Seeking undiscovered future high ROIC companies.

Stock discussion is not investment advice.

3 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/F_Compounders/status/18400657811464645652/4 I can't believe I looked at $AZO mid-2005 but passed. Hindsight in 20/20 but even ignoring what AutoZone has become, it should have been a buy.

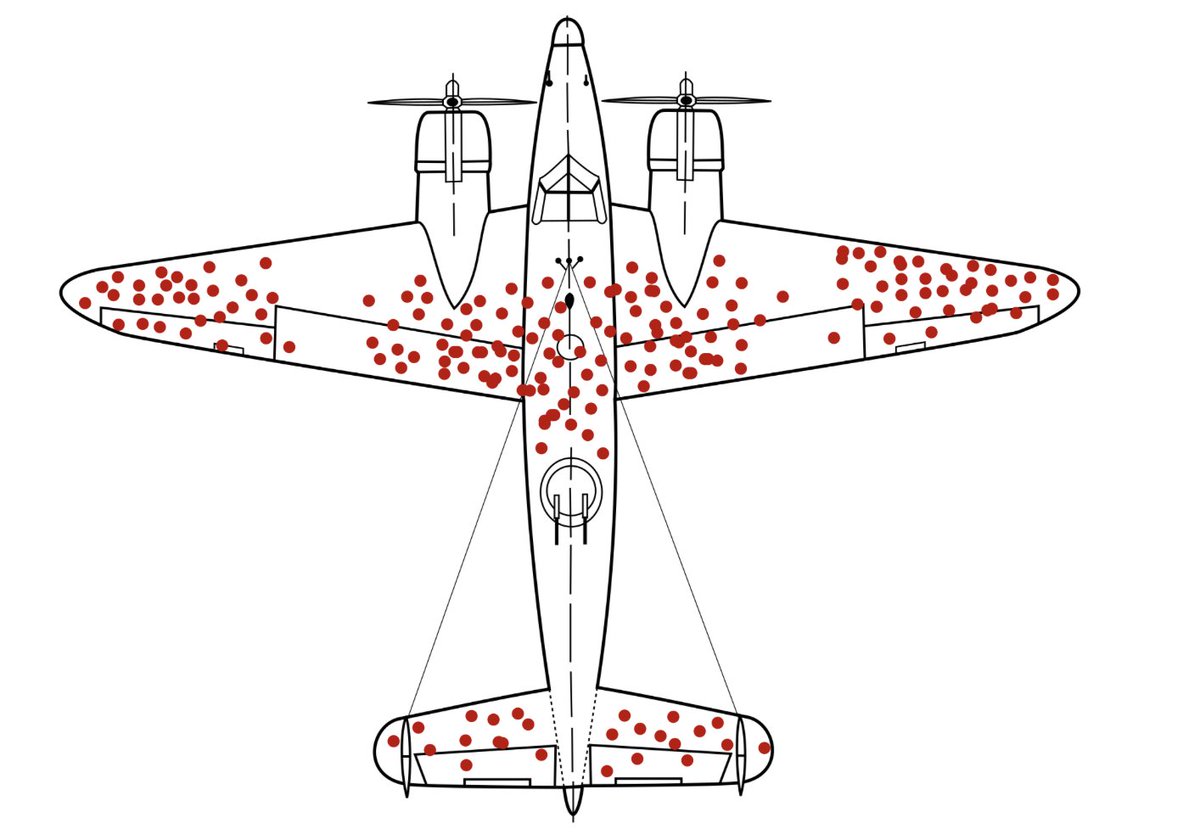

2/6 Cue the obligatory "survivor bias" image. One must acknowledge an element of luck in "buying right & sitting tight."

2/6 Cue the obligatory "survivor bias" image. One must acknowledge an element of luck in "buying right & sitting tight."

https://twitter.com/eboroian/status/11866739731295600652/13 But what is Good Luck in Investing? It’s finding yourself in a stock – if you knew the future – that compounds at an impressive rate for a long time. Therefore, today’s price with 20/20 hindsight proved very cheap years from now.

https://twitter.com/BobbyKKraft/status/1070350415080828928#2 Although Ensemble Capital are not microcap investors, Stannard-Stockton notes that microcap investors can look for firms with emerging moats and growing competitive advantages. Find that high ROIC microcap company with a (hopefully) durable advantage!