Not a bull, not a bear. Just TA. (Liquidity & market psychology).

I will never DM you first.

Not Financial Advice

8 subscribers

How to get URL link on X (Twitter) App

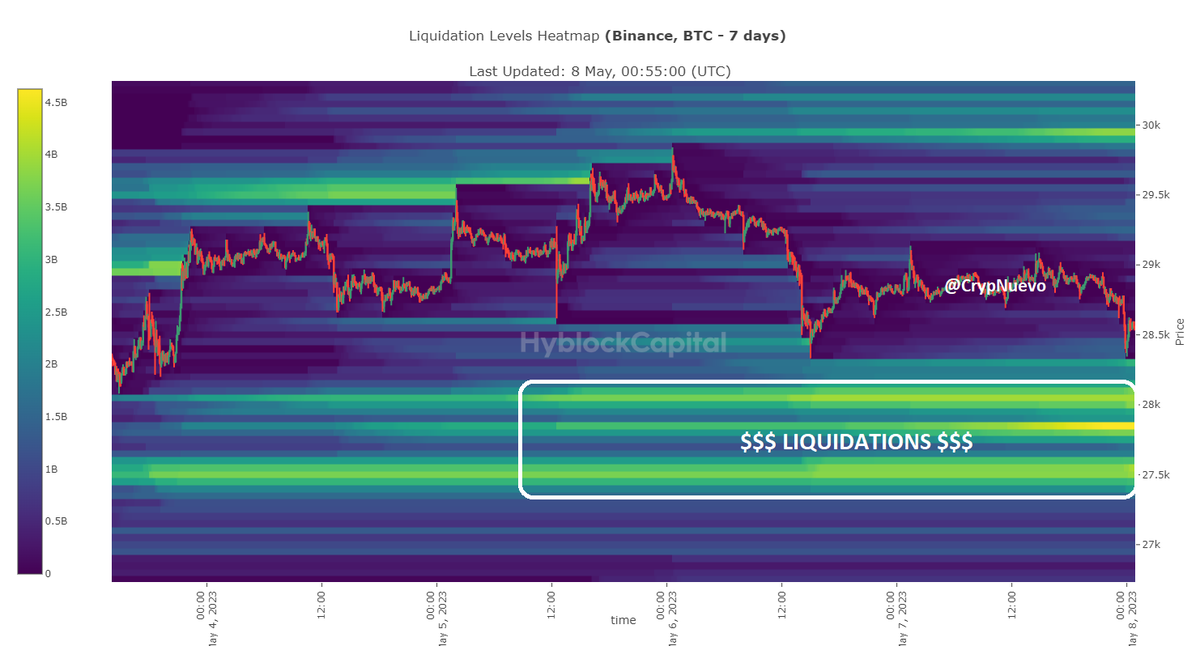

It means that there shoudn't be much left to sell.

It means that there shoudn't be much left to sell.

Although we could, it doesn't mean that we'll get an inmediate ATH - there might be a pullback in-between like in Sep' 21.

Although we could, it doesn't mean that we'll get an inmediate ATH - there might be a pullback in-between like in Sep' 21.

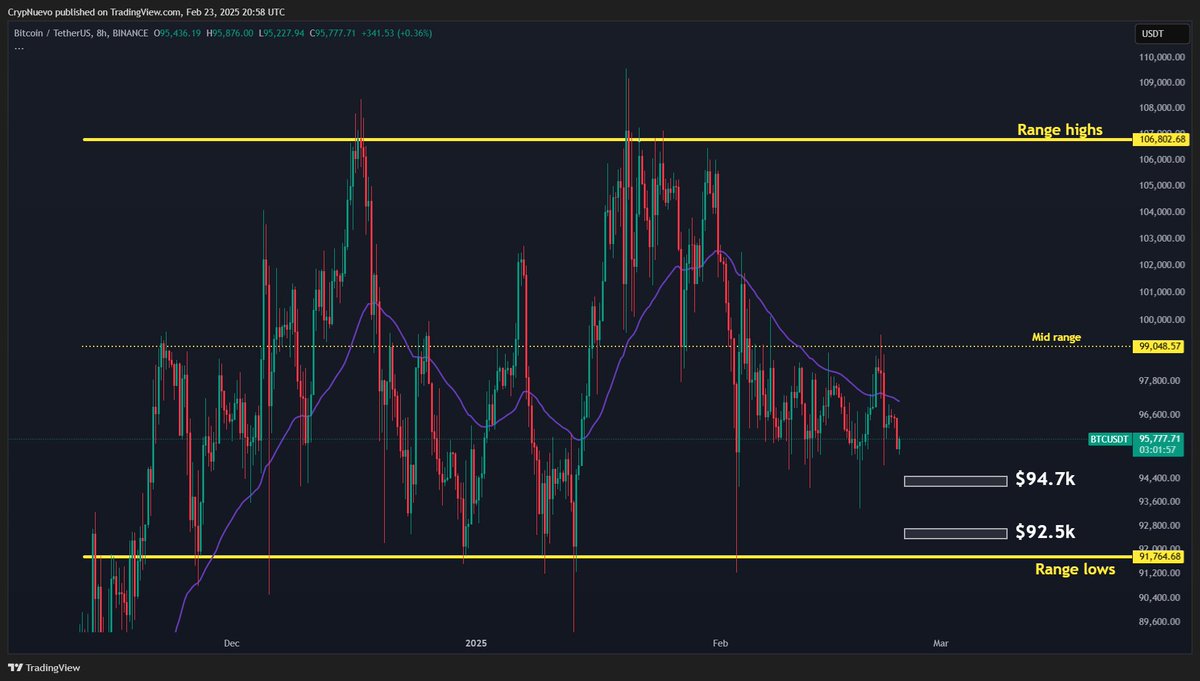

Defining:

Defining:

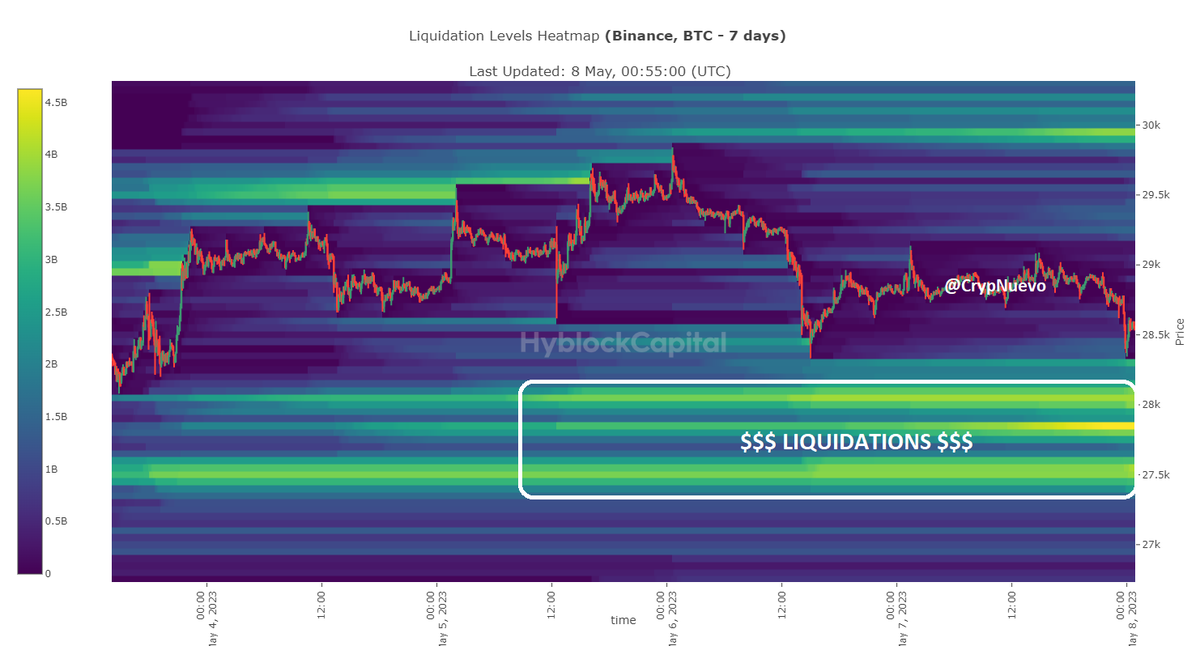

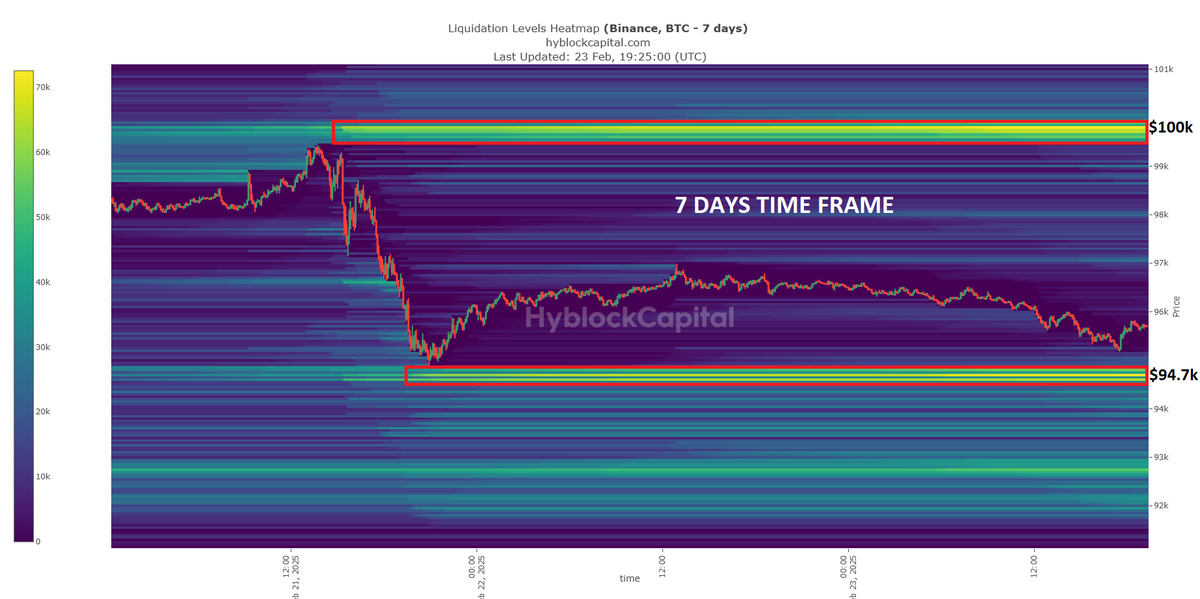

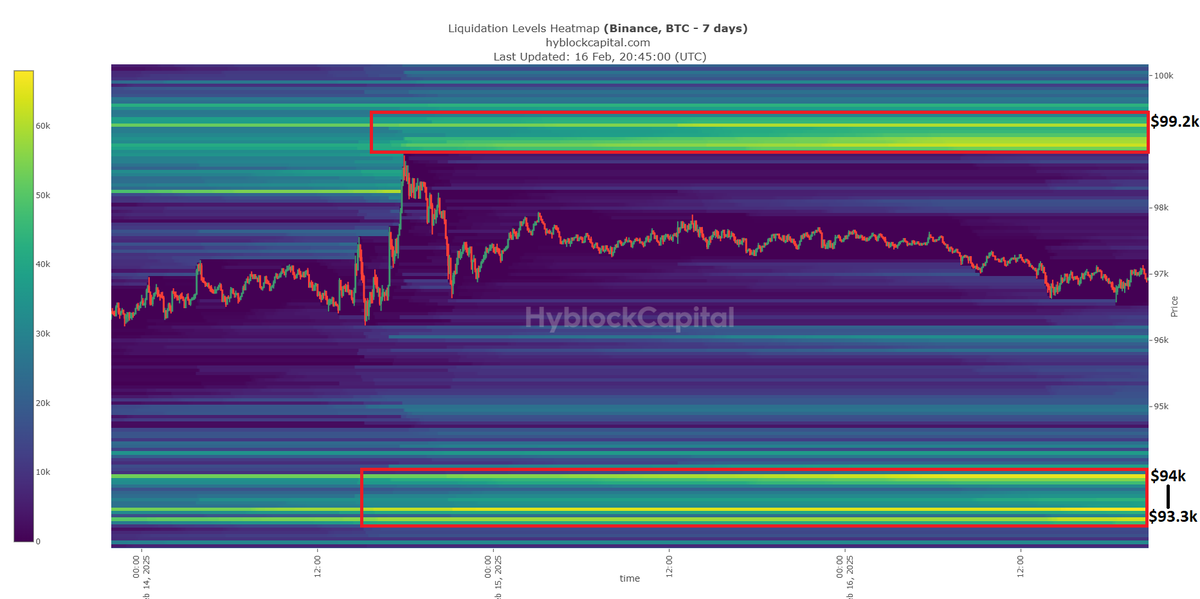

The liquidations data gave us the best trade last week: a long from $93.3k until $99k.

The liquidations data gave us the best trade last week: a long from $93.3k until $99k.

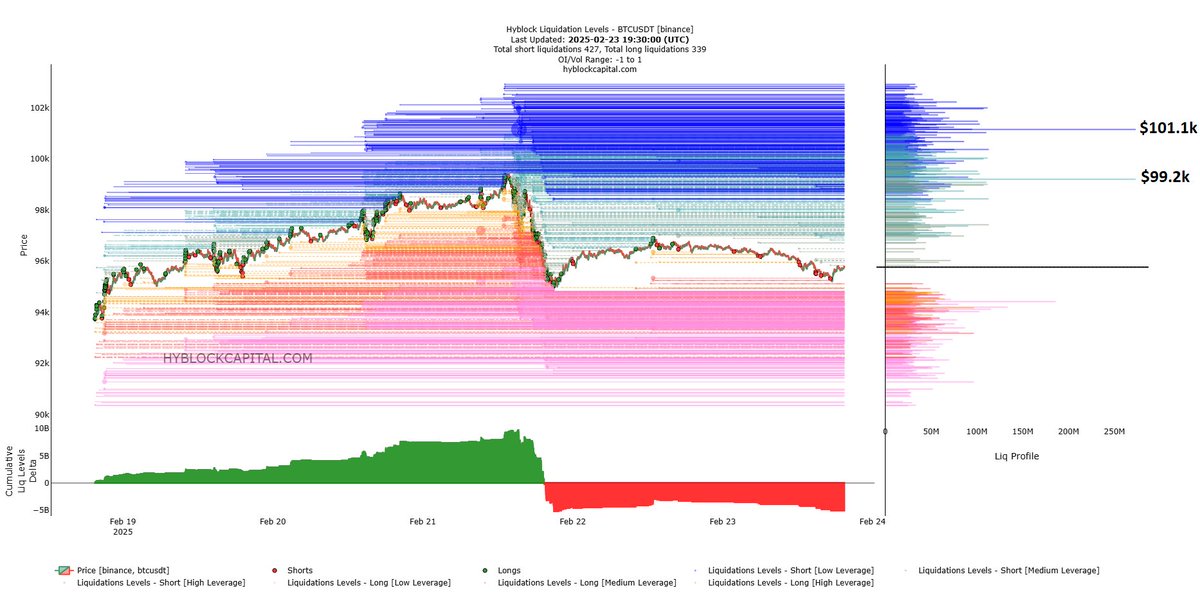

Liquidity in both sides.

Liquidity in both sides.

Before vs after:

Before vs after:

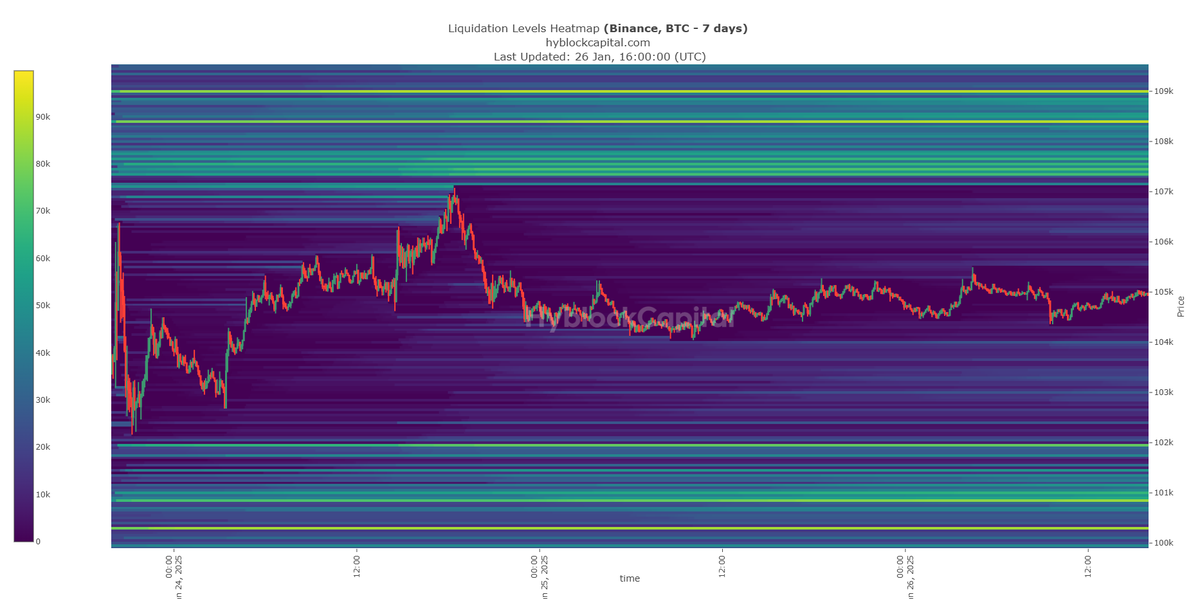

There isn't any clear on-chain data regarding liquidations atm.

There isn't any clear on-chain data regarding liquidations atm.

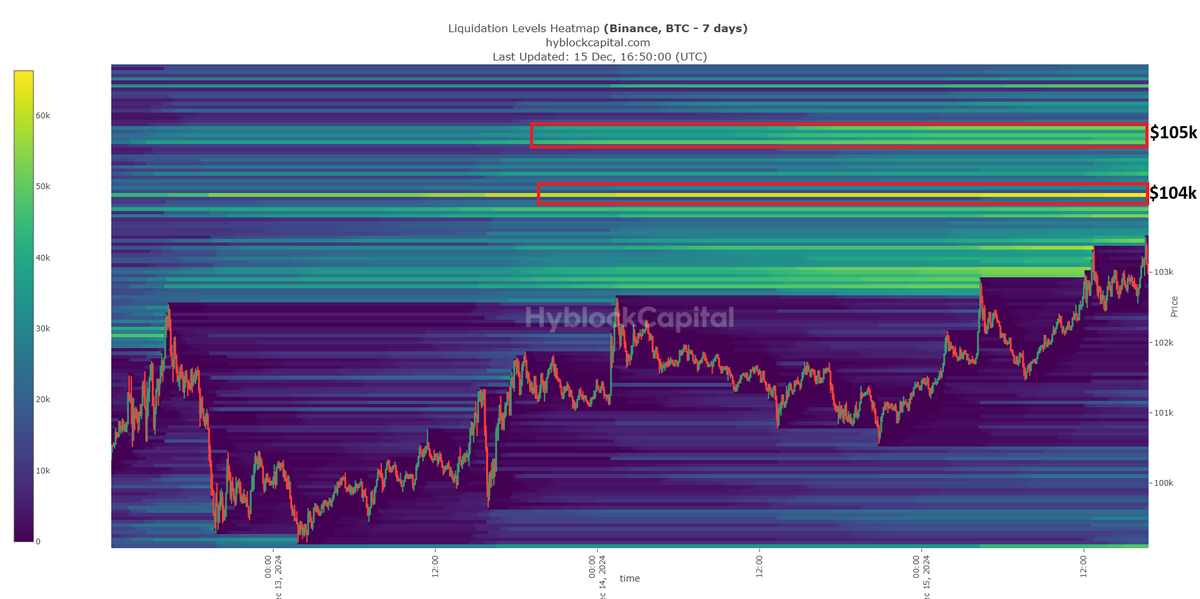

Last Wednesday FOMC's dump was likely a shakeout and not a turning point for 2 reasons:

Last Wednesday FOMC's dump was likely a shakeout and not a turning point for 2 reasons:

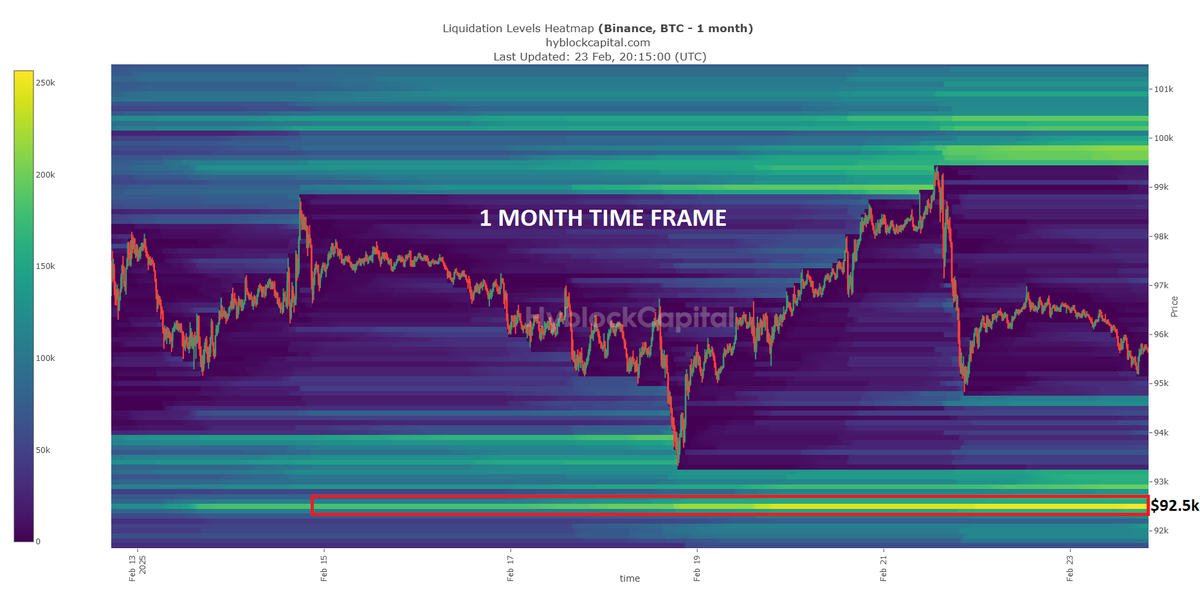

Short liquidations keep appearing higher which makes me think that we continue going higher towards them in the mid-term.

Short liquidations keep appearing higher which makes me think that we continue going higher towards them in the mid-term.

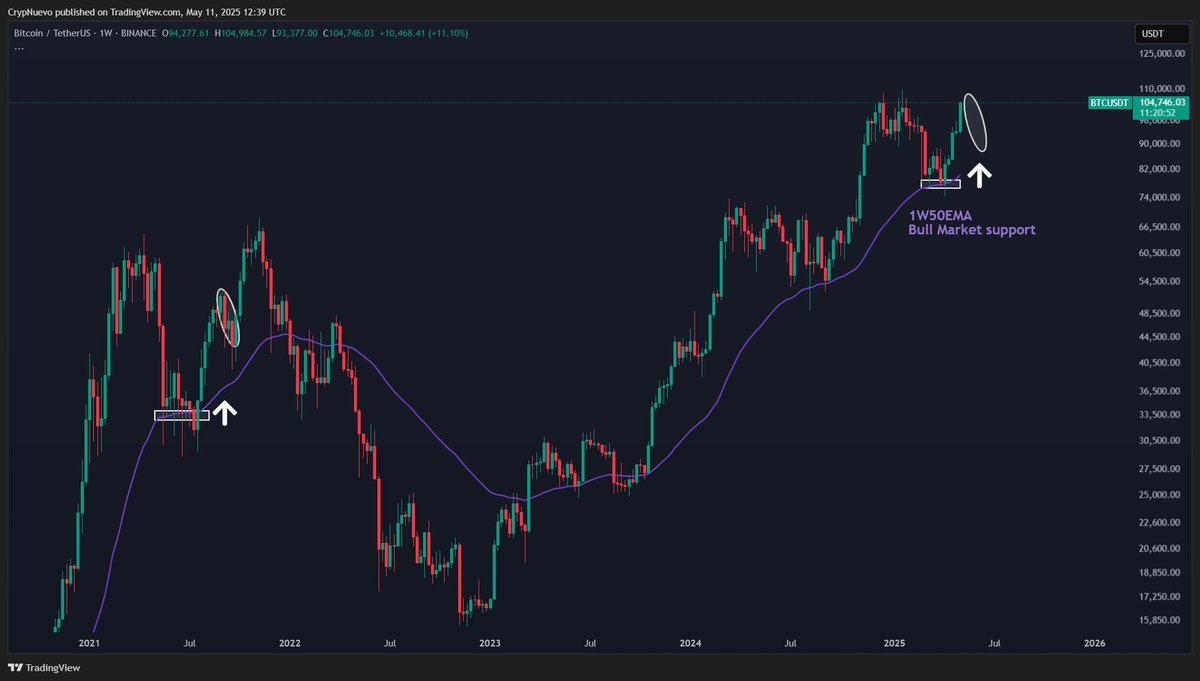

From a liquidity data perspective, it was clear that we were going to see a spike between $77k-$77.5k.

From a liquidity data perspective, it was clear that we were going to see a spike between $77k-$77.5k.

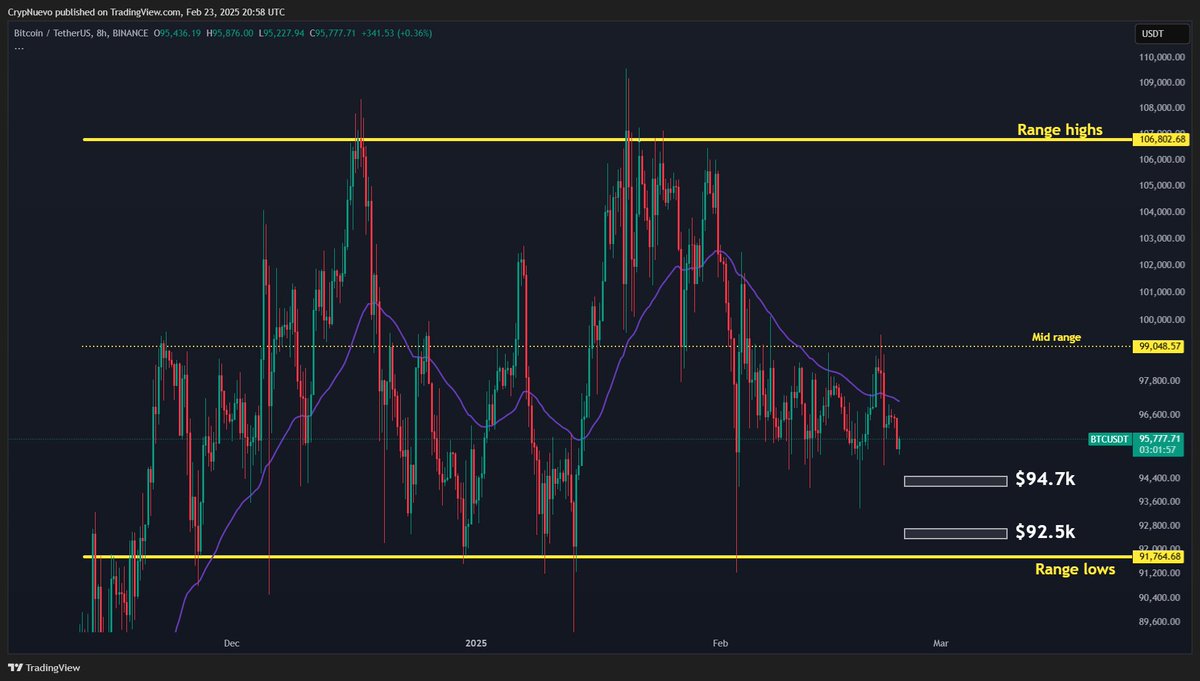

The first thing to know is that there will be some volatility on Wednesday while counting votes and knowing who is winning the US elections.

The first thing to know is that there will be some volatility on Wednesday while counting votes and knowing who is winning the US elections.

We could see some volatility related to the monthly close.

We could see some volatility related to the monthly close.

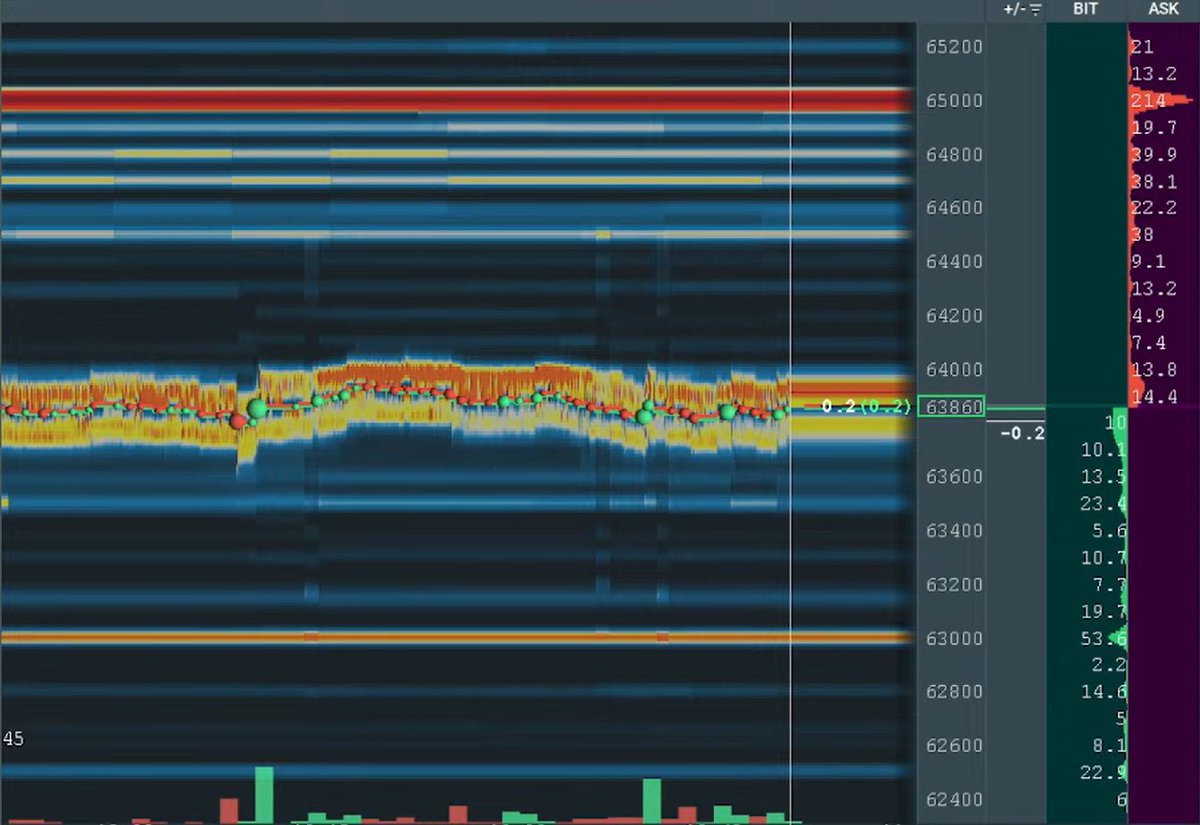

Wicks have priority in my trading system, they give us a lot of information:

Wicks have priority in my trading system, they give us a lot of information:

The orderbook is showing a lot of liquidity at the wick:

The orderbook is showing a lot of liquidity at the wick:

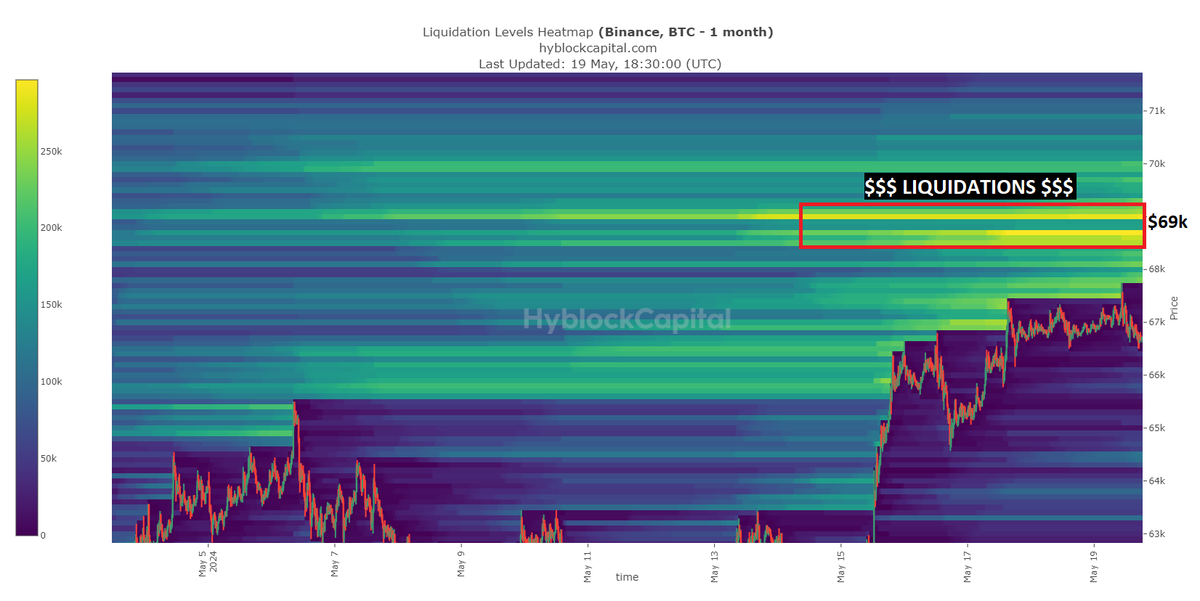

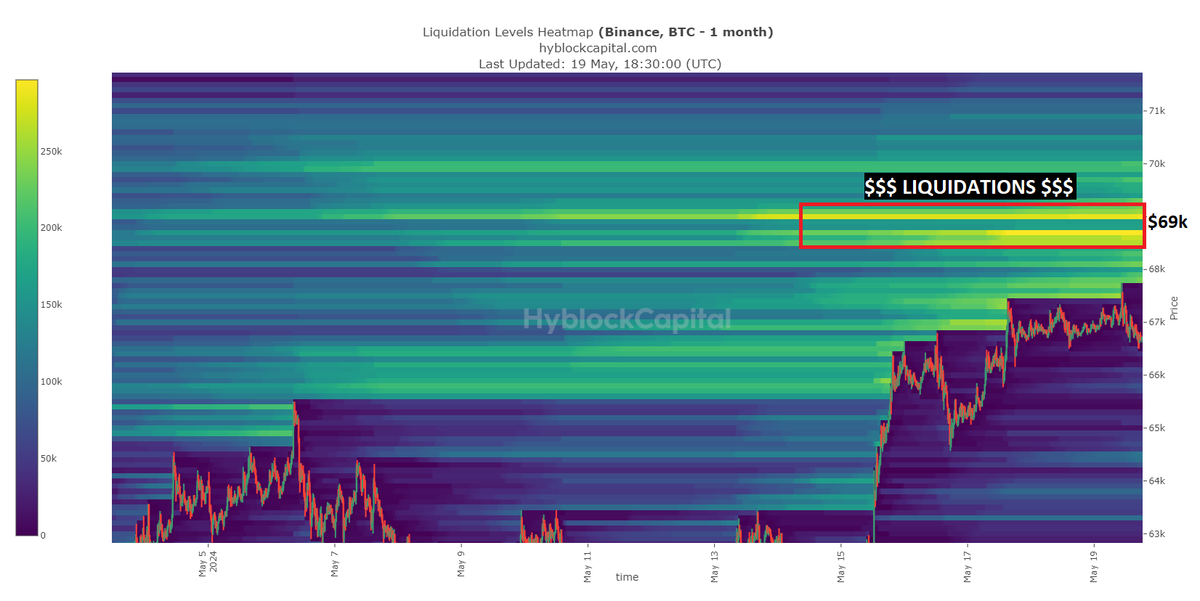

Those HTF liquidations at $69k are short liquidations from swing traders that took the wrong trade.

Those HTF liquidations at $69k are short liquidations from swing traders that took the wrong trade.

So far, $BTC is following the projection from our last Sunday update.

So far, $BTC is following the projection from our last Sunday update.

We didn't see the stophunt to $64k which is actually good news.

We didn't see the stophunt to $64k which is actually good news.

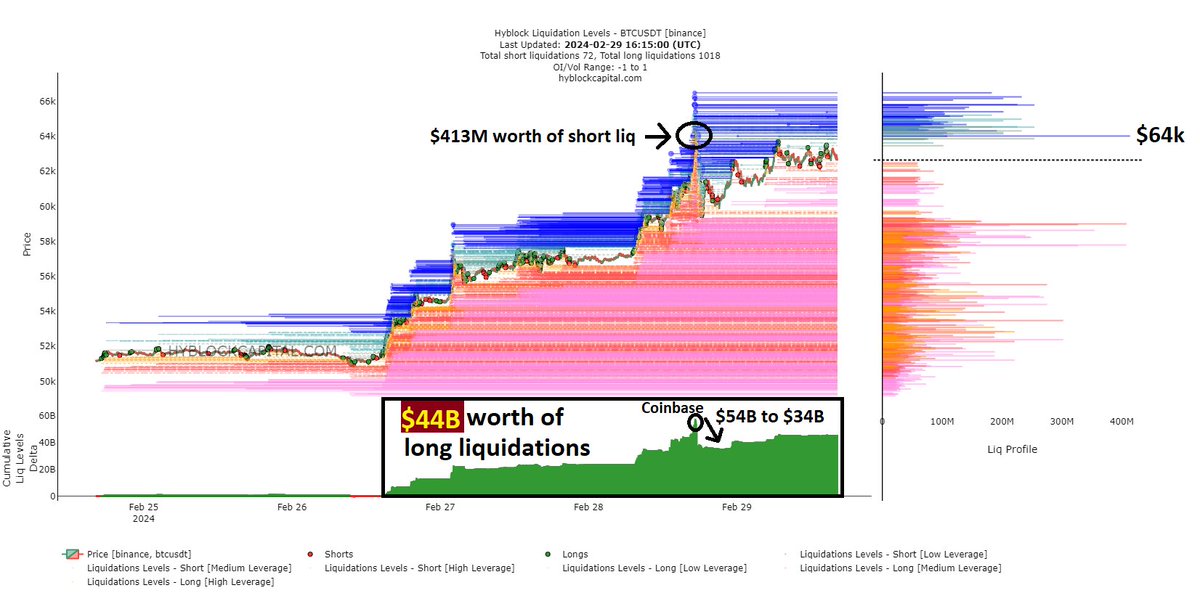

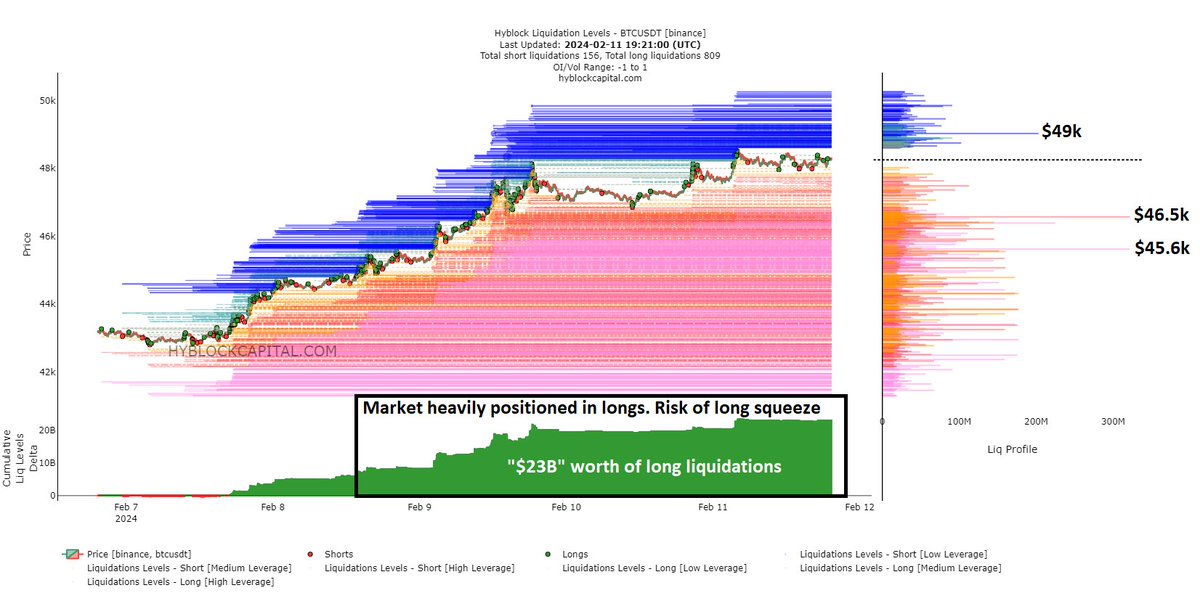

The liquidation levels are showing a great amount of long liquidations at the moment which puts the market at risk of a new long squeeze.

The liquidation levels are showing a great amount of long liquidations at the moment which puts the market at risk of a new long squeeze.

I found a few interesting things in the liquidation levels:

I found a few interesting things in the liquidation levels:

August CPI is expected to rise from previous 3.2% to 3.6%

August CPI is expected to rise from previous 3.2% to 3.6%