Teaching investing, business, and personal finance.

Research @Speedwell_LLC YouTube @DrewCohenMoney

How to get URL link on X (Twitter) App

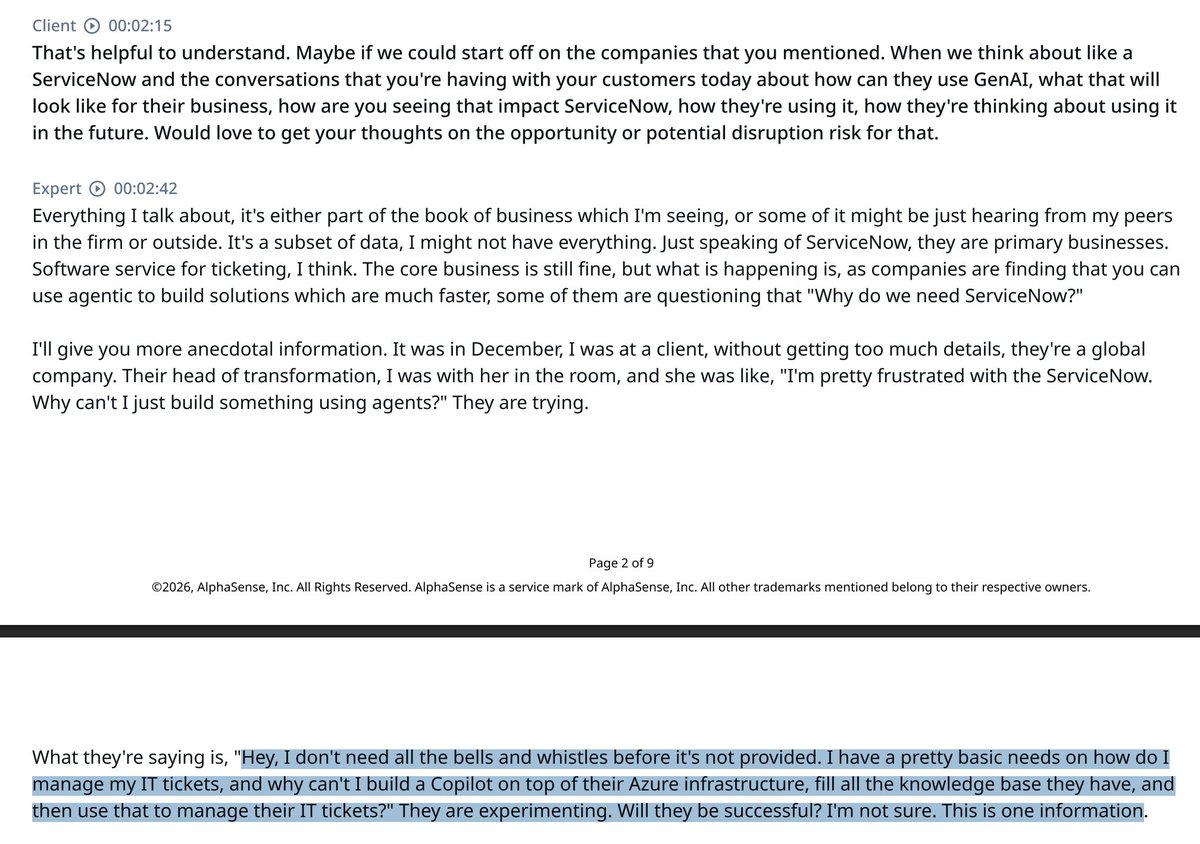

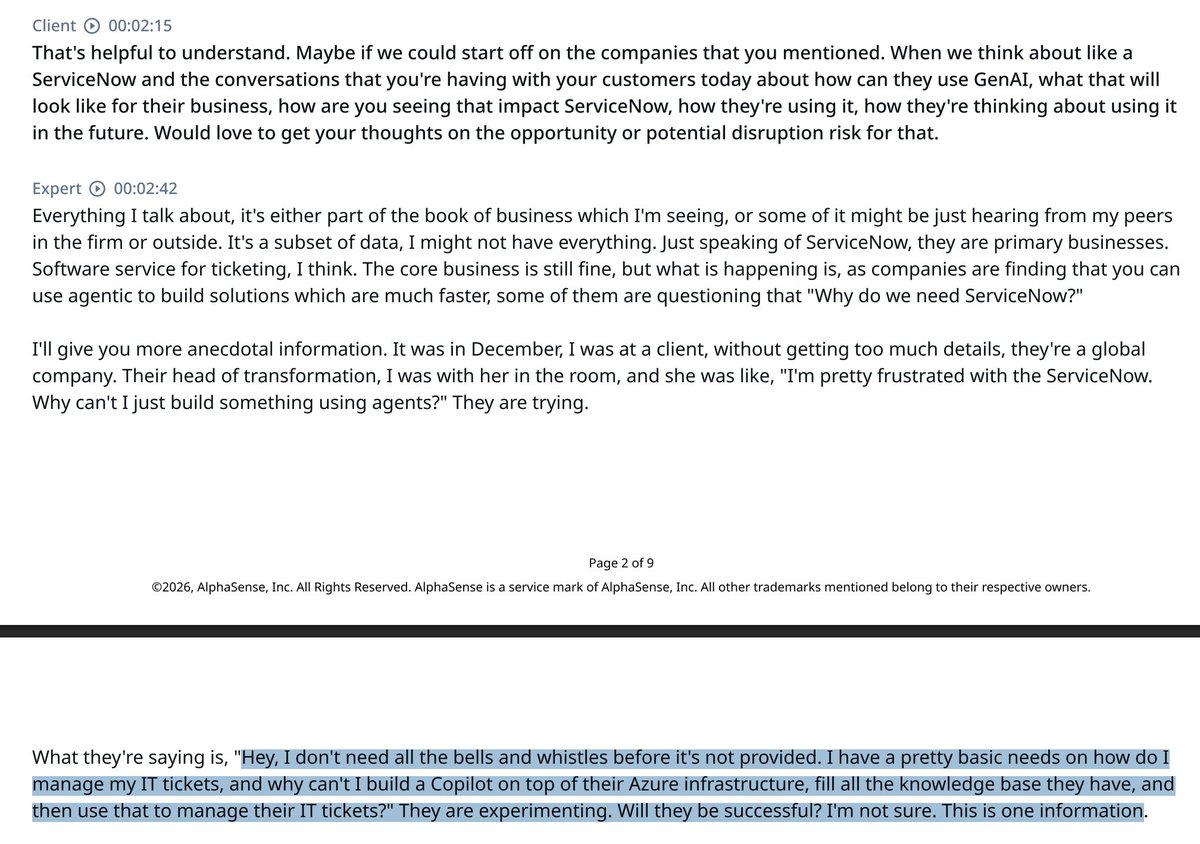

2) Replaced the software/ use cases with AI and Agents is feasible, but maintaining that business is another ball game

2) Replaced the software/ use cases with AI and Agents is feasible, but maintaining that business is another ball game

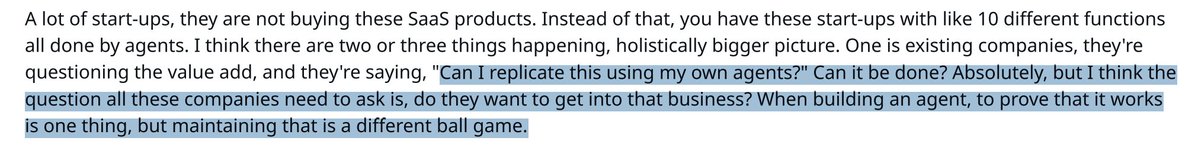

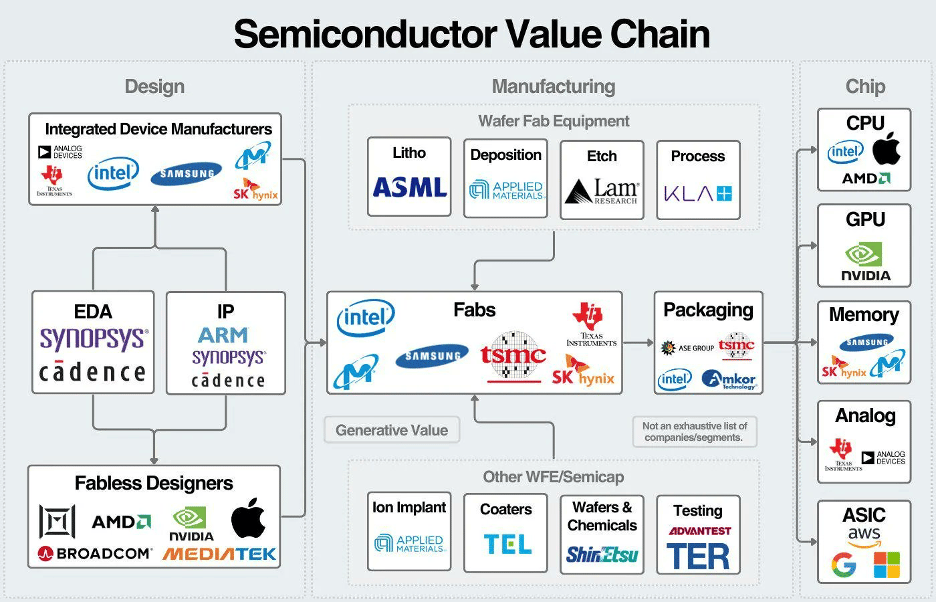

Everyone knows $NVDA

Everyone knows $NVDA

$UBER simply takes a % of each transaction with no cost of goods sold.

$UBER simply takes a % of each transaction with no cost of goods sold.

Understanding how $TSLA achieved this outcome requires examining four interlocking elements of its business model:

Understanding how $TSLA achieved this outcome requires examining four interlocking elements of its business model:

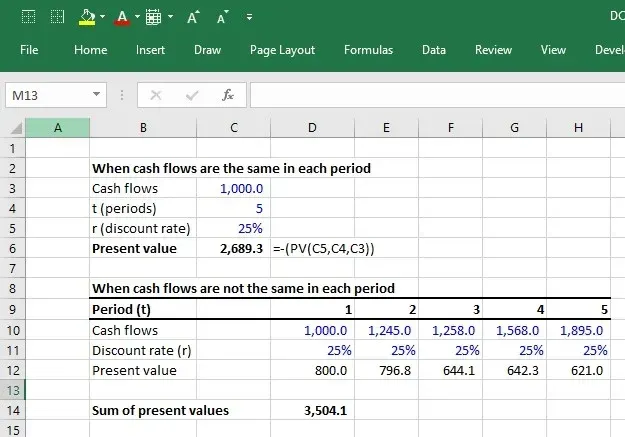

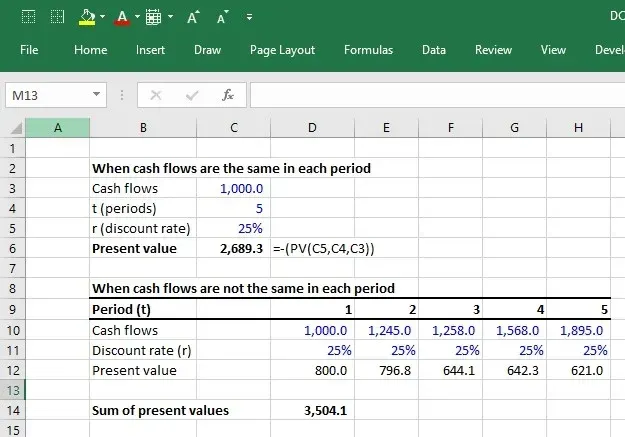

Investing is simply giving up money now in order to have more money in the future.

Investing is simply giving up money now in order to have more money in the future.

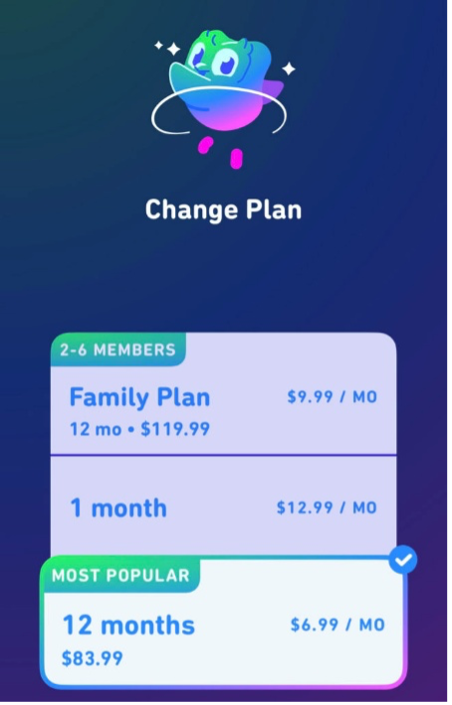

$DUOL is a mobile app that helps people learn new languages.

$DUOL is a mobile app that helps people learn new languages.

In 2022, $CRWV had just $15 million in revenues.

In 2022, $CRWV had just $15 million in revenues.