| Curious mind | 🇮🇳

Trying to Connect the dot in the field of Businesses, Finance, macroeconomics.

| View Personal | Not SEBI registered

How to get URL link on X (Twitter) App

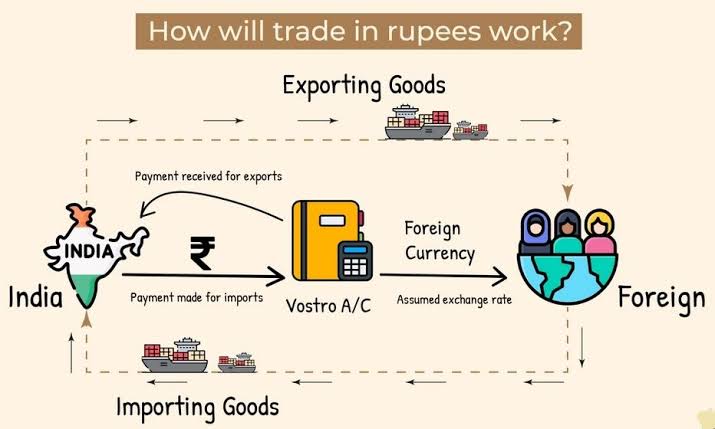

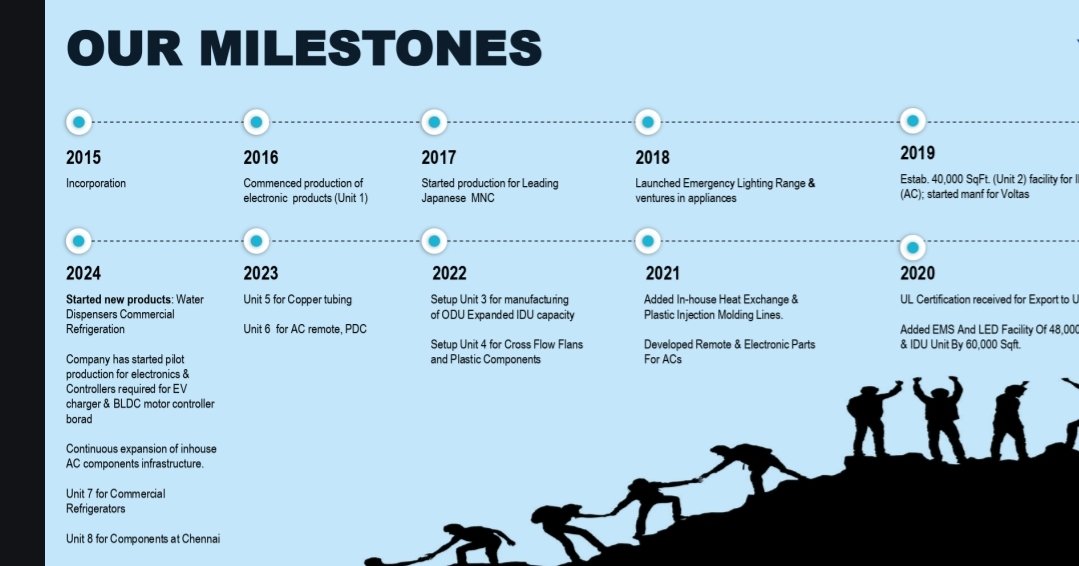

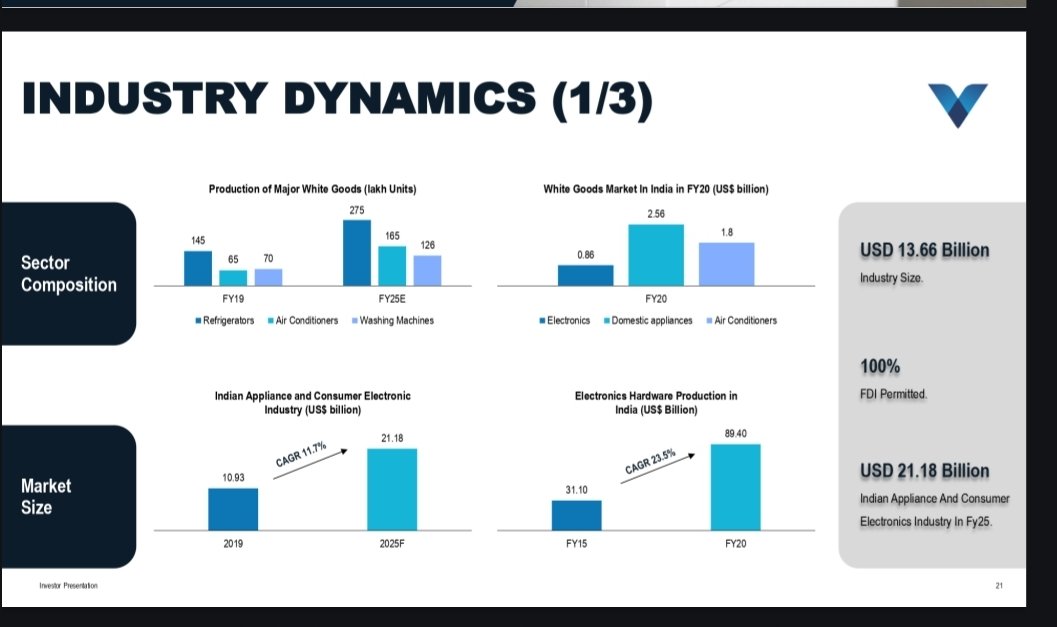

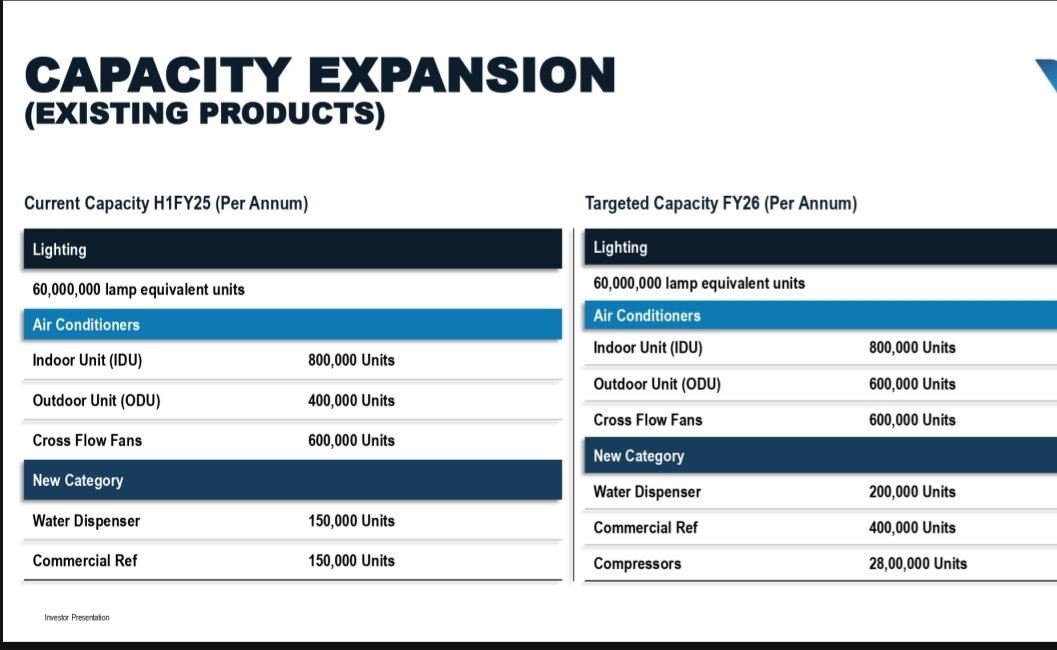

The company is implementing a product diversification strategy across various categories to mitigate potential risks and capitalize on the expanding market opportunities in India, particularly in the air conditioning, refrigeration, and washing machine segments.

The company is implementing a product diversification strategy across various categories to mitigate potential risks and capitalize on the expanding market opportunities in India, particularly in the air conditioning, refrigeration, and washing machine segments.

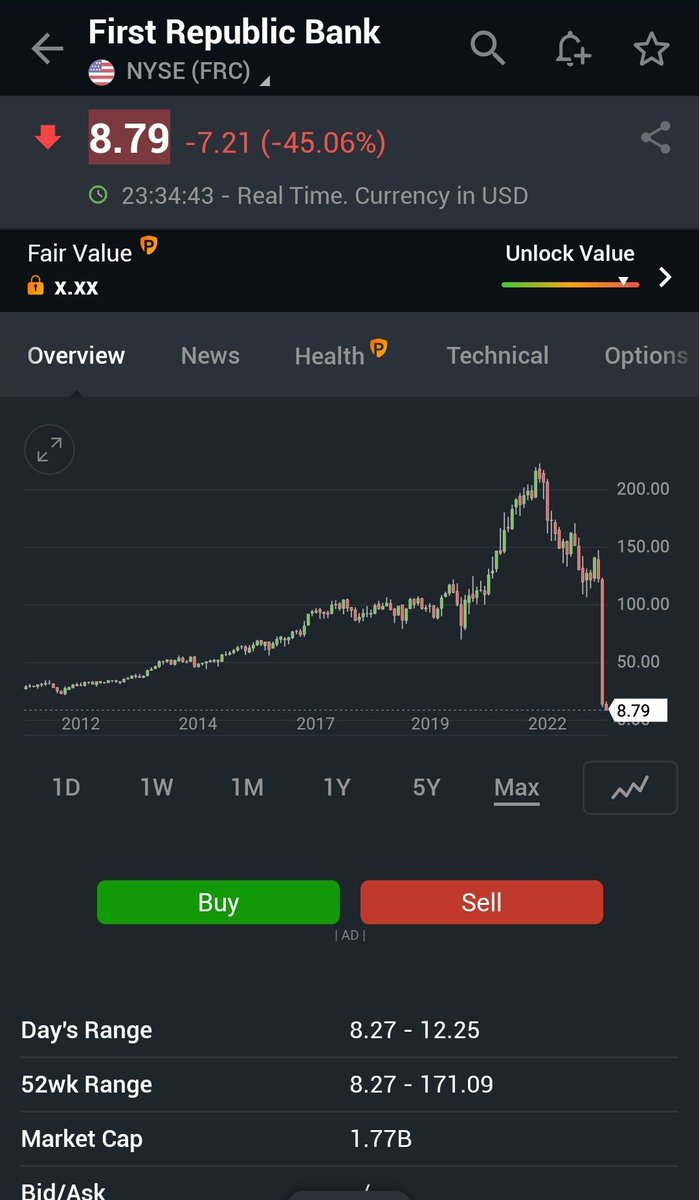

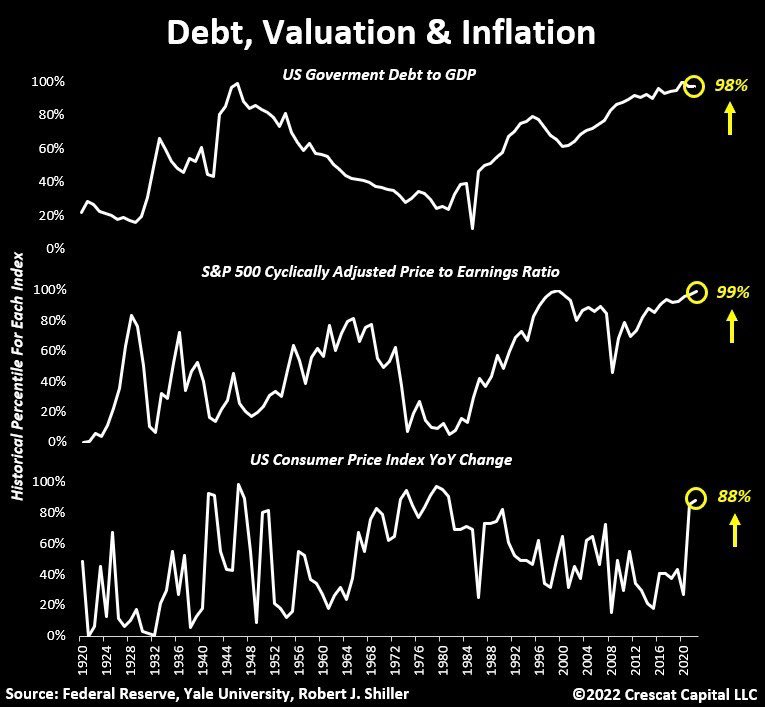

This is the second biggest Banking failure in US history.

This is the second biggest Banking failure in US history.

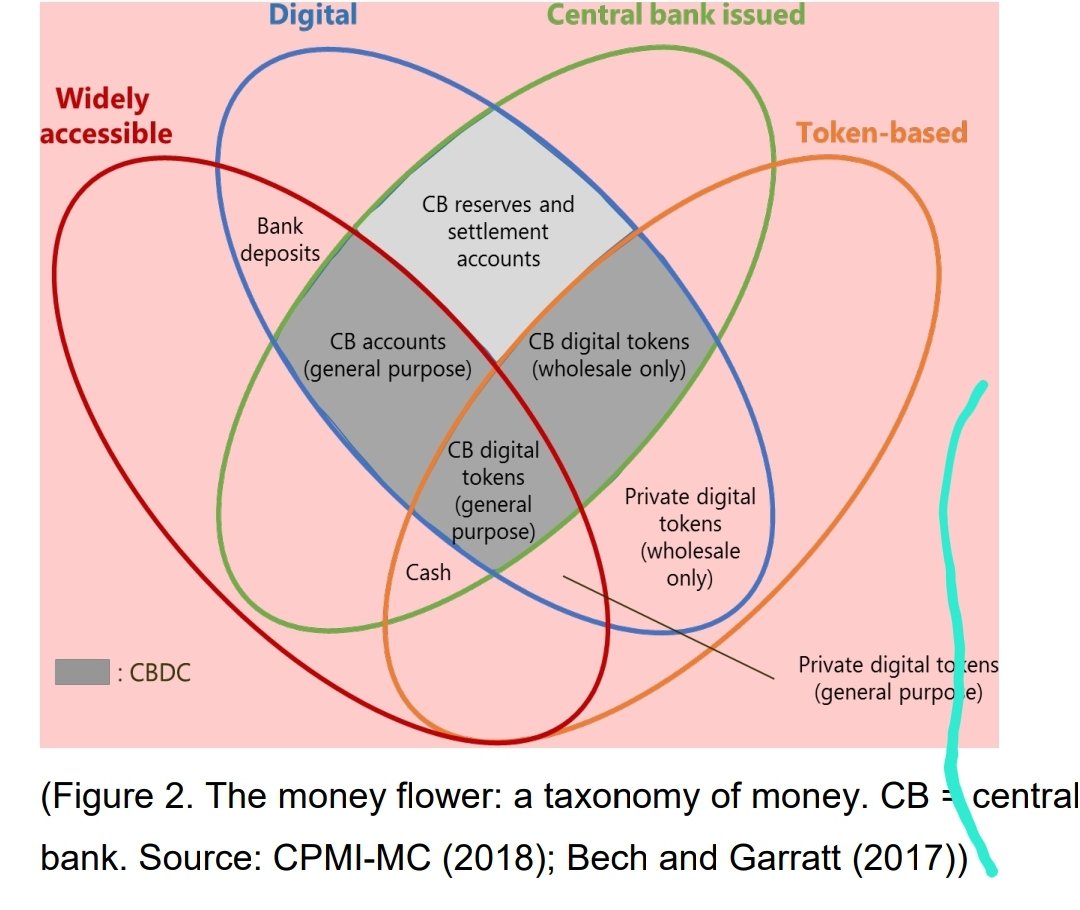

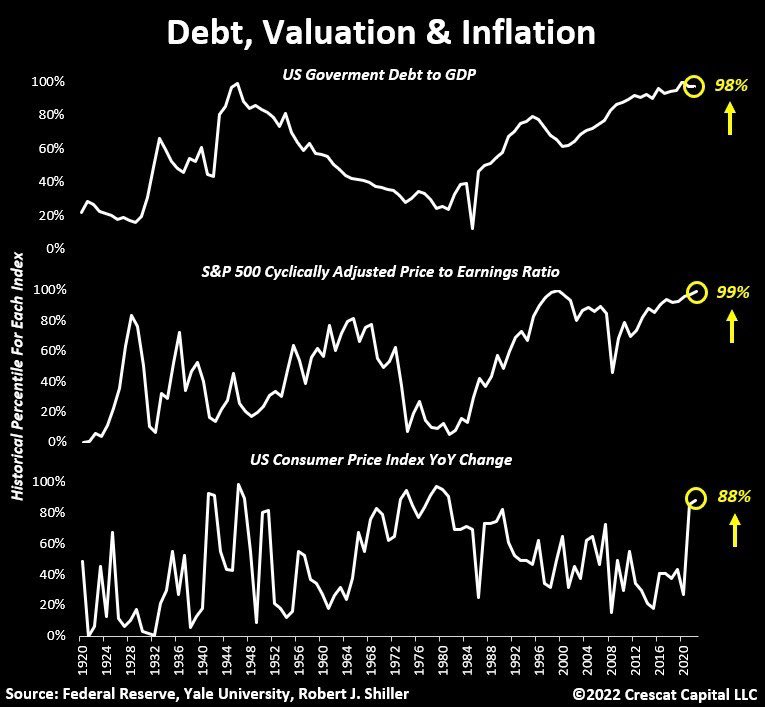

•The US national debt hit an all-time high of $31.5 trillion.

•The US national debt hit an all-time high of $31.5 trillion.

•Bank used to provide personalized service to high net-worth individuals.

•Bank used to provide personalized service to high net-worth individuals.

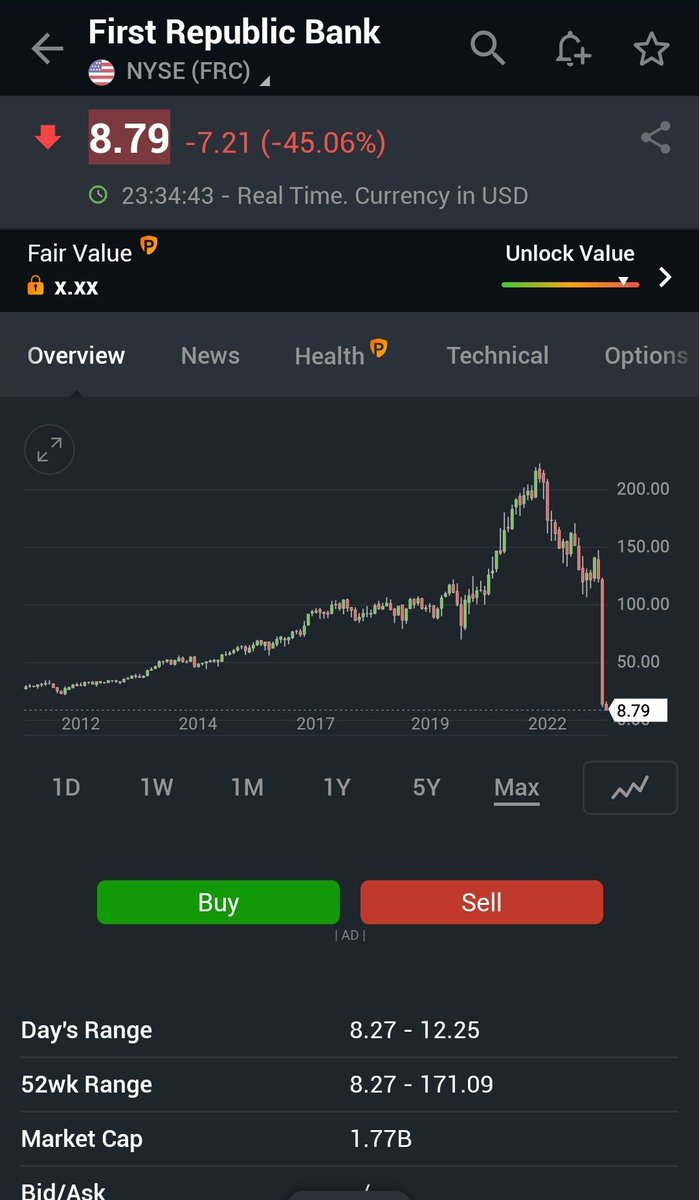

Central Bank Digital Currency, which is a country's fiat currency that is issued and backed by the country's central bank. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are decentralized and not backed by any government or central authority.

Central Bank Digital Currency, which is a country's fiat currency that is issued and backed by the country's central bank. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are decentralized and not backed by any government or central authority.

The global crude oil market size is $2747.78 billion in 2022 and it is expected to grow to $2904.09 billion in 2023.

The global crude oil market size is $2747.78 billion in 2022 and it is expected to grow to $2904.09 billion in 2023.

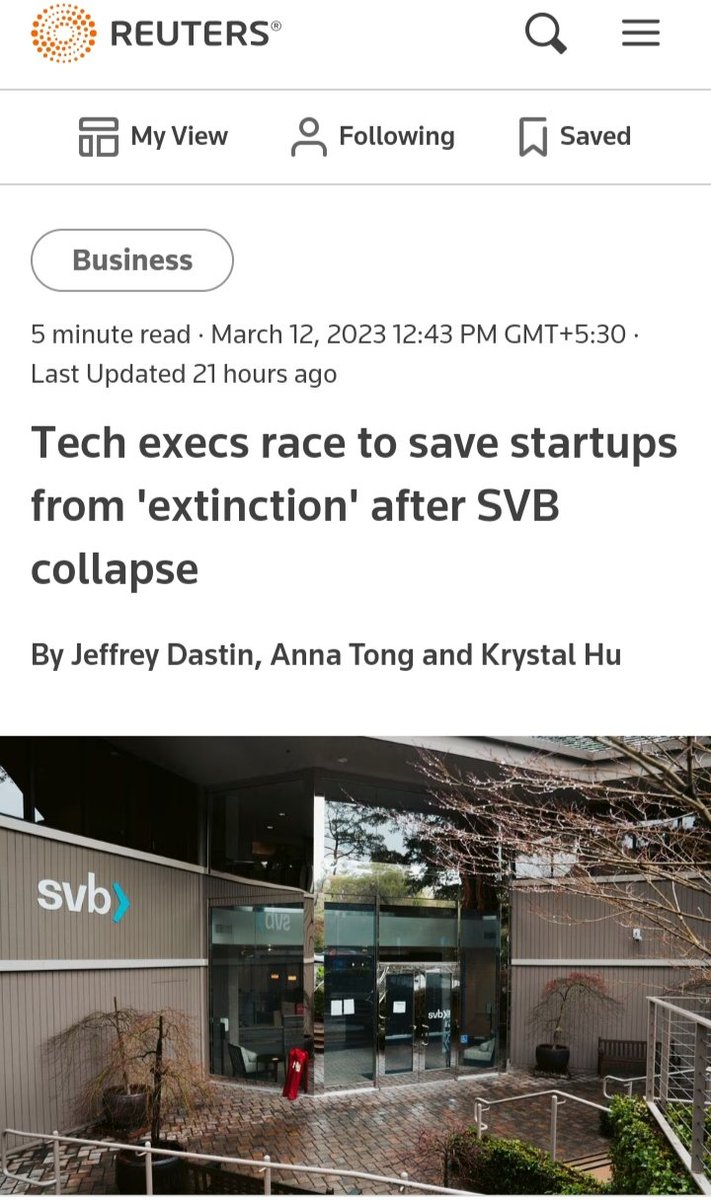

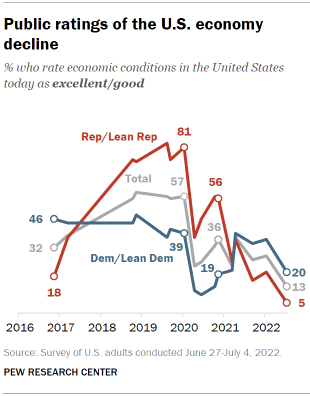

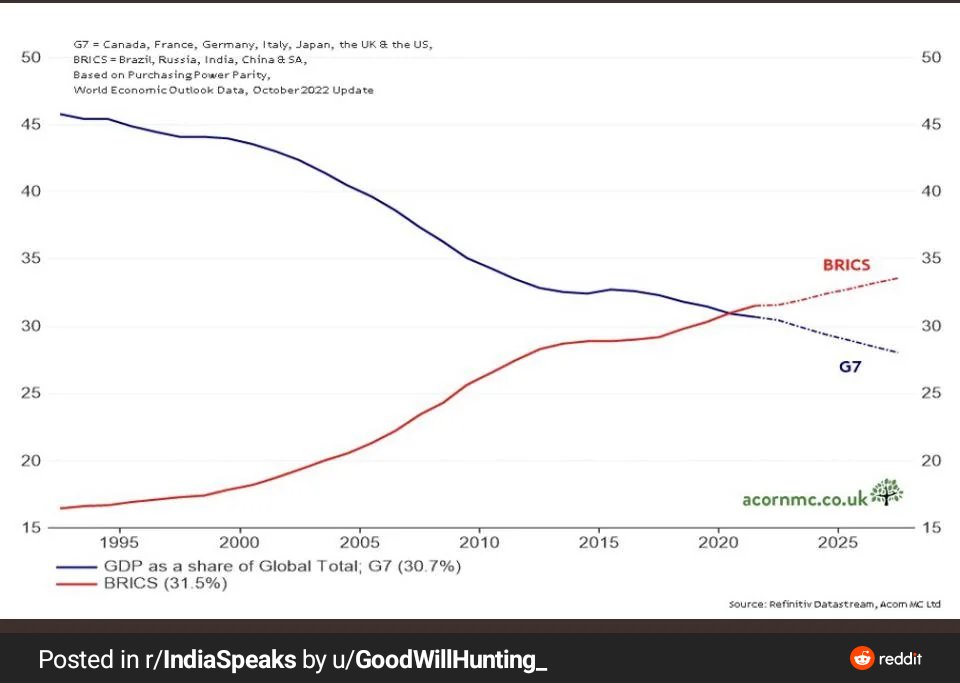

you will realize why these things are happening rapidly in the direction of de-dollarization.

you will realize why these things are happening rapidly in the direction of de-dollarization.

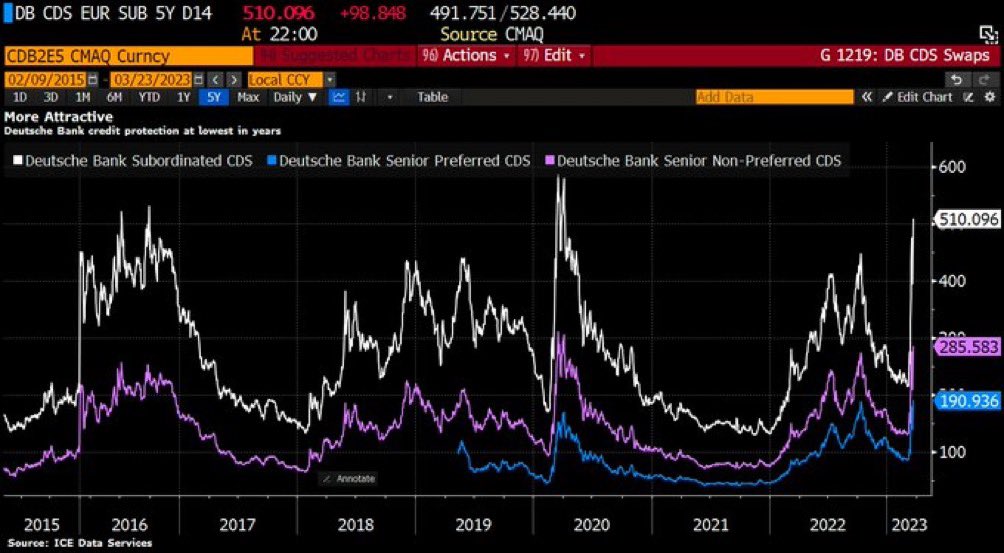

The concept came after the 2008 Global financial crisis, Global systematically important banks (GIBs) were identified by the Basel Committee on Banking Supervision.

The concept came after the 2008 Global financial crisis, Global systematically important banks (GIBs) were identified by the Basel Committee on Banking Supervision. https://twitter.com/Chandankr2018/status/1629343334081740801?t=Yfj9zEZqe5qcp9_V5oPHWw&s=19

Deal to take over Credit Suisse by UBS :

Deal to take over Credit Suisse by UBS :