Free Market Economist, Financial Services, Trade, Agriculture.

Fellow @CentreBrexit

https://globalbritain

Views my own. Retweets not necessarily endorsements.

2 subscribers

How to get URL link on X (Twitter) App

2. The last line of the passage above is extremely important. The US is not the chump that some UK politicians seem to think it is. The US-UK EPD did not grant the UK the ability to bank the US largesse and then cosy up to the EU, or China. The removal of the US Section 232 tariffs on UK steel and aluminium exports was conditional on the UK meeting the EPD’s requirements for secure supply chains, including the ownership of the production facilities.

2. The last line of the passage above is extremely important. The US is not the chump that some UK politicians seem to think it is. The US-UK EPD did not grant the UK the ability to bank the US largesse and then cosy up to the EU, or China. The removal of the US Section 232 tariffs on UK steel and aluminium exports was conditional on the UK meeting the EPD’s requirements for secure supply chains, including the ownership of the production facilities.

1. ‘Deep alignment with the EU for goods and services could benefit UK GDP by 2%’

1. ‘Deep alignment with the EU for goods and services could benefit UK GDP by 2%’

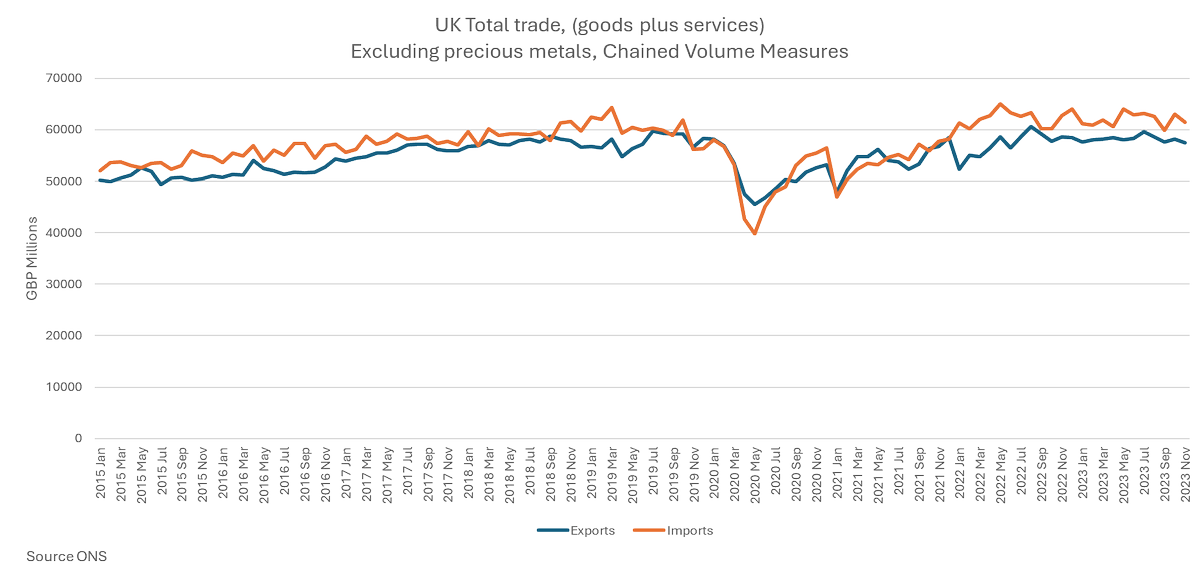

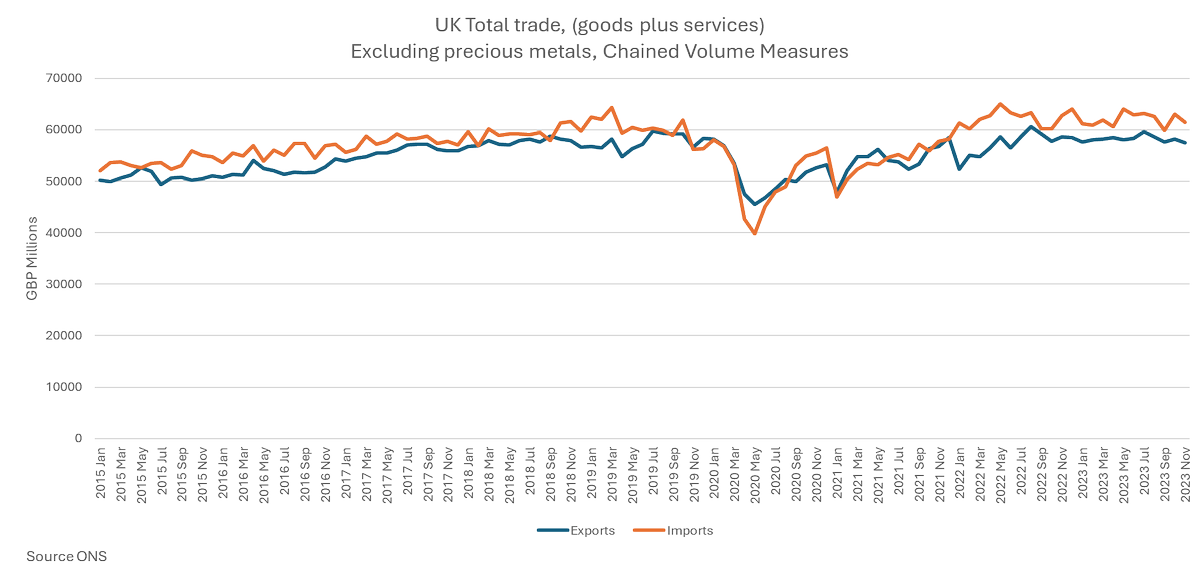

Trade intensity is total trade (exports plus imports of goods and services) as a proportion of GDP. Adding exports and imports is a strange idea. The mathematically astute readers will immediately understand that, as trade intensity is a fraction, it could fall due to a drop in the numerator or by an increase in the denominator. The OBR wants us to believe that any change could only be due to a change in the denominator….

Trade intensity is total trade (exports plus imports of goods and services) as a proportion of GDP. Adding exports and imports is a strange idea. The mathematically astute readers will immediately understand that, as trade intensity is a fraction, it could fall due to a drop in the numerator or by an increase in the denominator. The OBR wants us to believe that any change could only be due to a change in the denominator….

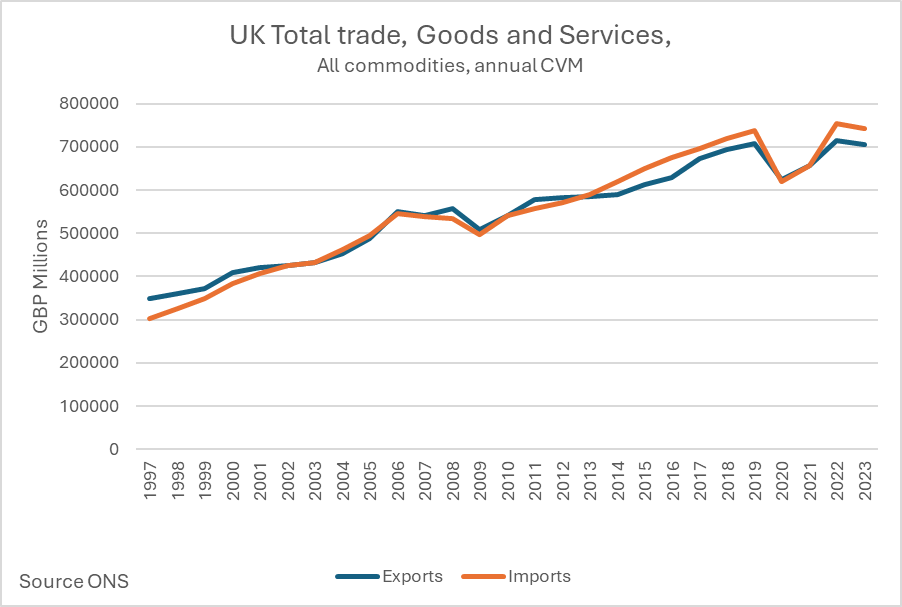

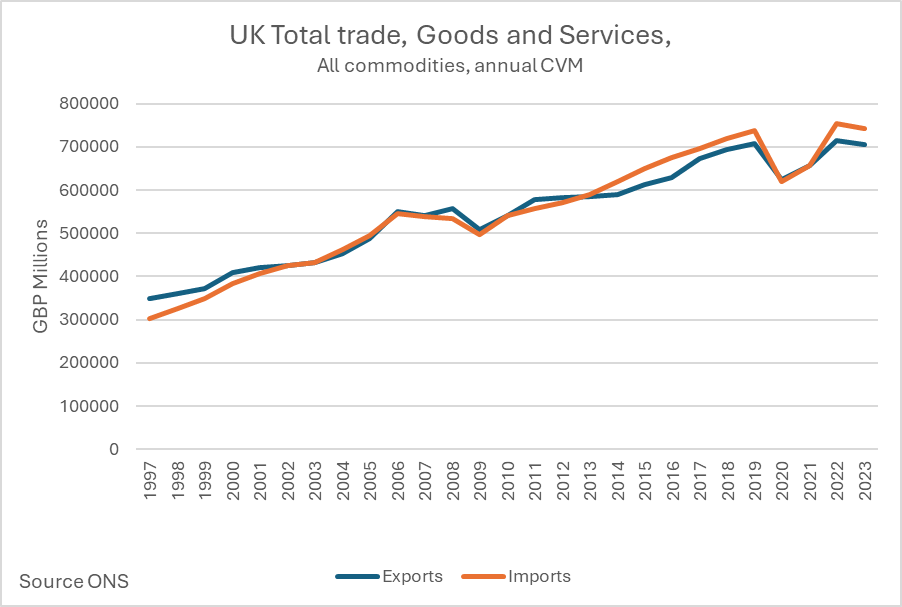

The FT has published a chart of 5-year rolling percentage changes to declare the five-year percentage change between 2018 to 2023 as the worst since 'records began' (in 1997).

The FT has published a chart of 5-year rolling percentage changes to declare the five-year percentage change between 2018 to 2023 as the worst since 'records began' (in 1997).

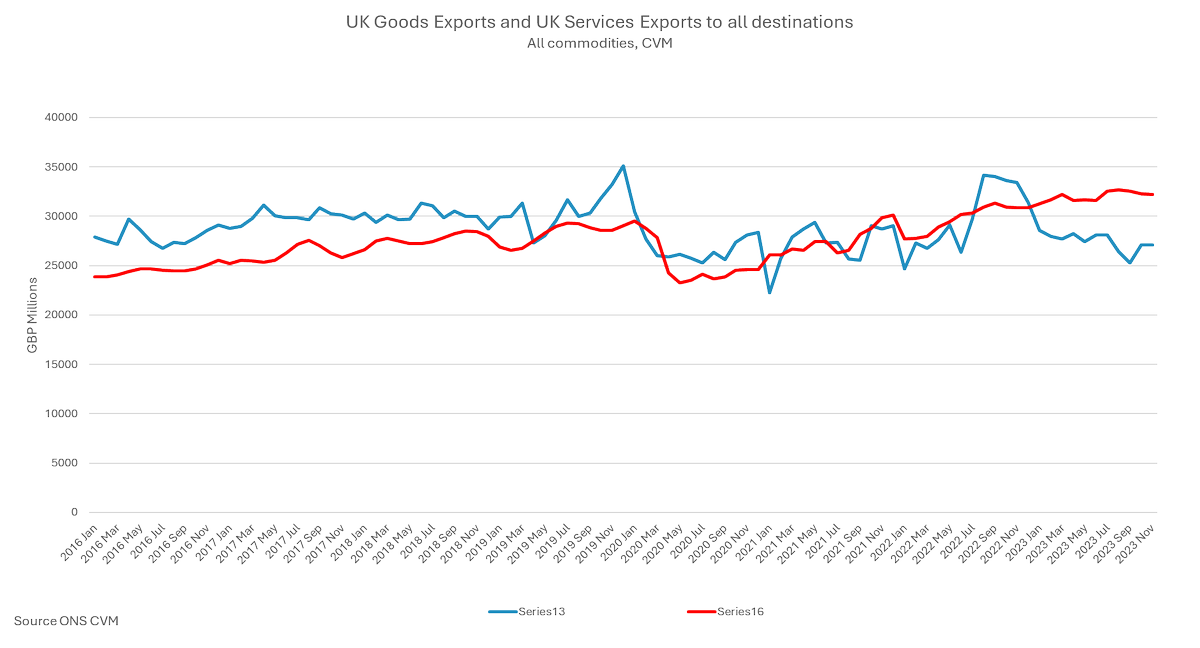

If we look at UK exports we can see that we now export more services, the red line below, than goods, the blue line.

If we look at UK exports we can see that we now export more services, the red line below, than goods, the blue line.