Tweets are our opinion only. Tweets are for informational purposes & do not represent financial advice. Don't trust - DYOR & verify.

How to get URL link on X (Twitter) App

The purpose of this thread is not to praise or denounce ICOs.

The purpose of this thread is not to praise or denounce ICOs.

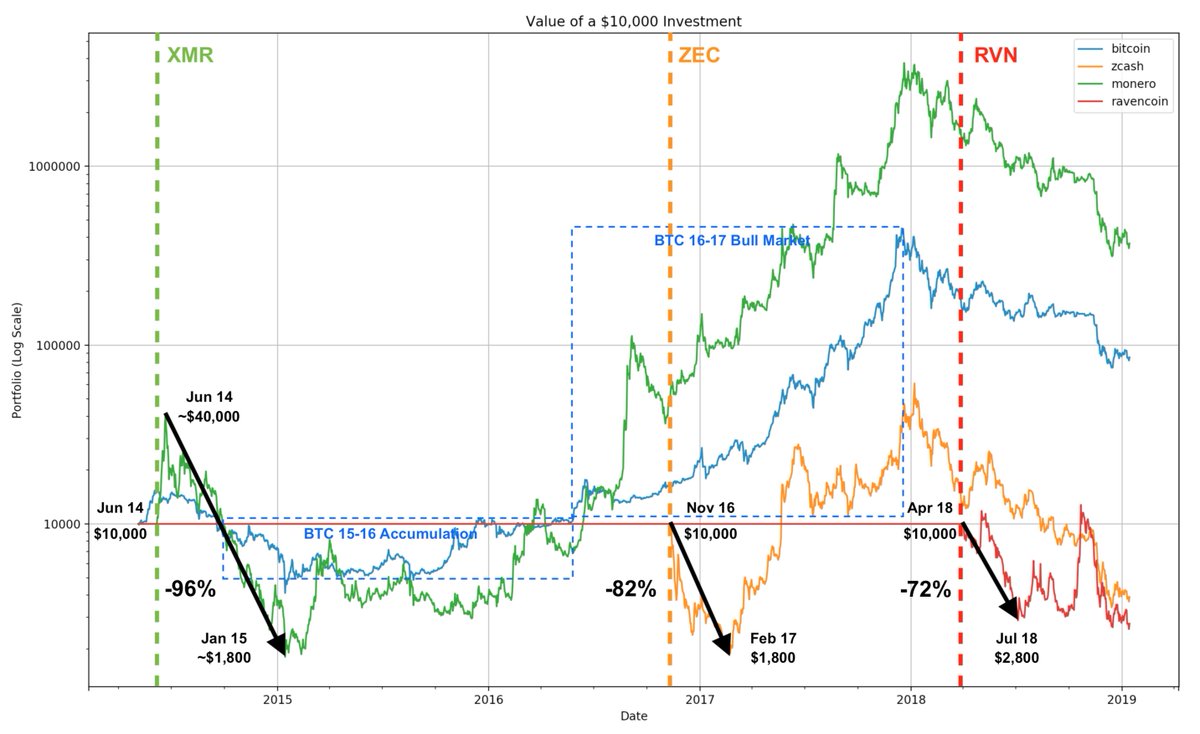

@grinMW The chart tracks the value of $10,000 invested into each coin at the earliest date of recorded price data with a $BTC benchmark portfolio (blue).

@grinMW The chart tracks the value of $10,000 invested into each coin at the earliest date of recorded price data with a $BTC benchmark portfolio (blue).

Categories of non-sovereign stores of value?

Categories of non-sovereign stores of value?

Think of $BTC as a decentralised clock ticking every 10 minutes:

Think of $BTC as a decentralised clock ticking every 10 minutes: