mostly investing opinions with some warriors basketball and politics sprinkled in. all opinions are my own and not any recommendation to others to buy/sell

2 subscribers

How to get URL link on X (Twitter) App

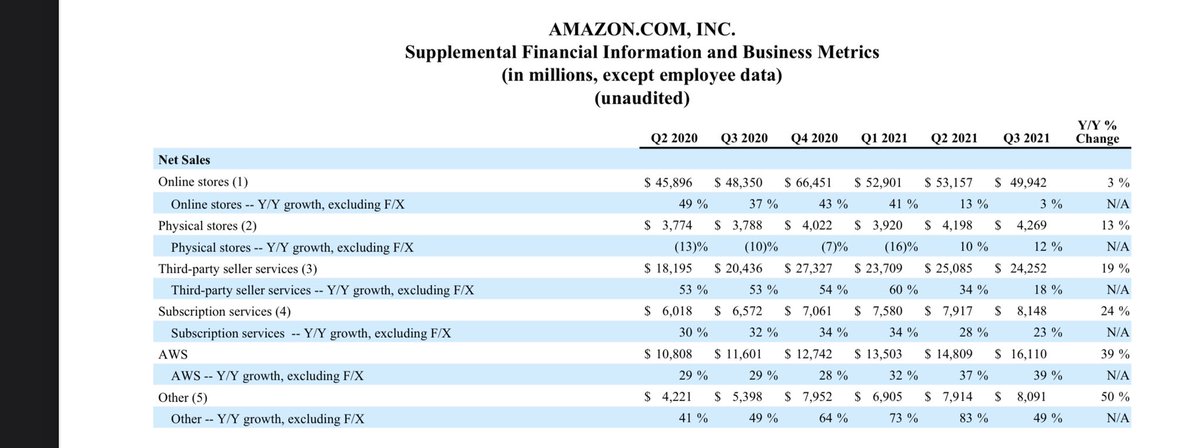

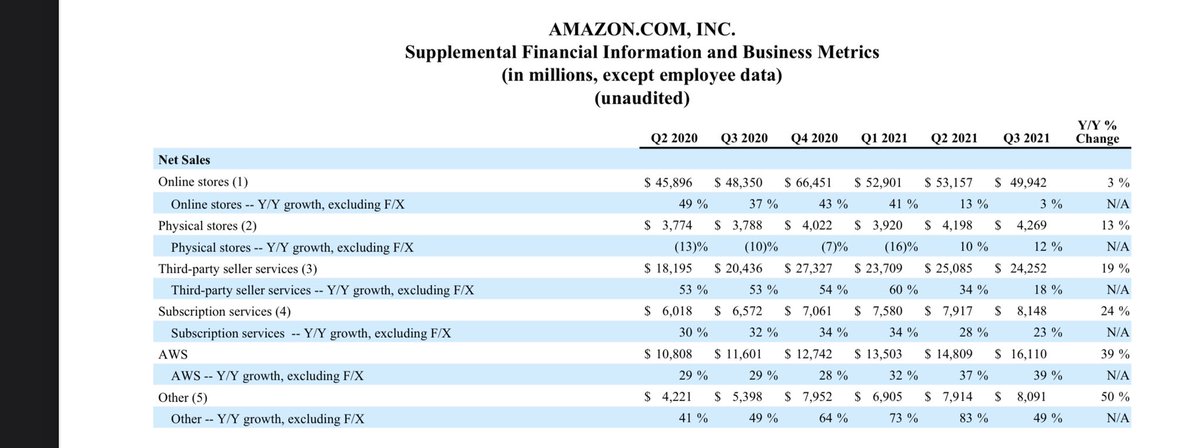

I can see ad rev flat or up $1B at most though supply chain issues make me think flat or down is possible. Even if up a full $1B on ads that would be just 15% growth which would be the headline…

I can see ad rev flat or up $1B at most though supply chain issues make me think flat or down is possible. Even if up a full $1B on ads that would be just 15% growth which would be the headline…

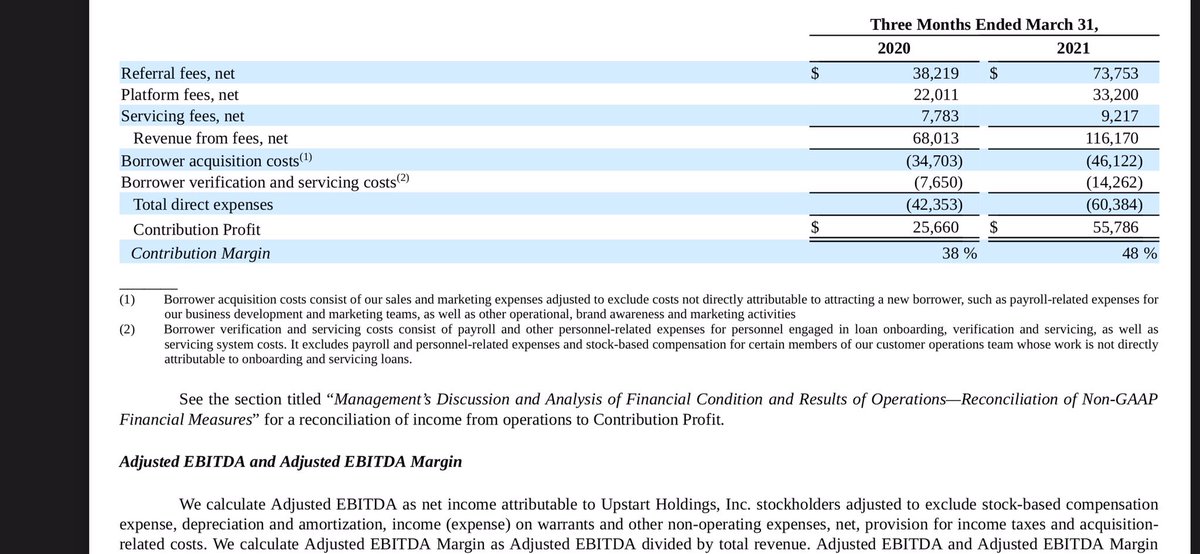

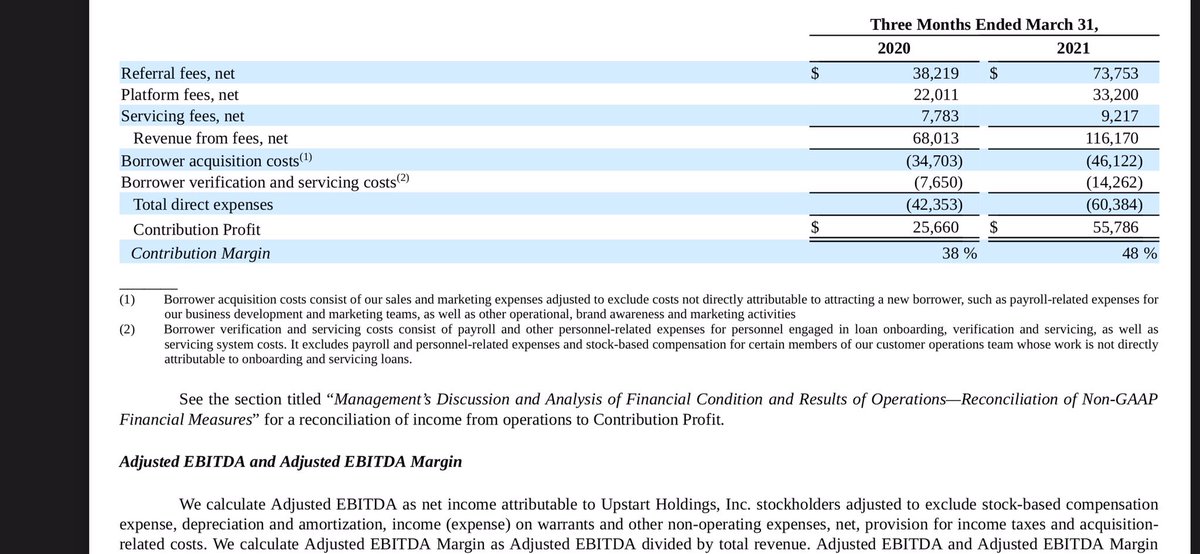

Good news is that the company did raise a lot of cash with 465M on the books, i he bad news is they lost 54M in cash from ops this q off revs off 120M in revs which is god awful. Adv rev did rise 200% but thats just 12M now.

Good news is that the company did raise a lot of cash with 465M on the books, i he bad news is they lost 54M in cash from ops this q off revs off 120M in revs which is god awful. Adv rev did rise 200% but thats just 12M now.

Still see $amzn and $aapl being good opptys into earnings with $amzn finally breaking out post earnings. Have sold off the last 3 crushed reports, with sentiment changing and union win think it wont sell off a 4th time. Also prime day back to June which might not be in estimates

Still see $amzn and $aapl being good opptys into earnings with $amzn finally breaking out post earnings. Have sold off the last 3 crushed reports, with sentiment changing and union win think it wont sell off a 4th time. Also prime day back to June which might not be in estimates