We're here for all of your crypto tax needs! We offer crypto reports, tax returns, consultations, and a crypto tax course 🇺🇸 hello@cryptotaxgirl.com

How to get URL link on X (Twitter) App

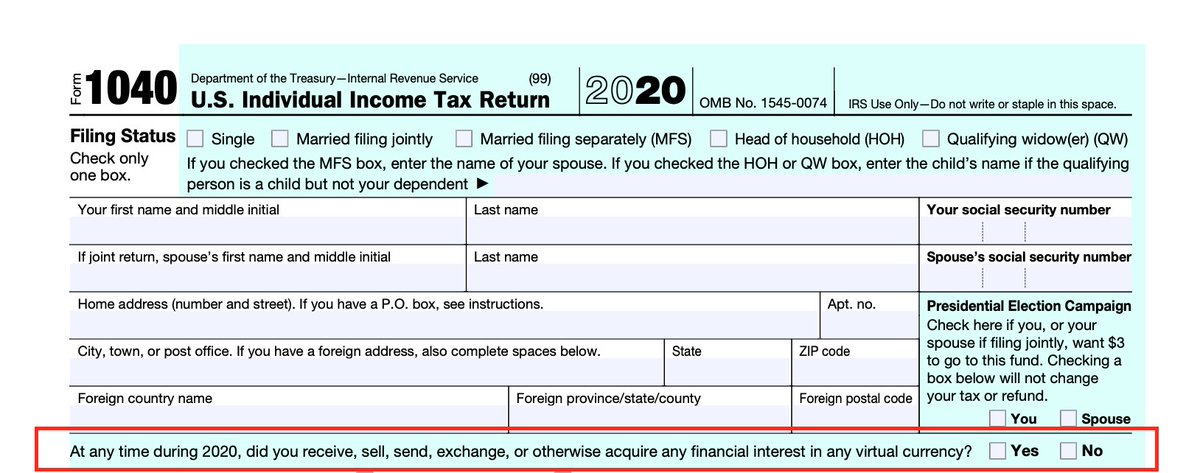

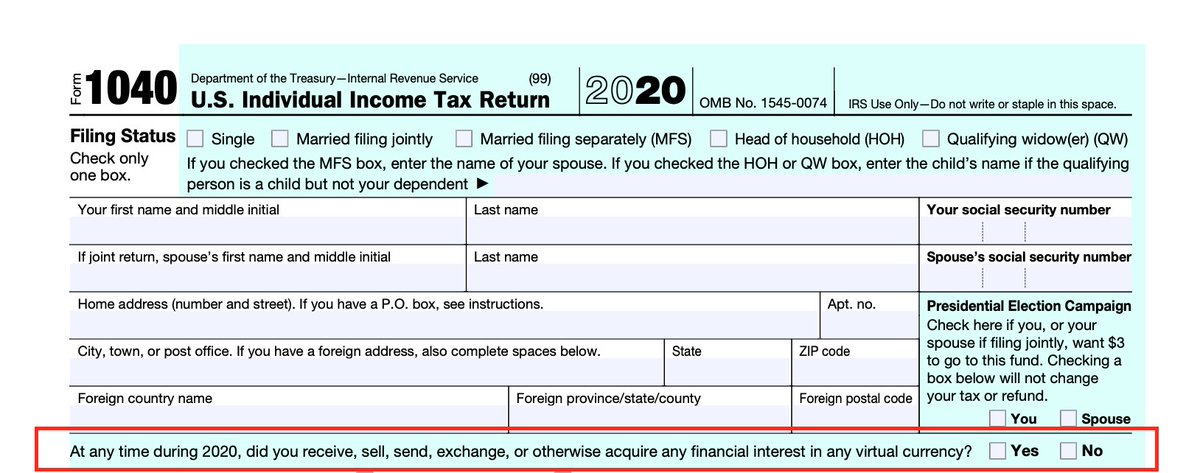

Answer YES if you:

Answer YES if you:

The IRS plans to use interviews, open-source searches, electronic surveillance, social media searches, and Grand Jury subpoenas given to a variety of companies.

The IRS plans to use interviews, open-source searches, electronic surveillance, social media searches, and Grand Jury subpoenas given to a variety of companies.