How to get URL link on X (Twitter) App

Commodities are a great investment during times of high inflation.

Commodities are a great investment during times of high inflation.

Let’s start from the beginning.

Let’s start from the beginning.

1. Your margin is my opportunity.

1. Your margin is my opportunity.

In order to prepare for the future, it’s important to study history and see how things have played out in the past.

In order to prepare for the future, it’s important to study history and see how things have played out in the past.

1. Investing is Complex

1. Investing is Complex

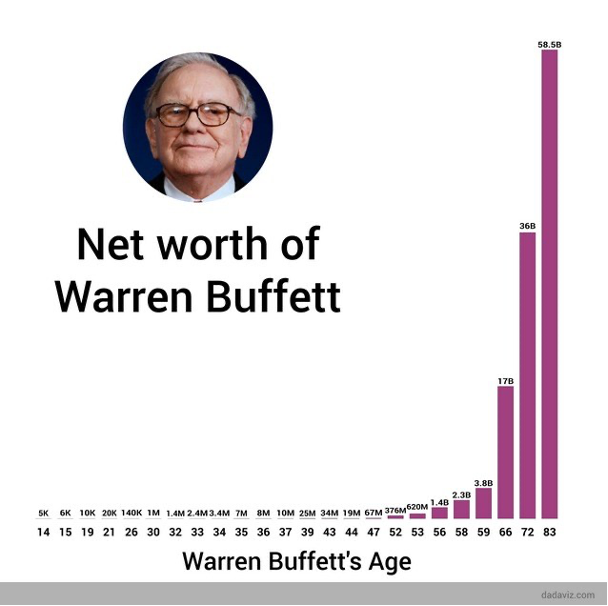

1. Utilize Compound Interest

1. Utilize Compound Interest