Chief Investment Officer at NewEdge Wealth⚡️CFA Charterholder⚡️will never solicit in messages

How to get URL link on X (Twitter) App

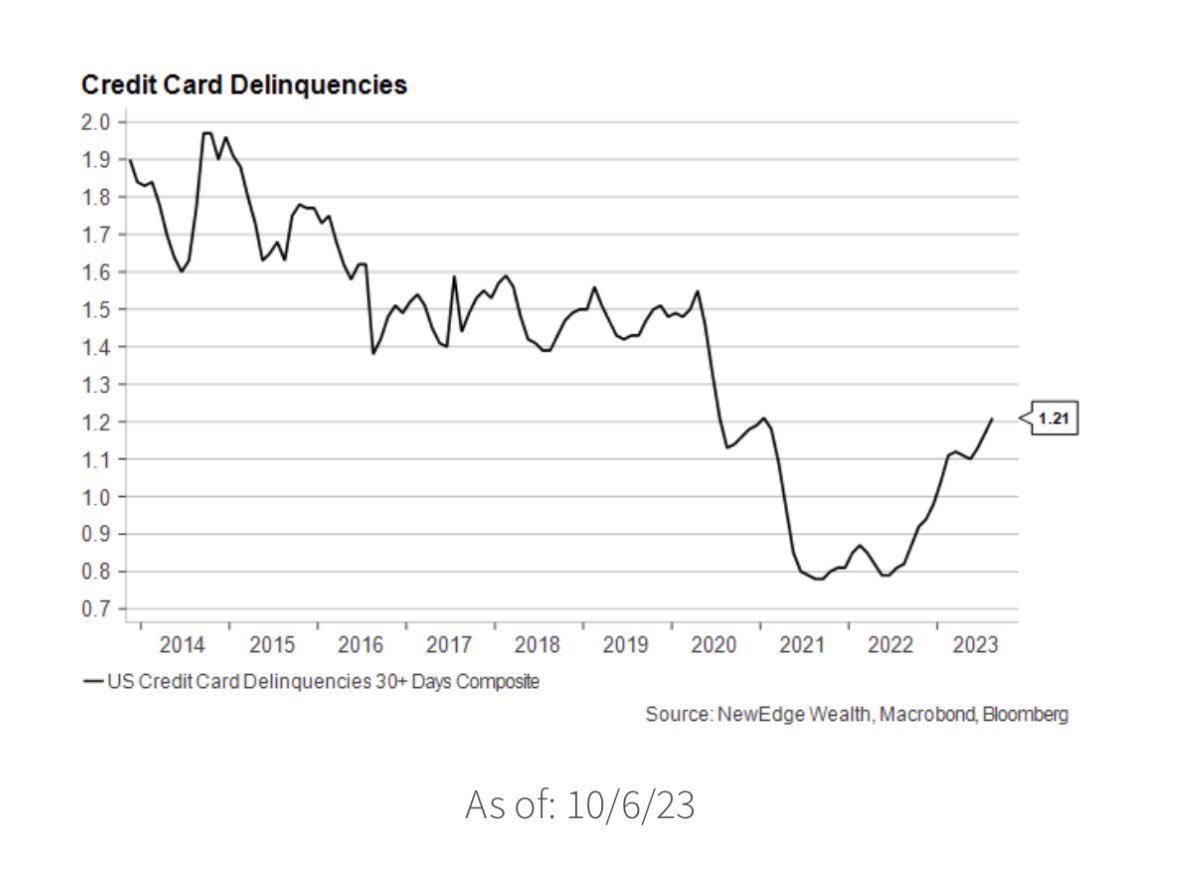

Delinquency levels are rising rapidly, but have not eclipsed pre-COVID levels and are well below GFC levels. Further, CC balances as a % of income are well below pre GFC levels and even below pre-COVID levels.

Delinquency levels are rising rapidly, but have not eclipsed pre-COVID levels and are well below GFC levels. Further, CC balances as a % of income are well below pre GFC levels and even below pre-COVID levels.

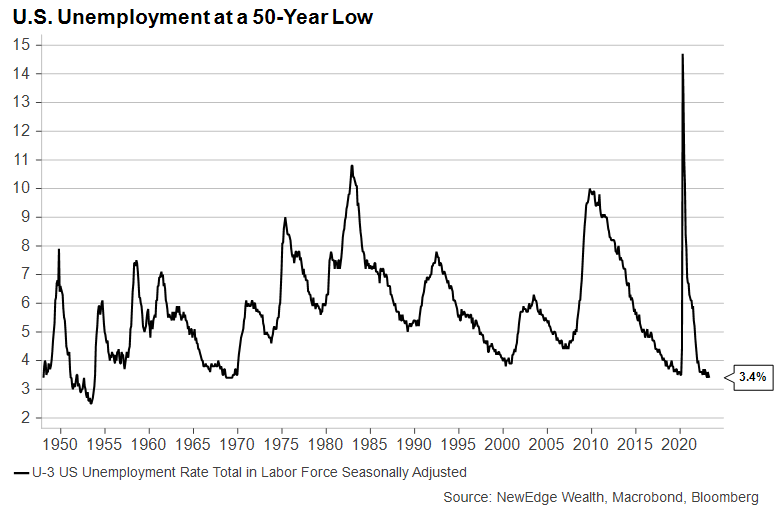

2. Everybody’s Working (for the Weekend):

2. Everybody’s Working (for the Weekend):

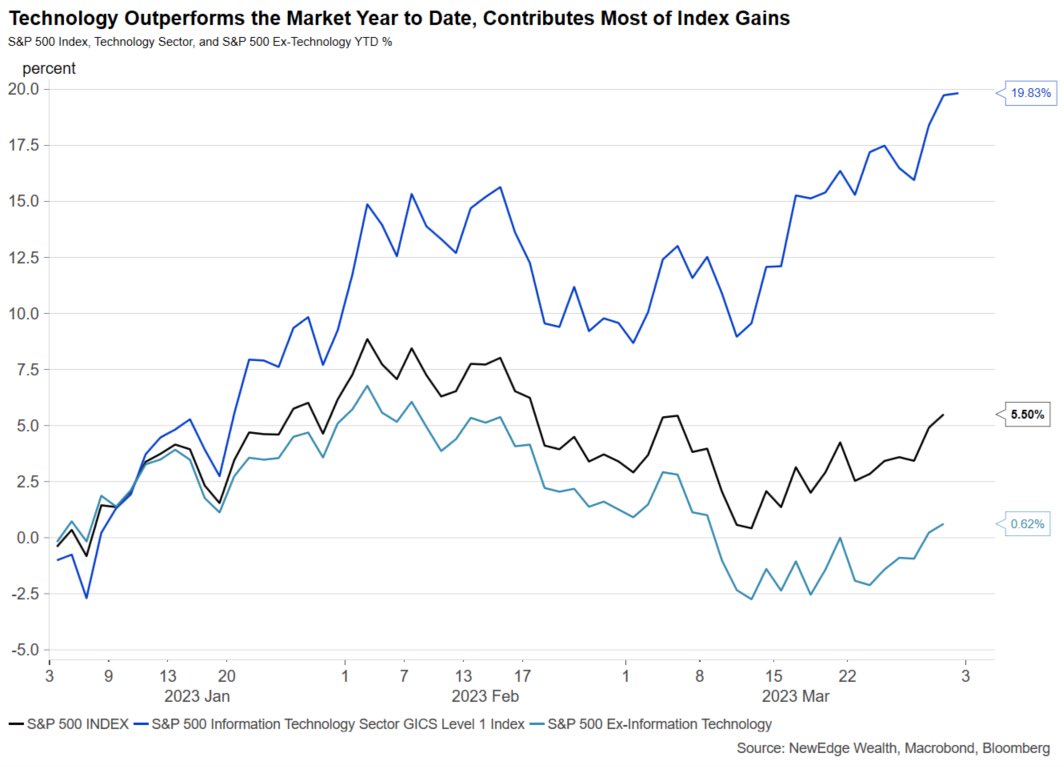

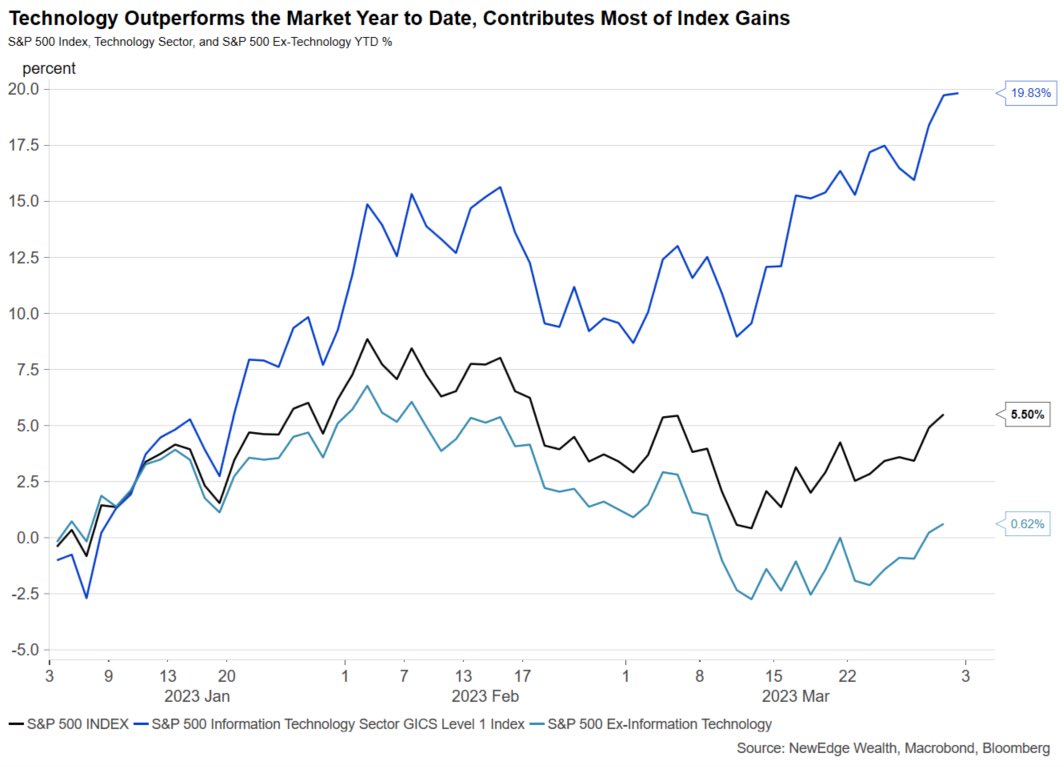

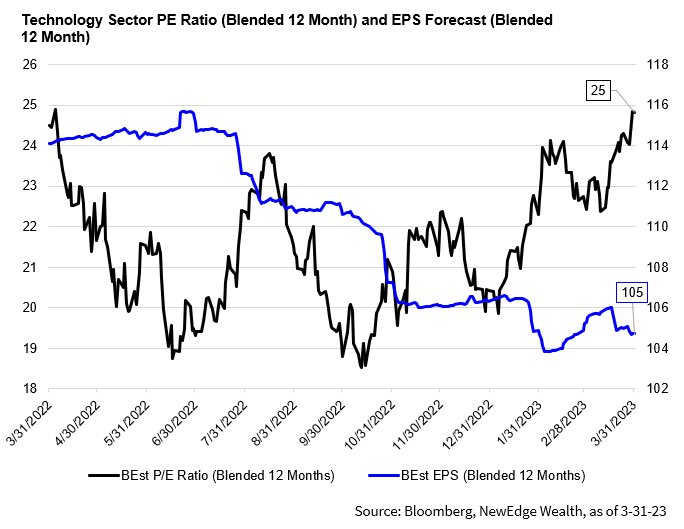

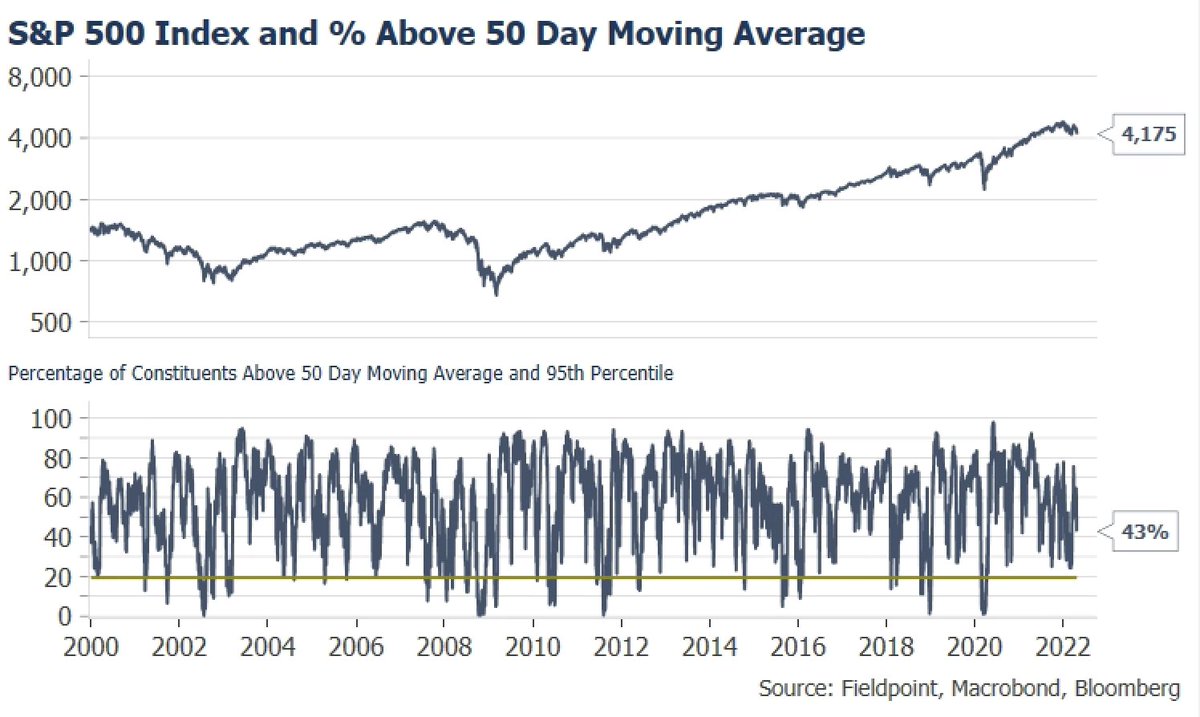

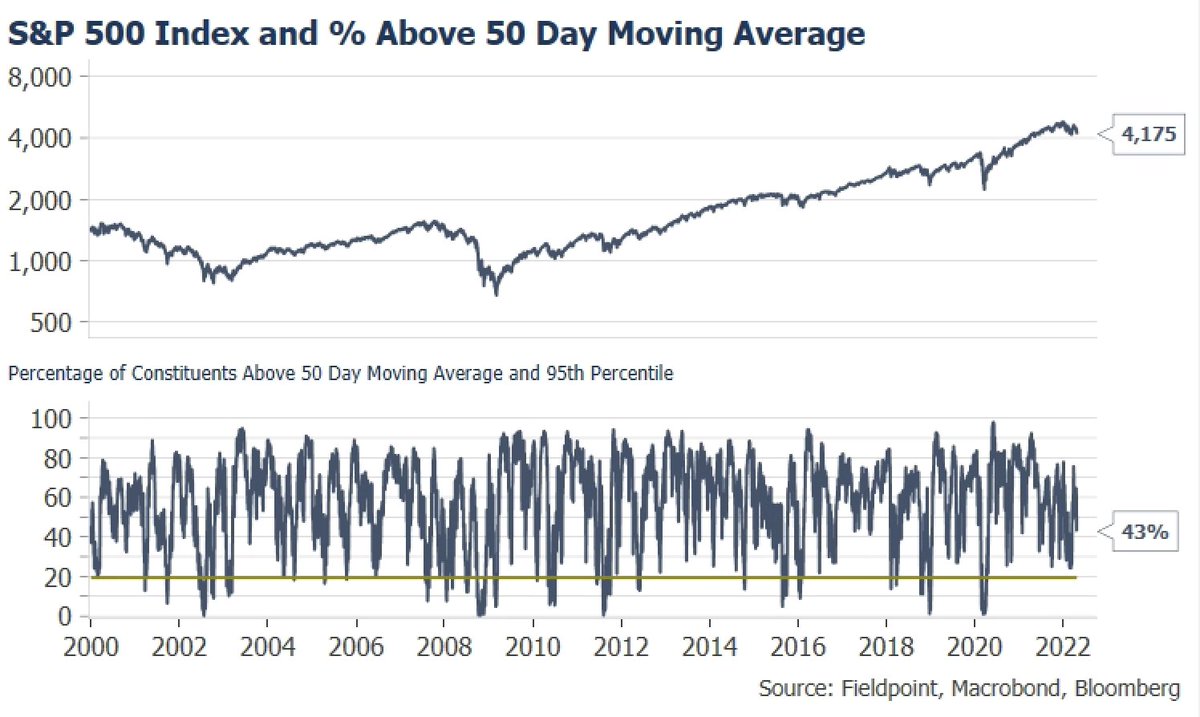

Tech’s strength YTD has been entirely driven by multiple expansion.

Tech’s strength YTD has been entirely driven by multiple expansion.

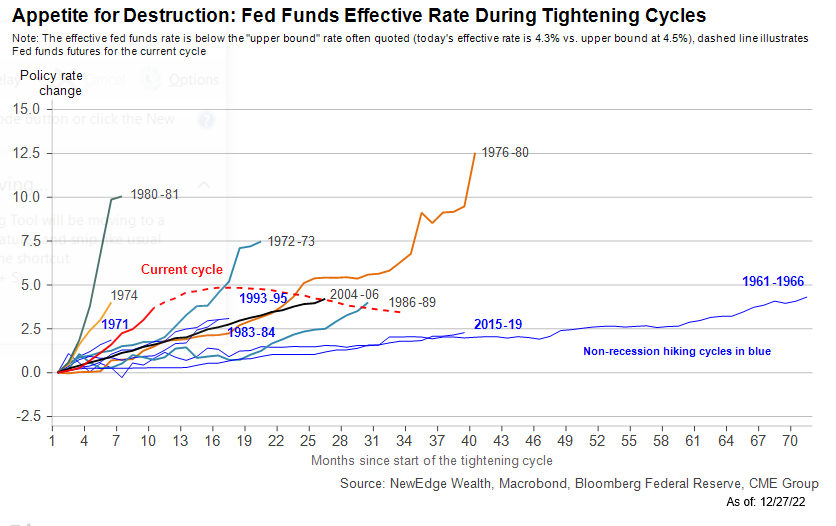

2. Appetite for Destruction:

2. Appetite for Destruction:

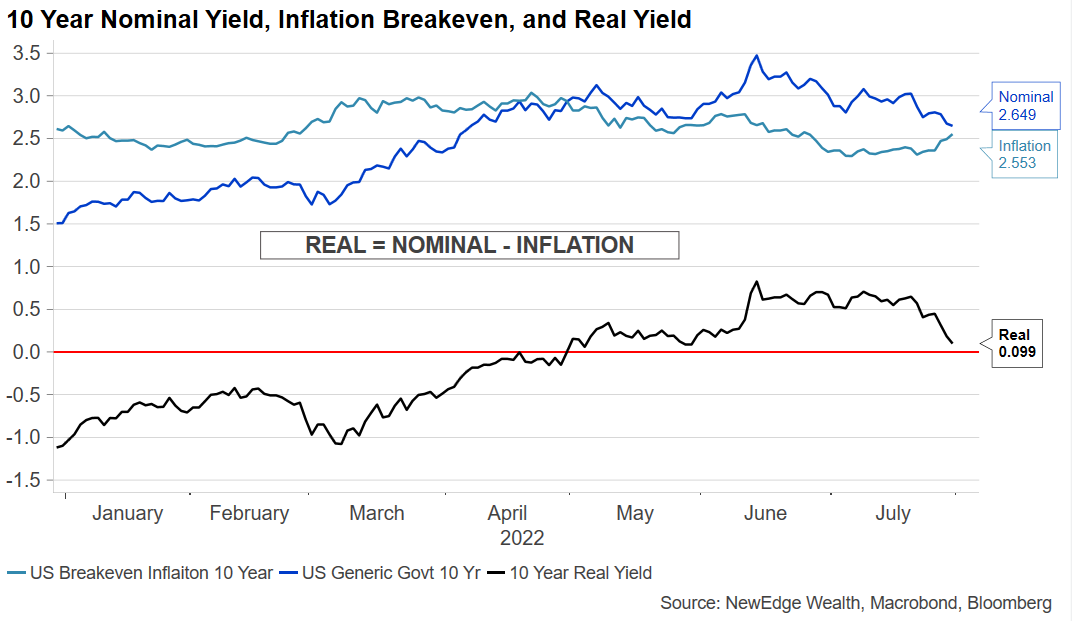

First, a quick reminder of how real yields are calculated:

First, a quick reminder of how real yields are calculated:

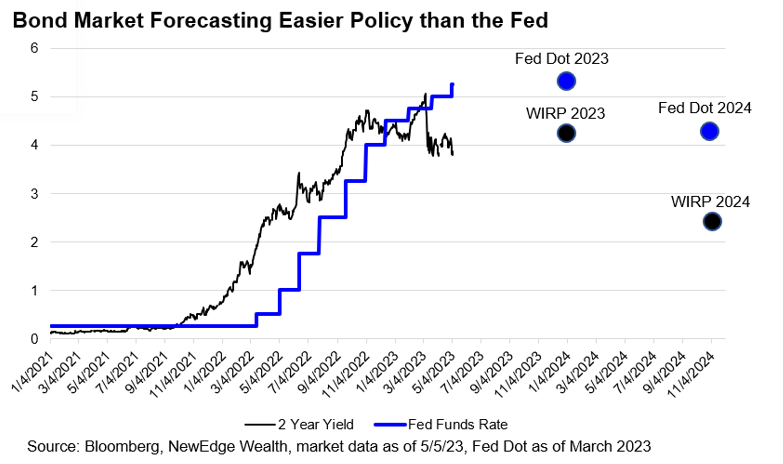

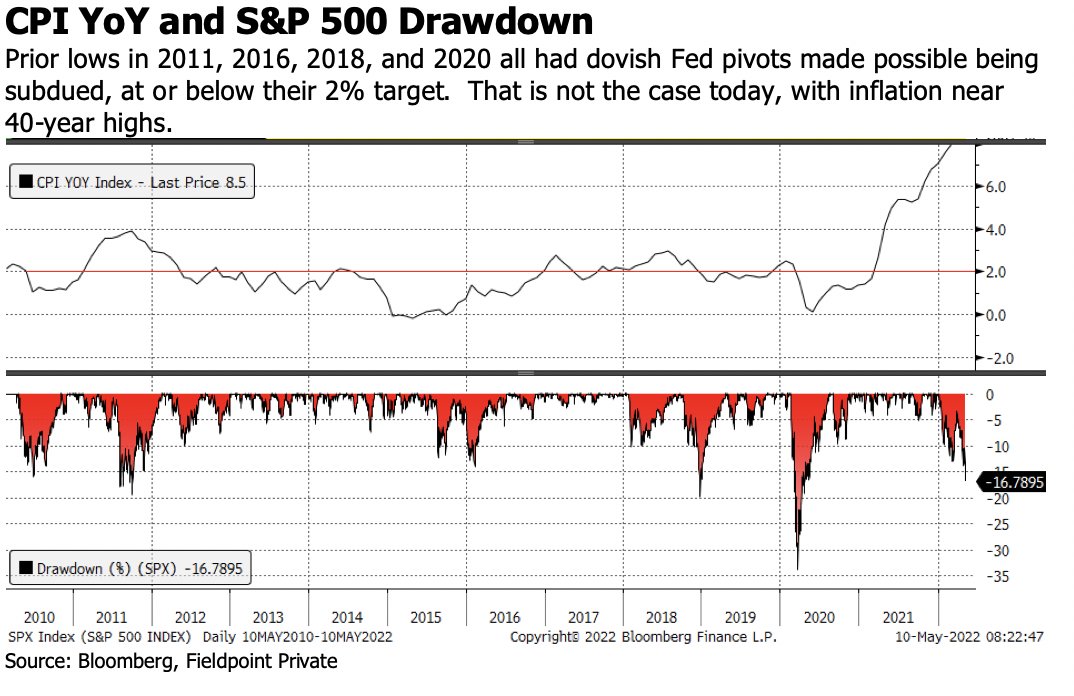

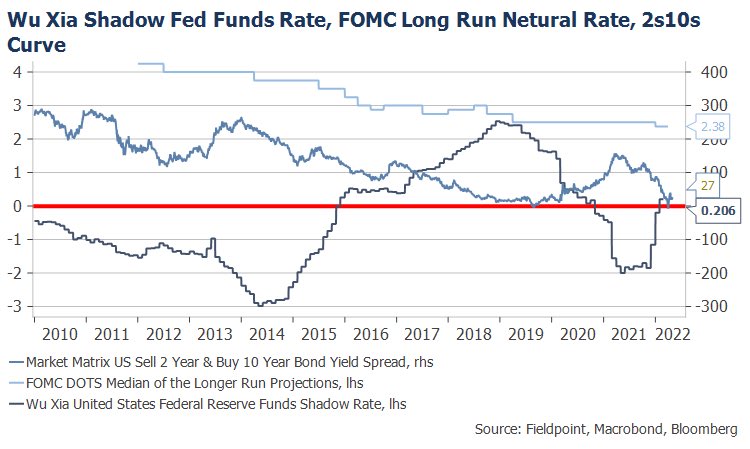

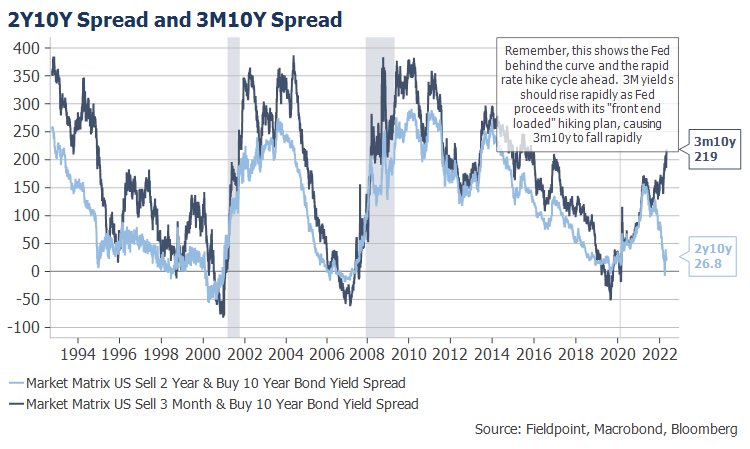

Next, we have to acknowledge how different the Fed's/liquidity's posture is this time around. Capitulative lows in the prior cycle (11, 16, 18, 20) all were accompanied by a pivot to Fed dovishness, made possible by inflation being at or below their 2% target.

Next, we have to acknowledge how different the Fed's/liquidity's posture is this time around. Capitulative lows in the prior cycle (11, 16, 18, 20) all were accompanied by a pivot to Fed dovishness, made possible by inflation being at or below their 2% target.

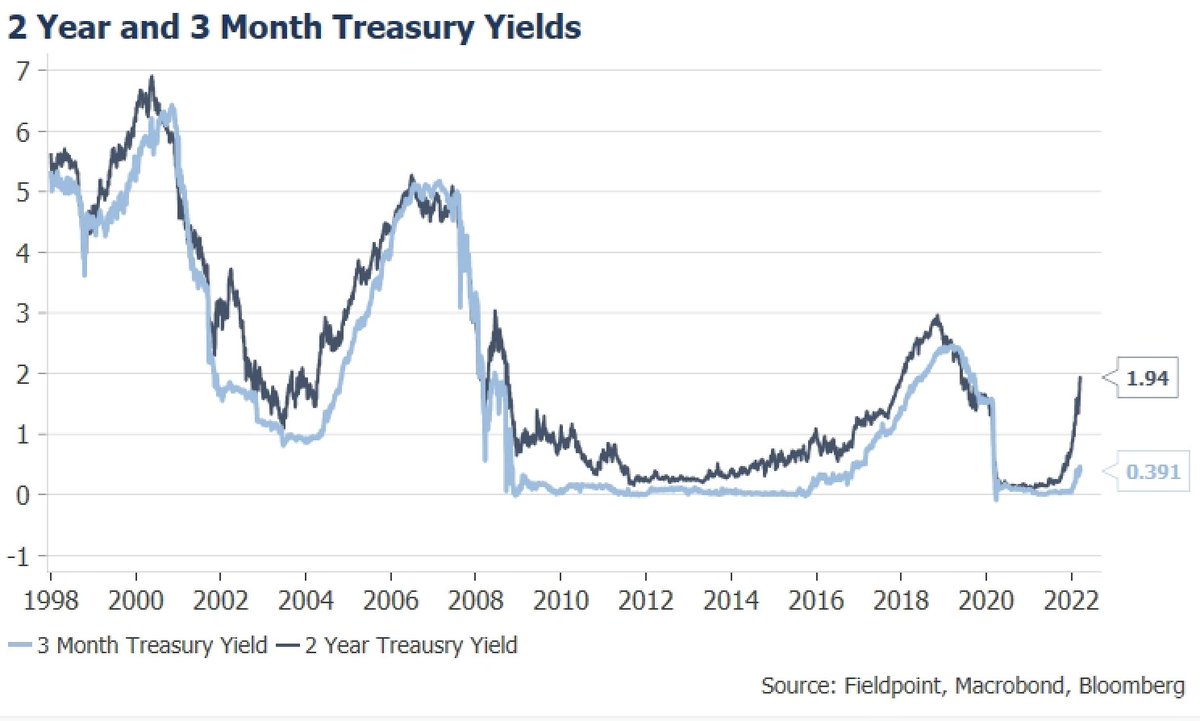

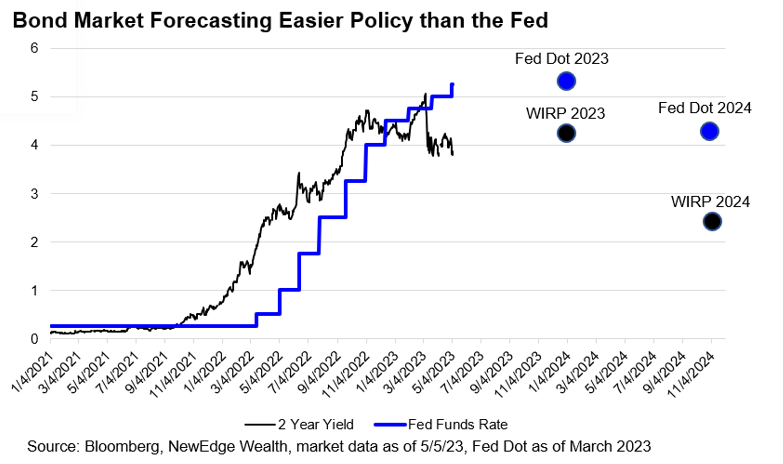

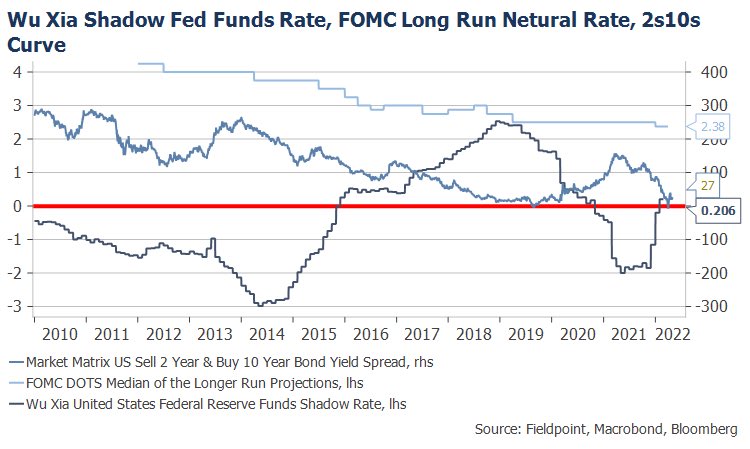

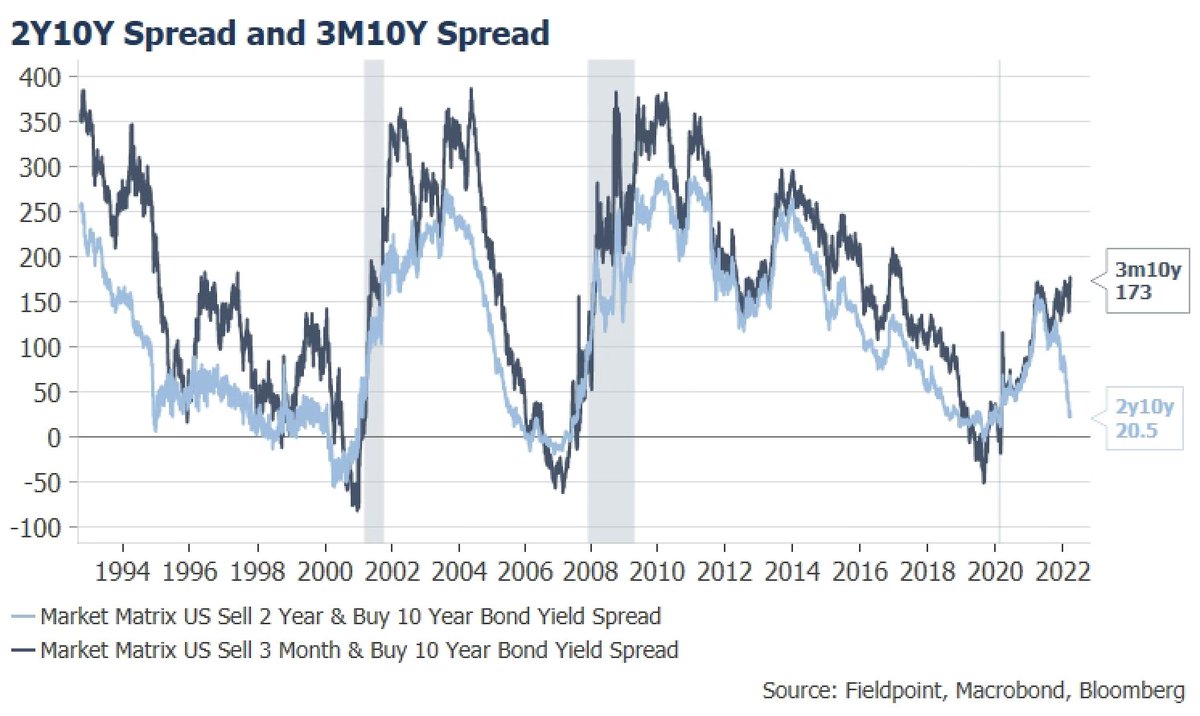

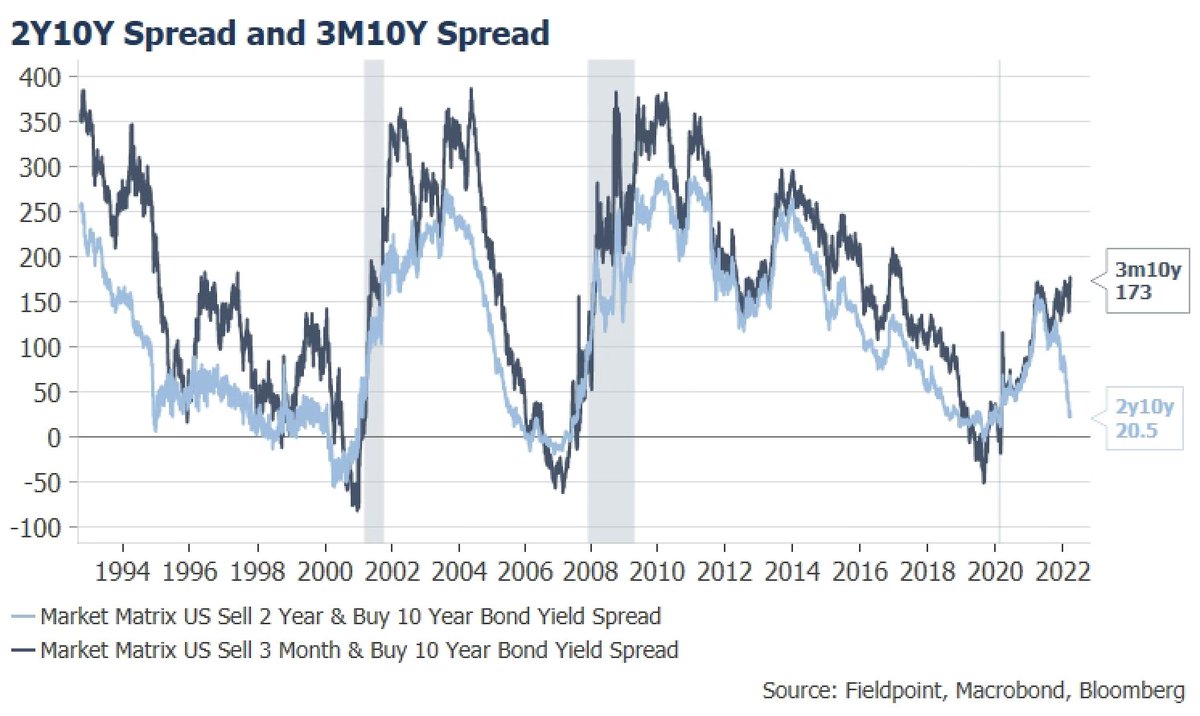

The 3m10y curve should begin to fall rapidly as the Fed delivers on its front-end-loaded rate hike plan, meaning 3m yields will move rapidly higher.

The 3m10y curve should begin to fall rapidly as the Fed delivers on its front-end-loaded rate hike plan, meaning 3m yields will move rapidly higher.

The 3M10Y curve remaining steep at the beginning of a tightening cycle makes sense. In an overly simplistic description, the 3M yield is reflecting just the Fed policy moves over the coming 3M (1 more hike), while the 2Y is reflecting the policy moves over the next 2Y (~8 hikes)

The 3M10Y curve remaining steep at the beginning of a tightening cycle makes sense. In an overly simplistic description, the 3M yield is reflecting just the Fed policy moves over the coming 3M (1 more hike), while the 2Y is reflecting the policy moves over the next 2Y (~8 hikes)