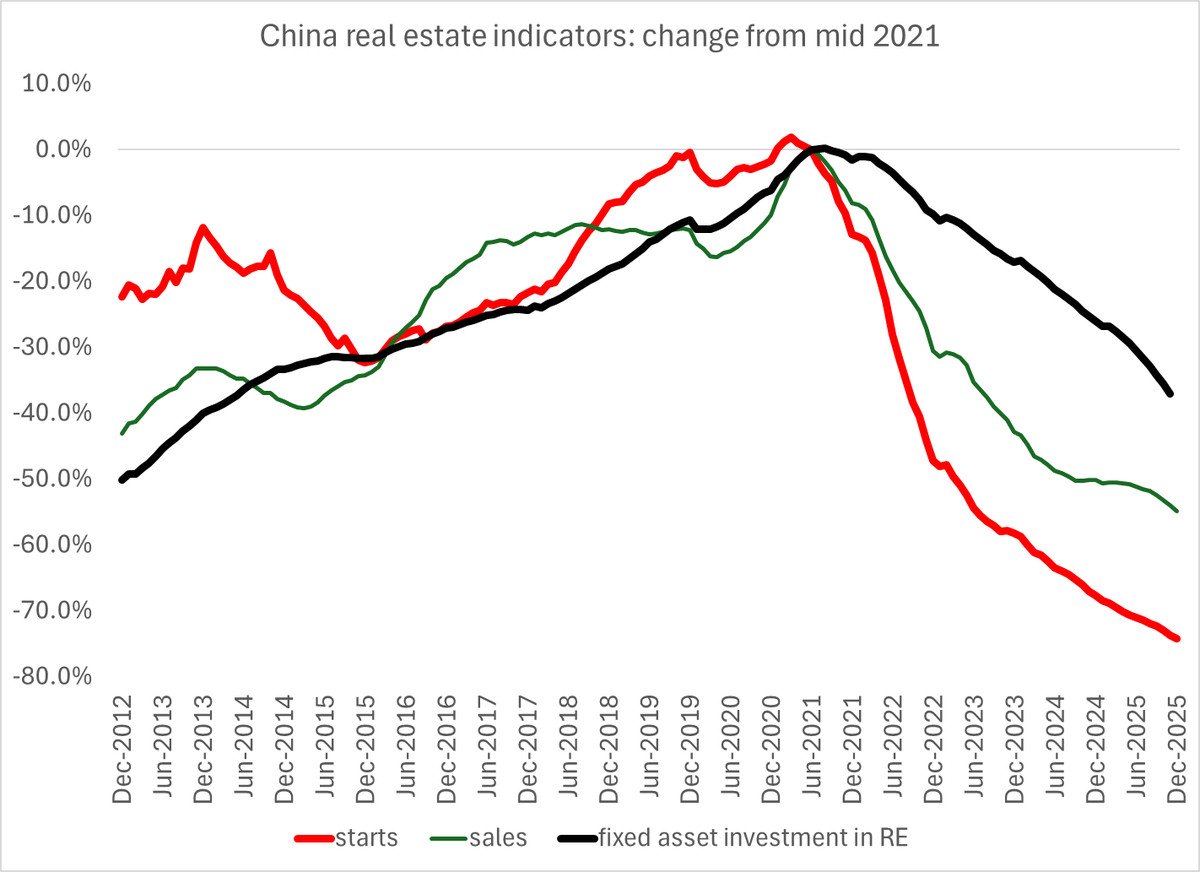

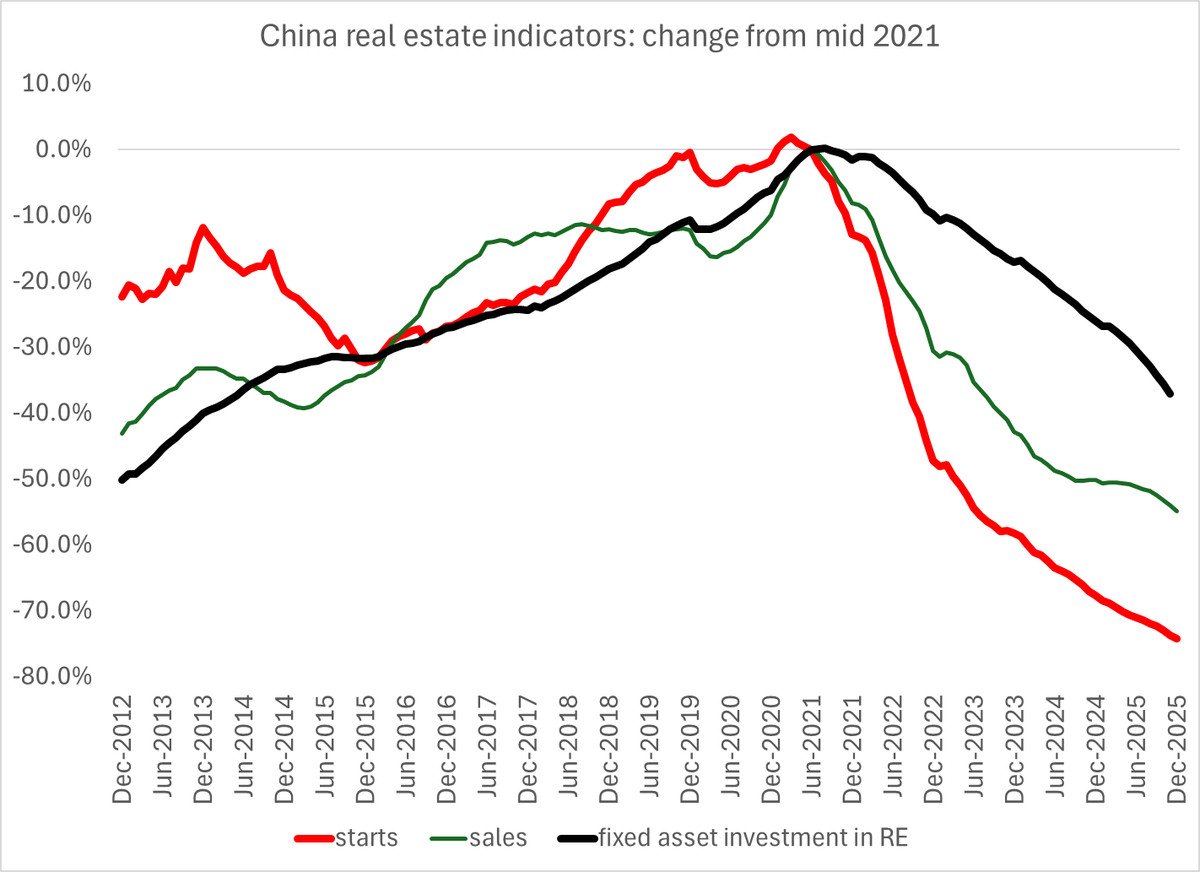

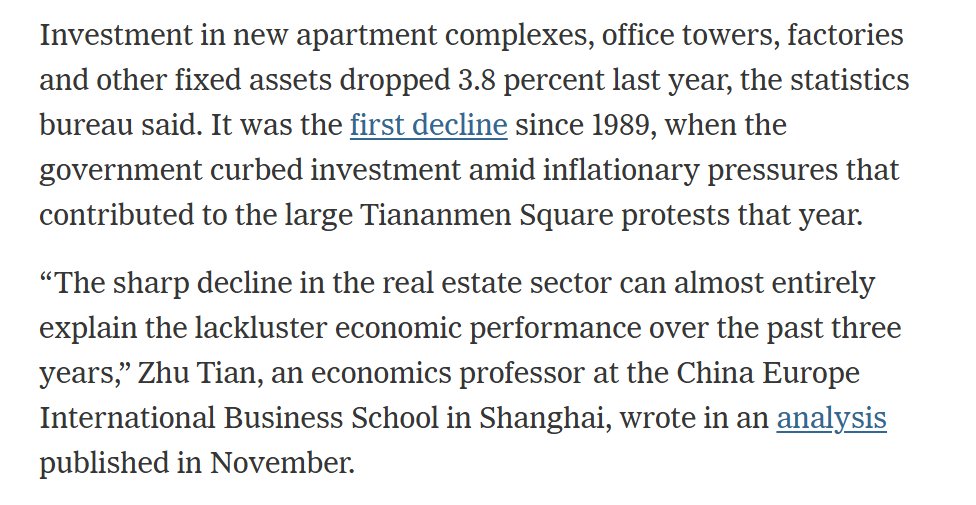

. @KeithBradsher covered this well is the Times' story on China's 5% (shock, shock) reported growth in 2025 ... which understandably (being non-news) got overshadowed by the real news over Trump's Greenland/ peace prize obsession

. @KeithBradsher covered this well is the Times' story on China's 5% (shock, shock) reported growth in 2025 ... which understandably (being non-news) got overshadowed by the real news over Trump's Greenland/ peace prize obsession

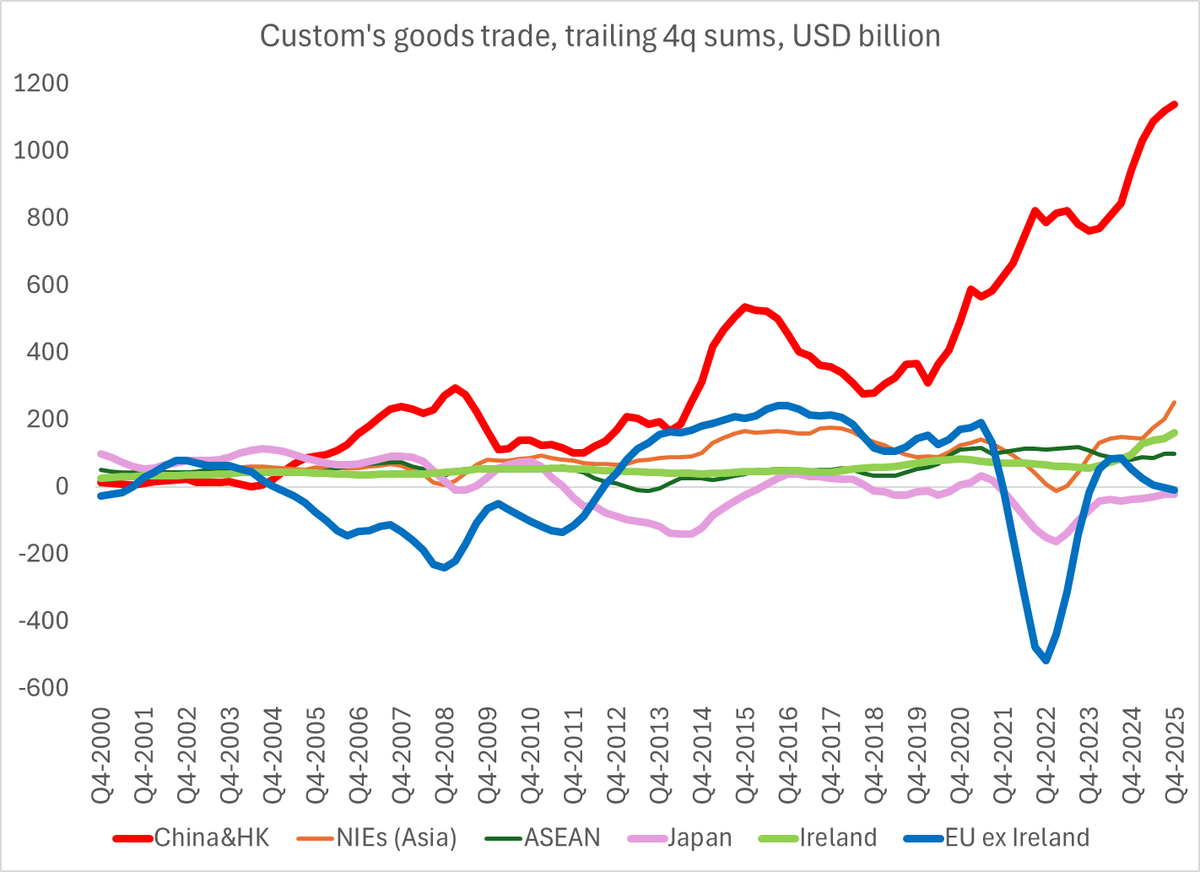

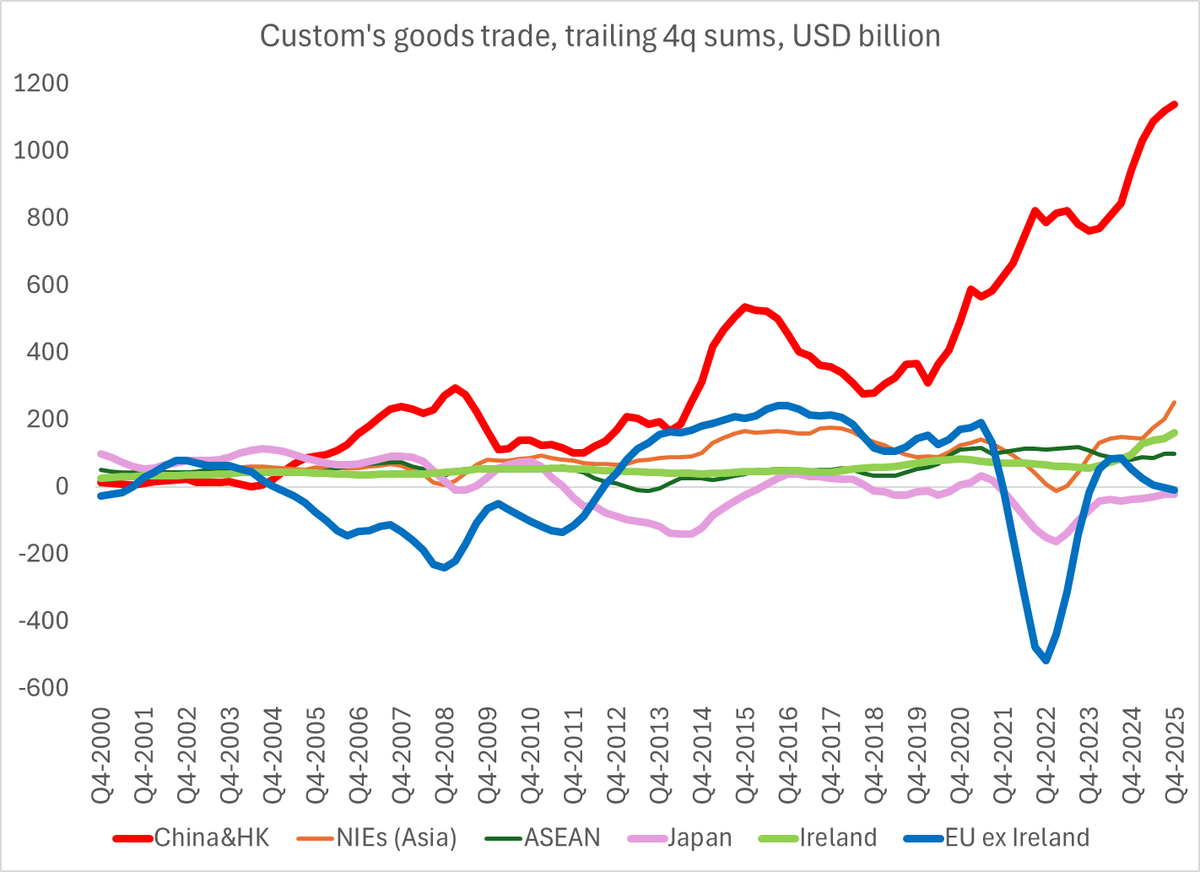

In a sane world of course the US should care about this -- but Trump is already taking credit for the (irrelevant) fall in the bilateral deficit with China, and seems poised to focus his trade policy (ha!) on the non-Ireland EU and Canada ...

In a sane world of course the US should care about this -- but Trump is already taking credit for the (irrelevant) fall in the bilateral deficit with China, and seems poised to focus his trade policy (ha!) on the non-Ireland EU and Canada ...

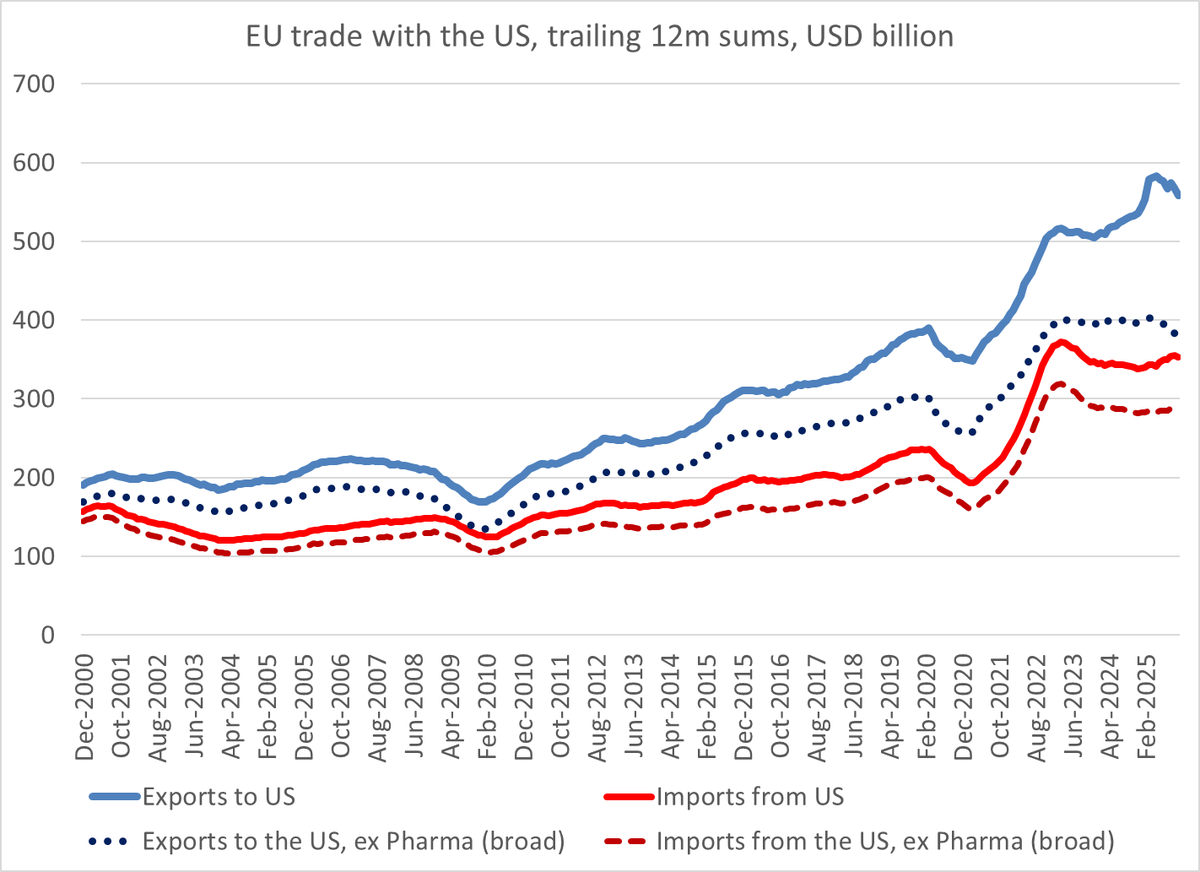

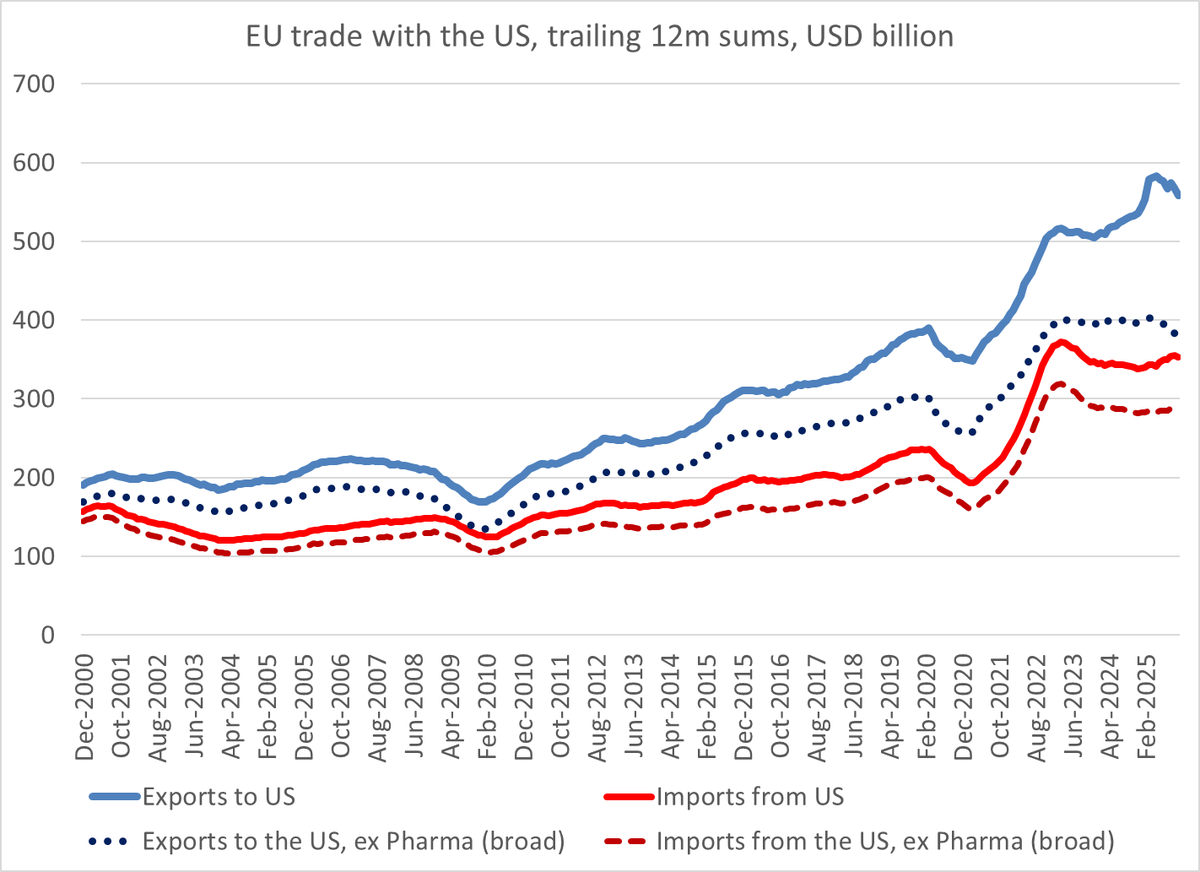

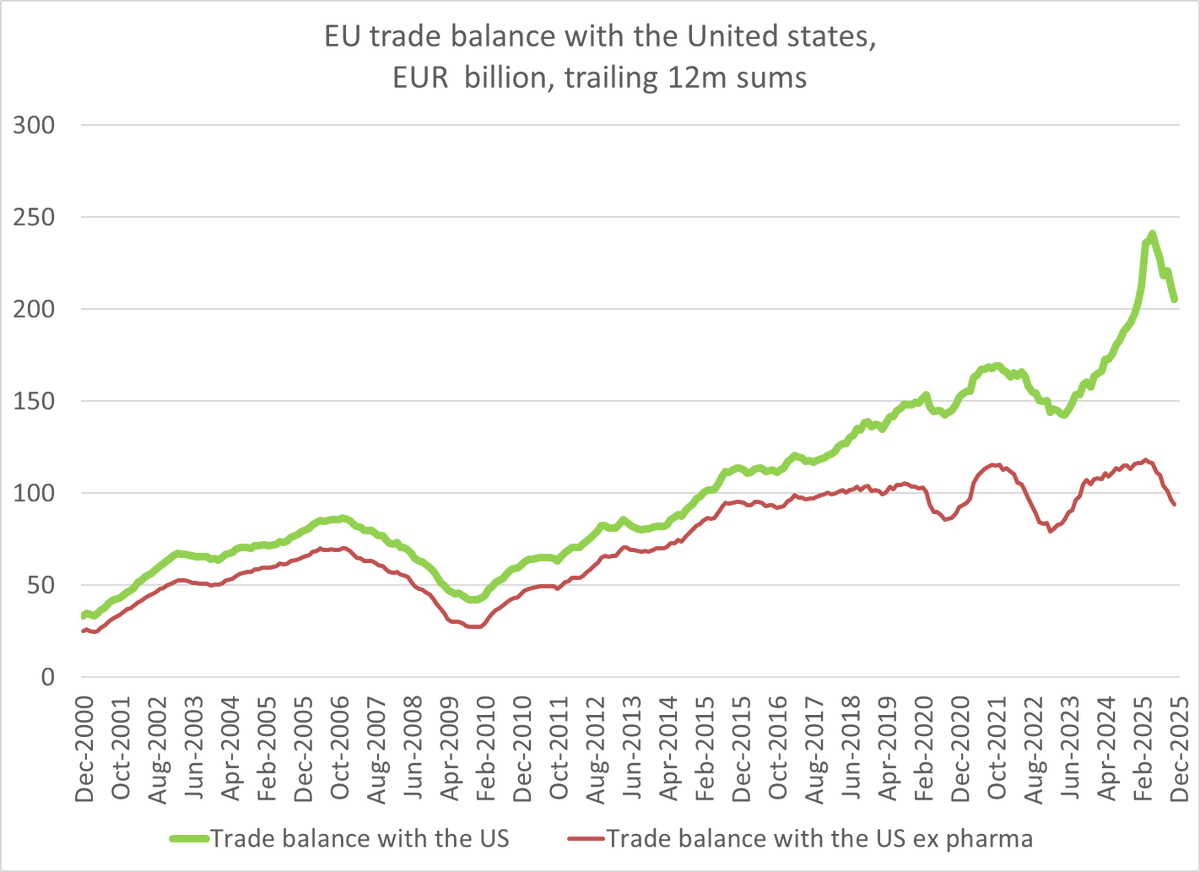

About half the US trade deficit with Europe/ the European surplus with the US (~ $100b) is trade in tax (i.e. pharmaceutical trade). Ex Pharma, the EU now exports ~ $400b to the US and imports ~ $300b. Big numbers, no doubt, but materially less than if pharma is included

About half the US trade deficit with Europe/ the European surplus with the US (~ $100b) is trade in tax (i.e. pharmaceutical trade). Ex Pharma, the EU now exports ~ $400b to the US and imports ~ $300b. Big numbers, no doubt, but materially less than if pharma is included

https://twitter.com/EtraAlex/status/2012699377186312609A portion of those are hedged (apart from the Norges holdings) but hedging doesn't offer protection in the event of a full fledged financial war (which I certainly hope can be avoided)

Some obvious reasons for the spike, which maps to ongoing reports of SCB purchases in November:

Some obvious reasons for the spike, which maps to ongoing reports of SCB purchases in November:

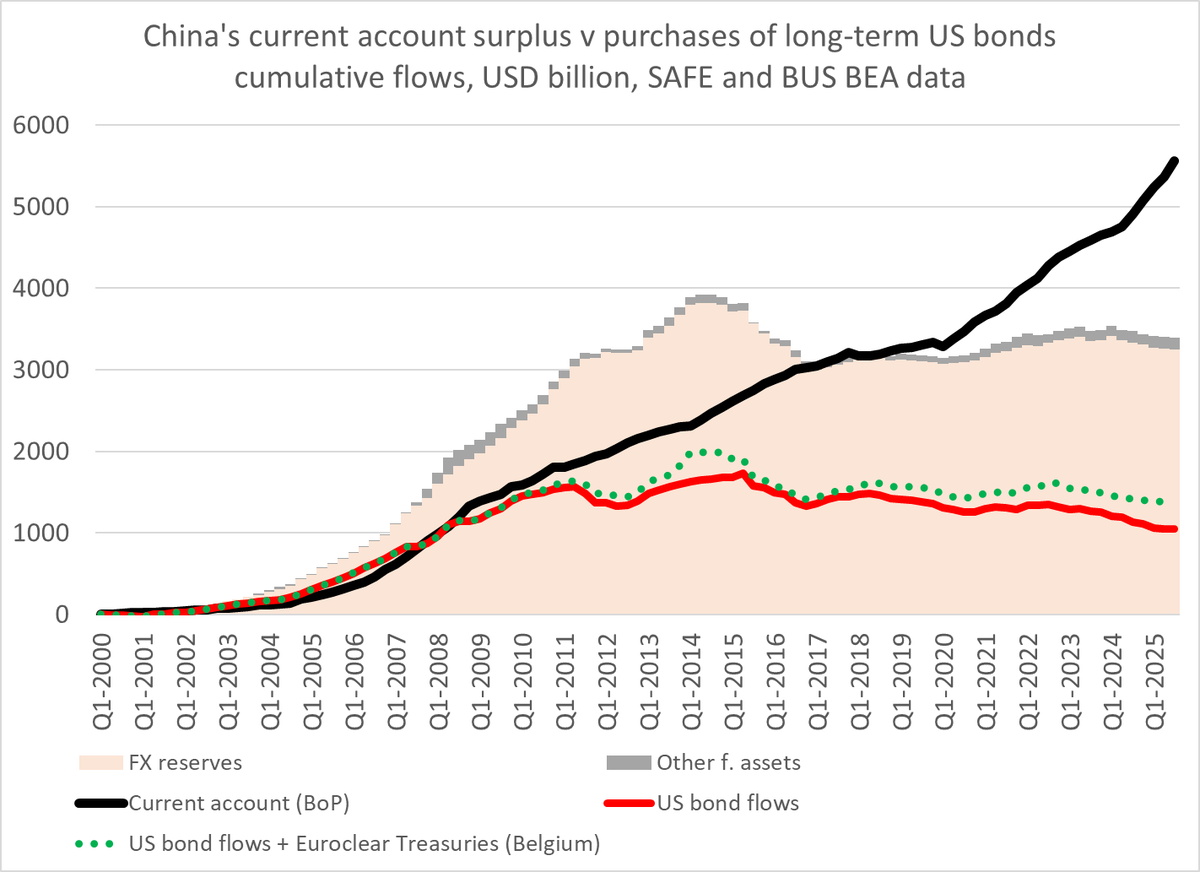

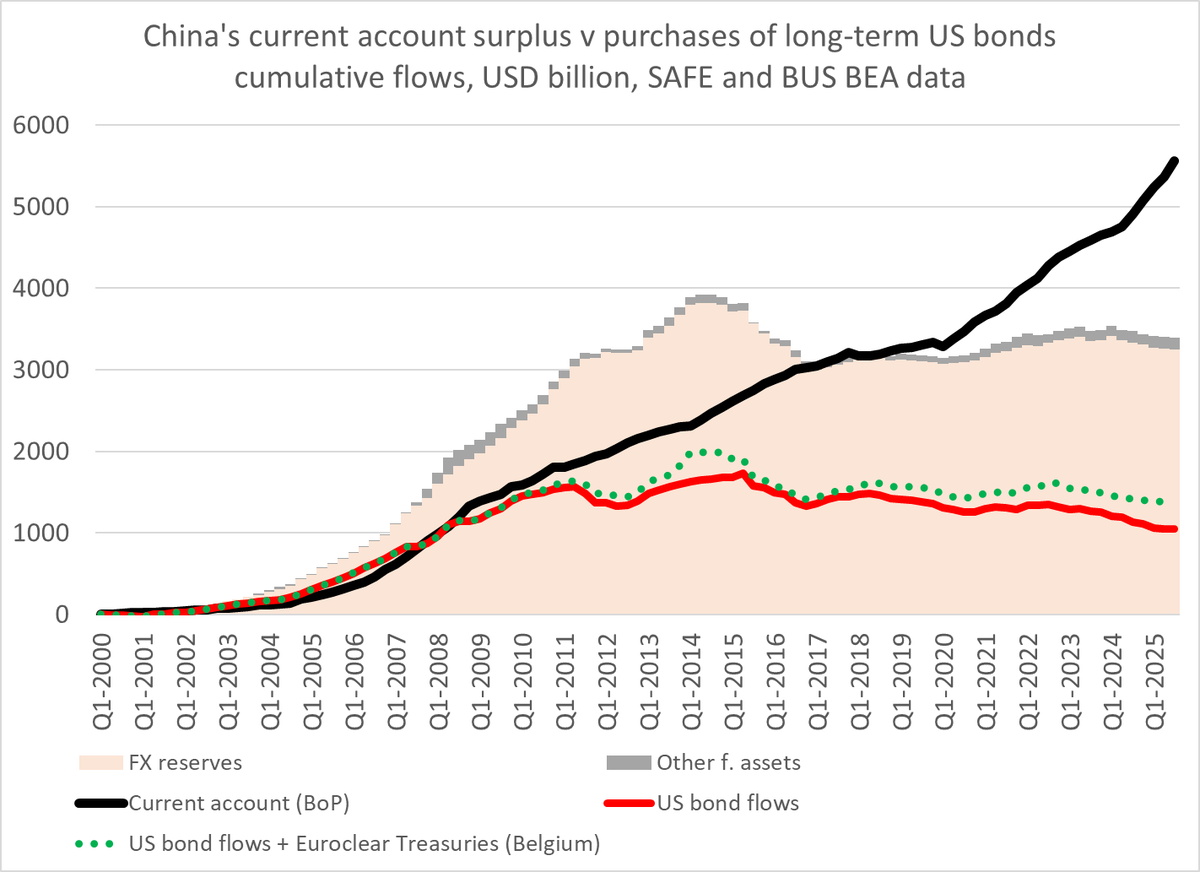

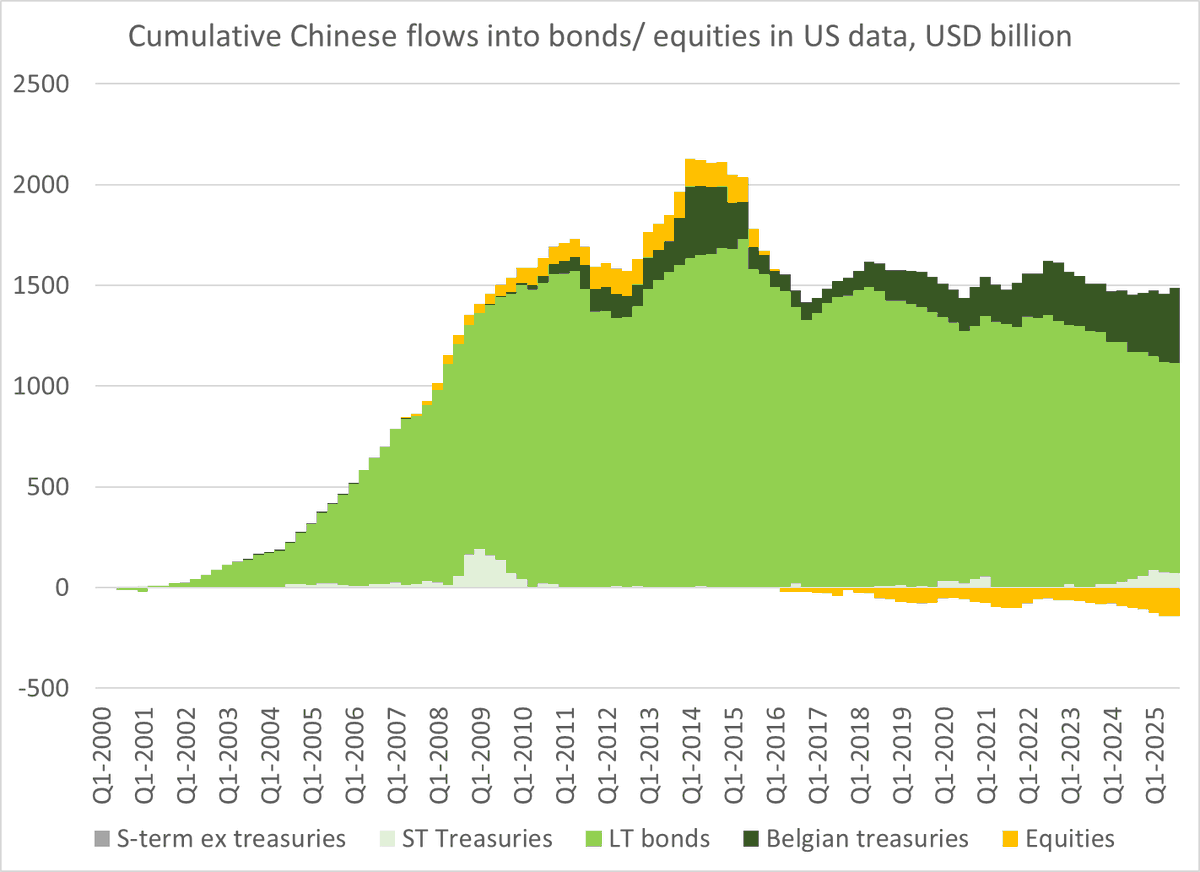

Even adjusting for Euroclear (part owned by the PBOC incidentally) and short-term holdings, there is no visible net flow from China into the US bond market over the last 8 years ...

Even adjusting for Euroclear (part owned by the PBOC incidentally) and short-term holdings, there is no visible net flow from China into the US bond market over the last 8 years ...

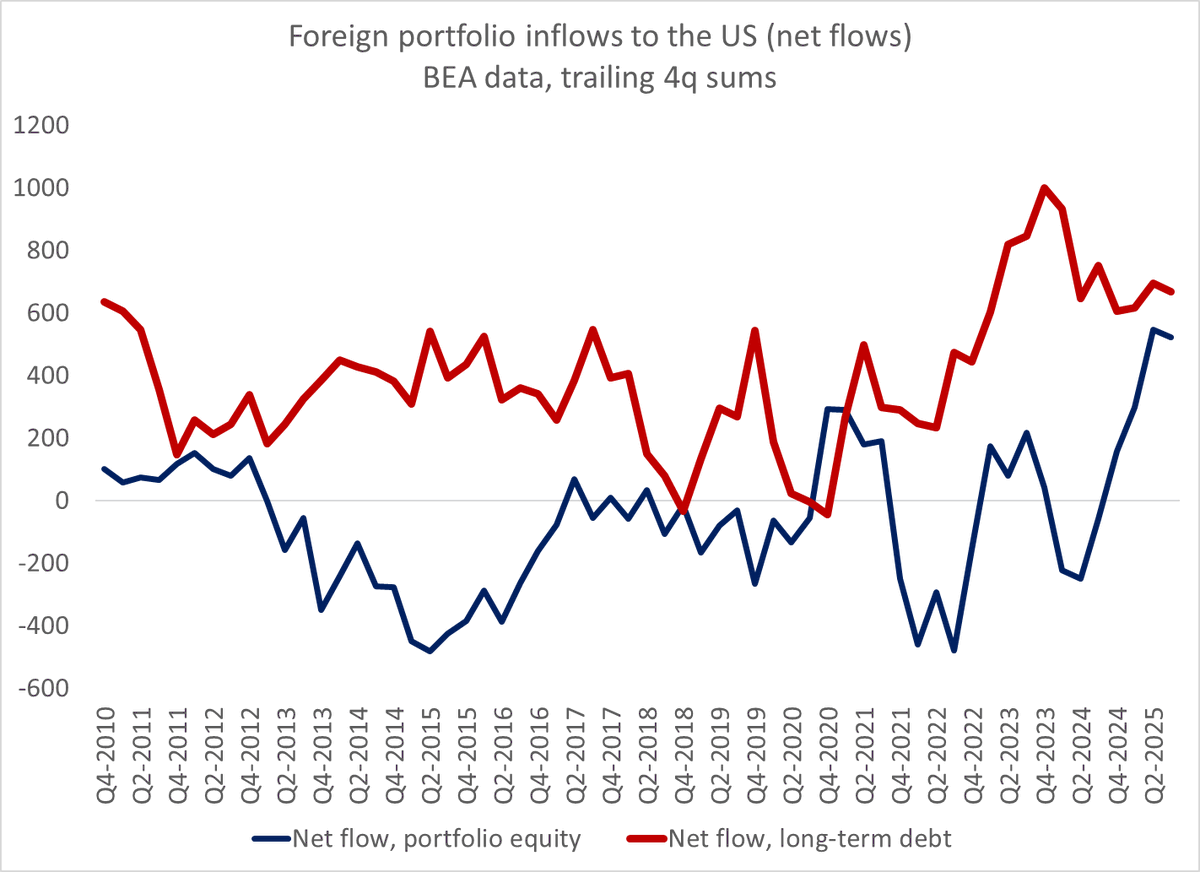

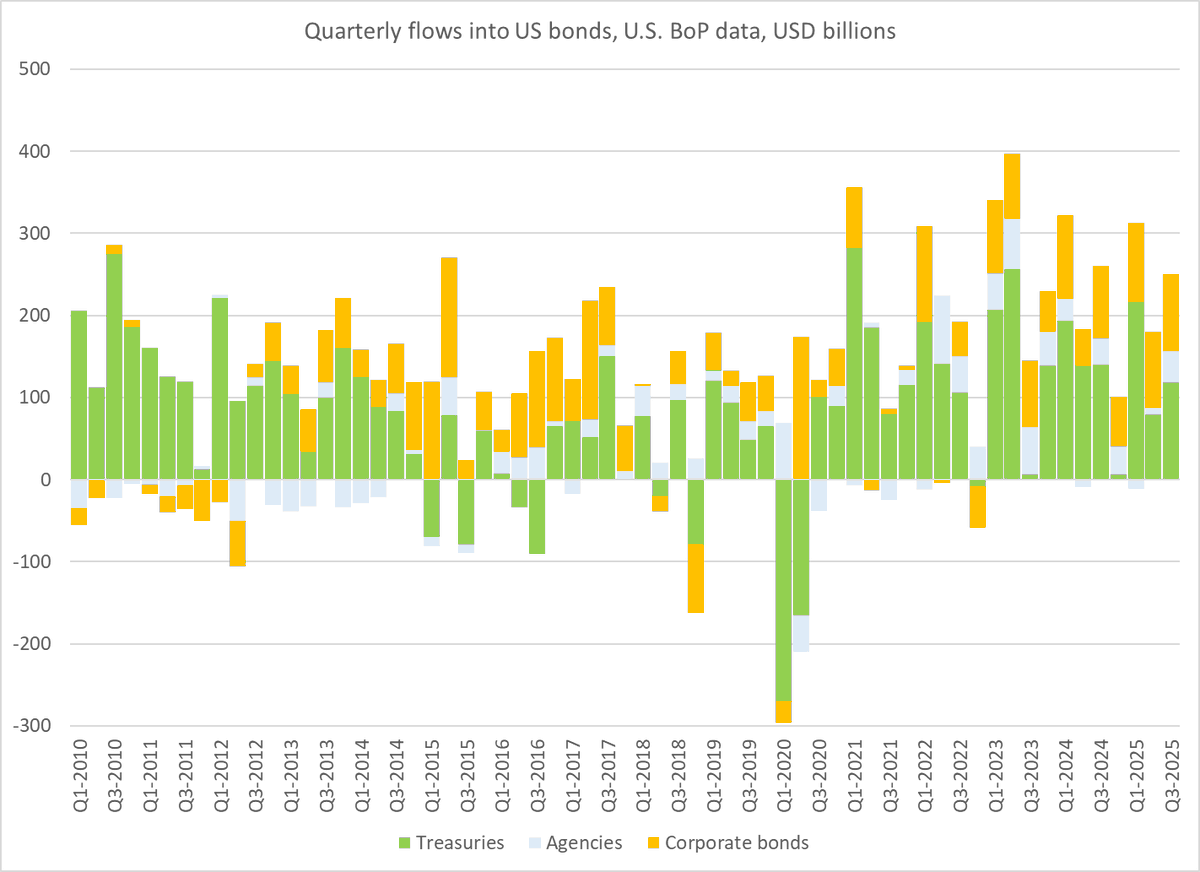

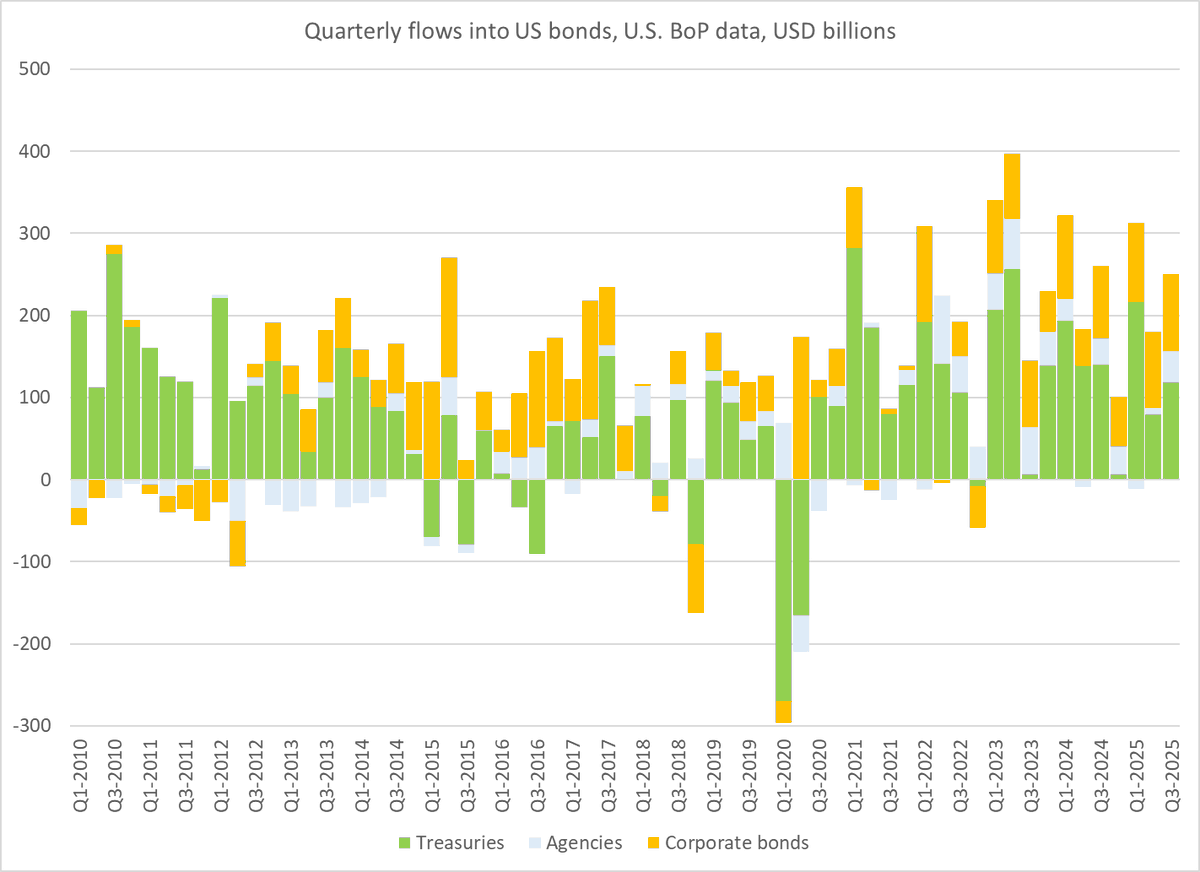

The balance of payments data doesn't provide any detail on hedging -- but the total flow into US bonds has been pretty stable at a $600-700b annual pace. And (net) inflows into US equities have been unusually strong (and equity flows typically are not hedged)

The balance of payments data doesn't provide any detail on hedging -- but the total flow into US bonds has been pretty stable at a $600-700b annual pace. And (net) inflows into US equities have been unusually strong (and equity flows typically are not hedged)