EnerWrap. Click here to get daily energy data-driven insights delivered to you inbox for FREE! 👇

4 subscribers

How to get URL link on X (Twitter) App

https://x.com/EnergyCredit1/status/1781132524833431941

Datawrapper is a cloud-based data visualization platform, used mostly by many news organizations

Datawrapper is a cloud-based data visualization platform, used mostly by many news organizations

So if $BTU pays the unfunded revolver fee to maintain the liquidity, they can draw down the cash everyone was bitching they got forced to hold

So if $BTU pays the unfunded revolver fee to maintain the liquidity, they can draw down the cash everyone was bitching they got forced to hold

This is the provision petitioners lawyer relies on to make this claim. It fails on its face by the plain language

This is the provision petitioners lawyer relies on to make this claim. It fails on its face by the plain language

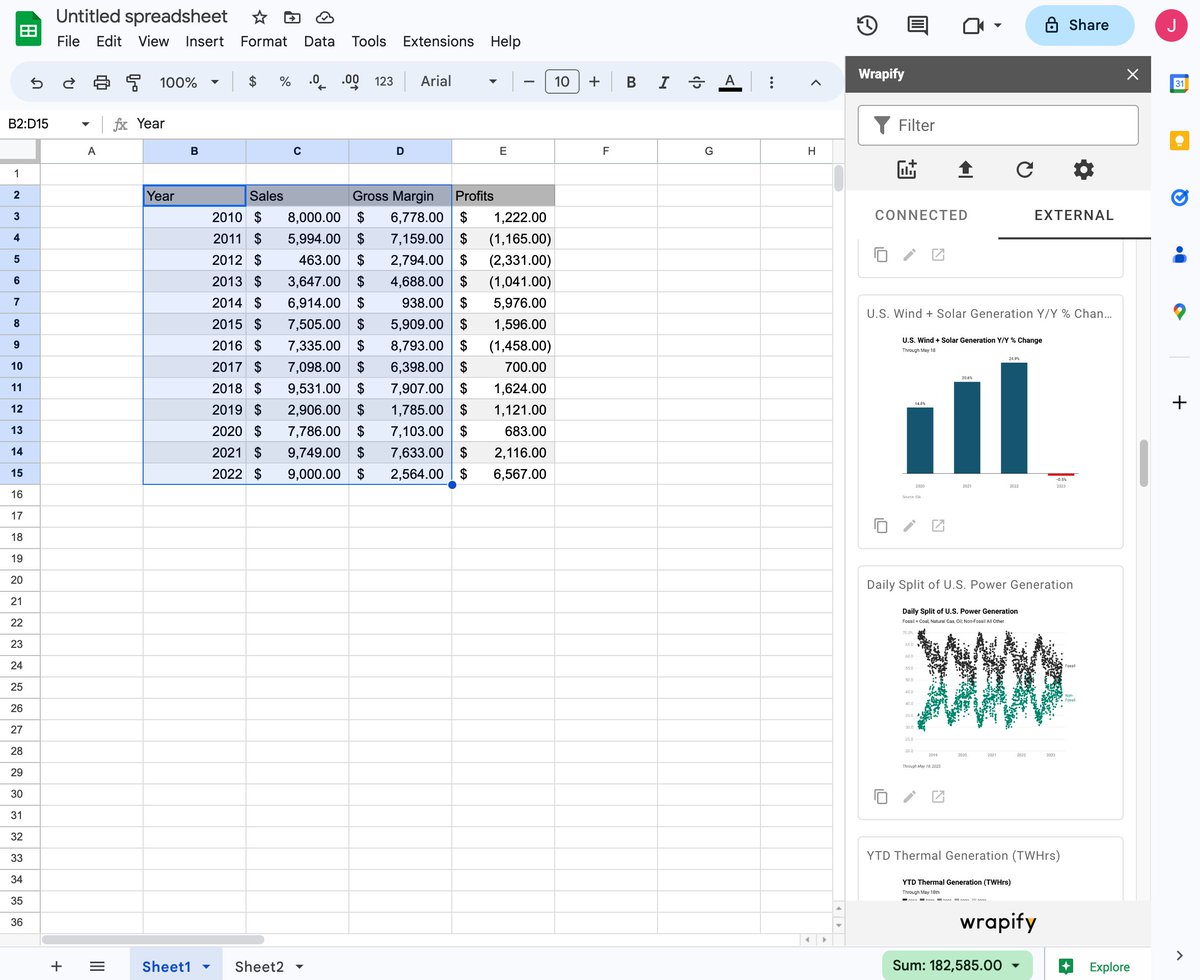

Like many software solutions before us Wrapify began as a way to solve our own pain points, in this case ingesting and visualizing data as spreadsheet junkies.

Like many software solutions before us Wrapify began as a way to solve our own pain points, in this case ingesting and visualizing data as spreadsheet junkies.

In their s-1 Delvina claims to have not worked for Hudspeth / Next Bridge until Sept 21

In their s-1 Delvina claims to have not worked for Hudspeth / Next Bridge until Sept 21

Problem is when you hold an asset held for sale, you still need to run the AHFS cash flow through the cash flow statement

Problem is when you hold an asset held for sale, you still need to run the AHFS cash flow through the cash flow statement

Importantly, $MMTLP / NBH and $MMAT have an information sharing agreement whereby NBH agreed to help $MMAT with its audit through 2023

Importantly, $MMTLP / NBH and $MMAT have an information sharing agreement whereby NBH agreed to help $MMAT with its audit through 2023