CTO @thegravyapp

Software Engineer with 2 successful exits. I help you learn how to earn cash flow with dividends https://t.co/OMjYYaAIGH

How to get URL link on X (Twitter) App

Make Friends with Smart People

Make Friends with Smart People

https://twitter.com/JeremyInvests/status/1294010383192260611

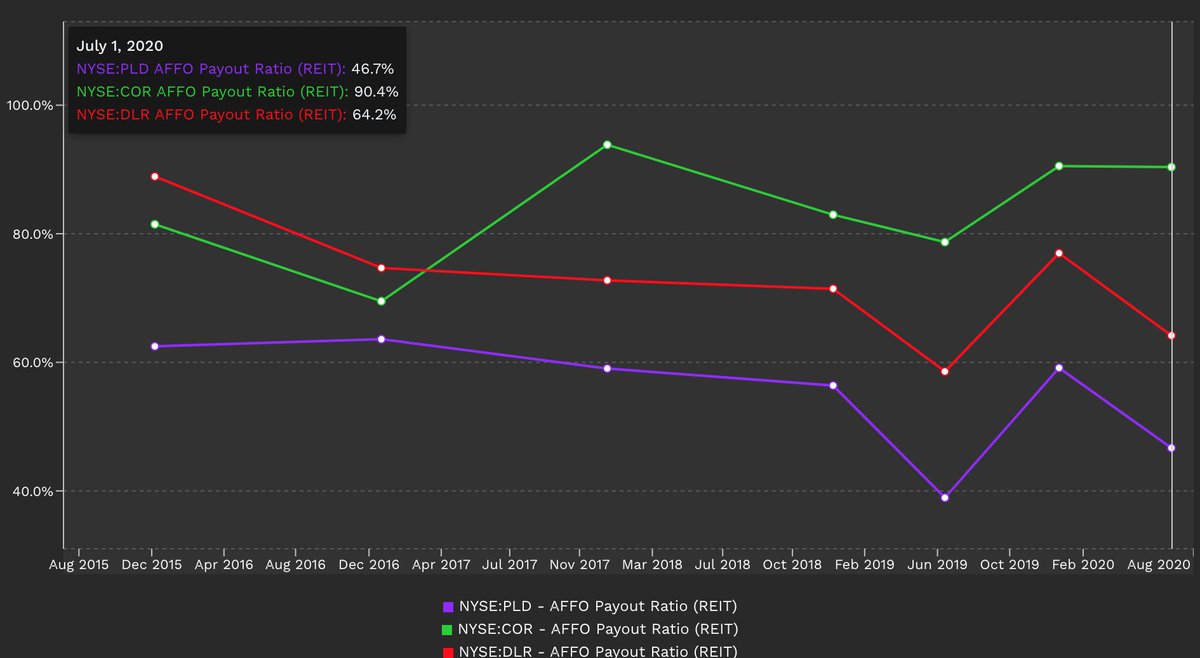

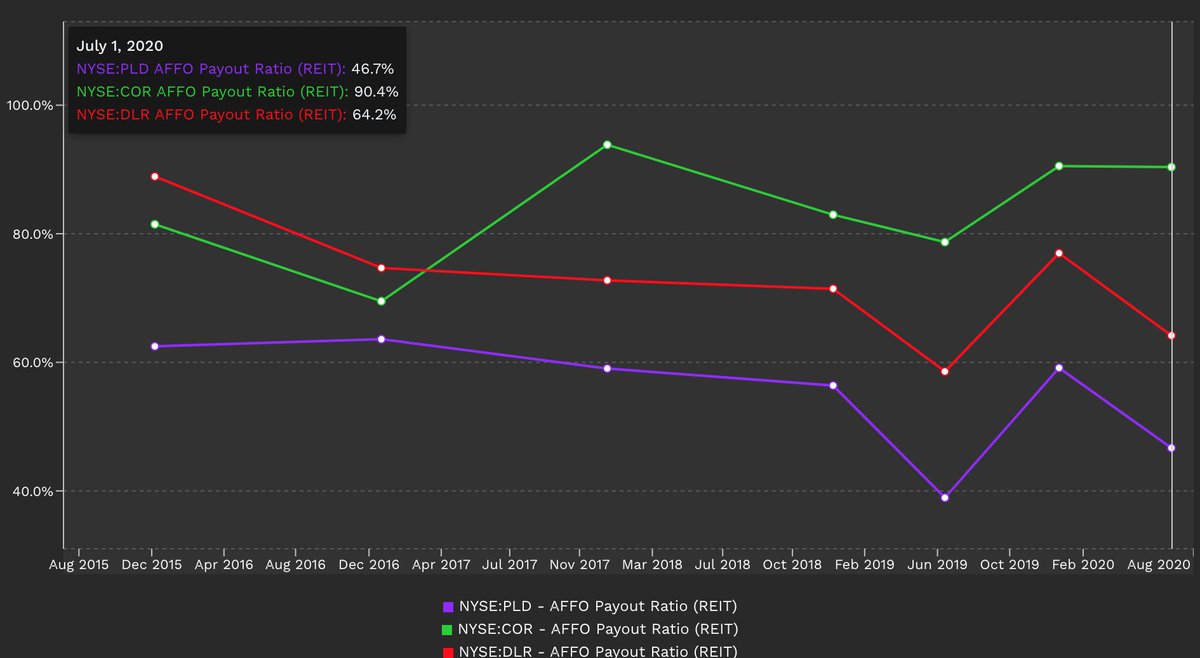

I also like to invest in non-cyclical sectors.

I also like to invest in non-cyclical sectors.https://twitter.com/DivCultivator/status/1283782874743939072?s=20

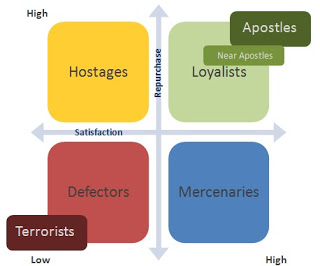

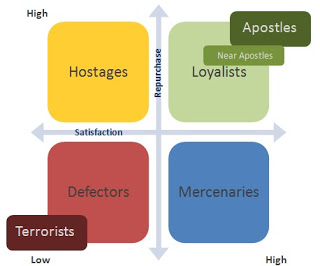

The Apostle Model classifies customers into 4 quadrants based on Net Promoter Score and Likelihood to Repurchase.

The Apostle Model classifies customers into 4 quadrants based on Net Promoter Score and Likelihood to Repurchase.