Distilling the next big investment narrative—before it moves markets.

3 subscribers

How to get URL link on X (Twitter) App

@BittelJulien 2/ Currently, $BTC has been oscillating within a defined range for 6 months.

@BittelJulien 2/ Currently, $BTC has been oscillating within a defined range for 6 months.

2/ Origin of the Strategy:

2/ Origin of the Strategy:

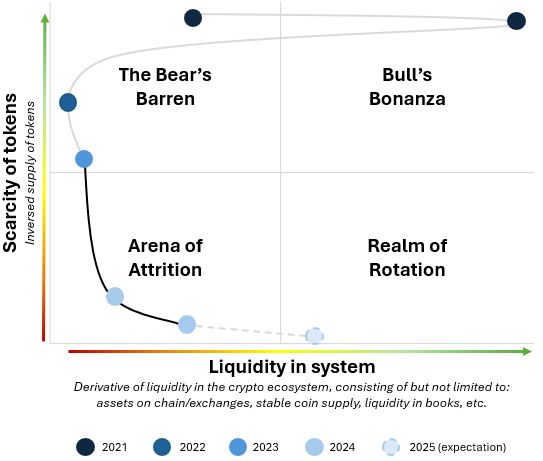

2/ The best altcoin model I’ve come across is @Rancune_eth's quadrant model.

2/ The best altcoin model I’ve come across is @Rancune_eth's quadrant model.

1/ Unrealized size is not size.

1/ Unrealized size is not size.

2/ MVRV & Market Trends:

2/ MVRV & Market Trends:

1/ Liquidity Injections:

1/ Liquidity Injections:

2/ The first and most important step is to block all the noise.

2/ The first and most important step is to block all the noise.

2/ Understanding Reflexivity:

2/ Understanding Reflexivity:

2/ Small Caps & The Real Economy:

2/ Small Caps & The Real Economy:

@RaoulGMI @cburniske 2/ Token Growth vs. Attention Growth:

@RaoulGMI @cburniske 2/ Token Growth vs. Attention Growth:

2/ Balloon > Bubble:

2/ Balloon > Bubble:

2/ The Greatest Trick Of The Market:

2/ The Greatest Trick Of The Market:

2/ The Case For Equities:

2/ The Case For Equities:

2/ Thread Overview:

2/ Thread Overview:

2/ The ETF Impact On $BTC:

2/ The ETF Impact On $BTC:https://x.com/jvs_btc/status/1803445629860938054

2/ The Impact Of Policy:

2/ The Impact Of Policy:https://x.com/pakpakchicken/status/1801874175726076095

2/ Monthly Chart:

2/ Monthly Chart:

1/ What Is Max Pain?

1/ What Is Max Pain?

2/ The New BTC Paradigm:

2/ The New BTC Paradigm: