The easy and fun way to stay informed and grow smarter. Daily newsletter of 20k+ Malaysians. Subscribe for FREE below ⬇️

General Digital Sdn Bhd (1454715T)

How to get URL link on X (Twitter) App

Word on the street is that Malaysia’s O&G giant PETRONAS could face workforce cuts, bonus cancellations, and reduced salary increments.

Word on the street is that Malaysia’s O&G giant PETRONAS could face workforce cuts, bonus cancellations, and reduced salary increments.

The WK was not named but is believed to be an O&G co from the Middle East. The deal seems far from final - subject to conditions

The WK was not named but is believed to be an O&G co from the Middle East. The deal seems far from final - subject to conditions

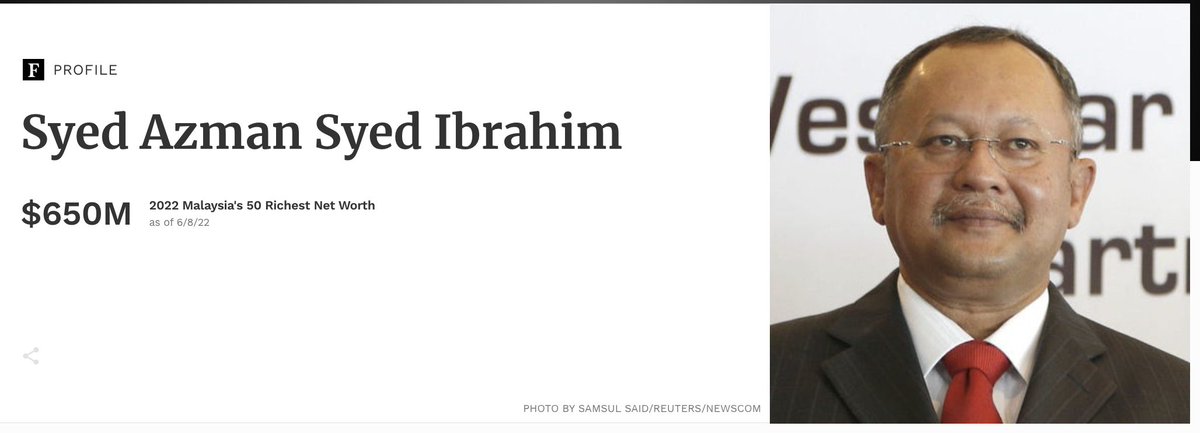

Weststar was founded in 2003 by business Tan Sri Syed Azman Syed Ibrahim

Weststar was founded in 2003 by business Tan Sri Syed Azman Syed Ibrahim

History

History

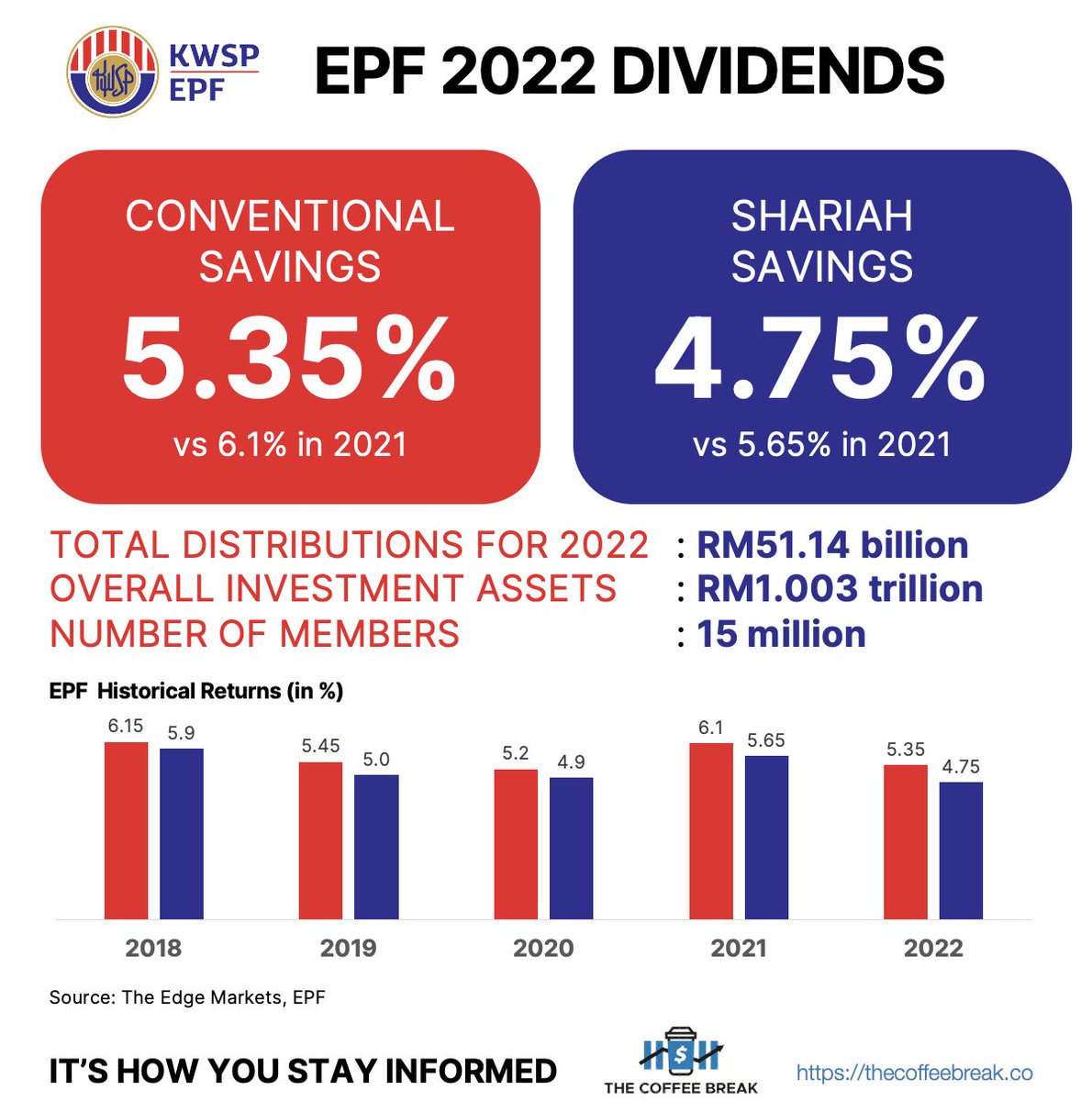

With great profits, come great dividends - Petronas is paying the govt RM50 bil in dividends

With great profits, come great dividends - Petronas is paying the govt RM50 bil in dividends

Before we start, some historical figures

Before we start, some historical figures

There are few copies held by several museums throughout the world.

There are few copies held by several museums throughout the world.

Some background - launched in 2013, it now has 37 outlets. It plans to double its # outlets and considering to expand to PHP and Indonesia,

Some background - launched in 2013, it now has 37 outlets. It plans to double its # outlets and considering to expand to PHP and Indonesia,

He tried applying for digital banking license but no luck. But nvm.

He tried applying for digital banking license but no luck. But nvm.

Chapter 1: 1995

Chapter 1: 1995

1. He will protect Malaysia's image amongst Indonesians.

1. He will protect Malaysia's image amongst Indonesians.

1. He will champion the rights of political detainees.

1. He will champion the rights of political detainees.

1. Former director of Ultra Kirana Sdn Bhd (UKSB) Harry Lee Vui Khun told the court that his company paid cash monthly to the former deputy PM.

1. Former director of Ultra Kirana Sdn Bhd (UKSB) Harry Lee Vui Khun told the court that his company paid cash monthly to the former deputy PM.

A maximum fine of RM4 mil, totalling RM16 mil that has been paid.

A maximum fine of RM4 mil, totalling RM16 mil that has been paid.

The sellers r likely to be Ambank’s 2 largest shareholders - Australia and New Zealand Banking Group Ltd (ANZ) (21.68% stake) and Azman Hashim (11.83% stake).

The sellers r likely to be Ambank’s 2 largest shareholders - Australia and New Zealand Banking Group Ltd (ANZ) (21.68% stake) and Azman Hashim (11.83% stake).

1. Let's rewind the clock a little to May 2021.

1. Let's rewind the clock a little to May 2021.

The injunction capped their monthly expenses to no more than RM20k for living and legal expenses.

The injunction capped their monthly expenses to no more than RM20k for living and legal expenses.

How much was raised from alternative financing?

How much was raised from alternative financing?

2. So, 200k plans x RM639 / plan = RM127.8 mil airasia is going to collect upfront from consumers from selling unlimited flights and food delivery.

2. So, 200k plans x RM639 / plan = RM127.8 mil airasia is going to collect upfront from consumers from selling unlimited flights and food delivery.