CEO & Portfolio Manager | JD 🏛 | Long-Term Buy & Hold Investor Focused on Buying Undervalued High-Quality Stocks 💵 | Not Investment Advice ‼️

How to get URL link on X (Twitter) App

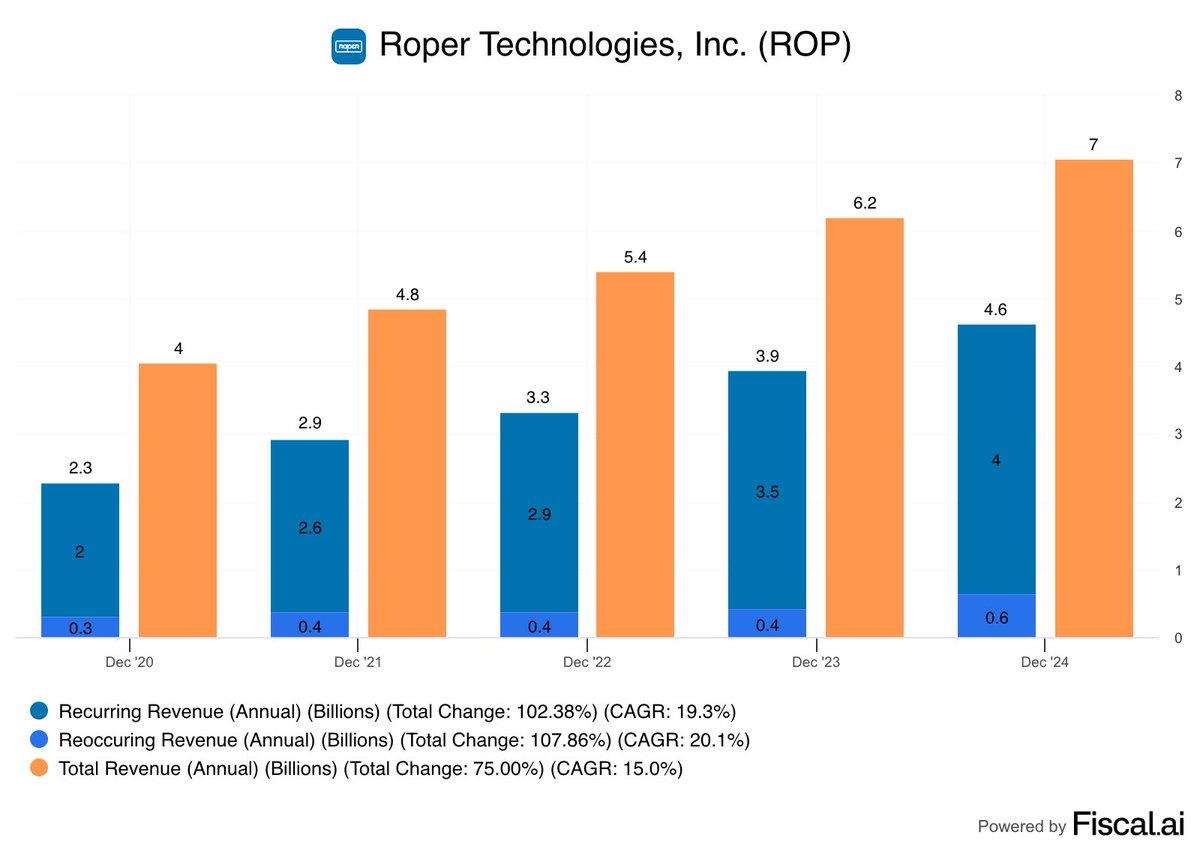

1. Roper Technologies $ROP (Mon AM)

1. Roper Technologies $ROP (Mon AM)

1. Novo Nordisk $NVO 🧬

1. Novo Nordisk $NVO 🧬

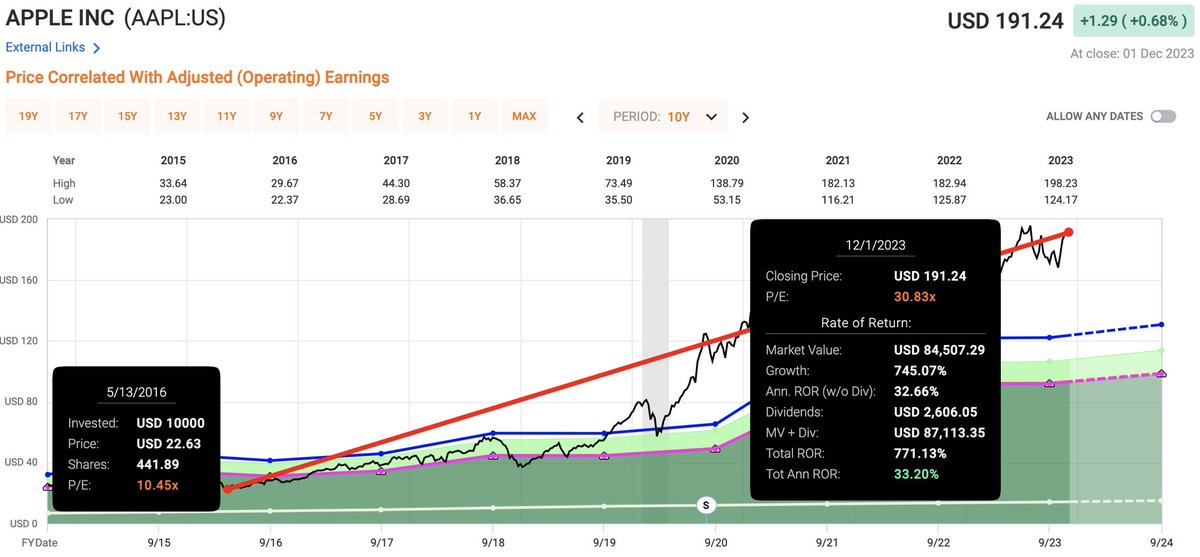

1️⃣ Apple $AAPL

1️⃣ Apple $AAPL

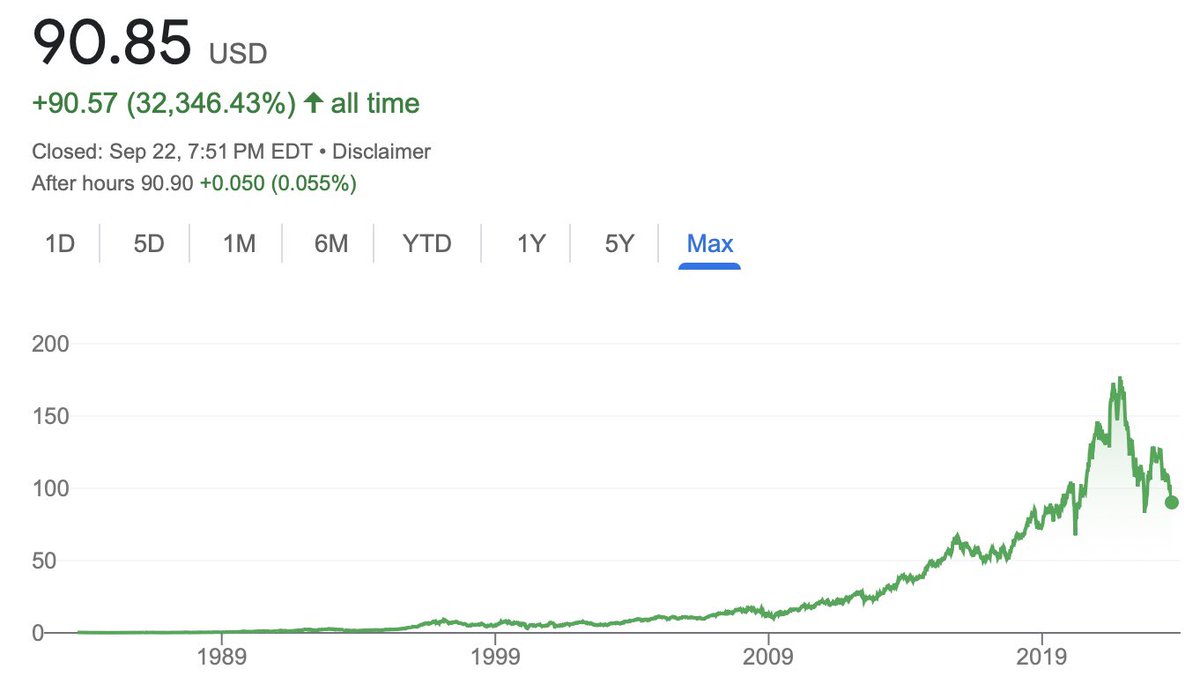

1️⃣ BlackRock $BLK (-33%)

1️⃣ BlackRock $BLK (-33%)

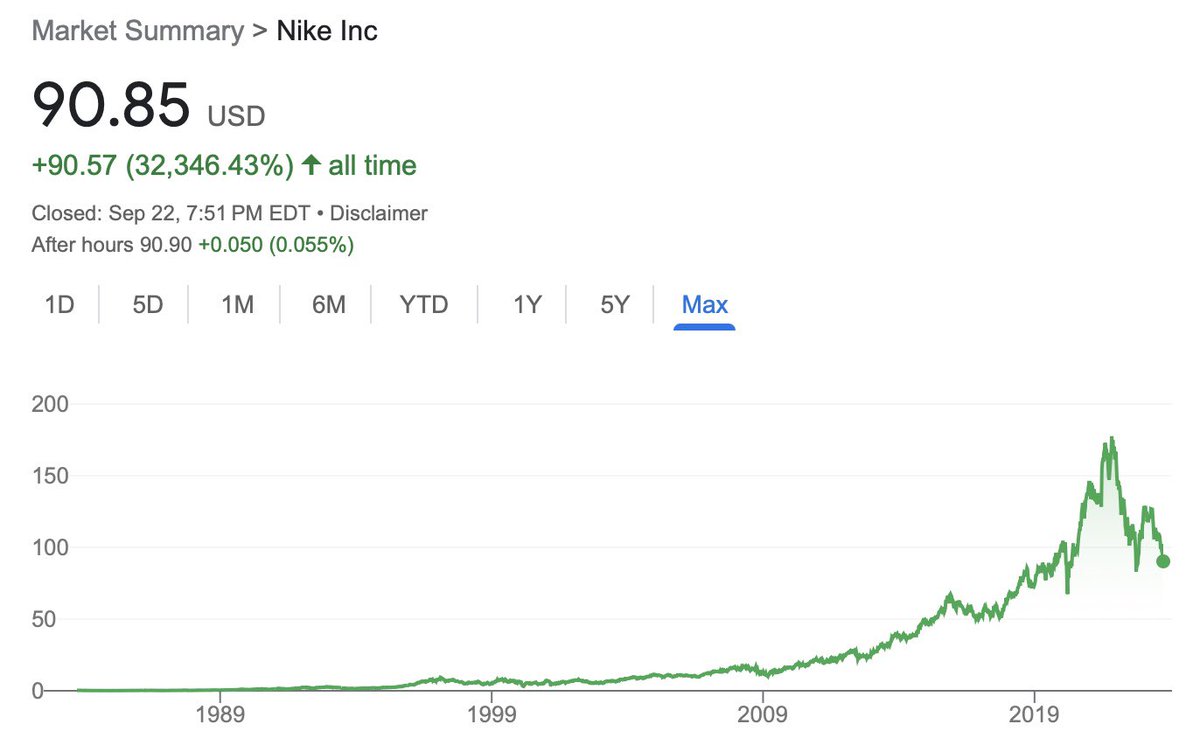

1️⃣ Nike $NKE

1️⃣ Nike $NKE