A think tank designing ownership models for a democratic and sustainable economy.

How to get URL link on X (Twitter) App

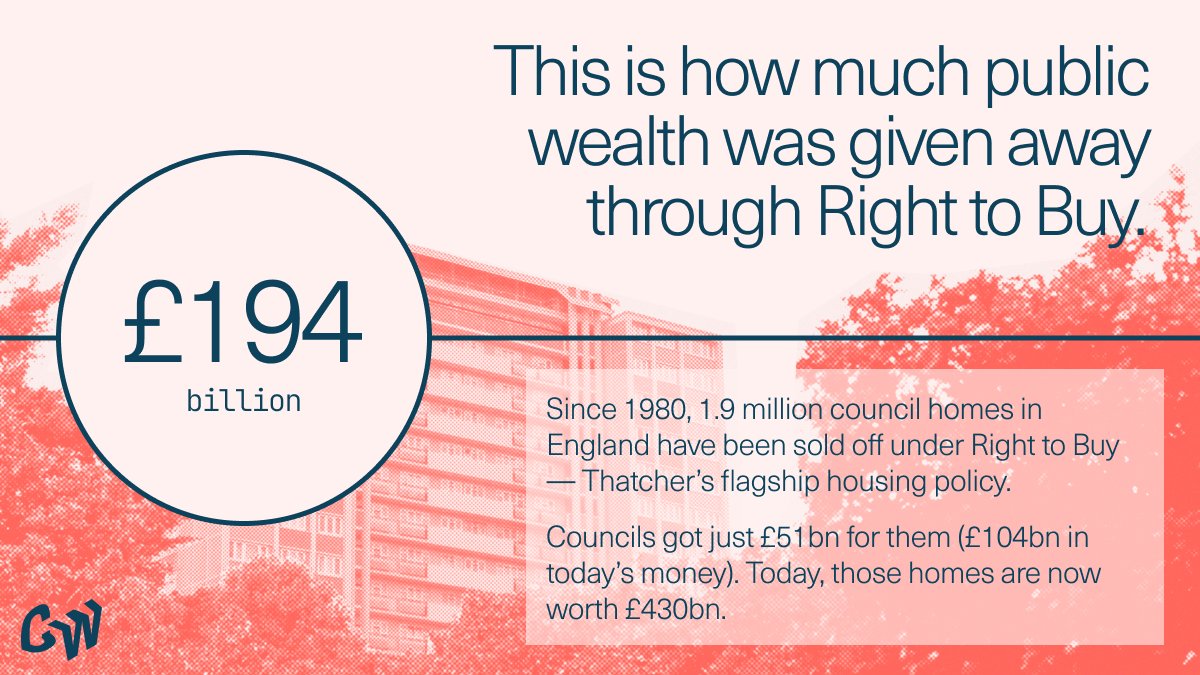

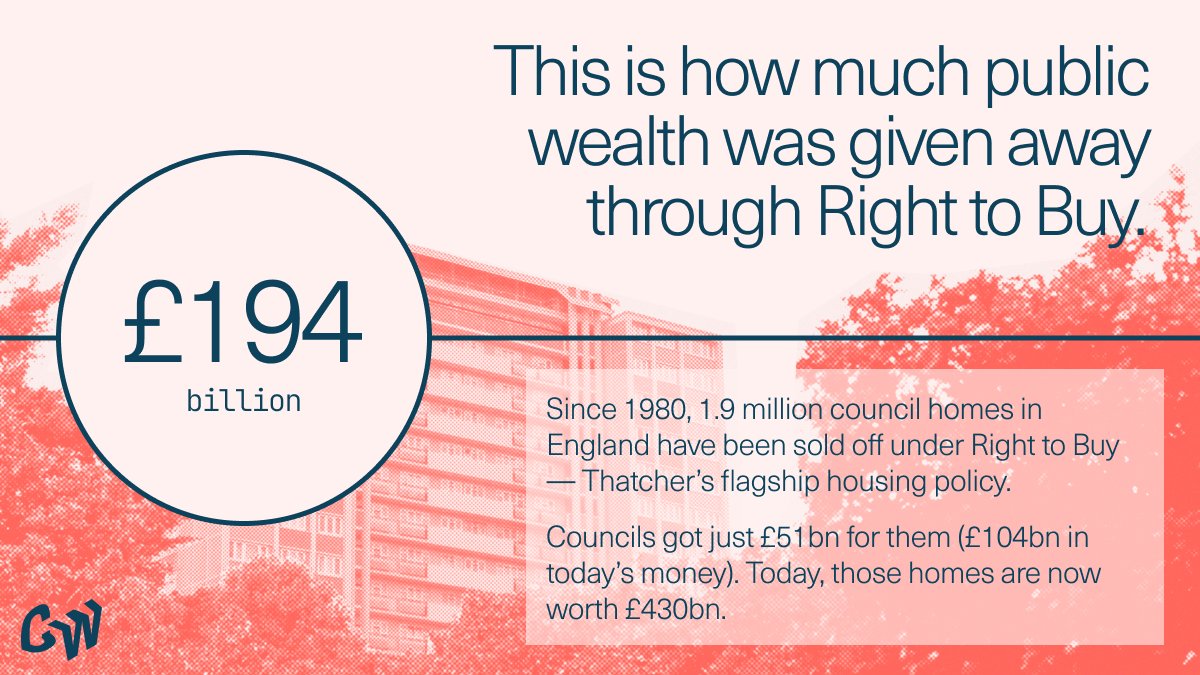

Since 1980, 1.9 million council homes in England have been sold off under Right to Buy — Thatcher’s flagship housing policy.

Since 1980, 1.9 million council homes in England have been sold off under Right to Buy — Thatcher’s flagship housing policy.

https://twitter.com/telegraph/status/1917113465044451655

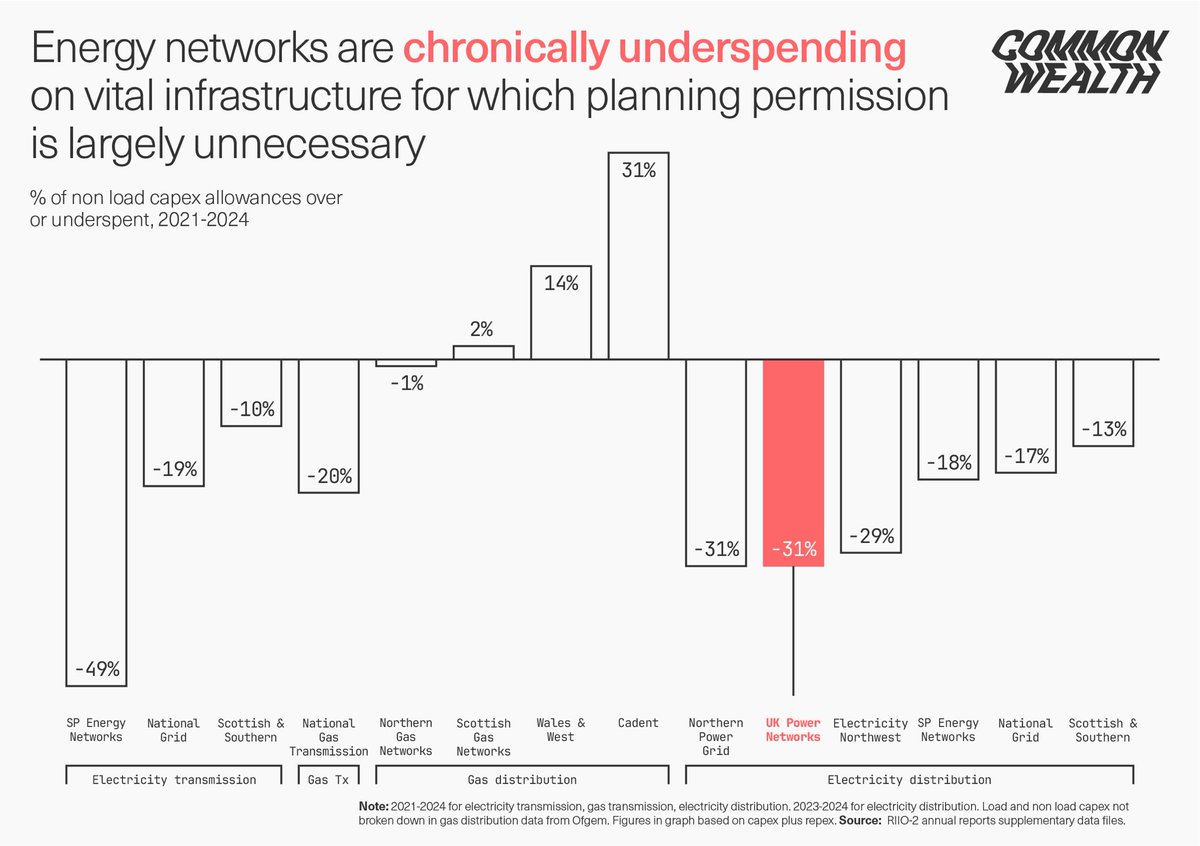

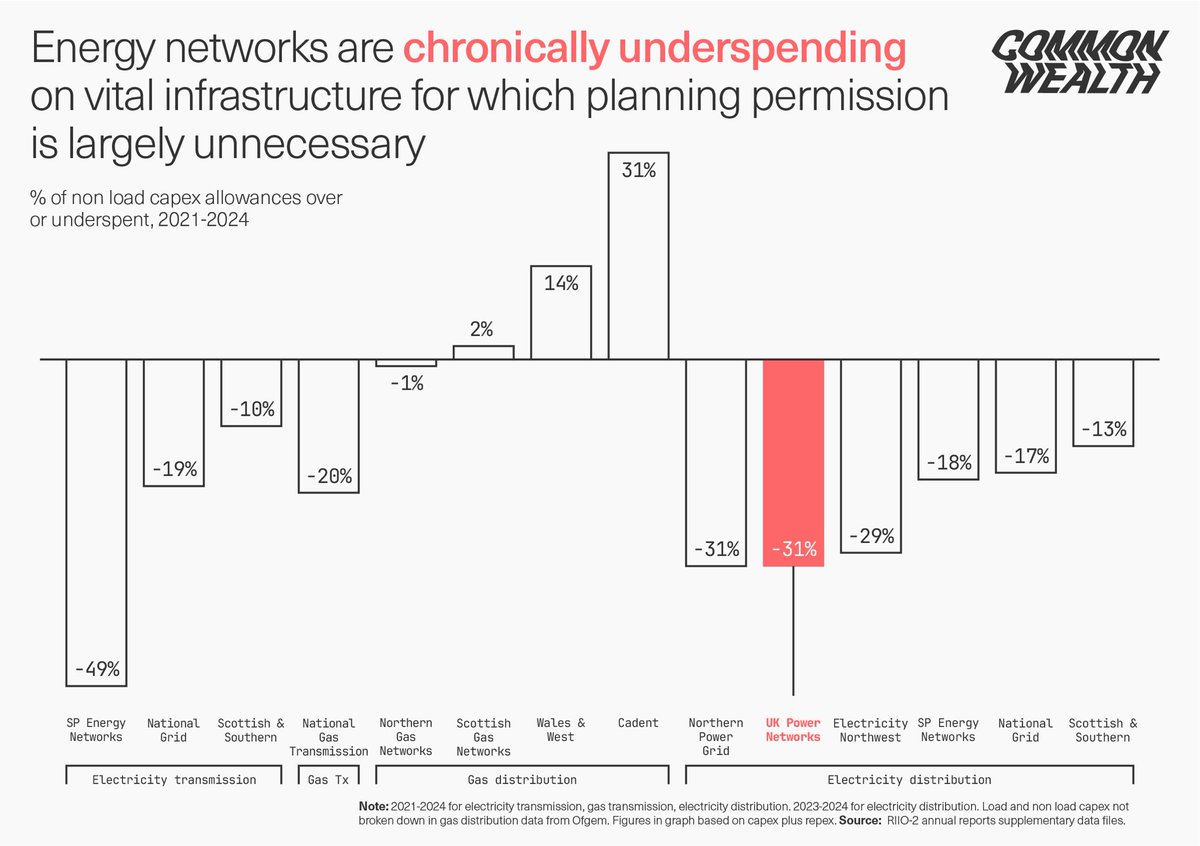

Electricity network companies are under spending on basic asset replacement work by £460 million every year.

Electricity network companies are under spending on basic asset replacement work by £460 million every year.

In the 3 years since Russia invaded Ukraine, we have *still* not decoupled electricity from the price of gas, meaning we still pay far above the price needed.

In the 3 years since Russia invaded Ukraine, we have *still* not decoupled electricity from the price of gas, meaning we still pay far above the price needed.

💧 The largest publicly-listed infrastructure company in Hong Kong has just made a £7 bn bid for a majority stake in Thames Water.

💧 The largest publicly-listed infrastructure company in Hong Kong has just made a £7 bn bid for a majority stake in Thames Water.

Since the austerity era ushered in under the Conservatives, the NHS has seen budgets slashed, and our health service has been forced to do more with less.

Since the austerity era ushered in under the Conservatives, the NHS has seen budgets slashed, and our health service has been forced to do more with less.

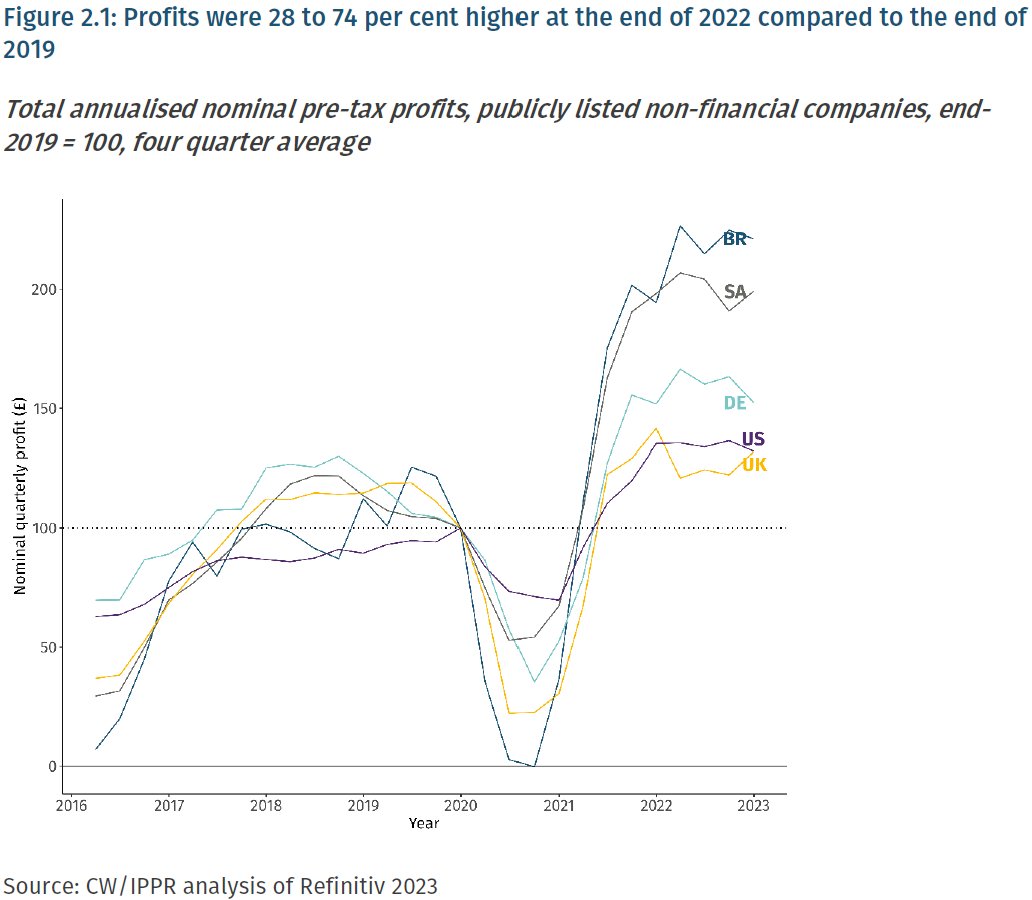

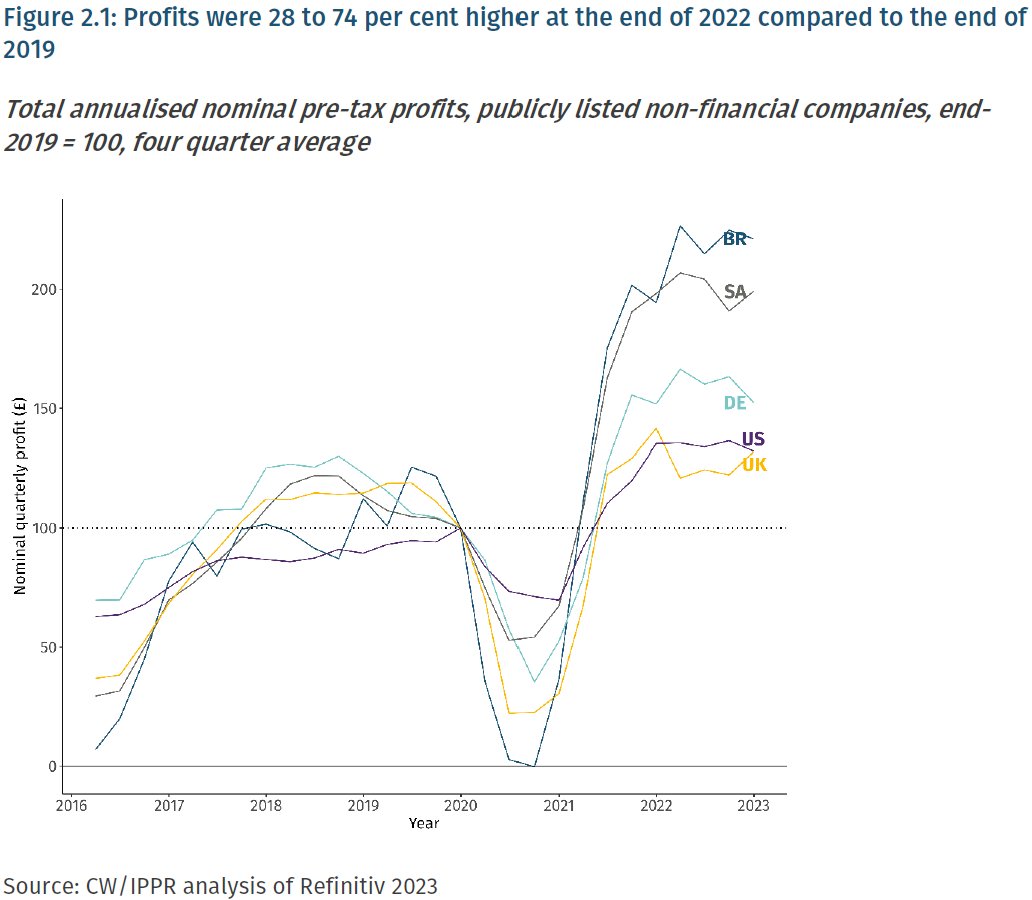

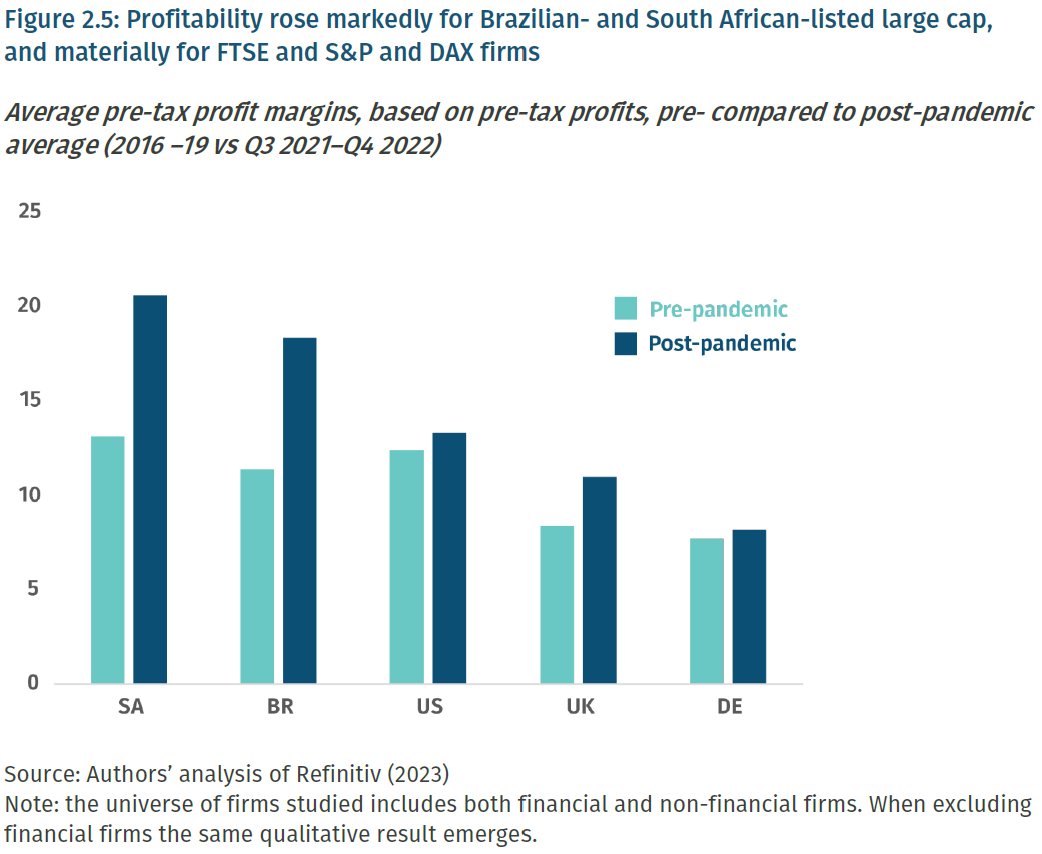

Profit margins – that is, profits as a percentage of revenues – are on average higher than they were pre-pandemic. Margins among FTSE firms were still flat after stripping out commodity extraction firms (like oil & gas) and finance firms.

Profit margins – that is, profits as a percentage of revenues – are on average higher than they were pre-pandemic. Margins among FTSE firms were still flat after stripping out commodity extraction firms (like oil & gas) and finance firms.

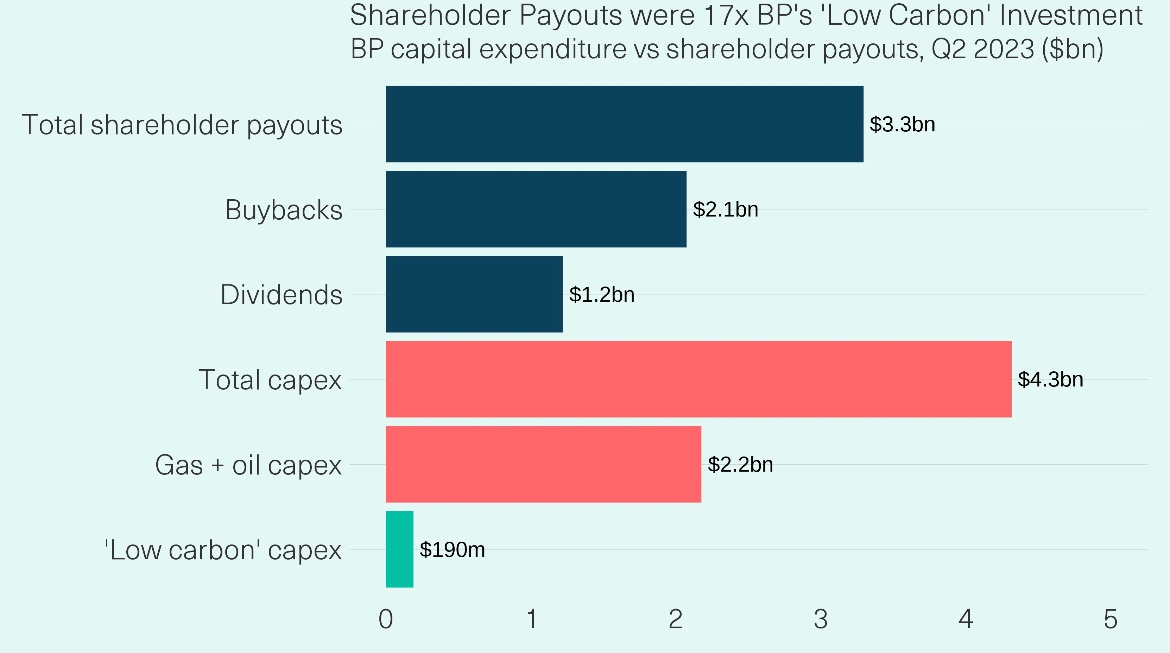

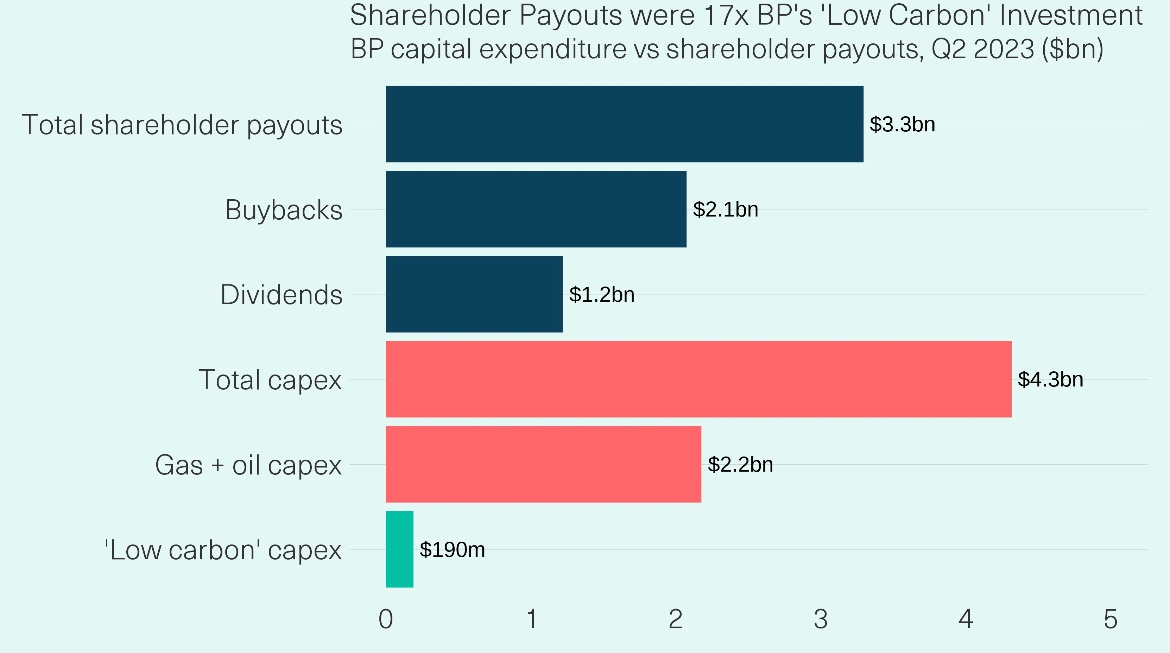

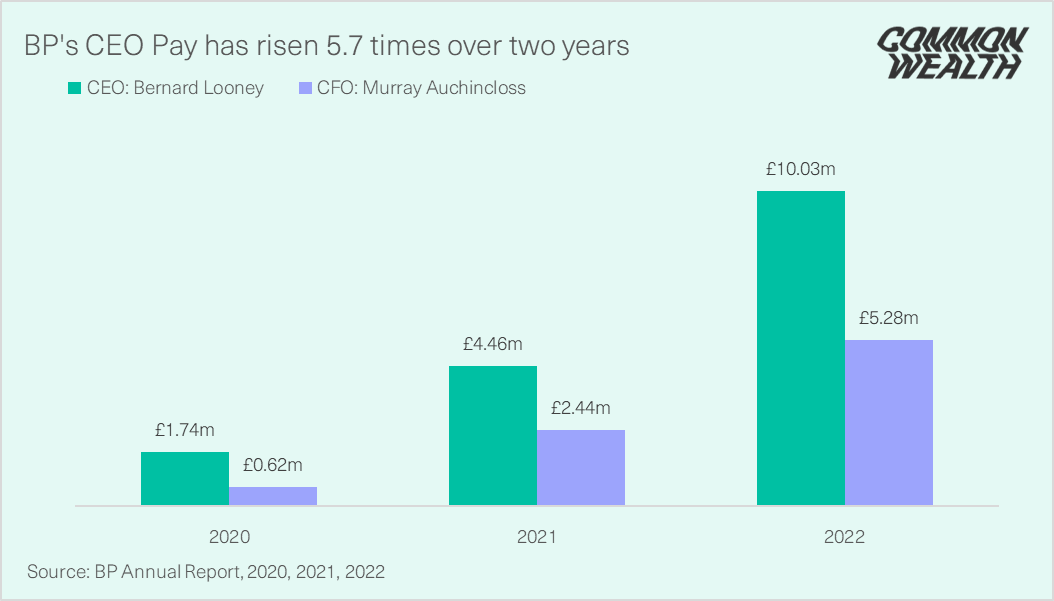

Even as the fossil fuel industry drives “global boiling”, BP continues to be a cash machine for investors.

Even as the fossil fuel industry drives “global boiling”, BP continues to be a cash machine for investors.

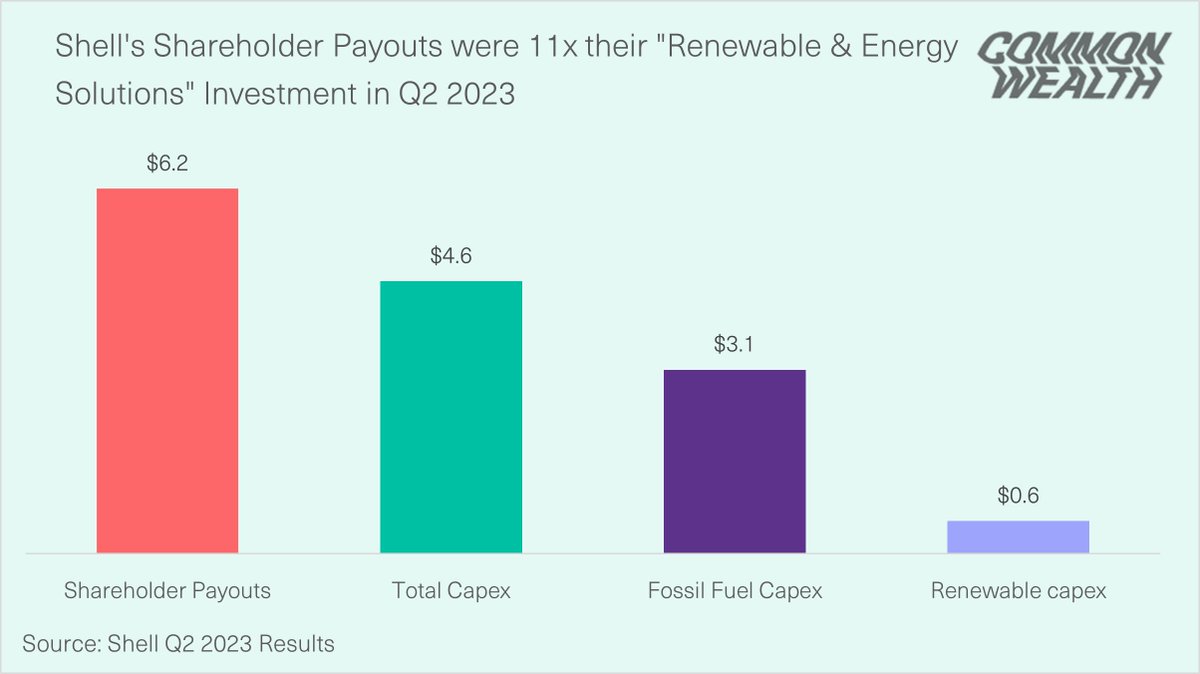

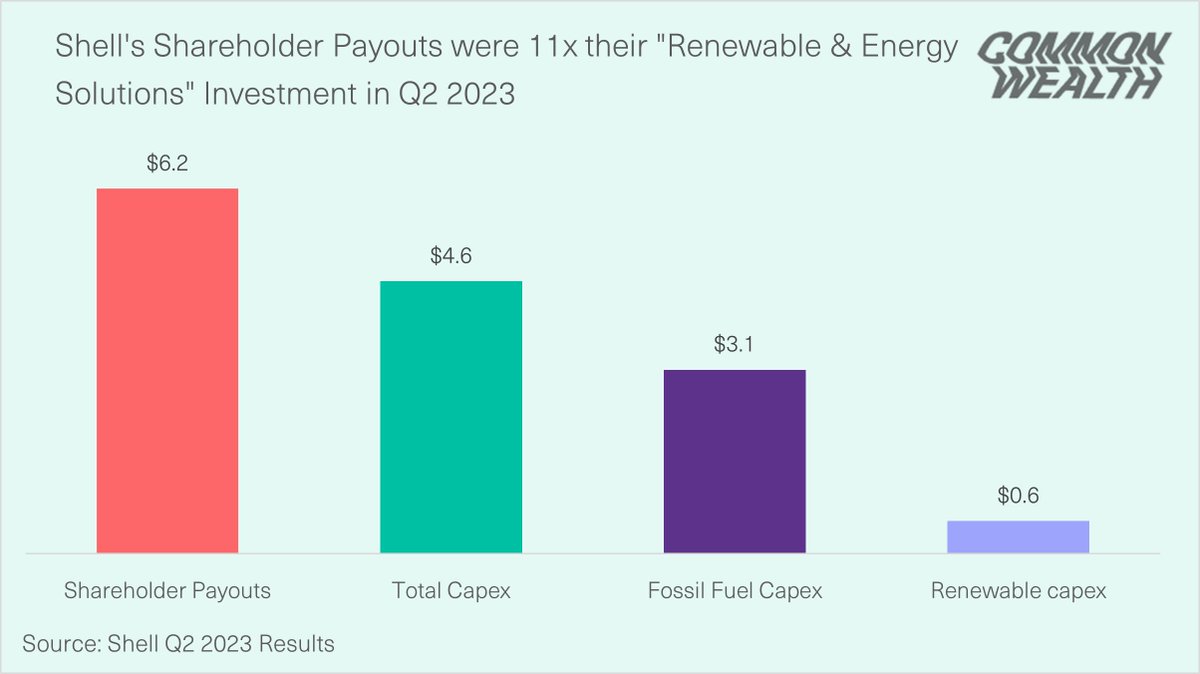

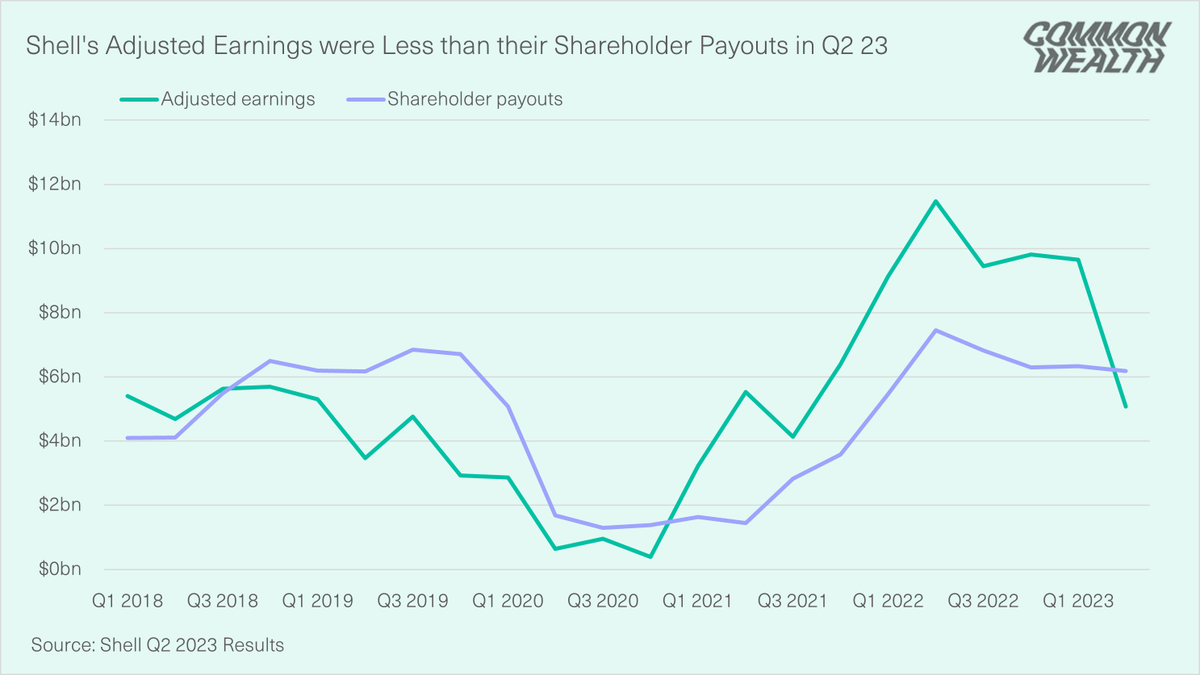

Even as fossil fuels heat the planet, Shell continues to be a cash machine for its investors.

Even as fossil fuels heat the planet, Shell continues to be a cash machine for its investors.

Total payouts to shareholders remain higher than investment.

Total payouts to shareholders remain higher than investment.

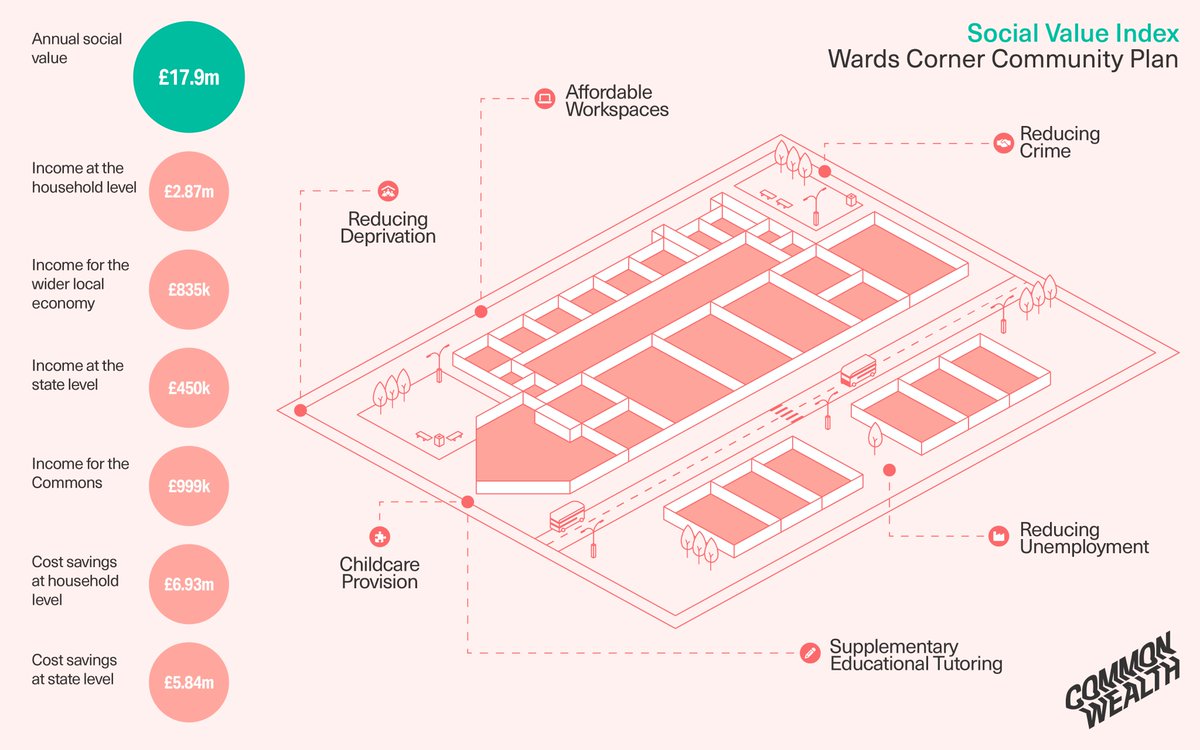

Developed by @adammarqalmeida, the Social Value Index takes into account a broad range of metrics, from childcare provision to air pollution and the impact on social harms and violence, to evaluate the value to local communities.

Developed by @adammarqalmeida, the Social Value Index takes into account a broad range of metrics, from childcare provision to air pollution and the impact on social harms and violence, to evaluate the value to local communities.