How to get URL link on X (Twitter) App

2/ GMX differs from traditional AMMs by offering zero slippage on trades via an oracle price update system. Differing from AMMs like @Uniswap, which relies on arb bots to properly balance prices in their pools, GMX updates the prices of assets themselves via these oracle updates

2/ GMX differs from traditional AMMs by offering zero slippage on trades via an oracle price update system. Differing from AMMs like @Uniswap, which relies on arb bots to properly balance prices in their pools, GMX updates the prices of assets themselves via these oracle updates

https://twitter.com/ChainsightA/status/1482750801705635841

2/

2/

https://twitter.com/ChainsightA/status/1460824051010744327

2/ A quick primer—@ConvexFinance exposes a form of LTMEV when compounding must occur on their CRV rewards.

2/ A quick primer—@ConvexFinance exposes a form of LTMEV when compounding must occur on their CRV rewards.

https://twitter.com/ChainsightA/status/1471246878012579843

2/

2/

https://twitter.com/ChainsightA/status/1479115264767582214

2/ KP3R token is the fee-bearing asset for 4 (for now) @AndreCronjeTech projects. In order to claim fees, the KP3R must be locked, and the locker receives vKP3R in return. dune.xyz/embeds/271075/…

2/ KP3R token is the fee-bearing asset for 4 (for now) @AndreCronjeTech projects. In order to claim fees, the KP3R must be locked, and the locker receives vKP3R in return. dune.xyz/embeds/271075/…

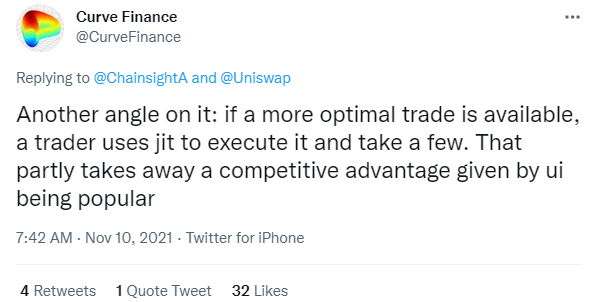

https://twitter.com/ChainsightA/status/1457958811243778052From @Uniswap — "it's a powerful feature", "LPs should plan accordingly", to...

https://twitter.com/WillHennessy_/status/1458228993321209858

2/ Using @DuneAnalytics, we find the @Uniswap positions that are added and removed in the same block for the same LP. From this, we calculate the revenue from the fees of the sandwiched trade, and subtract the gas costs required to perform the JIT attack:dune.xyz/embeds/233623/…

2/ Using @DuneAnalytics, we find the @Uniswap positions that are added and removed in the same block for the same LP. From this, we calculate the revenue from the fees of the sandwiched trade, and subtract the gas costs required to perform the JIT attack:dune.xyz/embeds/233623/…

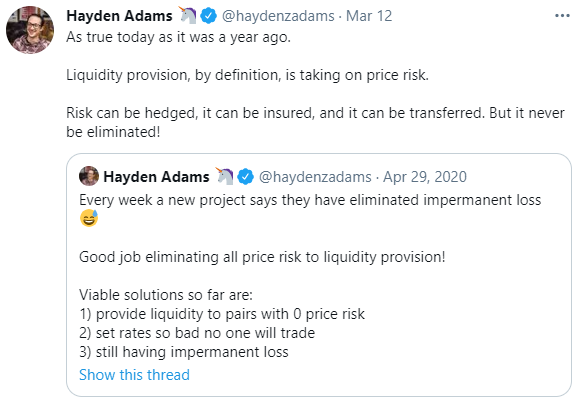

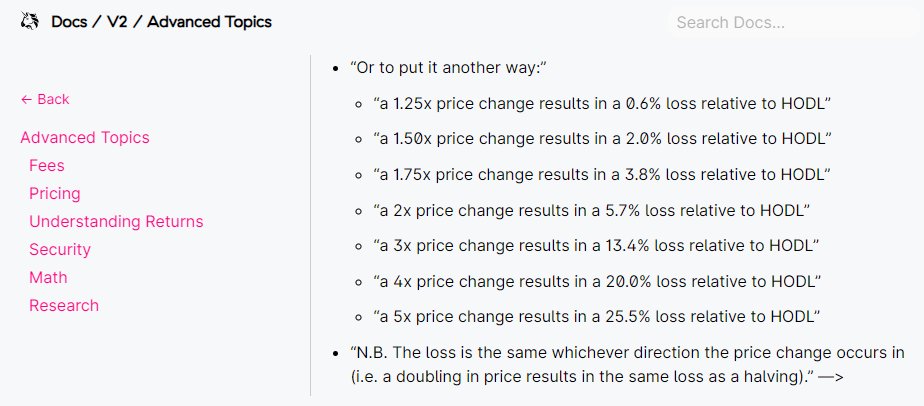

2/ First, a quick primer on Impermanent Loss - it occurs when the price of either asset changes after you've initially supplied liquidity (as you hope it does, since price changes are how a liquidity provider actually earns fees). Or, to take it straight from the Unicorn's mouth:

2/ First, a quick primer on Impermanent Loss - it occurs when the price of either asset changes after you've initially supplied liquidity (as you hope it does, since price changes are how a liquidity provider actually earns fees). Or, to take it straight from the Unicorn's mouth:

https://twitter.com/BigSnek4/status/13505208346837114962/ Previously, we explored the difference between the 1inch referred volume to various DEX's on LINK, and saw how there was a massive gap between Bancor's expected (31%) vs. actual (8%) volume share. We surmised massive volume share growth was imminent.