Founder, CEO and CIO @ARKinvest. Thematic portfolio manager for disruptive innovation, mom, economist, and women's advocate. Disclosure: https://t.co/chxRD4oWOd

47 subscribers

How to get URL link on X (Twitter) App

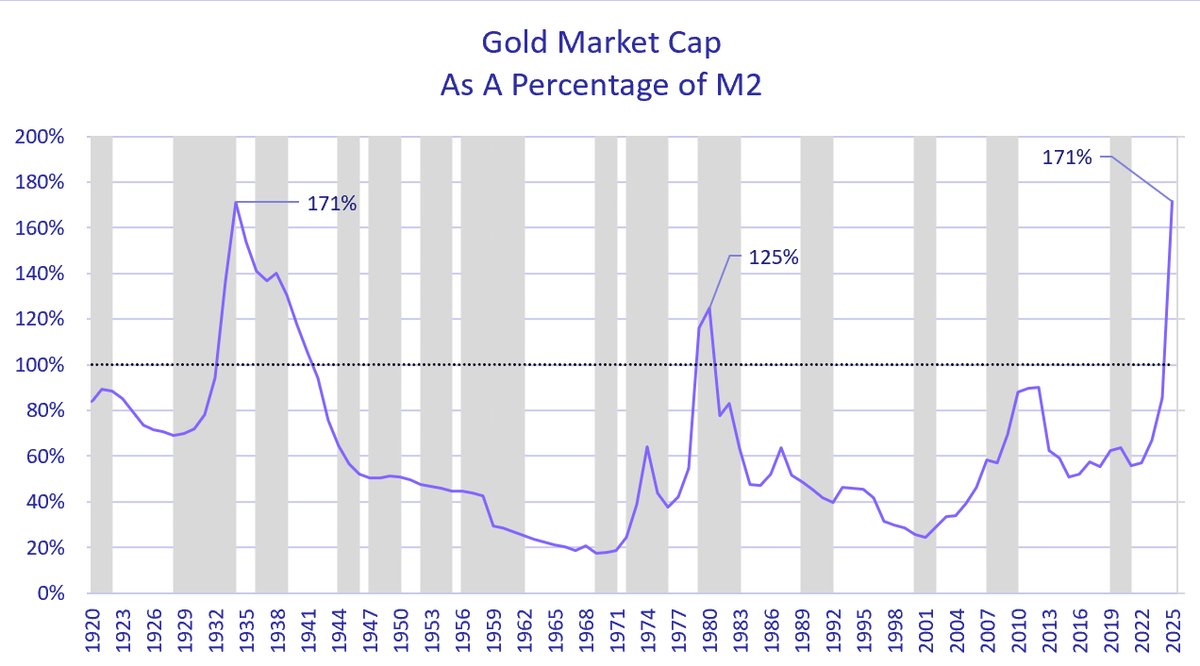

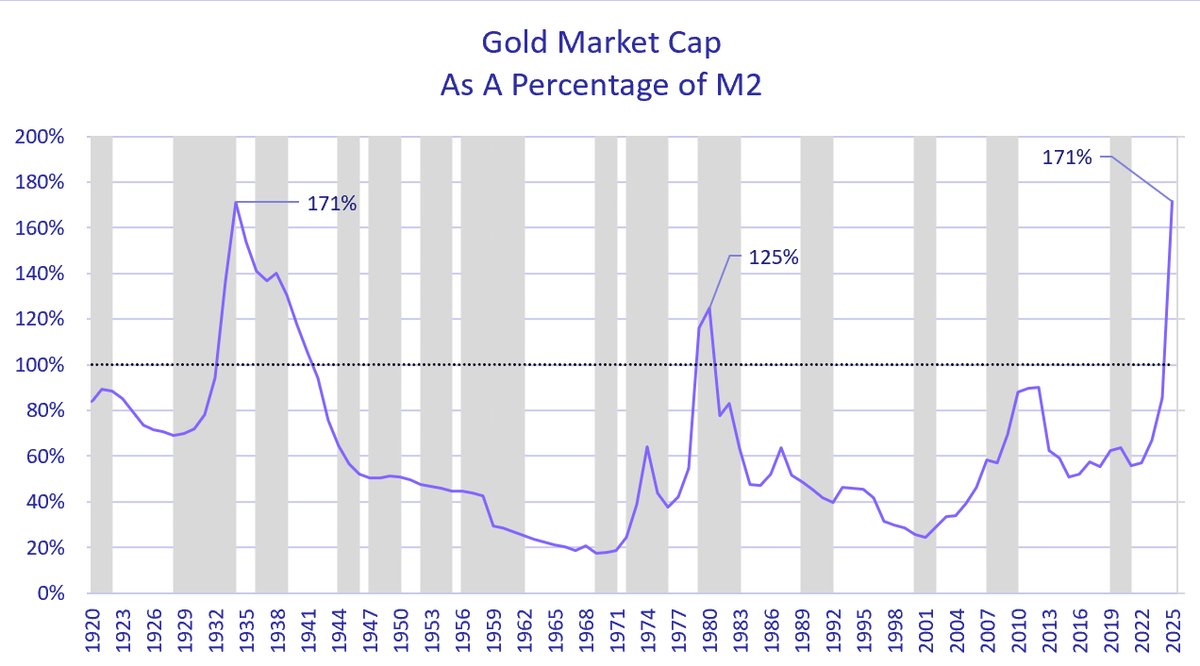

the ratio of gold to M2 has hit the all time high recorded during The Great Depression in 1934. In that crisis, the dollar devalued relative to gold by almost 70% on January 31, 1934, the government banned private ownership of gold, and M2 collapsed.

the ratio of gold to M2 has hit the all time high recorded during The Great Depression in 1934. In that crisis, the dollar devalued relative to gold by almost 70% on January 31, 1934, the government banned private ownership of gold, and M2 collapsed.

https://twitter.com/ericbalchunas/status/1980124342391656813What do Glass Lewis and ISS know about the convergence among the robots, energy storage, and artificial intelligence (AI) involved in robotaxis and humanoid robots? Have they researched the odds of Elon leading Tesla to 10 years of 41% EBITDA growth on average?

https://twitter.com/arkinvest/status/1820448809790439717In 1987 and 2020, the panic/cathartic moves in the VIX created significant buying opportunities, particularly for stocks trounced during those downturns. In 2008, however, after the VIX spiked, the broad based equity markets did not bottom for another six months in March, 2009.

At first I thought that Amazon still was taking share and causing problems, but this chart suggests that market share has changed very little since 2020.

At first I thought that Amazon still was taking share and causing problems, but this chart suggests that market share has changed very little since 2020.

https://twitter.com/gopmajoritywhip/status/1636008298481680384Despite a yield curve that inverted last July - and credit default swaps that started flashing red - the Fed continued to vote UNANIMOUSLY to jack rates up in 75 basis point increments. They paid no heed to commodity prices and other inflation indicators that were unwinding.

https://twitter.com/elonmusk/status/1635811818169044994In response to a supply chain- and war-related surge in inflation, the gold standard forced the newly formed Fed to drain money from the economy, pushing pricing from a 24% inflationary peak in June 1920 to a -15% deflationary trough one year later in June 1921.

https://twitter.com/cathiedwood/status/1574513481436520461Many banks parked the COVID stimulus gusher in long term bonds at record low 1-2% interest rates, never expecting the Fed funds rate to surge a record-breaking 19-fold to 4.75% in less than a year. Now deposit outflows are forcing them to sell “safe” securities at losses.

https://twitter.com/nancy__davis/status/1575158583678967809Second, despite record-breaking monetary stimulus during COVID, the yield curve steepened only ~half as much in 2020 as “normal” during past crises: 150 basis points vs. 250-300. In other words, the long bond market seemed to be flagging a significant deflationary undertow.

https://twitter.com/elonmusk/status/1568383953370767365As measured by the Manheim, used car prices dropped 4% in August (roughly 50% at an annual rate!), have dropped 10% since peaking in January, and if electric vehicles are as disruptive as we believe, could be cut in half, hitting lows last seen during the GFC in late 2008.

https://twitter.com/arkinvest/status/1566035275456864256At Jackson Hole, Chairman Powell invoked Volcker’s name twice directly, twice indirectly. Today’s COVID-supply-shock inflation is nothing like the ‘70s inflation that started with “guns and butter” in 1964, and accelerated after Nixon ended the gold-exchange standard in 1971.

https://twitter.com/realmeetkevin/status/1526284407035858944Walmart’s inventories increased 33% in nominal terms on a year over year basis, translating into 20-25% in real or unit terms, as Target’s inventories increased by 42% and 30-35%, respectively. In my 45 years in this business, I have never seen such inventory excesses.

https://twitter.com/ARKInvest/status/1510231665137930249Economists have learned over many cycles that the 10-2 year measure of the yield curve leads another one: the difference between the 10 year Treasury yield and the 3 month Treasury rate. I have no idea why many strategists and economists are reverting to the latter one now.