Dividend Growth Investor

Long term buy and hold investor focusing on Dividend Growth Stocks

11 subscribers

How to get URL link on X (Twitter) App

2/ He had started working at the age of 13, but his mother took most of his income

2/ He had started working at the age of 13, but his mother took most of his income

https://x.com/DividendGrowth/status/1780596494326014381

1. The big money is not in the buying and the selling, but in the waiting

1. The big money is not in the buying and the selling, but in the waiting

1. “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1”

1. “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1”

1. Go for a business that any idiot can run – because sooner or later any idiot probably is going to be running it

1. Go for a business that any idiot can run – because sooner or later any idiot probably is going to be running it

1. The big money is not in the buying and the selling, but in the waiting

1. The big money is not in the buying and the selling, but in the waiting

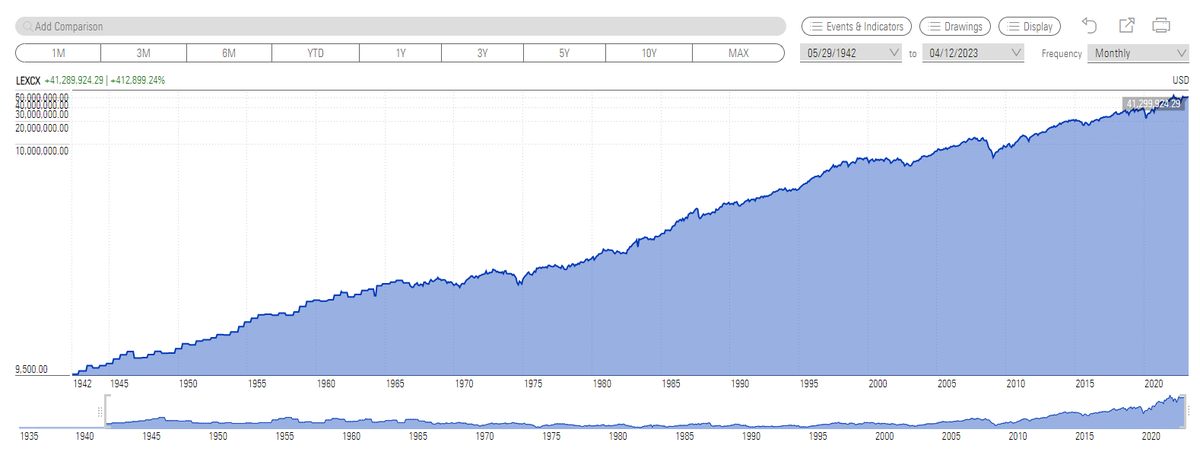

Getting wealthy, he explains, is like rolling a snowball.

Getting wealthy, he explains, is like rolling a snowball.

1. “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1”

1. “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1”

I believe that investors would do better if they focus on the dividend income generated from their portfolios, and ignore short term fluctuations

I believe that investors would do better if they focus on the dividend income generated from their portfolios, and ignore short term fluctuations

Getting wealthy, he explains, is like rolling a snowball.

Getting wealthy, he explains, is like rolling a snowball.

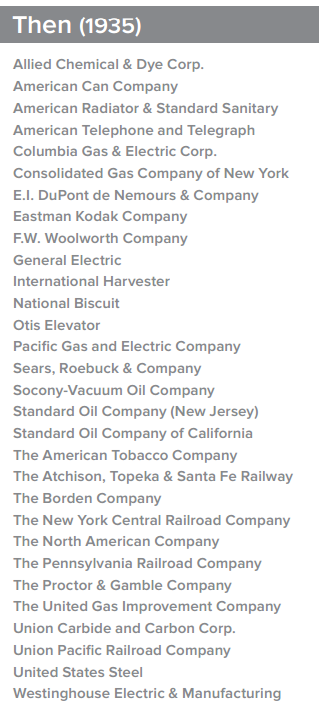

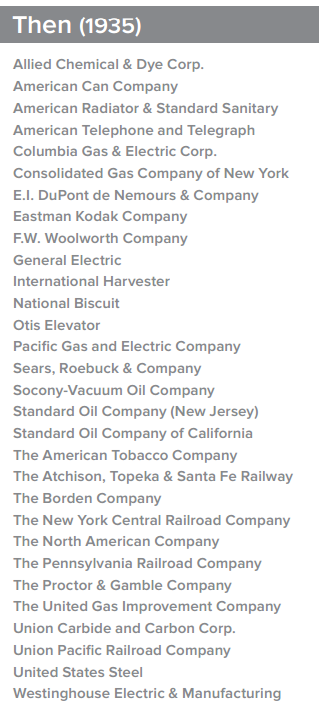

The companies that they bought were leading blue chip companies

The companies that they bought were leading blue chip companies

I like to look at the trends in earnings per share over the past decade

I like to look at the trends in earnings per share over the past decade

This is a list of the 1997 Dividend Achievers with the highest ROE h/t @BrandonVanZee

This is a list of the 1997 Dividend Achievers with the highest ROE h/t @BrandonVanZee