Founder at https://t.co/hXct8goWlA | Helping entrepreneurs build & scale their businesses | Sharing 20+ years of hard-earned business & marketing lessons.

3 subscribers

How to get URL link on X (Twitter) App

In 2022, Ray Dalio left the firm he founded.

In 2022, Ray Dalio left the firm he founded.

2011: Jobs is dying.

2011: Jobs is dying.

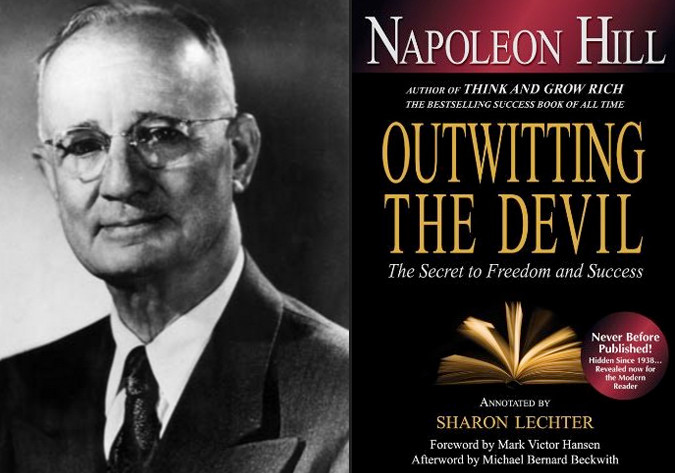

1. It was never meant to be published.

1. It was never meant to be published.

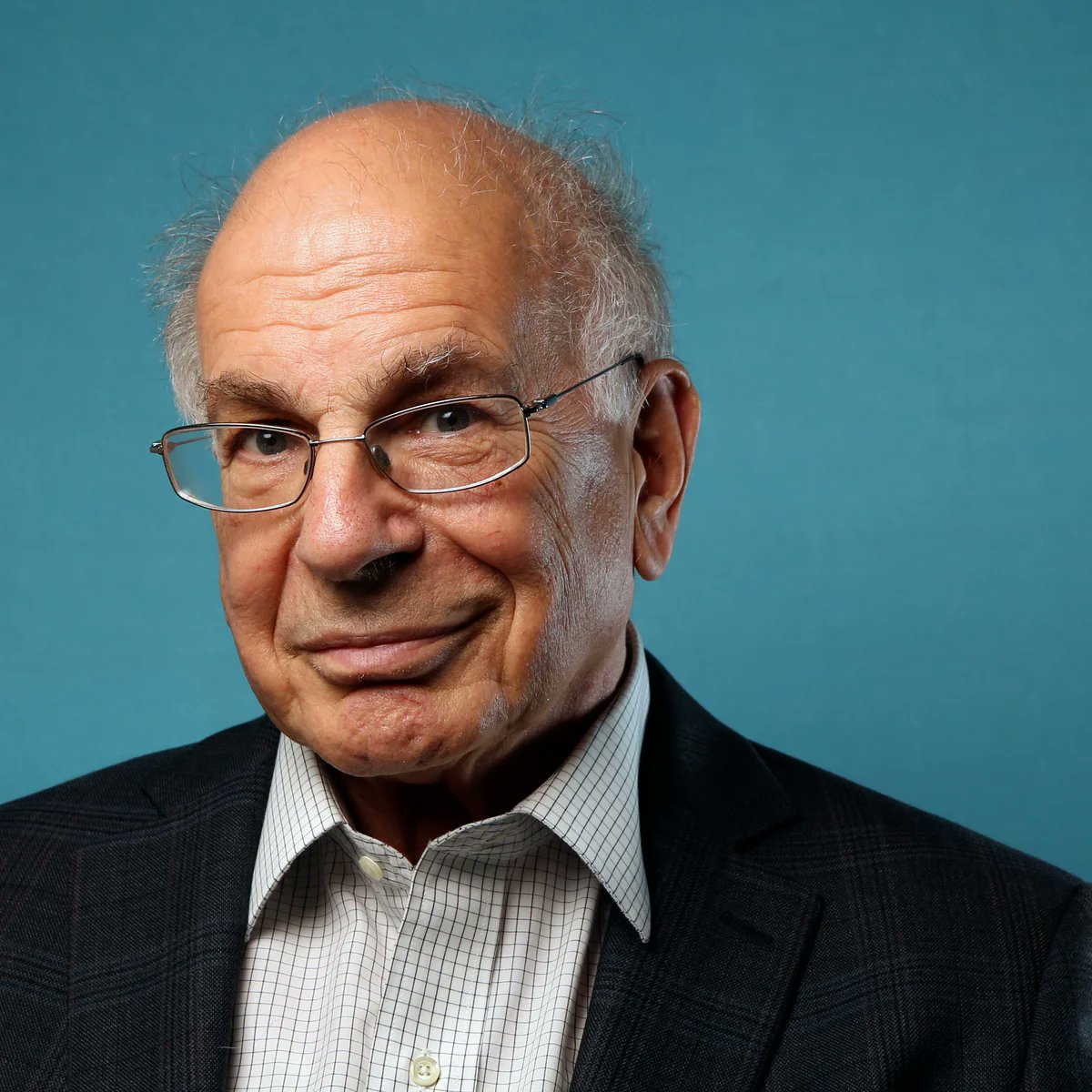

In 2002, Kahneman won the Nobel Prize in Economics.

In 2002, Kahneman won the Nobel Prize in Economics.

Charlie Munger wasn’t always a billionaire.

Charlie Munger wasn’t always a billionaire.

China had nothing in 1949

China had nothing in 1949

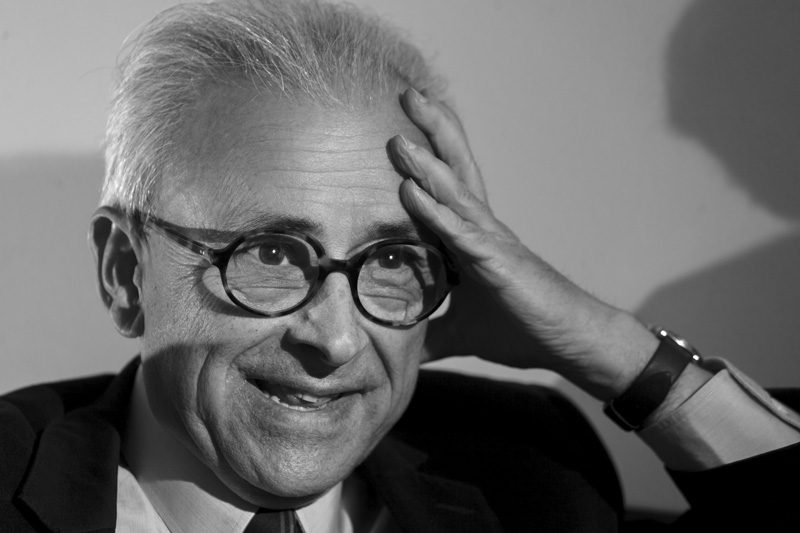

Meet Antonio Damasio.

Meet Antonio Damasio.

Markus Persson was a coder, not a CEO.

Markus Persson was a coder, not a CEO.

1. No one’s coming to save you.

1. No one’s coming to save you.

1. Your brain runs on two operating systems

1. Your brain runs on two operating systems

The Billionaire Tax Playbook:

The Billionaire Tax Playbook:

1/ What is Inversion Thinking?

1/ What is Inversion Thinking?

1. Solve Expensive Problems

1. Solve Expensive Problems