How to get URL link on X (Twitter) App

Before we begin, what is the Darvas Box Theory?

Before we begin, what is the Darvas Box Theory?

What's amazing is this pattern isn't just something that happened back in the 1900s, it still happens today. AND, it's not uncommon for stocks to top into these levels either.

What's amazing is this pattern isn't just something that happened back in the 1900s, it still happens today. AND, it's not uncommon for stocks to top into these levels either.

Before we get into the lessons, here's a top resource that every trader MUST read:

Before we get into the lessons, here's a top resource that every trader MUST read:

Here are the steps we're going to lay out for you using the RS Line:

Here are the steps we're going to lay out for you using the RS Line:

Zanger's foundation is built on William O'Neil & Jesse Livermore.

Zanger's foundation is built on William O'Neil & Jesse Livermore.

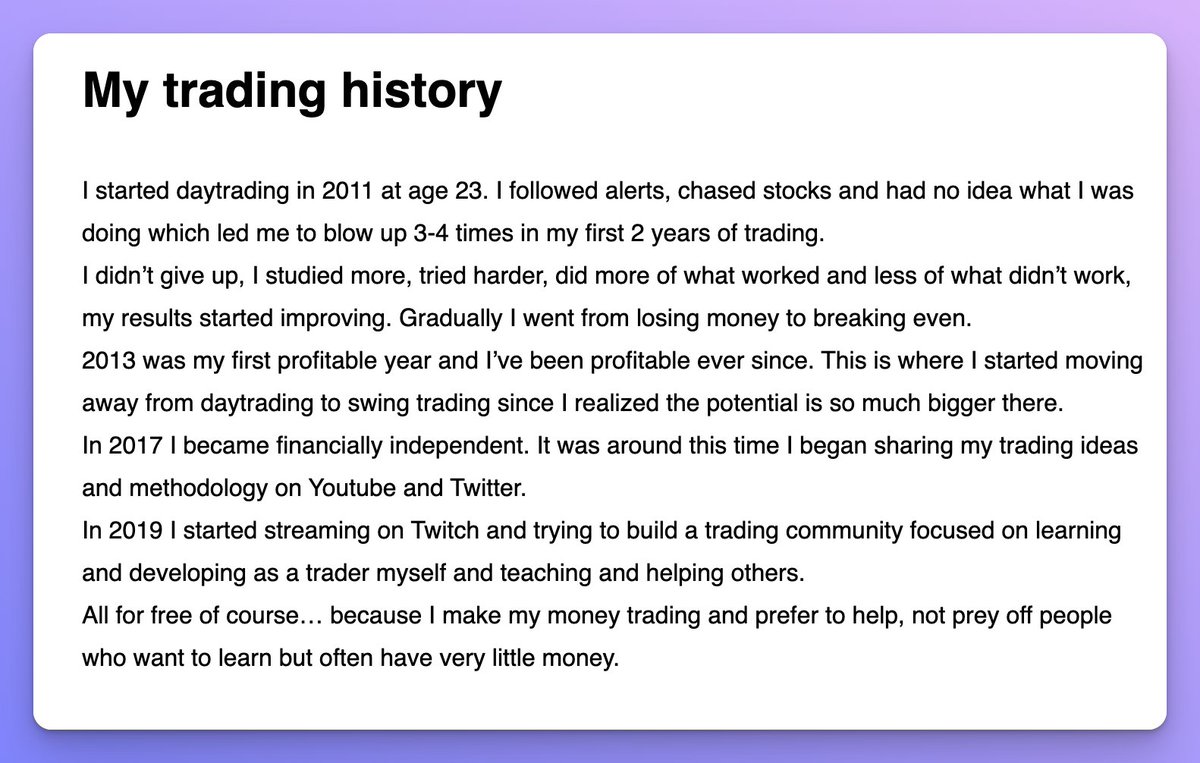

A little more on Kristjan:

A little more on Kristjan: