Ramblings of a regulatory professional and crypto/investing enthusiast. Irresponsibly long and betting the fiat farm | $BTC $MTPLF $MSTR $TSWCF

How to get URL link on X (Twitter) App

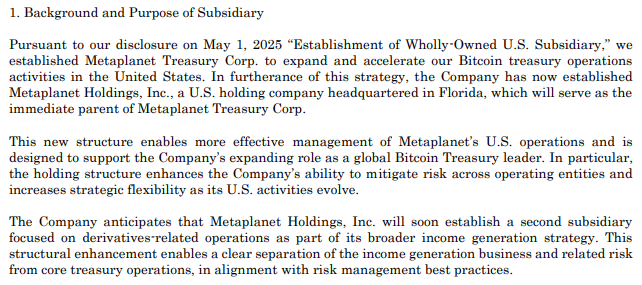

1. Background and Purpose

1. Background and Purpose

https://twitter.com/gerovich/status/1942087330514255980Before diving in here, let's take a moment to appreciate the Metaplanet website. It has all the analytics and metrics you could ask for, as well as a complete archive of ALL relevant disclosures to shareholders. Most of the information I share here can be found/verified on the site, and I would encourage shareholders to bookmark it and review every new disclosure that comes out because there are often hidden nuggets.

Level 1 – BTC Treasury Company Overview

Level 1 – BTC Treasury Company Overview

https://twitter.com/bitcoinrachy/status/1938805402604576947Diversification is Dead: the Case for Bitcoin-centration