How to get URL link on X (Twitter) App

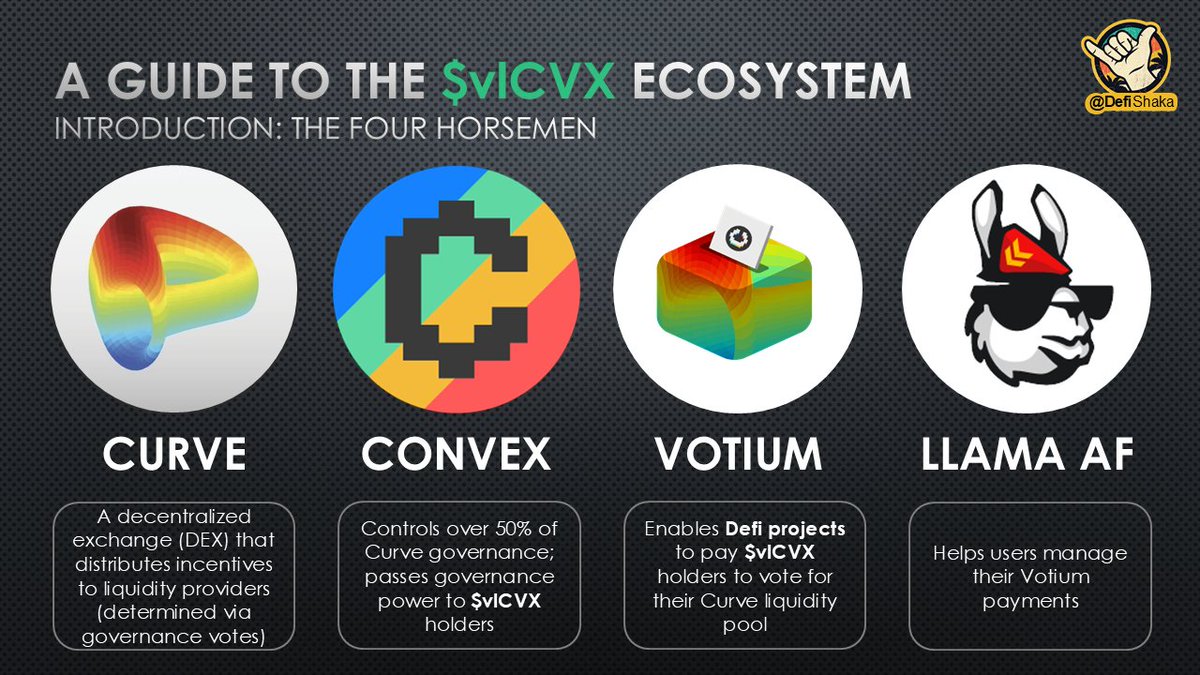

(2/8) So why do Defi projects pay for your Convex voting power?

(2/8) So why do Defi projects pay for your Convex voting power?

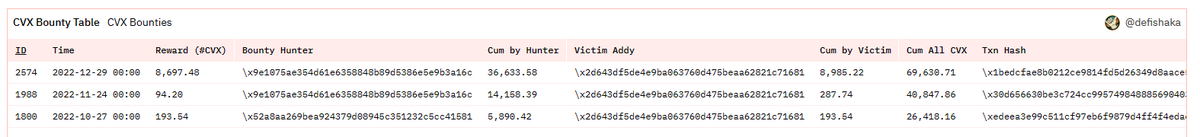

@OlympusDAO 2 / Here are the 3 bounty claims made against @OlympusDAO, with the most recent resulting in a bounty of 8,697.48 $CVX.

@OlympusDAO 2 / Here are the 3 bounty claims made against @OlympusDAO, with the most recent resulting in a bounty of 8,697.48 $CVX.

https://twitter.com/DefiShaka/status/1606131537472155650@DuneAnalytics 2 / Here are the CVX Bounty Hunter stats:

https://twitter.com/DefiMoon/status/1606028595289169921?s=20&t=PGicItdiLBXD7LOJCm2Frw

2 / View Terra's full $vlCVX history on my @DuneAnalytics dashboard:

2 / View Terra's full $vlCVX history on my @DuneAnalytics dashboard:

2 / $CVX from the top 100 unlockers was allocated as follows (by #CVX):

2 / $CVX from the top 100 unlockers was allocated as follows (by #CVX):