How to get URL link on X (Twitter) App

Characteristics of Zombie VCs

Characteristics of Zombie VCs

Chart: PitchBook diagram of VC cashflows showing massive gap in liquidity.

Chart: PitchBook diagram of VC cashflows showing massive gap in liquidity.

Here's the trendlines for showing the year-over-year TOTAL deal percentage. Up and to the right.📈

Here's the trendlines for showing the year-over-year TOTAL deal percentage. Up and to the right.📈

Step 1: Return Capital to LPs

Step 1: Return Capital to LPs

Law of VC Database: roamresearch.com/#/app/Funds/pa…

Law of VC Database: roamresearch.com/#/app/Funds/pa…

1) Liquidation Preferences

1) Liquidation Preferences

https://twitter.com/scienceisstrat1/status/16276610034491473932/ In 2021, VCs closed a record-setting 270 first-time funds raising an aggregate of $16.8B

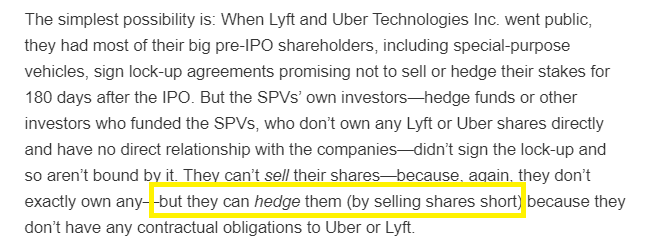

There are two ways to approach financial securities.

There are two ways to approach financial securities.

https://twitter.com/ChrisHarveyEsq/status/1412490535541956609?s=20

2/ After five years of testing pre-money Safes, YC made two major changes to the Original Safe:

2/ After five years of testing pre-money Safes, YC made two major changes to the Original Safe:

https://twitter.com/ChrisHarveyEsq/status/1331236377946689538

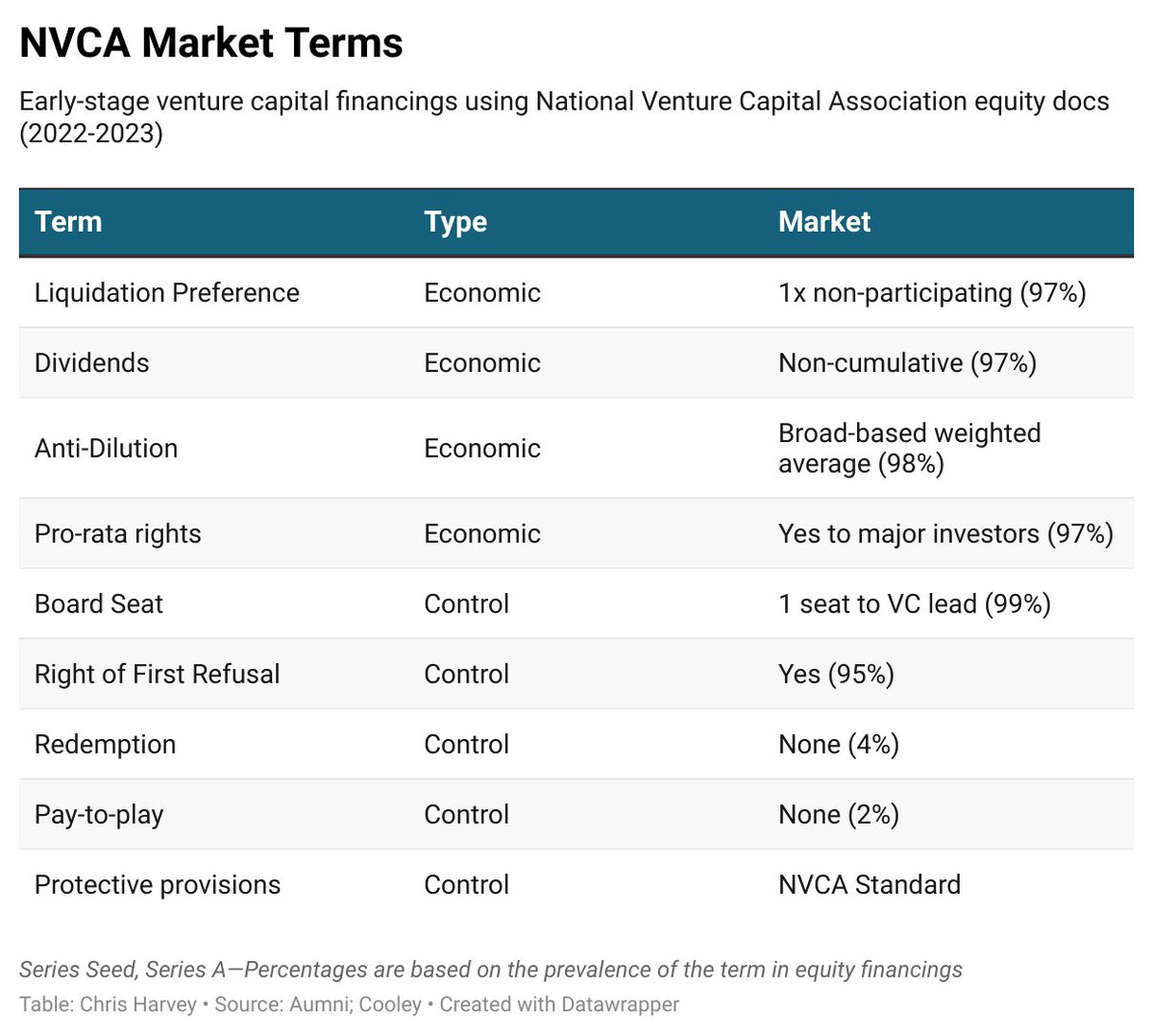

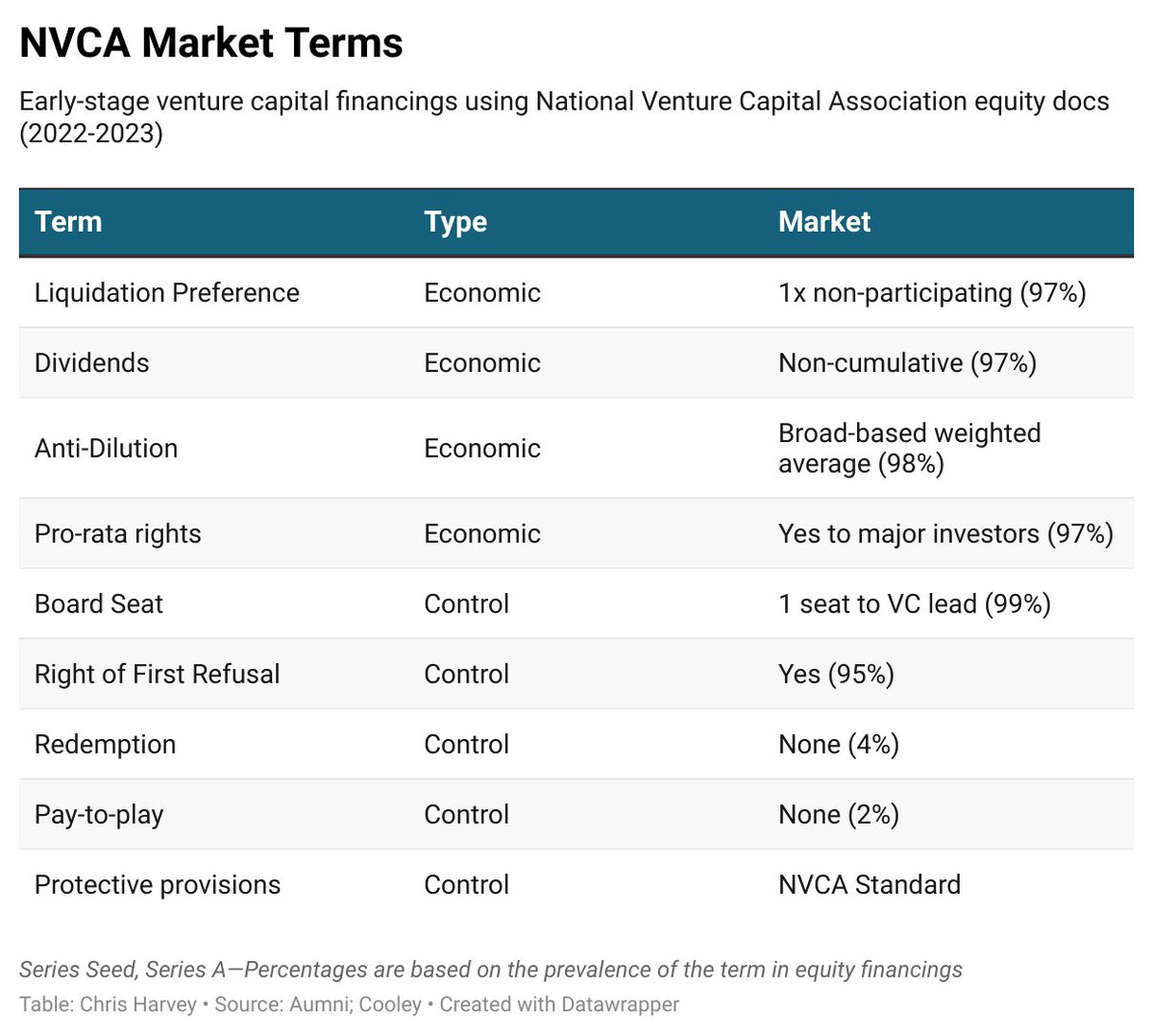

Market Terms for Emerging Venture Funds:

Market Terms for Emerging Venture Funds:https://twitter.com/ChrisHarveyEsq/status/1107998912546308097?s=20