An optimist who assumes everyone is full of shit or lazy. Smart because he forgets. Fuck everyone against sensible gun reform. 👨👩👦👦👶🏻🐶🍔🍺🏀⚾️📊🤘

How to get URL link on X (Twitter) App

https://twitter.com/one4thecashbag/status/1635337106376769538?s=20

https://twitter.com/spomboy/status/1508913481113812995

https://twitter.com/Wealthfront/status/1486388725676343298

The craziest stat to me is JPM (as swap counterparty) has made more off the fund in $$ terms since inception (what they charge above LIBOR) than their shareholders.

The craziest stat to me is JPM (as swap counterparty) has made more off the fund in $$ terms since inception (what they charge above LIBOR) than their shareholders.

https://twitter.com/econompic/status/1468627450301087752

Another way to show this... the current top ten is > 30% of the index and was < 10% ten years ago.

Another way to show this... the current top ten is > 30% of the index and was < 10% ten years ago.

~8 years ago @theeconomist again outlined the bubble in Bitcoin.

~8 years ago @theeconomist again outlined the bubble in Bitcoin.

Ten years ago he shared 5 ways to weather the “US debt hurricane”

Ten years ago he shared 5 ways to weather the “US debt hurricane”https://twitter.com/mebfaber/status/11080700257708564482) illiquid securities, even something with the liquidity of high quality credit, should not be passively indexed in a stand alone product

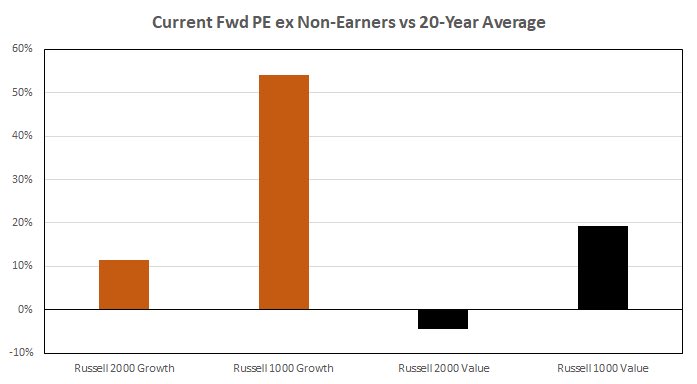

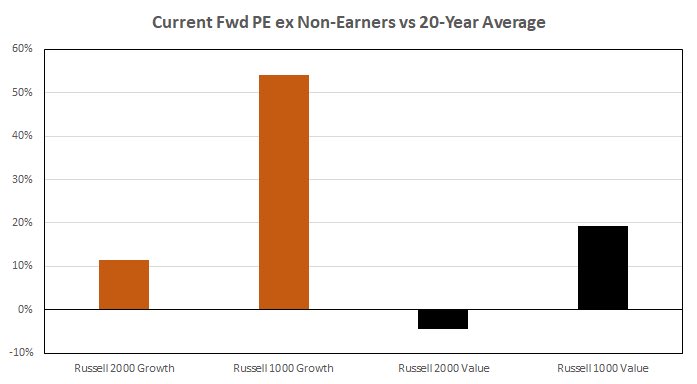

BUT we need to recognize “growth” stocks (by definition) should have higher earnings growth than value stocks longer-term.

BUT we need to recognize “growth” stocks (by definition) should have higher earnings growth than value stocks longer-term.

https://twitter.com/TheStalwart/status/1405535922599301129These were three days apart!