How to get URL link on X (Twitter) App

Also, I really do feel a debt of gratitude to the @SubstackInc platform for the way in which we were able to handle this. Through the chat we were able to keep constant contact with our readers and update them in real time, rather than have them kept in the dark while we wrote.

Also, I really do feel a debt of gratitude to the @SubstackInc platform for the way in which we were able to handle this. Through the chat we were able to keep constant contact with our readers and update them in real time, rather than have them kept in the dark while we wrote.

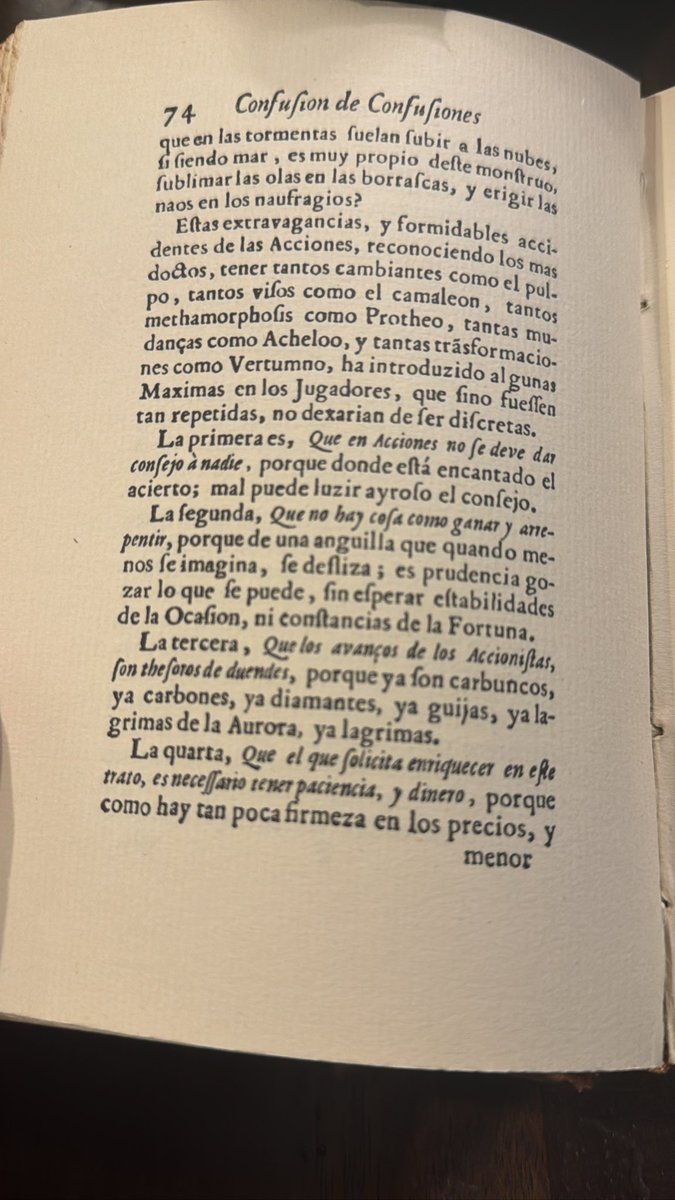

The most well known portion of the book is the discussion of de la Vega’s “four principles”. Paraphrased, these are…

The most well known portion of the book is the discussion of de la Vega’s “four principles”. Paraphrased, these are…

https://twitter.com/citrini7/status/1824606279173579053

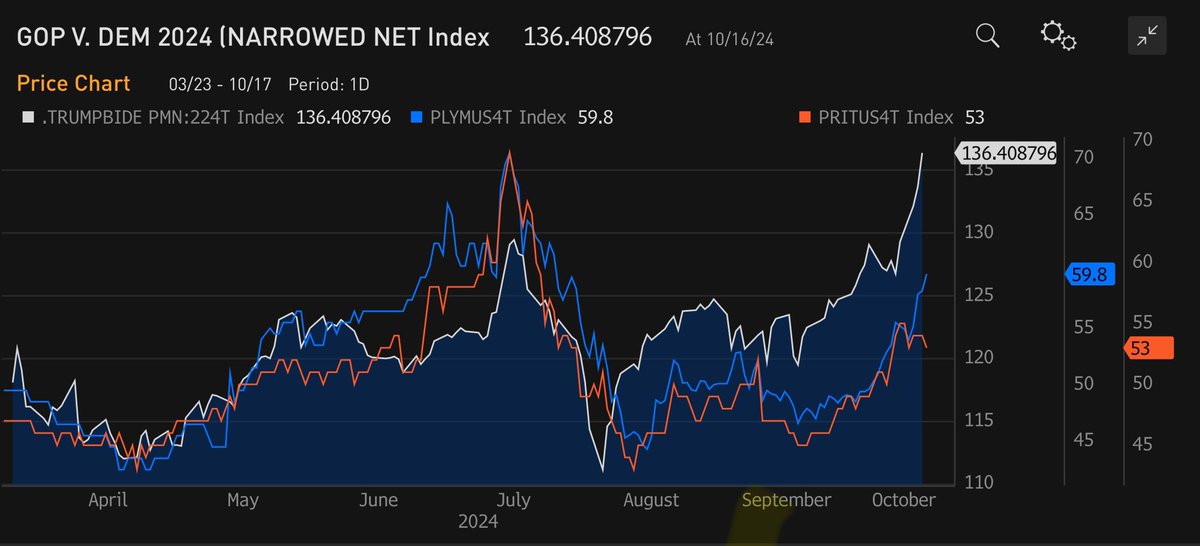

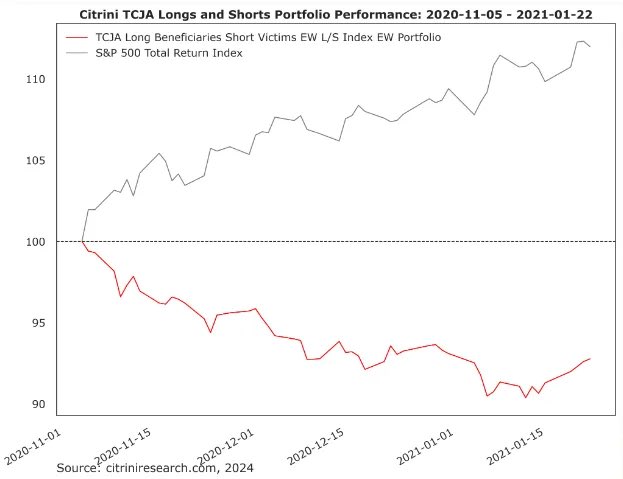

Some people love formulating a comprehensive thesis on single name equities, I love constructing baskets.

Some people love formulating a comprehensive thesis on single name equities, I love constructing baskets.

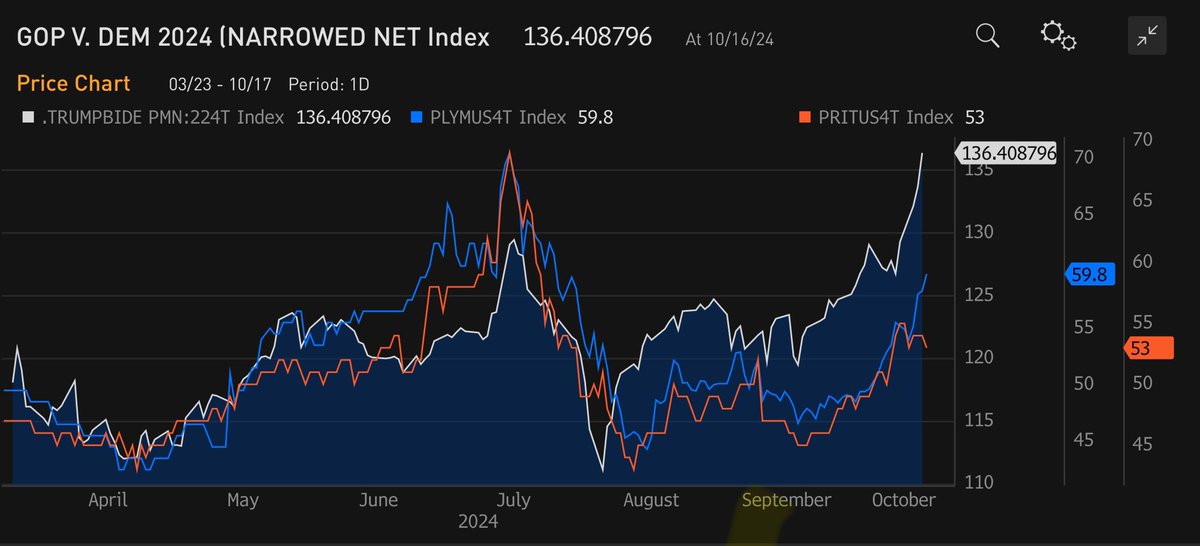

Read my plan, published on 3/5/24. It includes both baskets I mention above & also discusses the potential impact of election results on broad assets & single names alike.

Read my plan, published on 3/5/24. It includes both baskets I mention above & also discusses the potential impact of election results on broad assets & single names alike.

https://twitter.com/thestalwart/status/1670469739242463236Fisk arrived in NY with dreams of fortune, but Wall Street devastated him. He lost money in the bear market, with Civil War events affecting stocks & gold prices unpredictably. Despite the losses, Fisk had a plan.

https://twitter.com/citrini7/status/1656504013859192835How does it relate to the market?

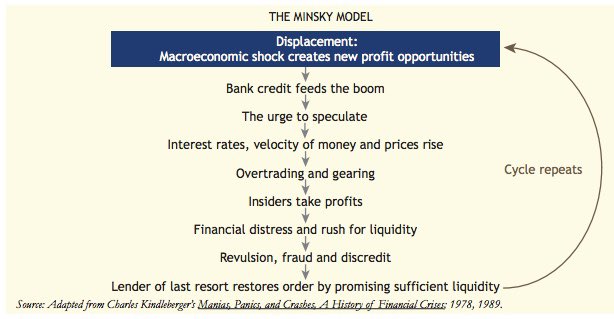

WARNING: UNHINGED MACRO THESIS

WARNING: UNHINGED MACRO THESIS

Number 2, never let ‘em know your next move. Don’t you know bad boys move in silence and violence?

Number 2, never let ‘em know your next move. Don’t you know bad boys move in silence and violence?