Dad. RGA Investment Advisors. Soundview Equity Partners. GARP investor. Mets, Jets, Isles fan. Compulsive reader. In awe of nature. Co-host @twiii_podcast.

3 subscribers

How to get URL link on X (Twitter) App

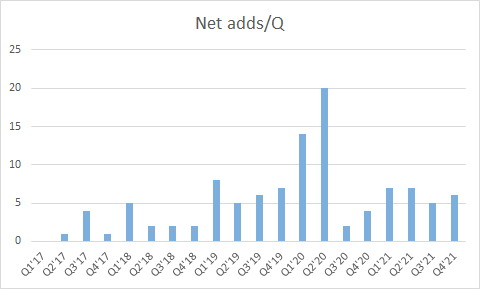

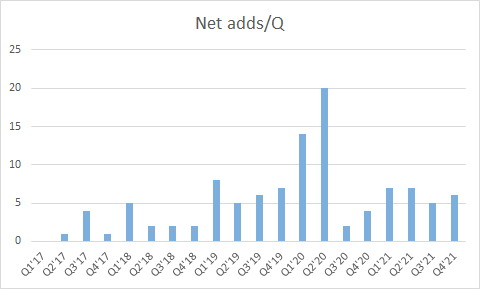

It's a good sign that net new users has stabilized at a higher plateau. The breakout heading into COVID looks especially clear now. Getting up to a 12m/Q pace looks challenging.

It's a good sign that net new users has stabilized at a higher plateau. The breakout heading into COVID looks especially clear now. Getting up to a 12m/Q pace looks challenging.

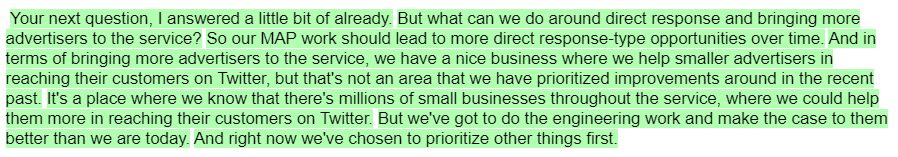

https://twitter.com/twiii_podcast/status/1386049234244456450Traits of quality:

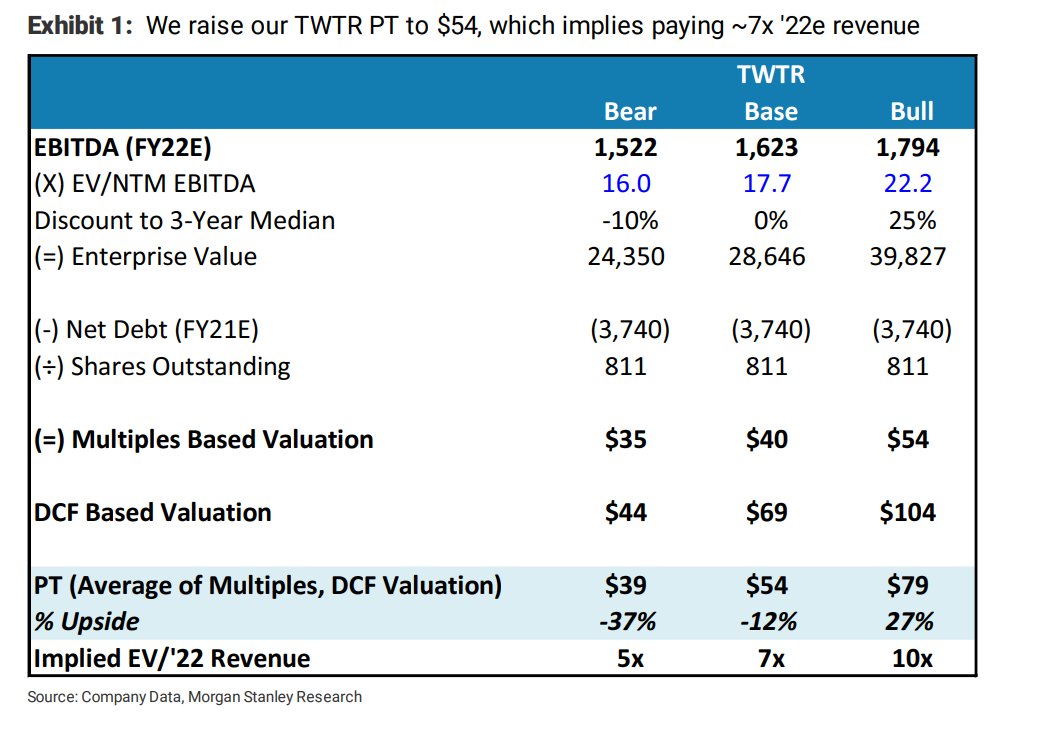

The amount of stocks I've seen where it's like "DCF is a $30 / share price but the peer group is trading at 20x sales, so my PT is $72" is a dime a dozen.

The amount of stocks I've seen where it's like "DCF is a $30 / share price but the peer group is trading at 20x sales, so my PT is $72" is a dime a dozen.

https://twitter.com/kayvz/status/1187350677581946882