Retired RE and special situations investor (GS and own firm). Economics (Bowdoin College/LSE) and Finance (Univ of Mich). Libertarian. NOT INVESTMENT ADVICE.

How to get URL link on X (Twitter) App

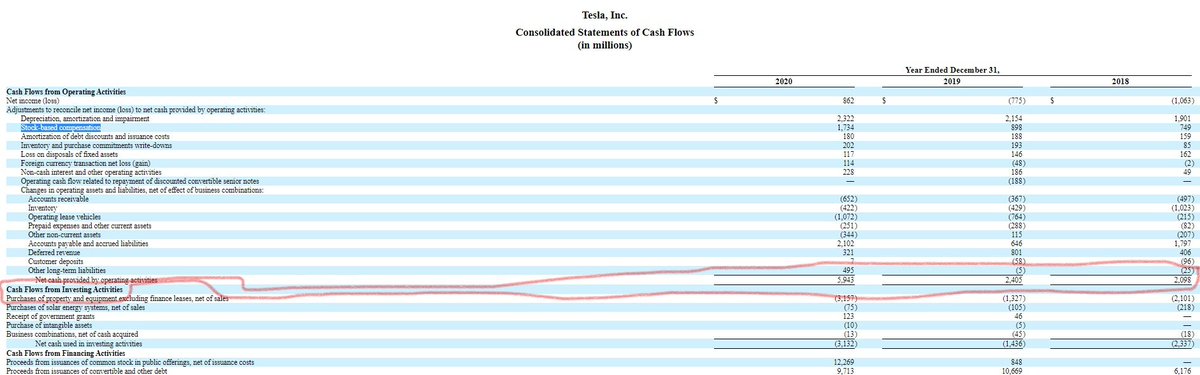

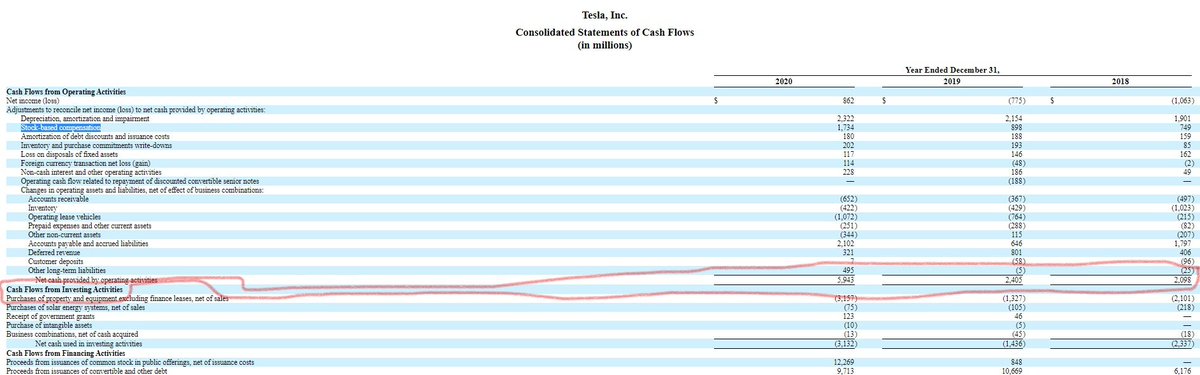

https://twitter.com/p_ferragu/status/1395756279705088002Let's start where Pierre starts: with Tesla's annual cash flows statement, which is attached below. Pierre starts with the line "Net cash provided by operating activities," which is pretty far up the table. (I wonder why the accountants provide all that other useless info?)